Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

A stock can transform you into an owner of a billion dollar empire. But the stock market is a complex hunting ground for investors. Understanding its basic structure is crucial to surviving and thriving.

What is a Stock?

A stock is a piece of ownership in a company. Stocks are often called “shares” and when you buy a stock you become a “shareholder.” The amount of stock you own, divided by the total stock the company has given out, equals your percentage of ownership.

For example, Google has given out about 350 million shares. So if you buy 35,000 shares of Google stock, you own .01% of Google.

A stock can give you the right to:

- Vote on company decisions at annual shareholder meetings

- Receive a share of the money if the company is sold

- Receive a share of company profits (called dividends)

Why would a company give you stock? Companies issue stock to raise money for expenses. To raise this money they sell stock for cash. It’s an easy way for a company to get a large amount of cash that it never has to pay back.

Shareholder Voting and Meetings

As a shareholder you can vote on company decisions at shareholder meetings. You can vote in-person or by proxy. Voting by proxy is just mailing in your vote or giving your vote to someone else.

Companies can vary the frequency of shareholder meetings, but they usually happen once per year. Shareholders only vote on major decisions for the company. The most important issue shareholders vote on is electing the board of directors (the highest level of management in a company). Besides voting, shareholders have little say in the decisions of a company. You just sit back and hope for your investment to grow and bring you money.

You can invest in stock in a variety of ways. Before you start it’s important to understand some of the different forms stock can take.

Common and Preferred Stock

Stock is usually either common or preferred. Common stock is the original stock a company issues when it is formed. Common stock is less desirable than preferred stock.

Preferred stock is called “preferred” because it has a priority (preference) over common stock. Preferred stock owners are first in line for company profits. High level investors typically require the company to give them preferred stock to protect their investment. Preferred stock gives the investors a priority right to:

- The money left if the company fails

- Cash from selling the company

- A share of profits the company gives to shareholders

Stock comes in a variety of shapes and sizes. The preferred stock of one company will be different then the preferred of another. There can even be different series of preferred stock in the same company. To learn about the stock you’re interested in you need to read the company’s bylaws. The bylaws will describe every class of stock in detail. If you have the opportunity to buy stock the company will let you review their bylaws.

Public or Private Stock

Stock can also be private or public. Only public stocks can be freely traded. All companies begin with private stock. Private stock is usually non-assignable, meaning it can’t be transferred to anyone else. Unless you’re a certified investor or founding a company, you generally can’t buy private stock.

Public stock is different. For a company to trade its stock it needs to register with the U.S. Securities and Exchange Commission (SEC) and hold an Initial Public Offering (IPO), the event where a stock is first sold to the public. In most cases, a company that attempts to sell its stock to the general public without registering with the SEC is breaking the law.

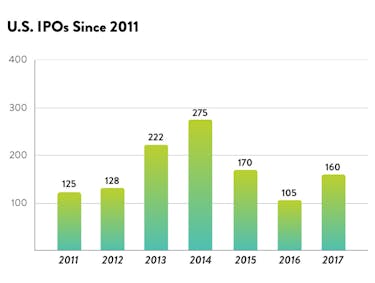

An IPO is the event where a company offers their stock for sale to the public for the first time. IPOs are rare. There are only 50-300 IPOs per year even though there are ~7 million US Companies.

You can learn about upcoming IPOs at MarketWatch.com, but you won’t have much luck buying stock at an IPO. It’s difficult to buy stock at an IPO because companies going public usually negotiate the first sale of the stock to large investors like banks. But soon after the IPO the stock will be available on an exchange and you’ll be able to invest.

Even if you have an opportunity to do it, investing in IPO stocks is risky. It’s not rare for stocks to be trading below the IPO price for a year after the IPO. For example, if you spent $1,000 on Snapchat stock at the IPO (March 2017), today (14 months later) your investment would only be worth ~$400. That’s a huge loss!

People buy stock for a variety of reasons. People usually buy to trade it later (with the hope it will be worth more in the future) or to collect profits from the company (assuming the company has profits to give). When a company has paid all of its expenses, it has the option to distribute profits to shareholders. These distributions are called “dividends.”

Stock Dividends

When a company has extra cash after paying all of its bills, it can give dividends to its shareholders. Shareholders get dividends equal to the proportion of shares they own. So a shareholder that owns 20% of all shares gets 20% of the dividend. Many companies regularly give shareholders dividends. After all, the purpose of a company is to make money for the people who funded it.

For example, in 2017 Coca-Cola gave a dividend of $1.48 per share. So if you had 100 shares of Coca-Cola, you would have been paid $148 in 2017 just for being a shareholder.

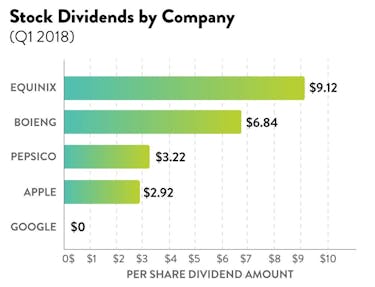

But, modern company managers have great discretion in choosing to issue dividends. For example, Google has had public stock since 2004, but has never given a dividend. Google doesn’t issue dividends because the management of the company prefers to reinvest profits into research, development, and acquisitions.

Today there is a big range in the amount of money companies issue as dividends.Below are some examples of the differences in dividends offered by various companies.

Dividends are great but many investors buy stock solely to trade it.

Trading Stocks

Another way to profit from stocks is to buy and sell at a higher price. This is called trading. Only licensed brokers can trade high value stocks. If you want to trade high value stocks you need to hire a broker. Brokers trade stocks on exchanges. In the past you needed to hire a broker on Wall Street, give them a call, and tell them what to buy or sell. Today, you can do all of this through your computer. There are many digital brokers like eTrade.

You have a lot of strategies to choose from when trading stocks. The two most common strategies are “day trading” and “value investing.”

Frequently buying and selling stock is called day trading. When people imagine workers on Wall Street with lots of computer monitors they’re thinking of day traders. Day traders are waiting for a stock they believe will increase in value soon. They buy it at a low price with the plan to immediately resell it at a higher price. Day trading is very risky and if you’re not experienced, it can feel more like gambling.

Another strategy for trading stock is called value investing. Value investors buy stock in companies they think will grow in value. Value investors benefit by collecting dividends from the companies they invest in or by selling the stock down the road for a substantial profit. The champion of value investing is Warren Buffet. Warren Buffett is the most famous value investor in the world. He’s the CEO of Berkshire Hathaway and the third richest person in the world. He is known in the financial world as the Oracle of Omaha.

Stock Market Infrastructure

To profit from the stock market, you need to understand its infrastructure. Most people confuse stock market exchanges, indices, and funds. It’s understandably confusing.

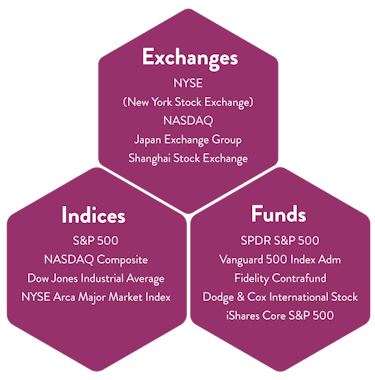

An exchange is a marketplace where stocks are traded. The two largest exchanges in the US are the NYSE and the NASDAQ. In order to trade stocks on an exchange you need to hire a broker or become one. Then you tell the broker how to buy or sell stocks for you. To trade stock, brokers and traders typically rely on indices.

An index is a list of companies whose stocks are measured together. The point of an index is to provide a snapshot of the economy or a segment of the economy. The most famous index, and Warren Buffett’s favorite, is the S&P 500. The S&P 500 is a list of the top 500 companies (measured by market capitalization) listed on the NYSE and NASDAQ (exchanges). An index is useful for gauging the health of the economy. An index is also useful to diversify stock investments. Warren Buffett often points out that few investors see a greater return then the S&P 500 in a ten year period.

A stock needs to be worth a minimum value to be traded on a major exchange. Stocks that are worth less than the minimum value are traded on over-the-counter (OTC) markets. In an OTC market, you don’t need a broker. Individuals can buy and sell stocks to one another without a middleman. An example of an online OTC market is TD Ameritrade.

A fund is a company that invests in a group of stocks hoping to profit on the investment overtime. There are many different types of funds, all distinguished by their investing strategies. For example, index funds invest in the stocks listed in an index without discretion. Similarly, a growth fund invests in the stocks that grow the fastest.

Nice job! You did it, you made it through an introduction to the stock market. That was a long and complicated introduction to stocks. Let’s read a story and illustrate how all these pieces fit together.

The Story of Fred

Fred the entrepreneur wants to start a business selling table salt called “Bedrock.” He registers the company with the state, but is disappointed when he realizes he doesn’t have enough money to fund Bedrock. He has to pay for an office, trucks, and for employees to mine the salt. So Fred goes to his good friend Barney, and asks Barney to invest in Bedrock.

Bedrock does well and starts selling salt like crazy. Fred has more sales than he can handle. Everyone wants Bedrock salts. Bedrock has so many orders that its facility is overwhelmed and has to turn away customers. Fred realizes it’s time to expand and needs more money to do so. Bedrock is profiting and growing, but not fast enough to keep up with the demand.

So Fred goes to Stonehenge Capital, a venture capital firm, and asks them for a $500K investment. After looking over Bedrock’s financials, Stonehenge Capital agrees to the $500K investment for 5,000 shares of preferred stock. The preferred stock is very different from Barney’s common stock. For example, if Bedrock collapses, Stonehenge gets paid in full before Barney gets anything. If Bedrock profits and gives a dividend to shareholders, Stonehenge gets paid twice as much as Barney per share.

The $500k investment really takes Bedrock to the next level. Fred opens 5 new locations his first month, and 15 new locations his second month. Soon Bedrock has a total of 50 stores and is doing really well. Bedrock’s profits are pouring in.

One year after Stonehenge’s investment, Bedrock is doing $100M a year in sales. Fred, Barney, and Stonehenge can’t believe their eyes. They’re doing great but growth has slowed. They all agree it’s time to take Bedrock to the ultimate level. It’s time to go public, with an Initial Public Offering (“IPO”).

Fred contacts the SEC and starts the IPO registration process. Three years after Fred started the company, Bedrock has its IPO. All of Barney’s common stock, and Stonehenges preferred stock is converted to a single type of stock. Bedrock issues 10,000 new shares and sells them to the public. The shares sell out in a few hours.

Half of the shares are purchased by individuals, and the other half are purchased by stock funds. One of the individual investors is Wilma. Wilma buys two shares of Bedrock and receives the stock certificates in the mail. She frames them and mounts them on her wall. Wilma wants to save them and give them to her children in 20 years. Wilma hopes that in 20 years the stock will be worth 10x what it is today. Wilma is using a value investing strategy.

Another individual investor is Bam-Bam. Bam-Bam buys 10 shares at 11:00am. In only three hours the price of the shares increases by 15%. By 2:00pm Bam-Bam tells his broker to sell the shares on the Mammoth Exchange for profit. In only 3 hours Bam-Bam turned $1,000 into $1,150. Bam-Bam is using a day trading strategy.

Bam-Bam’s not the only day trader. The day after the IPO the Mammoth exchange is flooded with brokers trading Bedrock stock. Traders like Bam-Bam are calling their brokers every 15 minutes to buy and sell Bedrock stock.

The other half of the shares are purchased by funds. Growth funds buy the stock because Bedrock has grown very rapidly and fit the growth fund portfolio requirements. Index funds don’t purchase Bedrock because the company isn’t big enough to make it into any of the indices like the Mammoth 100. The Mammoth 100 is a group of the most valuable 100 companies in the Mammoth Exchange.

Stonehenge Capital sells all of its shares on the Mammoth for a whopping $5M. Stonehenge couldn’t be happier, turning $500K into $5M, a return of 10x on their investment.

One month after Bedrock has its IPO, the tides begin to change. A scathing article comes out in the newspaper linking salt consumption to early death. Customer demand shifts in an instant. Restaurants and grocery stores stop selling salt. Bedrock’s stock begins to be sold for less and less as traders try to cut their losses. Fred powerlessly watches the price of Bedrock stock drop by 98% in a single day. When the Mammoth Exchange closes for the day, the stock is being sold for less than $2 per share. The Mammoth kindly informs traders, that stock under $3 per share cannot be traded on the Mammoth and removes Bedrock’s stock from the exchange.

Betty is a doctor. She reads the newspaper article linking salt consumption to death and is very skeptical. She thinks the newspaper article is wrong. She decides to capitalize on the opportunity. The next day, she tries to buy Bedrock stock at the Mammoth but learns it’s no longer traded there.

Betty doesn’t get discouraged. She does some research learns how to buy Bedrock stock. Betty goes online to eRubble.com, an over-the-counter market for buying cheap stocks. She talks directly with a stock owner and negotiates to buy 500 shares at $1 per share. Betty is overjoyed and patiently sits on her investment.

The next month, the newspaper issues a massive retraction on the salt article. Betty is delighted. Bedrock shares start creeping back up. They quickly climb to $20 per share and return to the Mammoth Exchange. Once they make it to the Mammoth Exchange, traders get eager, and the price sores even higher, topping off at $50 per share.

Betty is overwhelmed. Her $500 investment is now worth $25K. Now Betty has a decision to make. Should she sell now for a 50x return on her money? Or should she hold the stock even longer betting Bedrock salt will be in demand for decades to come?

What should Betty do?