Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

- What is a 40-Year Mortgage?

- How Does a 40-Year Mortgage Work?

- Advantages of 40-Year Mortgage

- Disadvantages of 40-Year Mortgage

- 40-year Mortgage Rates

- Calculating a 40-Year Mortgage Calculator

- What Lenders Offer A 40-Year Mortgage?

- Can You Refinance a 40-year mortgage?

- Alternatives to 40-Year Mortgages

- The Bottom Line: Avoiding a 40-Year Mortgage

Whether you are a homeowner or real estate investor, you have several mortgage options to choose from when purchasing a property.

Long-term loans provide a fixed interest rate for the life of the loan — usually 15, 20, or 30 years.

A 30-year mortgage is the most common loan and has the lowest monthly payment due to the length of the loan.

Those who are looking for a lower monthly payment look at other loan options — like a 40-year mortgage. A 40-year mortgage offers the consistency of a 30-year mortgage but provides a more affordable monthly payment.

Though it has this advantage, the truth is that you’ll wind up paying far more overall when using a 40-year mortgage.

Let’s look at a 40-year mortgage and why it can be troublesome long-term for home buyers.

What is a 40-Year Mortgage?

A 40-year mortgage is a real estate loan similar to a 15, 20, or 30-year mortgage, except it has a longer repayment period.

This extra ten years helps lower the monthly payment.

However, the additional years on a 40-year mortgage means you will pay more interest by the end of the term than you will on a loan with a shorter term.

How Does a 40-Year Mortgage Work?

A 40-year mortgage can be a bit of a hybrid loan because of the different ways lenders offer it.

It may have a fixed interest rate and monthly payment for its full term, just as a 15 or 30-year mortgage does. The first ten years of a 40-year mortgage might only require an interest-only payment. During these ten years, the borrower can also pay on principle if they wish.

This will help lower the payment for the last 30 years.

Some lenders may provide a 40-year mortgage in a five or 10-year annual renewable term loan for all or part of the 40 years.

A 40-year mortgage with this structure may also have a balloon payment due at some point.

Advantages of 40-Year Mortgage

A 40-year mortgage offers these advantages:

Lower Monthly Payment

With the loan stretched out for a greater time, the monthly payment is less for a 40-year mortgage than for a 30-year mortgage, a tremendous advantage.

More Buying Power

Your ability to qualify for a certain loan amount depends on your credit score and debt-to-income ratio.

Because of the lower monthly payment, a 40-year mortgage may allow you to buy a higher-valued home that you otherwise couldn’t afford.

Flexibility

You typically have an option to pay extra on the loan without a penalty.

You can pay off more during the months you’re flush with income or stick with the typical monthly payments as needed.

Buyers who earn commissions or have income streams from various businesses could greatly take advantage of this financial flexibility.

Disadvantages of 40-Year Mortgage

Compared to the advantages, there are more disadvantages to a 40-year mortgage. These include:

Higher interest rate

A 40-year mortgage rate can be 25% to 50% higher than a 30-year mortgage rate.

This is because the 40-year mortgage places the lender at risk for a longer time.

It’s A Non-Qualified Mortgage (QM) Loan

Non-qualified mortgages (non-QM loans) use non-traditional means to establish credibility — common examples of this include bank statements and personal assets.

The danger is not being able to pay back the loan if your financial circumstances substantially change.

Availability

Most lenders do not offer a 40-year mortgage, so it may take some time to find one who does, another disadvantage.

Slower Equity

Using a 40-year mortgage, it takes longer to build equity.

A monthly loan payment has two primary components:

- principal

- interest

Your payment gets applied first to the interest due on the loan balance and then to the principal.

This portion applied to the principal is part of your equity.

In the early life of the loan, the lender applies the majority of your monthly payment to the interest.

As the principal decreases, this trend reverses, and more money gets applied to the principal.

The longer it takes to repay the loan, the more time it takes to build equity because of the amount of your payment that gets spent on interest.

Balloon Payment

Balloon payments provide you with smaller monthly payments, but you’ll have to pay a lump sum of what’s left once the term is up.

You won’t be paying as much monthly or in interest, but you’ll have to save up substantially to pay off the remainder of the loan.

That could be a huge disadvantage because you’ll need to pay a large amount of money all at once.

The danger is not having the full amount due at the end of the term, which results in penalties and possibly foreclosure.

Ultimately Costs More

Although the monthly payment for a 40-year mortgage is lower, they cost more in the end.

The additional cost is not only due to the 40-year mortgage rate, but also because of the extra ten years of interest the borrower pays.

40-year Mortgage Rates

In 2022, Average interest rates are just under 5% for a 40-year mortgage. These rates are almost a full point higher than 15-year mortgages.

Rates have been on the rise since 2020 and have already increased from an average of 2.7% to 4.7% for a 40-year loan.

The extra interest over 40 years can cost significantly more than a 30-year loan over time — something we’ll look further into next.

Calculating a 40-Year Mortgage Calculator

How much will a 40-year mortgage cost compare to a 30-year mortgage?

A lot more.

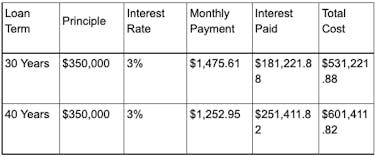

Let’s compare a 40-year mortgage to a 30-year using a 40-year mortgage calculator.

Instead of using a higher 40-year mortgage rate, we will use the same rate for both to gauge the cost difference created by the number of years.

You can use the 40-year mortgage calculator for both mortgage terms in our example by adjusting the loan term.

In this example, the 40-year mortgage monthly payment is $222.66 lower each month.

But a 40-year mortgage borrower will pay over $70,000 more by the end of the loan than they would with a 30-year mortgage.

Not only could you use that $70,000 to pay off your home. You could use it to get out of debt, save for retirement, or invest in real estate.

If you’d like to calculate your own rates, you can use this free mortgage calculator to get a cost estimate for a 40-year mortgage.

What Lenders Offer A 40-Year Mortgage?

Not all lenders offer a 40-year mortgage since they require non-QM loans. Buyers looking to get a VA or FHA loan will have to search elsewhere because these government-backed programs won’t offer one.

Most lenders will only offer these loans if they have independent or non-traditional investors since proof of funding comes from bank statements and assets.

Lenders that offer a 40-year-mortgage include:

- credit unions

- online banks

- mortgage brokers

Since you’re working with a non-traditional loan and already facing higher interest rates, it’s best to shop around and compare several options before signing on the dotted line.

Can You Refinance a 40-year mortgage?

Depending on who you have your loan with, you may have the opportunity to refinance.

Refinancing is typically only possible once you have equity in the home, which takes longer to build with a 40-year mortgage.

If your lender lets you refinance, you’ll have to stay patient until you build up the required equity per your contract.

You may reach the refinancing requirements faster by utilizing the flexibility of larger monthly payments when you have the cash.

Alternatives to 40-Year Mortgages

If your interest in a 40-year mortgage is due to the lower monthly payment, consider these alternative options before committing.

Larger Down Payment

Almost every mortgage-related document you read mentions a 20% down payment requirement for a home loan.

However, the average down payment today is closer to 6%.

A larger down payment on a 30-year mortgage can reduce your monthly payment.

Government-backed loans

There are other loans available with no, or very low, down payments and lower interest rates.

Even better, there are ways to use these loans to invest in real estate.

These include:

Mortgage Points

Buying mortgage or discount points — fees paid directly to the lender at closing — can help lower your interest rate.

Points cost around 1% of your mortgage, or $1,000 for every $100,000. One point equals a 0.25% interest rate deduction.

Buying down your interest rate helps lower your monthly payment and in some cases can be cheaper than paying a larger down payment.

30-Year Mortgage

Choosing a 30-year mortgage will still give you affordable monthly payments, but you can save some serious cash in the end.

In our example from earlier, you would save $70,000 if you went with a 30-year loan instead of paying for 40 years with the same interest rate.

The monthly payments were only $223 more for a 30-year loan, but you would $70,000 in the end, making this a practical alternative.

The Bottom Line: Avoiding a 40-Year Mortgage

Whether you are shopping for your last family home, or investing in real estate, decide what you wish to accomplish with your next real estate purchase.

Do you want to think short-term and have a lower monthly payment? Or do you want to think long-term and keep the total cost of your new home as low as possible?

Knowing the answers to these two questions, and crunching the numbers with a 40-year mortgage calculator will help you determine which loan is right for you.