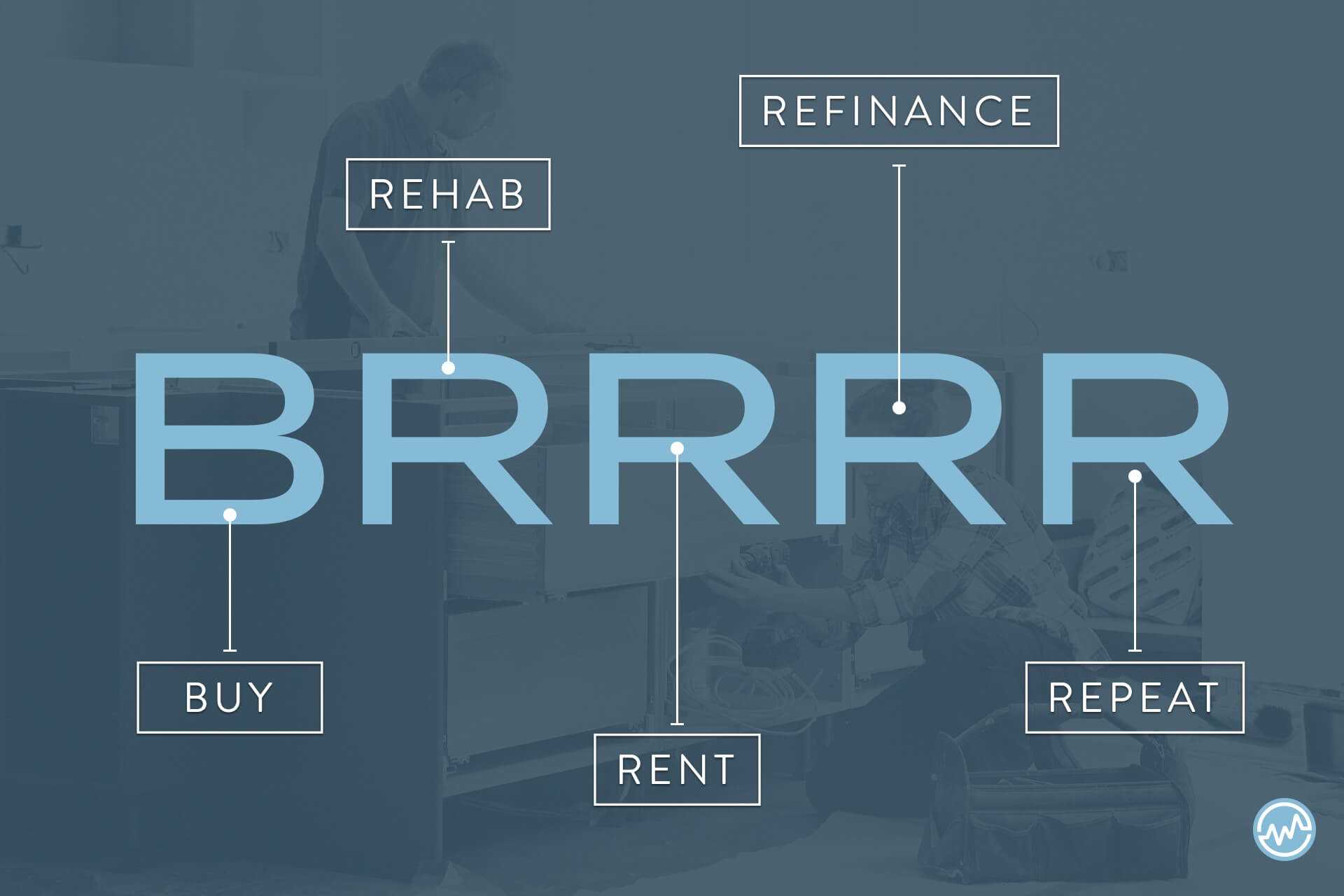

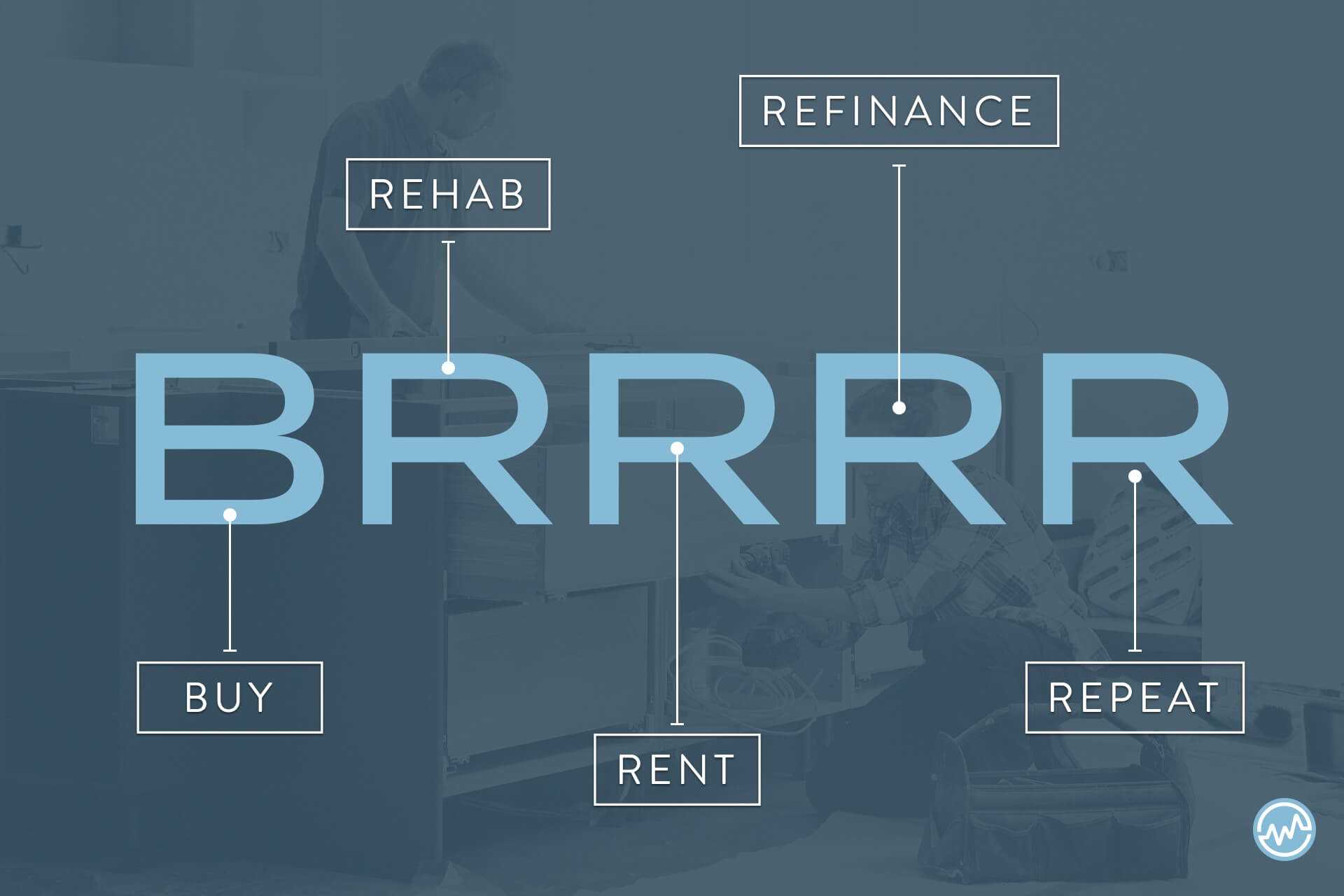

An increasingly popular real estate investing formula, the BRRRR method refers to a five-step process for buying homes in dilapidated conditions, renovating and improving them, generating rental income, and refinancing.

But the point of the BRRRR method is not just to do it once. Instead, the goal is to do it over and over again, with the vision of building an impressive portfolio of rental properties that generate consistent rental revenue.

The best part?

If it works according to plan, the BRRRR can give you as a real estate investor a great return on the capital you invest on your first property — capital you won’t have to spend again on future properties.

Here’s a breakdown of how the BRRRR real estate strategy works — and how you can utilize the BRRRR method to achieve your real estate dreams.

What Is BRRRR?

The steps of the BRRRR strategy are as follows:

Buy

The first step in the BRRRR real estate method is to buy a property in need of repair, also known as a “distressed property.”

This type of property is often foreclosed or close to being foreclosed by the bank.

You can pick up distressed properties for prices well below market value, allowing you to maximize your profits by making repairs and renting the newly renovated property — more on that in our next BRRRR step below.

Rehab

The second phase of the BRRRR real estate strategy is to renovate the home by bringing it up to code and making it livable.

Once that’s complete, you’ll focus on making upgrades that increase the home’s market value, such as:

- Curb appeal

- A total kitchen makeover

- Other miscellaneous improvements

Rent

The next step in the BRRRR method is finding a carefully screened tenantcarefully screened tenant to rent the property.

It’s essential to have someone living on the property because most lenders won’t agree to refinance an unoccupied home.

Refinance

The next step in the BRRRR method is for the property owner to take out a cash-out refinance.

Refinancing converts the equity you’ve built up in the home to money. Remember, the goal of the BRRRR method is to maximize the return on your investment. That means that you should focus on buying a distressed property, not close to market value.

If the home you purchase is on par with market value, you will have a tough time getting any cash out during the refinancing process.

Refinancing the property is easy as long as you have followed the first three steps of the BRRRR method to the letter.

You should be able to find plenty of financial institutions willing to provide you with a cash-out refinance as long as there is equity in the home.

Repeat

Using the money you earned from the cash-out refinance, the next step in the BRRRR method is to buy another distressed or foreclosed property and start the whole cycle again.

The BRRRR method is only effective if the home you buy has plenty of equity in it. When on the hunt for another investment property, be sure to do your research to have the equity you need during the refinance stage of the BRRRR method.

When to Use the BRRRR Method

The BRRRR method is a choice for real estate investors looking to earn long-term passive income.

It’s an effective and proven way to build a decent portfolio of real estate properties without investing too much of your own cash reserves.

When the BRRRR strategy works, the only capital you spend is on the purchase and rehab of the first property.

From that point forward, you use rental income and cash-out refinance to acquire new properties, generating more income and more equity along the way.

The BRRRR method is effective for patient and resourceful investors who understand the value of consistent, steadily-paced growth.

When NOT to Use the BRRRR Method

BRRRR is often touted as a passive income source, but be careful with that label. You have to put a lot of work at the beginning of the process in the “rehab” step. If you’re not willing to take the time to vet workers, then the rehab will drag on and you won’t be able to move into the other steps — a huge disadvantage.

Take the time to find the perfect general contractor. Once you get your process and the team figured out, you can transition to a more hands-off approach.

BRRRR Method Advantages

There are several key advantages to the BRRRR real estate strategy.

Simplicity

The BRRRR method is easy to understand, because it’s a 5-step formula that you apply to every single investment.

The details may be different, and complications may arise along the way, but because the high-level program is the same, it’s simple to follow.

Continuing ROI

In the perfect BRRRR method, your only major capital investment is on the first property you buy and fix up. You then use rental income and a cash-out refi to buy subsequent properties and generate additional income.

There’s a continual ROI on your first property — and each additional property.

Scalability

The BRRRR method is a great vehicle for expanding your real estate holdings.

Since the process repeats and the income keeps coming in, you can build a real estate portfolio in a relatively compact time.

Equity Capture

Homes that are the best candidates for the BRRRR method are usually underpriced for their neighborhoods.

By buying and rehabbing the property for less than its ideal market value, you capture considerable equity right off the bat — sometimes 20% to 30% on each home.

BRRRR Method Disadvantages

As with any real estate investing strategy, there are drawbacks to the BRRRR method that you should consider.

Poor Appraisal

An appraisal should be conducted on the property at the refinancing stage of the BRRRR method.

If your estimate of the home’s post-rehab value is higher than the appraiser’s value — if you went far over budget — you may not be able to complete the refinance, halting the 5 step BRRRR method in its tracks.

Repaying your lender may also be more difficult.

Rehab Delays and Cost Overruns

While using the BRRRR method, there can be delays projected timelines, costing cost overruns to your budget.

If they take too long or cost too much, you may face issues in repaying your lender.

Finding Reliable Renters on Time

Your rehabbed home needs to be occupied as quickly as possible after renovations are finished.

They need to be very qualified renters who meet each of your criteria, too.

If you can’t find qualified renters, you’ll be stuck with an empty home, no rental income, and no chance to refinance, another downside of the BRRRR method.

BRRRR Method Example

Here’s a very quick and rough outline of the numbers you might see with the BRRRR real estate strategy. Keep in mind this example doesn’t include peripheral expenses like taxes or fees.

Let’s say you buy a foreclosed home for $150,000. You front $50,000 for a down payment, and you borrow the remaining $100,000.

The rehab for the property costs $30,000.

Your total investment at this stage is $80,000 (down payment + rehab costs).

You find a qualified renter, and rent for $1,500 a month.

Next, you refinance the property one year later. The appraiser estimates the new value of the improved home is $250,000.

The bank loans you $187,500 — 75% of the home’s new value. You pay off the original $100,000 loan.

That gives you $87,500 for a down payment on a new home, allowing you to…

Repeat the process on your next home.

How To Find BRRRR Properties in 3 Steps

Next, we’ll take a look at specifically how to find BRRRR properties.

The key to finding a BRRR property is to stay focused on a deal. You are looking for a rehab property that comes with a discount.

One of the best ways to do this is to look for off-market properties that don’t come with competition.

Step 1: Look for properties that are run down.

Look for run-down properties in a neighborhood you’re interested in investing. Some signs to look for are:

- overgrown landscape

- boards on windows

- tarps

- general neglect

It’s a sign that the homeowner is not caring for the house and might be open to sale — a great BRRRR opportunity for you.

Step 2: Make your first contact with a note.

Send a letter that clearly states who you are and how to contact you — or, if you have another method of communication, utilize that.

In whatever communication you choose, explain that you would like to buy the house.

Step 3: Make contact in person.

Wait a couple of weeks, and try knocking on the door — sometimes meeting in person can speed up the process. This time, come armed with a purchase agreement.

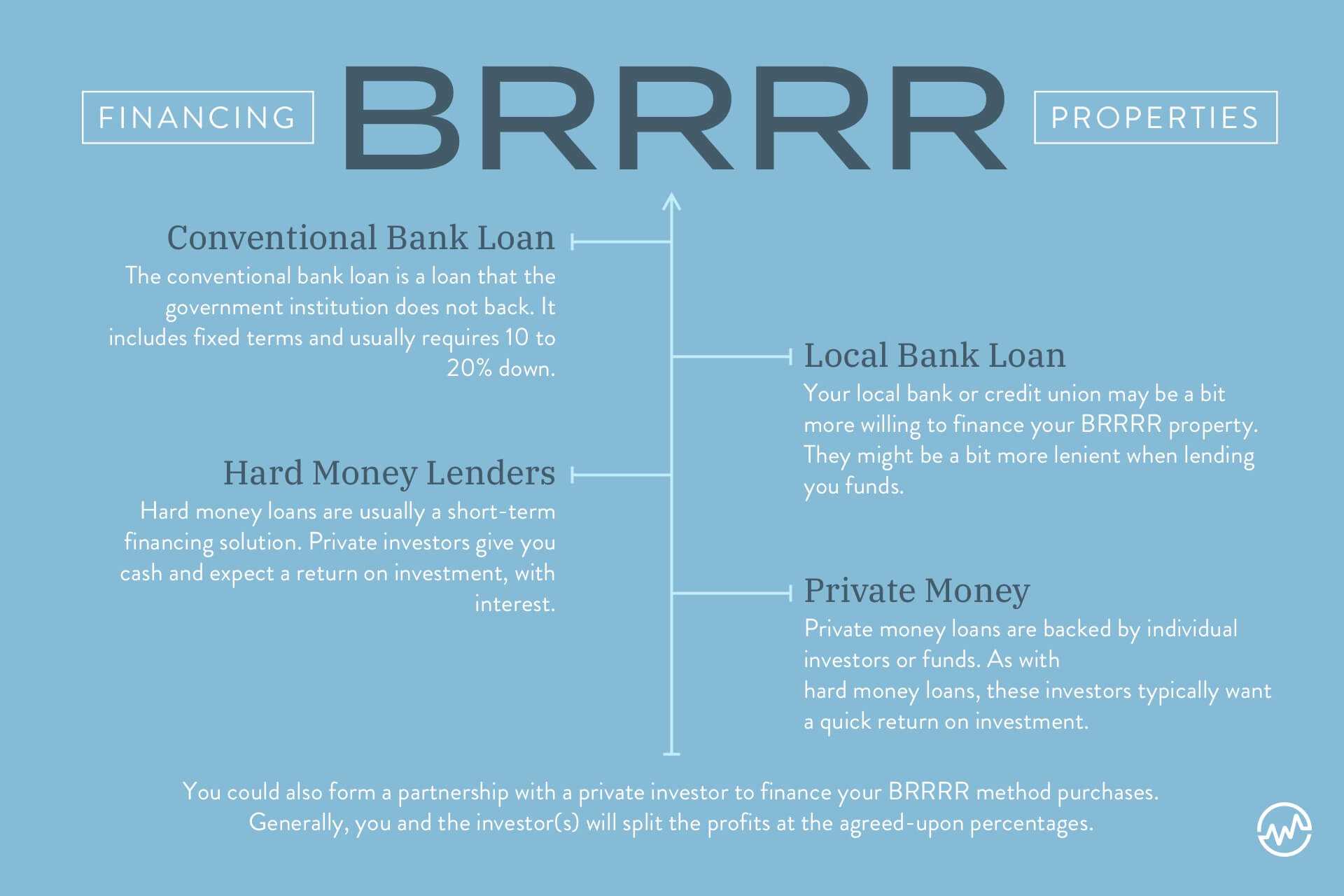

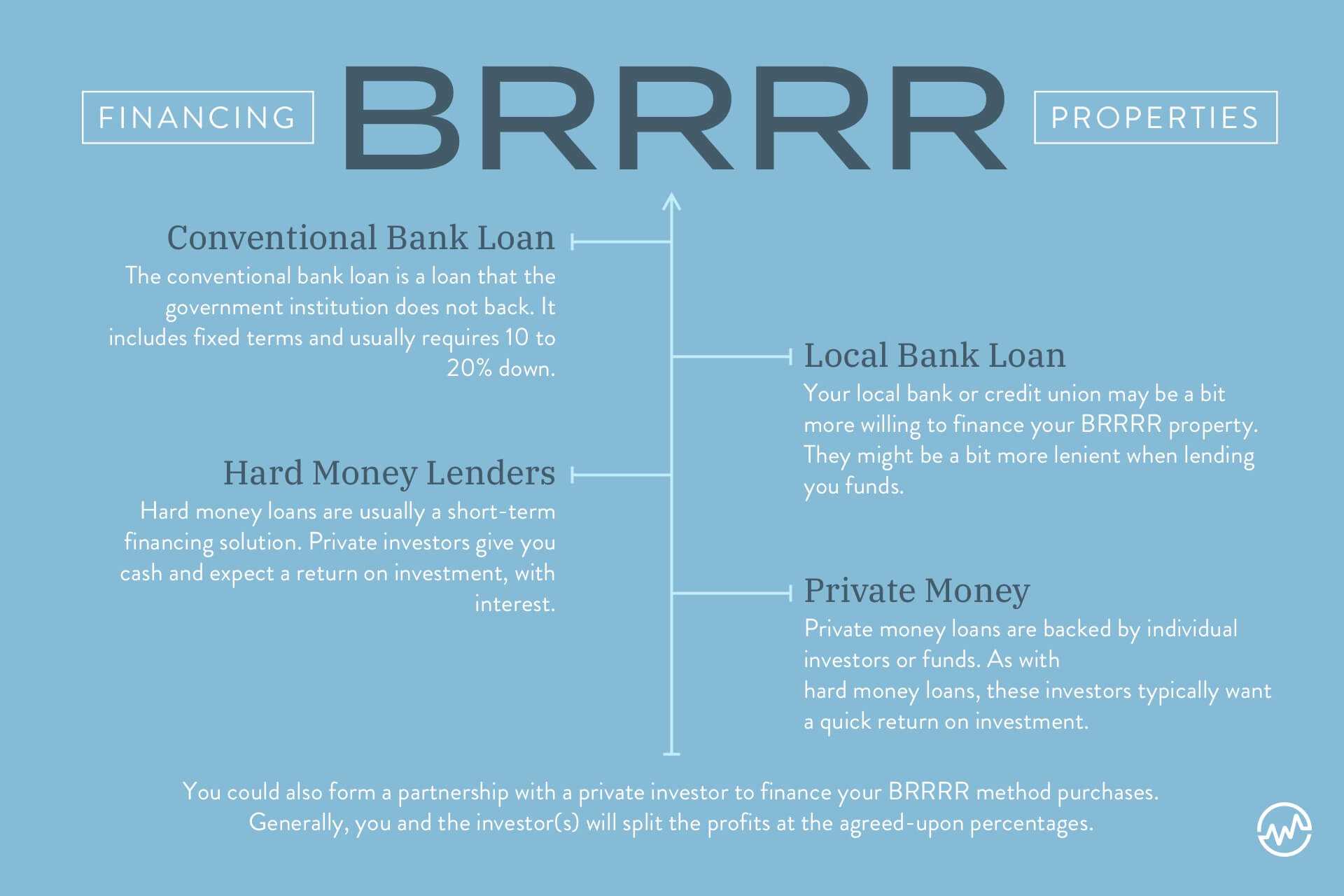

How to Finance BRRRR Properties

There are plenty of options for financing BRRRR properties.

They include the following:

Conventional Bank loan

The conventional bank loan is a loan that the government institution does not back. It includes fixed terms and usually requires 10 to 20% down.

Local Bank Loan

Your local bank or credit union may be a bit more willing to finance your BRRRR property. They might be a bit more lenient when lending you funds, especially if you have a good history of repaying your debts.

Hard Money Lenders

Hard money loans are usually a short-term financing solution. Private investors give you cash and expect a return on investment, with interest.

This type of loan may be beneficial if you intend to flip and sell a home instead of renting it.

Private money

Private money loans are backed by individual investors or funds. As with hard money loans, these investors typically want a quick return on investment. Be sure to do your research to deliver when it comes time to repay the loan.

BRRRR Lenders

When looking for BRRRR lenders, consider going with a lender who specializes in real estate investing. A BRRRR lender will help you secure financing and refinancing to do more projects.

Here are a few BRRRR lenders to consider:

The key to finding any kind of financing is to do your homework — never accept the first loan offer.

Instead, take the time to compare the rates and terms of each loan.

It may also be helpful to discuss initial financing and refinancing with prospective lenders since you will eventually do both.

Other Financing Options for the BRRRR Method

You could also form a partnership with a private investor to finance your BRRRR method purchases. Generally, you and the investor(s) will split the profits at the agreed-upon percentages.

BRRRR Method FAQs

Next, we’ll look at a few of the most commonly asked questions associated with BRRRR real estate and the BRRRR investing strategy.

How do I start the BRRRR method?

The first step to starting the BRRRR method is to buy. Start searching for distressed properties, and be sure to do your research before making that purchase. Failing to do so can leave you unable to refinance later, leaving you unable to continue the BRRRR method.

Where can I find properties to BRRRR?

There are several ways to find properties to use the BRRRR method, including talking with a real estate agent, networking with other real estate investors, looking at sites such as Redfin or Zillow online, or looking firsthand for distressed properties in your local area.

How many times can you BRRRR?

When executed properly, you can BRRRR as much as you want. The goal is to build wealth using multiple properties, and you can even build a real estate empire.

How much money do you need to BRRRR?

All you need is the ability to purchase the first home and make necessary renovations. You can buy the home with one of the financing options detailed above. Be sure that you can complete the renovation. Otherwise, you will be stuck with an uninhabitable property.

Can you BRRRR with a mortgage?

Yes, you can BRRRR with a mortgage. However, it may be a bit more challenging to get a conventional loan if your debt to income ratio is too high.

Q. Can you BRRRR with no money?

Yes, you can BRRRR with no money — if you’re willing to be creative.

Most lenders will require a down payment, even for your first property purchase. One option is seeking out a partner who can loan money for the down payment.

You could continue the partnership or wait until you have enough funds to go off on your own.

4 Tips To Get Started With the BRRRR Method

To begin using the BRRRR method, keep a few tips in mind:

1. Look for properties being sold far below their market value, especially in comparison to surrounding neighborhoods.

2. Set a reasonable and reachable budget and timeframe for the rehab.

3. Set your rental fees at costs that are both fair and designed to generate sufficient cash flow.

4. Screen your rental candidates thoroughly — verify:

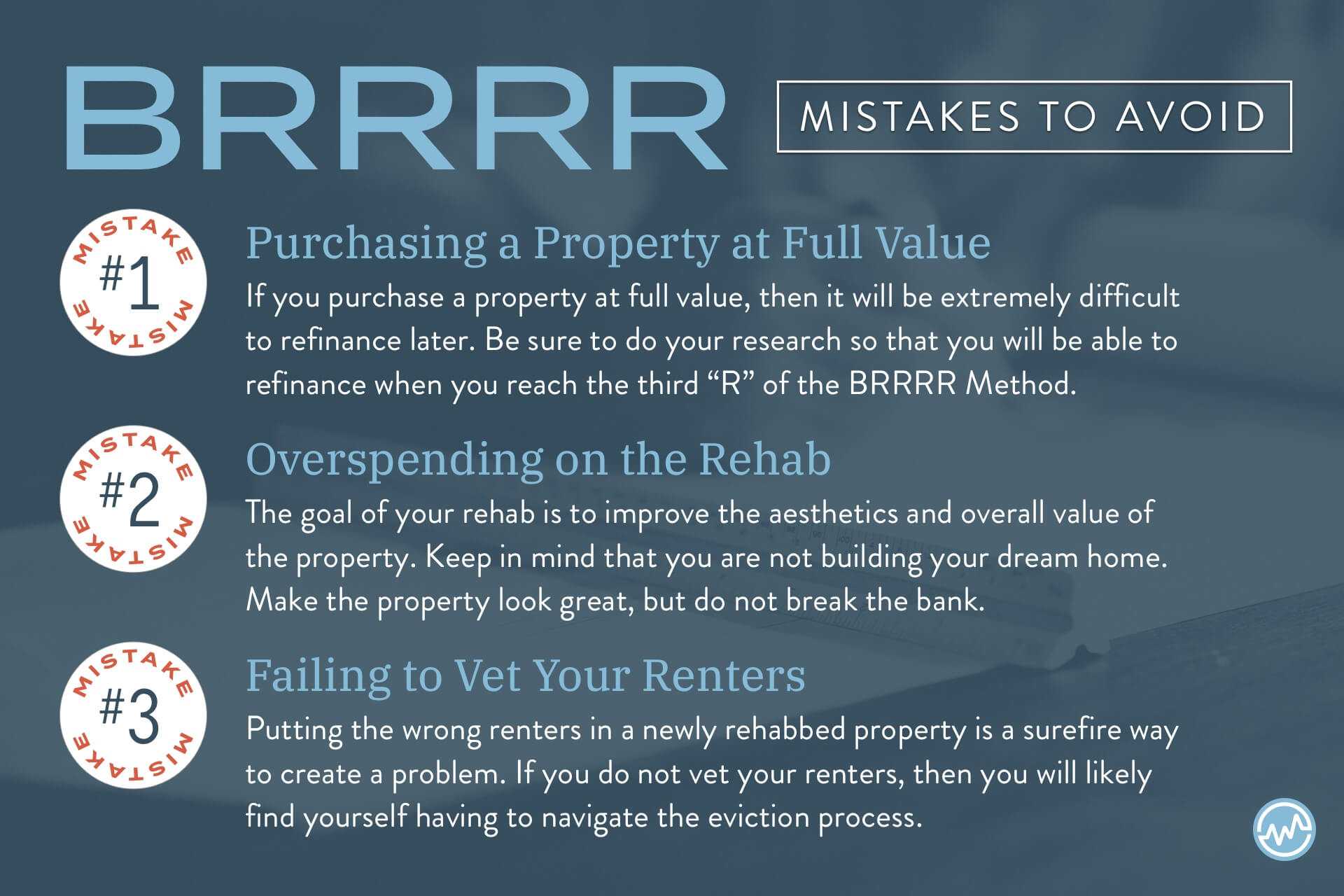

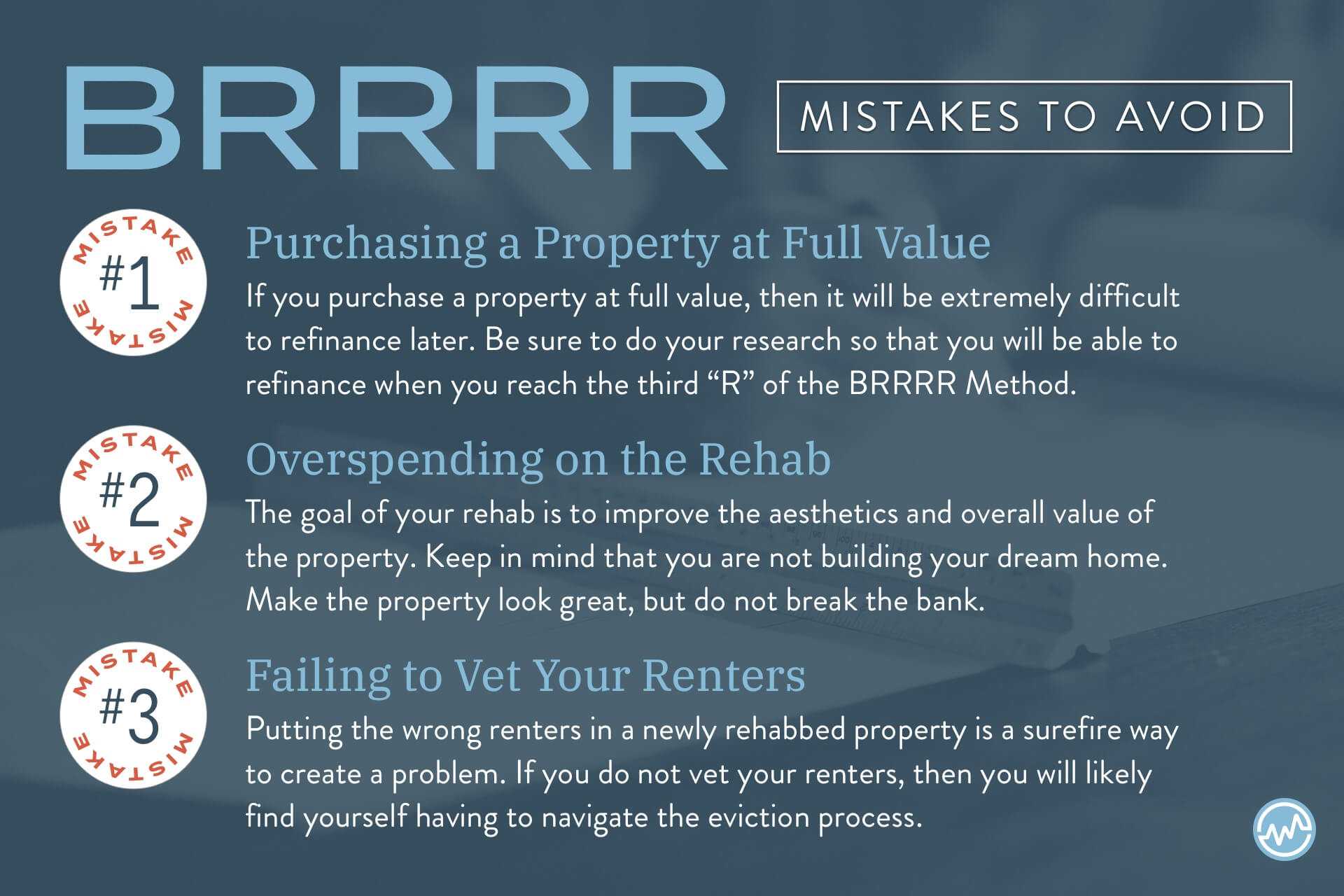

Mistakes to Avoid With BRRRR

Purchasing a Property at Full Value

If you purchase a property at full value, then it will be extremely difficult to refinance later.

Be sure to do your research so that you will be able to refinance when you reach the third “R” of the BRRRR Method.

Also, ensure that when you begin the BRRRR process, think about each step in the process before you buy a property — buy, rehab, rent, refinance, repeat — not just the next step. before you buy a property — buy, rehab, rent, refinance, repeat — not just the next step.

Overspending on the Rehab

The goal of your rehab is to improve the aesthetics and overall value of the property.

Keep in mind that you are not building your dream home.

Make the property look great, but do not break the bank. Doing so can overstretch your budget and will reduce your return on investment.

Failing to Vet Your Renters

Putting the wrong renters in a newly rehabbed property is a surefire way to create a problem.

If you do not vet your renters, then you will likely find yourself having to navigate the eviction process. Worse still, some renters are known to damage property, which can cost you thousands.

Ensure that you find not just tenants for your property, but the right tenants.

The Bottom Line: BRRRR Method

The BRRRR method is a simple concept. But it still requires careful consideration, budgeting, planning, and patience.

It won’t be the best idea for investors who want to cash in super quickly.

But for those that are willing to do due diligence, work patiently, increase their education, stay on top of financial agreements, and follow the formula, the BRRRR method can turn your portfolio into a source of continued passive income.