The Stock Investor’s Quick Start Bundle

In This Article

With so many stock investing strategies out there, how can you decide which is best for you?

There is one strategy that’s been around for 70 years and has shown remarkably good results. It requires a stock to meet one of seven criteria; if at any point a stock does not, it’s removed from the portfolio.

Compared to passive stock investing methods, this method, which requires a constant buying and selling of stock, is attractive to investors who prefer an active investing strategy.

We're talking about the CANSLIM investing method.

The CANSLIM method is an investing strategy that looks for high-growth stocks in a bullish market. The CANSLIM method was created by William O’Neil, a very successful stockbroker, in the 1950s.

In this article, we’ll break down the CANSLIM investing method to see if it’s a stock investing strategy that is right for you.

What is The CANSLIM Method?

The goal of the CANSLIM method is to yield returns above the market. As stated before, the strategy uses seven specific different criteria to select growth stocks, which we’ll look at in depth.

Since growth stocks are riskier than value stocks, investors need to be compensated for taking on this additional risk.

Additionally, the CANSLIM method requires investing during a bull market. During a bull market, growth stocks tend to outperform the market, thus yielding higher returns.

Next, we’ll break down each of the seven CANSLIM criteria.

C – Current Quarterly Earnings

The first criteria looks at the current quarterly earnings per share (EPS) for the company, and sees how much it has increased over the same quarter in the prior year.

EPS can be found by taking the quarterly net income the company generated and dividing it by the number of shares outstanding.

For example, right now companies are starting to report their earnings for the 3rd quarter of 2021. These results would then need to be compared to the earnings for the 3rd quarter of 2020.

But how much do the earnings per share need to increase for a company to be considered in the CANSLIM method?

The CANSLIM method requires at least a 20% increase in EPS over the same quarter from the previous year.

Any company that satisfies this 20% increase in EPS has passed the first criteria in the CANSLIM method.

A – Annual Earnings

While the first criteria dealt with quarterly earnings, the second criteria centers around annual earnings. There are two parts to annual earnings.

First, annual earnings (net income for the company’s fiscal year) must have increased for each of the past five years. This first part shows that the company is consistently generating a profit, and the profit is historically increasing over time.

Also, the company must be reinvesting its earnings efficiently. A company can either distribute its earnings as a dividend or keep it in the business as retained earnings.

To pass this test of the CANSLIM method, the company must be generating a return on equity (ROE) in excess of 17%.

Any company that has had at least five years of earnings growth and an ROE greater than 17% has now passed the second CANSLIM criteria.

N – New Product, Service, or Management

The third criteria is all about ‘new’.

The company needs something new for it to outperform the market. A new product, service, or management can allow a stock to generate buzz and get investors excited.

New can also mean a form of innovation. Any company that is constantly innovating and coming up with ways of improving its products and/or services is a company that investors will want to put their money in.

New products and/or services can also directly increase revenues and net income, whereas new management can indirectly increase revenues and net income.

Since stock prices are essentially the present value of future dividends, as revenues and net income increase, the stock price should as well.

This is because the higher the revenue and net income, the higher the dividend the company is able to payout.

S – Supply and Demand

The ‘S’ in CANSLIM stands for supply and demand.

This theory usually comes up in economics classes, but we can apply it to investing in the stock market as well.

The theory states that the price of a product increases as its demand increases and vice versa. And the price of a product increases as its supply decreases and vice versa.

William O’Neill used supply and demand in his CANSLIM methodology to look for stocks with limited supply.

If there was limited supply, and demand started to increase, the price of the stock would increase sharply.

This is because there would be higher demand and low supply, so investors would have to outbid each other to get in the stock.

As they start to outbid each other, the price of the stock would increase rapidly.

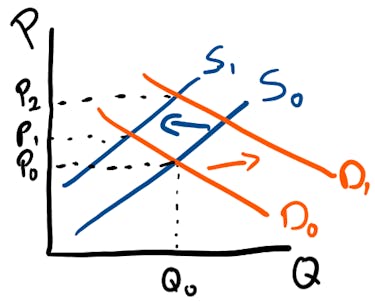

Let’s look at this using a supply and demand graph.

The price of the product is on the y-axis (vertical line), whereas the quantity of the product is found on the x-axis (horizontal line).

Our supply curve slopes upward and is in blue.

The demand curve slopes downward and is in orange.

The original supply curve is labeled S0 and the original demand curve is labeled D0.

The point of their intersection shows where the price and quantity are.

These are labeled as P0 and Q0.

If supply is restricted, as shown by moving the supply curve to the left to S1, then price immediately increases to P1.

So restricted supply alone means that the price is high. But then as the demand increases, as shown by a shift in the demand curve to the left, prices increase even higher to P2.

This is exactly what O’Neill was looking for when he wanted stocks that had limited supply.

While this works in theory, how can we apply it to the real world?

O’Neill recommended stocks with fewer shares, but who still have experienced high daily trading volume.

This is what we mean by low supply (fewer shares outstanding) and high demand (high trading volume).

Finding this mix in a stock can lead to a sharp increase in a stock.

L – Leaders or Laggards

The fifth criteria of the CANSLIM method asks whether a particular company is either a leader or a laggard in its industry.

Determining how a company compares to its peers is important information any investor must know if they are to put the company in their portfolio.

Since it is not easy for investors to determine how a company compares to all of its competitors, O’Neil publishes a Relative Strength Price Rating. This rating shows how well a stock has performed over the past year relative to all other stocks.

The rating is on a scale of 1 to 99, with 99 being the highest a stock can be. If a stock has a rating of 10, it has only outperformed 10% of other stocks.

If a stock has a rating of 90, it has outperformed 90% of other stocks. O’Neill suggests a rating of 80 for a stock to be considered in the CANSLIM method.

I – Institutional Ownership

The criteria related to institutional ownership may be the most confusing to understand of all the criteria in the CANSLIM strategy.

This one says that a stock must have some institutional ownership ... but not a lot.

Like we said — confusing indeed.

Institutional ownership essentially means large investment companies. This is important because if a large investing company, with a good historical track record, invests in the stock, then it indicates that this company is most likely a good investment.

O’Neill recommended considering institutional ownership as having a good track record if it had a rating of B+ or better from its previous Month Performance Rating.

There needs to be some institutional ownership because once demand increases, then these large investment companies can significantly influence the price.

There is also still room for additional institutional owners to come in and raise the price even more. But there shouldn’t be too many large investment companies who own it, because then there may not be any new investors and not much room for the price to increase.

How do you know if there are too many investment companies? This is what makes it difficult to understand. There is no rule of thumb for this criteria, and is more left to the investors discretion.

As long as there are at least a few, then this sixth criteria is met.

M – Market Direction

The seventh and final of the CANSLIM criteria is for the direction the market is headed. If all of the first six criteria are hit for a stock, then the investor needs to consider whether the market is going up or down.

Investors can do this easily by examining how the major indices have moved in the past month, quarter, and year.

These major indices are the:

- S&P 500

- Dow Jones Industrial Average

- NASDAQ Composite

If we are in a bull market and the indices have had positive returns, then the strategy states to go ahead and start investing.

If the market is currently in a bull market, then it is recommended to wait until the market begins to turn around.

Advantages of CANSLIM

There are several advantages related to investing using the CANSLIM method. These advantages include:

Higher Earnings

The CANSLIM method centers around investing in growth stocks. While growth stocks tend to be riskier than value stocks, they also have produced higher earnings as well. Because of this, this method can result in higher returns.

The CANSLIM method is only used when there is currently a bull market. If you can get in stocks at this time, then this is yet another reason to expect high returns.

Reduce Risk

Since it is not a buy-and-hold strategy, the CANSLIM method says to get out of a stock if it loses 8%.

This will reduce your risk because you are setting a stop loss for yourself.

Disadvantages of CANSLIM

Just as there are advantages, there are also disadvantages to the CANSLIM method.

Risks in Bear Market

You can expect high returns, but the risk is also greater. If you predict wrong and the bull market turns into a bear market, then there could be substantial losses.

High Number of Trades

The CANSLIM method can produce a high number of trades.

Constantly getting in and out of stocks is time-consuming.

Tax Implications

Selling stocks within a year leads to higher taxes than selling after a year.

If you take part in the CANSLIM method, you may end up paying more taxes.

When To Use CANSLIM — And When Not To

The best time to start using the CANSLIM method is during a bull market.

When To: Bull Market

This was the final of the criteria. If you get in during a bull market when prices are increasing, you can expect great returns.

When Not To: Bear Market

But if you get in during a bear market, it could prove to be disastrous for your portfolio.

When To: Investor with Experience

This is also a strategy for the experienced investor.

When Not To: New Investor

The CANSLIM method is not meant to be something new investors should partake in.

The reason being that the risk is high, and you really have to know what you are doing if you are going to start a risky strategy.

Not only do you have to be an experienced investor, but you also should be an investor who is comfortable taking on high risk and has a long timeframe.

When Not To: Short Timeframe or Risk Averse

If you are an experienced investor, but don’t like risk or don’t have a long timeframe, then you should avoid this strategy.

The Bottom Line: CANSLIM Method

The CANSLIM method has proven to be a great investing strategy. While it can be risky, it has also been shown to produce returns that consistently beat the market.

It does this by investing in growth stocks during a bull market. These growth stocks must also pass six different criteria. These six criteria are related to:

- quarterly earnings

- annual earnings

- new products/services or management

- supply and demand

- leaders in the industry

- institutional ownership

The seventh criteria mandates that the market is a bull market before any investor decides to start investing using this strategy.

This is also a risky strategy, and should only be used by investors who have a high tolerance for risk and a long timeframe.

The CANSLIM method is time-consuming as it involves taking an active approach with your portfolio.

But if you pass these criteria, and are confident that you can generate high returns using this strategy, then the CANSLIM method is one of many stock investing strategies to consider implementing in your portfolio.