Smart Money Moves for Parents

How To Teach Your Kids About Building Long Term Wealth

In This Article

- Why Get Credit Cards for Kids?

- How Old Do You Need to Be to Have a Credit Card in Your Name?

- Benefits of Credit Cards for Kids

- How To Get Credit Cards For Kids

- Best Credit Card for Kids: 9 Options

- Credit Cards for Kids: Teach More Than Just Credit Habits

- Final Thoughts on Credit Cards for Kids

- Continued Learning: Credit

Did your parents warn you about credit cards? Did they say something like . . . “not until you’re older!”

They had good intentions, but there’s a better way to handle children and credit today.

The solution to financial ignorance is education; not prolonged ignorance.

The earlier your kids learn about credit and start building it, the better.

Let’s explore credit cards for kids.

When you think about gifts for your children, you might think about trendy toys, the latest video games, clothes in bigger sizes, or even water park passes and concert tickets. But what about a financial gift setting them up for life?

No, we’re not talking big-money inheritances or trust funds.

There is a simple, cost-effective yet often overlooked financial move that can benefit your children for the rest of their lives by providing lasting financial education: credit cards for kids.

Why Get Credit Cards for Kids?

First of all, although we’re exploring credit cards for kids, this isn’t about giving your kids access to unlimited funds so they can splurge at any time like their favorite celebrity.

This is also not about giving kids money they haven’t earned or can’t repay.

Instead, this is about building credit for kids: helping your children build proper credit while they are young. In addition to building credit, credit cards for kids can also teach how to use credit responsibly to avoid costly mistakes later in life.

There are two different strategies you can use to get credit cards for your favorite little ones:

- Depending on their ages, you can add them as authorized users on your cards

- Set them up with their own credit cards

We’ll look at each option in-depth in this article. But before we do, let’s examine the benefits of credit cards for kids as well as building credit for kids.

How Old Do You Need to Be to Have a Credit Card in Your Name?

Before getting a kid’s credit card, you’ll need to be aware of the age restrictions.

To get a credit card in your own name, you must be at least 18 years old. However, with the Credit CARD Act of 2009, lawmakers created special protections for young adults to help prevent years of crushing credit card debt.

Now, credit card applicants under the age of 21 must have verified independent income or a cosigner to open an account. Unfortunately, most major credit card companies are no longer allowing cosigners.

So what options are there for credit cards for teens and young adults and how can they build credit?

The easiest and best way is for a parent to add their child as an authorized user on their credit card account. As an authorized user, the child will get a card in their name, but the primary account holder takes on the responsibility for paying the charges.

Kids can build credit as an authorized user, but parents must know that they are taking on the risk of their child’s spending habits. Some companies allow for limits to be place on authorized users which can be helpful as they learn responsible spending.

Benefits of Credit Cards for Kids

As unconventional as it may seem, there are real benefits to credit cards for kids.

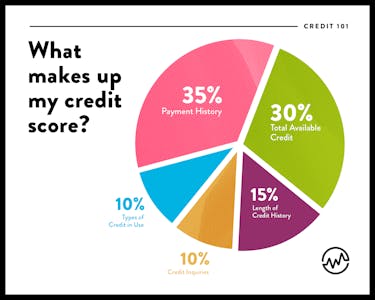

Did you know that 15% of your credit score is determined by the length of their credit history? It’s true.

Here’s the full breakdown:

Compared to payment history and total available credit, credit history is one of the hardest things to build because it takes time.

Even if a young adult is the picture-perfect credit card user, time is not on their side.

Someone with a more established credit history is more likely to have a higher credit score. With a higher credit score, your children will:

- Pay less for car insurance premiums

- Be more likely to be approved for an apartment or house rentals

- Have an easier time qualifying for student loans or a car loan

- Qualify for lower interest rates

- Avoid security deposits on cell phones or utilities

That’s a pretty big gift to give, don’t you think?

Credit history is not the only benefit to credit cards for your kids. In addition to building good credit, credit cards for your children can help boost their financial literacy.

Instead of being forced to learn the hard way, credit cards for kids offer the opportunity to teach the following before stepping into the world on their own:

- responsible borrowing habits

- spending limits

- budgeting

- interest rates

- debt repayments

This will certainly give them an advantage over their peers who are opening credit cards for the first time when they leave home for college and are making financial decisions without any input or modeling from their families.

How To Get Credit Cards For Kids

Strategy 1: Adding Children to Cards as Authorized Users

The first strategy to consider is adding your children as authorized users on your existing credit card accounts. This means you’re essentially giving your children access to your credit card — but in their names.

They can then use all the features of the card, but the primary account owner (that’s you!) is responsible for the payments.

Many times, the authorized users inherit the credit history of the account. So, you want to make sure you are adding them to accounts you already manage responsibly.

You may be surprised to learn there are several big-name financial institutions issuing credit cards with no minimum age requirement, such as:

- Bank of America

- Chase

- Wells Fargo

How To Add An Authorized User

You can quickly add your children as authorized users in a few simple clicks.

Sign in to your credit card account online and select the “add authorized users” option. You’ll then be prompted for your children’s personal information.

After processing and approval, they’ll ship off a brand-new card for your child.

Strategy 2: Giving Children Their Own Credit Cards

Another way to build your children’s credit history is to help them obtain their own cards.

As the shift to a cashless society continues, more and more families are making this choice. In T.RowePrice’s 14th Annual Parents, Kids & Money Survey, 17% of parents with children between the ages of 8 and 14 reported them having credit cards.

Your child’s credit card can help establish their credit history fast while teaching them about using credit responsibly and improving their financial know-how.

You can help your teenager apply for their own credit card once they are 18 years old. Your teen may be able to apply on their own if he or she has:

- a job

- paystub

- established credit history

If not — as we mentioned above in the article — you will need to co-sign for them.

Best Credit Card for Kids: 9 Options

Even if you aren’t ready to add your children as authorized users or give them their own credit cards today, understanding the best options now can help you make educated decisions later.

Not all plastic is created equal.

Here are 9 of the best credit cards for kids today.

Credit Card for Kids Option #1: The FamZoo Prepaid Card

If you want to keep the training wheels on, there’s an outstanding alternative to credit cards for kids under 18.

The FamZoo prepaid card is a strong choice because parents and children both get access to the same account. A FamZoo subscription costs $5.99 per month per family, with discounts for paying yearly.

With FamZoo — their tagline is “preparing kids for the financial jungle — there are different protection features.

You can lock or unlock the card and even connect its usage to various chores. For instance, you can use FamZoo to post chores you’ll pay for. Your children can then check the chores off once they’ve completed them and be paid automatically through the FamZoo app.

Another perk of FamZoo is that it helps teach kids how to budget at a young age. It accomplishes this via its app, which allows kids to split their money into four categories:

- spending

- saving

- investing

- charity

Not only can kids allocate money responsibly, but parents can also incentivize positive money habits by matching their savings and investing contributions.

Parents can even set up an interest rate and pay interest on savings. Children can then track how their savings grow as a result of the interest they earn.

Credit Card for Kids Option #2: Greenlight

Greenlight, known as “the debit card for kids” provides a Mastercard debit card for kids. At the cost of $4.99/month per family, it allows you to choose the stores where your kids can spend money.

Parents can also pay allowance for chores directly to the card, controlled by a downloadable app.

It also serves as an educational tool: kids have the ability to track their balances in “Spend, Save, and Give” accounts to help foster smart spending, budgeting and even giving back.

Credit Card for Kids Option #3: GoHenry

GoHenry notes that “It’s proven that money habits are formed early in life”. That’s why they want to help your child or teen create healthy financial habits.

A debit card and app, GoHenry offers “unique parental controls for young people aged 6 to 18.” On the app, parents can set limits on where and how much their kids spend.

At the cost of $3.99 per child per month, users can set savings goals and set aside money to reach those goals.

Credit Card for Kids Option #4: Discover It Student Cash Back Credit Card

For young adults who are interested in opening their own credit cards, the Discover It Student Cash Back credit card is an excellent option. With no annual fee and an introductory 0% interest rate, it’s a great value for those trying to establish or improve their credit.

Plus, the card only requires a fair credit score, and it offers a range of incentives.

For instance, college students can earn 5% cashback at a number of different locations, including:

- gas stations

- grocery stores

- restaurants

- wholesale clubs

- Amazon

Those cash rewards never expire and can be redeemed at any time.

The card also provides incentives for good grades. Students earn a $20 statement credit each year their GPA is above a 3.0.

This makes the Discover It card a favorite among college students.

Credit Card for Kids Option #5: The Journey Student Rewards Credit Card from Capital One

Another kid’s credit card option: the Journey Student Rewards Credit Card from Capital On, available to individuals with credit scores between 580-699.

Like the Discover It card, this card doesn’t have an annual fee and also offers cashback on purchases. Cardholders start out receiving 1% cashback.

However, by paying their credit card bill on time, they can boost their cashback bonus from 1% to 1.25%.

Credit Card for Kids Option #6: Busy Kid

Busy Kid is a great kids credit card for children between the ages of 5 and 17. It helps parents to teach their children to manage money and learn to spend responsibly.

Paired with the Busy Kid app, the prepaid debit card offers a way for children to earn money — through allowances and/or chores — and practice saving and real-life money management.

Parents have full access to their child’s account, and through the app can set limits or require approval for spending. Share your child’s BusyPay QR code with family members to make gift giving easy.

For a monthly fee starting at $3.99 per family, parents can help children learn smart spending and saving habits.

Credit Card for Kids Option #7: Petal Card

Petal is an excellent first credit card for teens, especially for young adults with no credit history. Backed by Visa, there are two card options, Petal 1 and Petal 2, each with several advantages.

The Petal credit card and app touts “A new approach to credit.” Without a credit history, most companies will not issue a credit card unless you have a co-signer. At Petal, they look at your banking history to create a Cash Score to determine your creditworthiness.

Both Petal 1 and Petal 2 offer:

- No annual or foreign transaction fee

- Bonus cash back on purchases at select merchants

- A path to increase your credit limit

Petal 1 is great for those with low-to-fair credit or cash flow. Petal 2 is for those with fair-to-good credit or cash flow. Petal 2 offers a lower APR rate and higher credit limit, with no late fees and 1% cash back on purchases.

Credit Card for Kids Option #8: Axos First Checking

Axos Bank takes a different approach to help families teach their children money management. First Checking is a joint checking account for teens ages 13-17 with an adult co-owner.

There are no maintenance or overdraft fees and the account can earn 0.10% APY. Teens learn responsible spending with a debit card and can even send payments to friends directly from their checking account.

First Checking does charge ATM fees and there are daily limits on transactions and debit spending. However, with many secure features such as account alerts and biometric authentication, it’s an ideal first bank account for teens.

Credit Card for Kids Option #9: Step

Step is a no-fee mobile banking app and Visa card designed for teens. There is no minimum age limit, but a parent or guardian must sponsor the child’s account, and a cell phone number is required.

Step is designed to teach children and teens financial responsibility. It’s an easy way to get a kid’s credit card.

Young users learn responsible spending habits by sending and receiving money through the app or by paying with the Visa card. Parents can deposit money into the account or set up a recurring allowance. Direct deposit is available for paychecks.

Avoid These Mistakes: Credit Cards For Kids

It’s true — there are pitfalls to avoid when discussing credit cards for kids. Authorized users can quickly reap benefits from a shared credit history with other cardholders who have joint access to the account.

But it can be a double-edged sword since mistakes are also shared.

One user’s irresponsible spending could have lasting consequences for everyone in the family.

Even if an authorized user is removed from the account, the original account owner is still left with any damage done.

Another concern is that credit card debt is actually the most common type of debt in the United States.

If children and teens have access to credit cards without really understanding the consequences of misusing them, they could face a lifetime of debt.

One way to avoid these pitfalls is to add your child as a user without giving them access to the card. Their credit history will continue to grow, but you can wait until they demonstrate more financial awareness and responsibility before allowing them to use the card.

Other families do not feel credit cards for kids under 13 years of age are appropriate; instead, they opt for prepaid cards until children demonstrate responsible spending habits.

If you and your kids are ready to take the credit card plunge, use these credit cards for kids tips to dodge common pitfalls:

- Work with children to set spending limits so the card balance can be easily repaid.

- Make sure children understand the importance of quickly reporting lost or stolen cards.

- Help your kids set up account access through a mobile app to monitor activity within the bank account.

- Read the fine print. It is important you understand all the terms and conditions of the card.

- Check credit reports for any errors and to understand you and your children's credit scores better.

Use Mistakes As An Educational Opportunity

At the end of the day, be aware that this is a learning process, and your children will make mistakes.

We all have.

That’s why it’s important to use any and every mistake as an educational opportunity so that they don’t make these mistakes in the future and fall into "bad" debt.

Credit Cards for Kids: Teach More Than Just Credit Habits

Educating your children about healthy money and credit habits is an incredible step — but don’t stop there.

There are still other areas of finance that you can teach them, such as:

- What ”Financial Adulting” looks like

- How to graduate college debt-free

- How to pay less taxes

- What retirement is — and how to save for it

Final Thoughts on Credit Cards for Kids

If you tell someone your to-do list for the weekend includes getting credit cards for your young kids or the teens in your family, they might be shocked.

But once an understanding of how credit cards work for kids and the advantages they can unlock, it’s easy to see it can be a smart money move.

Continued Learning: Credit

Now that you know the benefits of credit cards for kids along with the pitfalls to avoid, continue your financial education with these free Wealthfit-approved resources:

- Improve your credit score by using a Goodwill Letter

- Learn how to remove a derogatory mark from your credit report

- Utilize this free and easy credit repair tactic

- Did your credit score drop? This may be why