Crypto Investing 101

How to Invest in Crypto for Passive Income & Long-Term Wealth

In This Article

- Cryptocurrency for Beginners: What Is Cryptocurrency?

- Cryptocurrency for Beginners: What Makes Cryptocurrency Valuable?

- Cryptocurrency Basics: How Cryptocurrency Works

- The Different Forms of Cryptocurrencies

- Different Types of Cryptocurrency

- Example of a Cryptocurrency Transaction

- How Investors Buy or Trade Cryptocurrency

- Cryptocurrency Regulation And Rules

- Cryptocurrency Best Practices

- Cryptocurrency for Beginners: How to Get Started

- The Bottom Line: Cryptocurrency For Beginners

- Cryptocurrency for Beginners Free Resources

Cryptocurrency has been called everything from the money of the future to an extremely risky asset that shouldn’t be touched with a 10-foot pole.

So which is it? And should you be investing your hard-earned money in it?

That’s what this cryptocurrency for beginners article will explain: the cryptocurrency basics by breaking down its complex nature so that you can become more knowledgeable on the topic.

Only after you understand these crypto basics can you make a decision on whether or not it is right for your investment needs.

By the end of this cryptocurrency for beginners article, you’ll have an understanding of cryptocurrency basics such as:

- What cryptocurrency fundamentally is

- The different types of cryptocurrency

- Current laws and regulations surrounding crypto

- How to buy cryptocurrency

- How to sell cryptocurrency

- Best practices investors follow when investing in cryptocurrency

If you're ready to learn about cryptocurrency for beginners, let's get started!

Cryptocurrency for Beginners: What Is Cryptocurrency?

It’s easy to get tripped over the technicalities of cryptocurrency, so in this cryptocurrency for beginner's guide, we'll start with the cryptocurrency basics.

Cryptocurrency is digital money.

Because it’s purely digital, there are no physical coins or bills tied to it.

Cryptocurrencies are not tied to valuable assets — they are not tied to anything of value in the real world, and this makes the value fluctuate erratically, which you’ve likely seen.

In fact, 2022 marked the second year of Bitcoin’s life that had investors understandably worried for its future.

Sharing similarities with 2011, Bitcoin’s value dropped sharply in the second quarter — losing approximately 58% of its value.

Not only does this mark the second time that there’s been significant concern over the cryptocurrency but it’s also the single-worst month in Bitcoin’s history to date.

To put all of this into perspective, that’s more than $1 trillion worth of Bitcoin gone from the overall market.

Unfortunately, the current economy, as well as inflation, has adversely affected the crypto market, as well, with many Bitcoin holders selling off their assets in record numbers.

Cryptocurrency for Beginners: What Makes Cryptocurrency Valuable?

This volatility is something to keep in mind when discussing cryptocurrency for beginners because unlike stocks, bonds, artwork, real estate, or precious metals, cryptocurrencies have no use or value outside of possession.

Goldsilver's Founder, Mike Maloney, likes to compare "crypto" to gold — except the big distinction there is that gold actually has a purpose outside of using it for currency.

Gold is a vital component in electronics, and jewelry — and thus has value outside of its limited supply.

Cryptocurrency, on the other hand, only costs money because someone else has it, and wants money to give it to you.

Currencies have always faced two problems in general:

- They require a central authority to regulate their value, production, and authenticity.

- They fall victim to fraudulent creation.

Bitcoin — one of the many forms of cryptocurrency — was invented to combat these exact problems.

The blockchain system (which we’ll explain in a minute) and high-level encryption address both problems.

Because Bitcoin is automated and highly encrypted, the system doesn’t require a central authority to regulate it (in fact, it can’t be regulated) and transactions cannot be fraudulent.

That’s all bitcoin is — the answer to the question “what would it take to create a virtual currency without a central authority?”

Cryptocurrency Basics: How Cryptocurrency Works

In order to understand cryptocurrency, you should also understand the following technologies and principles:

Cryptography

Cryptocurrency utilizes cryptography — the method of disguising and revealing information — to ensure the security of user information and transactions are done safely.

Blockchain

A blockchain is a form of Distributed Ledger Technology (DLT), which is essentially a database spread over multiple operators (nodes, computing devices, etc.)

This is the technology that powers an entire cryptocurrency. It’s essentially a digital ledger that verifies accounts, balances, and transactions.

There are many uses for blockchain outside of financial purposes such as supply chain management, tracking art ownership, and even digital collectibles.

A term related to blockchain that will also be used throughout this article is a node. A node is the individual part of the larger data structure that is a blockchain. Without nodes, the entire system would fall apart.

Cryptography and blockchain help cryptocurrencies create new coins, enforce legitimate transactions, and create a secure system.

De-Centralized

Decentralization, as seen with Bitcoin, means that all authoritative power is distributed among all the peers on a network, and there isn’t one individual point of failure.

For example, in order to “hack” Bitcoin, someone would need to hack into at least 51% of the large network of computers responsible for running Bitcoin, which is considered an impossible task.

Peer-to-Peer

Cryptocurrency can be sent directly between two people without the need for a broker. These transfers are done with very low processing fees that go to compensate the network, making it possible for users to bypass hefty transaction fees with more traditional payment transfer services.

That means no need for a PayPal, Zelle, or a bank.

The Different Forms of Cryptocurrencies

When most people think of a cryptocurrency, chances are that they’re thinking of Bitcoin (BTC). Bitcoin is considered the cryptocurrency flagship — the coin that launched thousands of coins.

According to Statista, as of February of 2022 there are more than 10,000 cryptocurrencies, a 3.7 X increase from the cryptocurrencies that existed as of year-end 2019.

10,000!

But don’t worry — this article is focused on cryptocurrency for beginners, and as a beginner, you don’t need to learn every single cryptocurrency.

Instead, let’s go over just a few of the most popular types to give you an idea.

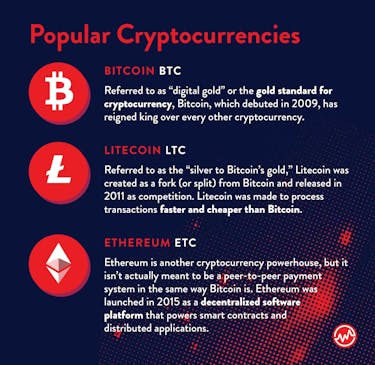

Bitcoin (BTC)

Referred to as “digital gold” or the gold standard for cryptocurrency, Bitcoin, which debuted in 2009, has reigned king over every other cryptocurrency.

With a market capitalization of over $900 billion, Bitcoin dominates the rest of the cryptocurrencies with the lion’s share of the total cryptocurrency market cap.

Investing in just one Bitcoin is an expensive endeavor compared to other investment vehicles. Just for comparison, one bitcoin is equivalent to $48,920.30.

Litecoin (LTC)

Referred to as the “silver to Bitcoin’s gold,” Litecoin was created as a fork (or split) from Bitcoin and released in 2011 as competition.

Litecoin was made to process transactions faster and cheaper than Bitcoin. One Litecoin is equal to about $178.93.

Ethereum (ETH)

Ethereum is another cryptocurrency powerhouse, but it isn’t actually meant to be a peer-to-peer payment system in the same way Bitcoin is.

Ethereum was launched in 2015 as a decentralized software platform that powers smart contracts (programmatically enforced contracts) and distributed applications (“decentralized” apps or dApps, which we’ll discuss later on in the article).

Tether (USDT)

The increased demand for USDT has led to its success as a stablecoin. By tethering the value of the token to the US dollar, USDT provides holders with a stable way to store value and conduct transactions.

The token has become one of the most popular cryptocurrencies, with a market capitalization of over $66 billion.

The success of USDT has led to the creation of other stablecoins, such as TrueUSD (TUSD) and Pax Dollar (USDP).

These tokens are also pegged to the US dollar, providing holders with a stable way to store value and conduct transactions.

The increased demand for stablecoins highlights the need for a reliable store of value in the cryptocurrency market.

U.S. Dollar Coin (USDC)

The U.S. Dollar Coin (USDC) is another stablecoin that has been a resounding success.

USDC was created by Circle, a Boston-based startup, and is backed by the U.S. dollar.

It is one of the most popular stablecoins, with a market capitalization of over $55 billion.

Interestingly, USDC is not just popular with traders; it is also widely used by corporations.

In 2019, Circle announced that it had partnered with Coinbase to offer USDC to its institutional clients.

Binance USD (BUSD)

Binance USD (BUSD) is another stablecoin that is pegged to the US dollar.

Binance launched BUSD in partnership with Paxos, a New York-based trust company.

BUSD is available on Binance’s spot exchange and can be traded against major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), and Tether (USDT).

dApps

These decentralized applications are open source, autonomous, have 100% uptime, and leverage all the benefits of a blockchain (no central server, extremely difficult to be hacked, etc.)

Imagine the apps in the iTunes store are instead their own entities instead of being centralized through Apple — that’s what a dApp is.

There are nearly 3,000 dapps using Ethereum’s blockchain and the blockchain of a few Ethereum competitors such as EOS, NEO, and Qtum.

Smart Contracts

These are strings of code that automatically execute a certain task when specific conditions are met. For example, Alex could set up a smart contract to “pay Steven $40 if he sends 10 unique logo designs by December 8th, 2021."

Once Steven completes this task, the smart contract automatically pays him the $40. If he doesn’t, then Alex is returned his $40.

Different Types of Cryptocurrency

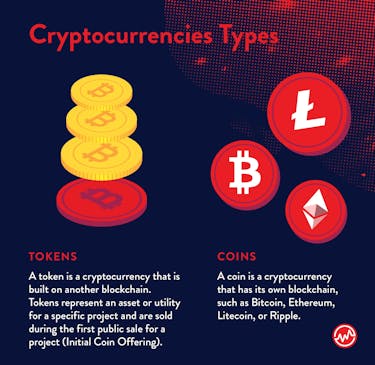

Let’s go over a small difference that many people get tripped over when trying to understand cryptocurrency basics. There are two different types of cryptocurrency: coins and tokens.

Coins

A coin is a cryptocurrency that has its own blockchain, such as Bitcoin, Ethereum, Litecoin, Ripple.

When someone says they "bought cryptocurrency", they are referring to buying coins.

Token

A token is a cryptocurrency that is built on another blockchain, for example, a dApp that runs on Ethereum’s blockchain.

Tokens represent an asset or utility for a specific project and are sold (or given) to during the first public sale for a project, an Initial Coin Offering (ICO), which mirrors an Initial Public Offering in the stock market.

The United States Government has been focused on tracking down fraudulent ICOs, but that's something we’ll get to later on.

There is another very important distinction with tokens. There are two general types of tokens: utility and security.

Utility Token

A utility token is intended to only be used to buy products or services from the company or platform that issues them.

Security Token

A security token is essentially a digital version of financial security that acts as a share of the value of an enterprise, similar to how owning AAPL essentially means you own a chunk of Apple.

In other words, security tokens pay dividends, share profits, pay interest or invest in other tokens or assets to generate profits for the token holders.

A digital asset is considered a security token if it meets three criteria:

- It requires a monetary investment.

- The collected funding goes to a single enterprise.

- Investors give their money with the expectation of gaining income derived on the work of the third party.

Security tokens must also be fully compliant and follow these regulations:

- Regulation D: The individual who is offering the security can only raise money from accredited investors and the information provided to them is “Free from false or misleading statements” (Section 506C).

- Regulation A+: An exemption that allows the creator to solicit non-accredited investors with SEC-approved security for up to $50 million in investment. This option takes a lot more time and is generally the most expensive route for issuance.

- Regulation S: This regulation outlines security offerings from countries outside of the US, which are therefore not subject to the registration requirements of section 5 of the 1993 Act. The creators of the security offering still must follow the security regulations of the country that they plan to solicit investment.

Example of a Cryptocurrency Transaction

Since this article is focused on cryptocurrency for beginners, let’s break down a hypothetical cryptocurrency transaction and how it takes place.

Let’s assume Alex wants to send Steven BTC.

- Steven sends his Bitcoin address (what’s known as a “hashed public key”) to Alex. This Bitcoin address is linked to whatever exchange or cryptocurrency wallet Steven set up. It looks something like this: 3D94LKmtQuVG8JFB3F7cB7gwj614yG4CPg.

- Alex enters the address in his cryptocurrency exchange or wallet along with the Bitcoin (BTC) amount — about 0.000042 BTC, which is equivalent to just over ~$1, and presses send.

- Steven receives the BTC minus a small fee. According to Bitcoinfees.info, these fees can range anywhere from $0.24 to be delivered within the next hour or $0.42 within ten minutes. It doesn’t matter if Alex sent $22 or $22,000,000 — the fees would still be the same.

How is all of this possible?

To explain the crypto basics, let’s jump behind the scenes:

From the moment Alex submits his transaction to the blockchain, every node in the Bitcoin network receives the transaction request. Every node makes sure that:

- Alex is actually who he is claiming to be. The nodes verify Alex’s identity through his private key — a private key identifies your source of funds. Anyone who has access to this private key has access to your money. This is why it’s paramount to make sure to keep your private key secure.

- He actually has the $5 to send to Steven. Since the nodes have a copy of the entire ledger of transactions, they can easily check to see if Alex has the money.

If at least 51% of the nodes come to a consensus on the two above elements, the transaction goes through and the nodes update the ledger with the new transaction.

How Investors Buy or Trade Cryptocurrency

Purchasing cryptocurrency has become a user-friendly process in the past year, with popular financial companies such as Robinhood and Square Cash jumping on board.

Here are a few alternative ways that investors currently buy or trade cryptocurrency to help boost your cryptocurrency IQ.

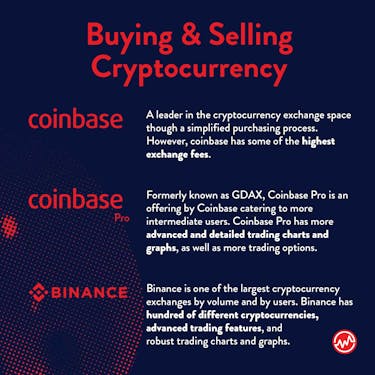

Coinbase

Coinbase built its reputation as a leader in the cryptocurrency exchange space by drastically simplifying how users buy cryptocurrency.

Coinbase has some of the highest exchange fees out of all of the cryptocurrency exchanges, with a 1.49% transaction fee if using a bank account or a whopping 3.99% if using a credit card.

- Advantages: User-friendly interface, a wide variety of cryptocurrencies available

- Disadvantages: Limited countries supported — US only

- Unique features: user-friendly interface and is one of the most popular exchanges online.

- Fees: Coinbase charges a flat fee of 1.49%

Coinbase Pro

Formerly known as GDAX, Coinbase Pro is an offering by Coinbase catering to more intermediate users. Coinbase Pro has more advanced and detailed trading charts and graphs, as well as more trading options.

The transaction fees are worth noting: they range from $0.10 to $0.30 depending on the order size.

Binance

Binance is one of the largest cryptocurrency exchanges by volume and by users.

Binance has hundred of different cryptocurrencies, advanced trading features, and robust trading charts and graphs. Binance charges a 0.1% trading fee.

- Advantages: Low fees, wide variety of cryptocurrencies available

- Disadvantages: Limited countries supported

- Unique Features: offers a very large number of cryptocurrencies to trade.

- Fees: Binance charges a fee of 0.1% for all trades.

- Supported Countries: Worldwide except for United States, Algeria, Bahrain, Cuba, Iran, Iraq, Lebanon, Libya, North Korea, Oman, Qatar, Saudi Arabia, Syria, Trinidad and Tobago, Tunisia, United Arab Emirates

HitBTC $

- Advantages: High liquidity, wide variety of cryptocurrencies available

- Disadvantages: Does not offer fiat-to-cryptocurrency trading, high fees

- Unique Features: HitBTC offers a variety of features that are not available on most other exchanges. These features include over-the-counter (OTC) trading, a fiat gateway, and a cryptocurrency debit card.

- Fees: HitBTC charges a fee of 0.25% for all trades. The fee decreases as the trade volume increases.

- Supported Countries: Worldwide

Huobi Pro

- Advantages: High liquidity, a wide variety of cryptocurrencies available

- Disadvantages: Does not offer fiat-to-cryptocurrency trading

- Unique Features: Huobi Pro offers a variety of features that are not available on most other exchanges. These features include over-the-counter (OTC) trading, a fiat gateway, and a cryptocurrency debit card.

- Fees: Huobi Pro charges a fee of 0.20% for all trades. The fee decreases as the trade volume increases.

- Supported Countries: Worldwide

Cryptocurrency Regulation And Rules

As of 2022, Cryptocurrency has few regulations.

What the United States government has been focused on in regards to cryptocurrency has been those laundering money or purchasing illegal substances and services through cryptocurrency, as well as identifying fraudulent ICOs, and collecting taxes.

Perhaps the most important and relevant piece of regulatory guidance for average cryptocurrency users is Notice 2014-21 issued by the IRS.

Notice 2014-21 says that cryptocurrency is treated as property for federal tax purposes and falls under general tax principles.

Thus, a gain or loss is recognized whenever a specific cryptocurrency is sold or used to purchase goods, services, or other cryptocurrencies (i.e., trading Bitcoin for Ethereum).

Also keep in mind:

- You must be 18 years or older to purchase cryptocurrency

- Crypto exchanges must be licensed and registered with the government

- Crypto assets are not legal tender

As someone diving into the cryptocurrency basics, it's important to understand the regulatory climate around cryptocurrency is in a constant state of flux — some details could even change tomorrow — with a few of the largest and most important landmark decisions still ahead of us.

Cryptocurrency Best Practices

While cryptocurrency allows anyone to become their own bank, this also comes with some unpleasant realities.

No central bank means no customer service, no guaranteed asset protection or FDIC insurance for cryptocurrency amounts, and no representative to call when things go awry.

This leaves your cryptocurrency at serious risk of:

- Getting hacked by malicious third parties.

- Being lost through personal negligence, such as sending your bitcoin to the wrong address or losing your private key.

However, both of these very real threats can be avoided by following cryptocurrency best practices.

Cryptocurrency basics and security hygiene revolve around keeping your private key secure.

Remember, your private key is complete access to your cryptocurrency. If you wrote down your 64-character private key on a notecard and someone gained access to it, they’re basically able to send your cryptocurrency wherever they please.

Here’s a quick cryptocurrency security checklist that investors utilize.

Cryptocurrency For Beginners: Use A Cryptocurrency Wallet

A cryptocurrency wallet is a platform that makes it possible to store, receive, and send cryptocurrency.

There are many different types of wallets, the two general categories are hot and cold.

Hot Wallets

“Hot” wallets are connected in some way to the Internet. For example, many cryptocurrency exchanges also provide users with a wallet feature.

If a hacker is able to finagle their way into someone’s exchange account, they’d be able to transfer the cryptocurrency. Additionally, if the exchange itself is hacked, the hackers could loot the cryptocurrency as well.

Another popular type of hot wallet is a software wallet, which is hosted as a program on your computer.

Cold Wallet

“Cold” wallets aren’t connected to the Internet and are therefore technically safer than hot wallets. For example, many cryptocurrency exchanges that hold massive amounts of cryptocurrency tend to keep a majority of the cryptocurrency in offline cold wallets to minimize the damage if a hack were to occur.

Cold wallets include hardware wallets, which are basically little plastic devices specifically designed for keeping someone’s private key safe.

Another type of popular cold wallet is a paper wallet, which is literally your private key printed (or written down) on a sheet of paper.

Enabling Two-Factor Authentication (and Google Authenticator)

Remember, most cryptocurrencies such Bitcoin cannot be “hacked” in the sense that someone can manipulate its programming as they please.

However, the places that store private keys are very within reach of being hacked.

The first line of defense is someone’s personal account. If funds are being held on a cryptocurrency exchange, it’s important to use secure and unique passwords that aren’t used for any other account (Gmail, Facebook, etc.)

The next step is enabling two-factor authentication (2FA). If 2FA is enabled, even if someone uses someone else’s password, they’ll still need to be approved via a text sent to the person’s (or Google Voice number).

If available, Google Authenticator is an extra layer of security.

Google Authenticator is an app on phones that implements a 2FA verification and generates new codes every 30 seconds that must be entered correctly to gain access to an account.

Cryptocurrency for Beginners: How to Get Started

How can you get started buying, trading, and selling cryptocurrency? Here’s a step-by-step breakdown to take you from rookie to crypto pro.

Step #1: Get a Bitcoin Wallet

The first step is to get a Bitcoin wallet. You can do this by setting up an account with a cryptocurrency exchange or by downloading a Bitcoin wallet app.

Step #2: Buy Some Bitcoin

Once you have a wallet, you can start buying some Bitcoin.

You can do this by using a credit card or by transferring funds from your banking account.

Step #3: Start Trading Cryptocurrency

The next step is to start trading cryptocurrency. There are many different exchanges that you may use to buy or sell cryptocurrencies.

Step #4: Start Mining Cryptocurrency

If you want to get more involved in cryptocurrency, you can start mining it. This involves using your computer to solve complex mathematical problems in order to verify transactions on the blockchain.

Step #5: Stay Up to Date

Finally, it’s important to stay up to date with news and developments in the cryptocurrency world. This will help you make informed decisions about when to buy and sell different cryptocurrencies.

The Bottom Line: Cryptocurrency For Beginners

Let’s be honest: cryptocurrency is here to stay.

Some investors have made an incredible profit from it, while others have experienced losses.

It's complex, it's volatile, but it's exciting — so is it right for you?

If you decide to go invest in it, the best way to maximize your profit while minimizing your risks is to go from a cryptocurrency beginner to a cryptocurrency pro.

Here are a few FREE resources that can help you do just that.

Cryptocurrency for Beginners Free Resources

- Coins vs tokens: What's the difference?

- These are the best cryptocurrency books to read, whether you are a cryptocurrency beginner or cryptocurrency pro.

- Should you invest your retirement in a BItcoin IRA? Read this guide to decide.

- These are the 10 best cryptocurrency exchanges to buy or trade cryptocurrency.

- Wondering about cryptocurrency laws and regulations? Read this guide to find out how they affect you.

- Buy land in the Metaverse using this guide.

- These are the most popular Alt Coins to buy today.