Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

What if you could hold a basket of well-diversified stocks in a single, tax-efficient investment?

What if you only had to buy one or two of these investments and then never make another portfolio decision again?

What if Warren Buffett suggested you do just that?

Luckily for you, John Bogle, the founder of Vanguard, thought of that in the 1990s. He called this new type of investment vehicle an ETF. Some argue that they’re one of the best financial products created.

Financial advisors, brokers, and mutual fund managers — those charging hefty fees for professional financial advice — would prefer you never hear of them.

But for the new or even experienced investor, an ETF can seem complicated. In this article, we’ll simplify it so that you can decide if it’s right for you and your financial goals.

What is an ETF?

An exchange-traded fund, or ETF, is a type of security that tracks an index, sector, or other asset but can be purchased and sold on a stock exchange.

Each ETF, like other types of funds, holds a basket of assets, typically stocks or bonds, making them a popular choice for investors seeking diversification.

An ETF can hold up to thousands of different stocks across multiple industries, or it can be isolated to a single sector, geographical location, or “factor” (such as growth or value).

Like stocks, ETFs trade throughout the day on an exchange.

Like mutual funds, ETFs represent partial ownership of a basket of underlying securities.

Like an index fund, ETFs are the model form of passive investing and are typically created to track the indexes themselves.

Example of an ETF

The most well-known example of an ETF is the SPDR S&P 500 ETF (ticker: SPY) which tracks the S&P 500 Index.

Buying a single share of SPY instantly gives you exposure to the 500 largest companies in the United States.

ETFs are the bread-and-butter of passive investors, coupling the buy-and-hold approach with a broad form of simple diversification.

ETF Advantages

ETFs provide easy diversification and steady returns while being simple to trade and very inexpensive.

They are easily the best option for a wide range of investors, regardless of specific circumstances and retirement goals.

ETF Disadvantages

Because of their diversification, investors should not expect to get rich overnight by investing in ETFs, making them a less exciting investment than some of their counterparts.

Types of ETFs

Many types of ETFs exist with varying goals, ranging from income generation and hedging to outright speculation and aggressive price appreciation.

A few of the more common are:

- stock (equity) ETFs

- bond ETFs

- industry ETFs

- currency ETFs

- commodity ETFs

Most ETF investors will allocate set amounts of their portfolios to each of the above types, heavily favoring stock and bond ETFs.

ETFs vs Mutual Funds, Stocks and Index Funds

When considering adding an ETF (or multiple) to a portfolio, investors need to weigh them against their other options.

ETFs vs Mutual Funds

The biggest difference between ETFs and mutual funds is the way they’re managed. Namely, ETFs are passively managed while mutual funds are typically actively managed.

Active management is when professional money managers attempt to beat the market with hand-picked investments. Passive management, instead, is content with market returns and simply holds the entire market (index) at once.

Although the possibility of higher returns is alluring, the majority of professional money managers cannot beat, or even keep pace with, the market they’re trying to outperform.

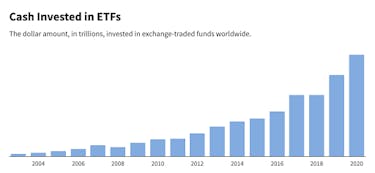

This is one of the greatest paradoxes in investing and supports the massive inflow of cash into ETFs over the past 10 years.

ETFs vs Stocks

Since ETFs and stocks are both marketable securities — they trade on an exchange with a fluctuating price based on buying and selling activity — they share a lot of characteristics.

This is one of the greatest strengths of ETFs and is part of the reason for the radical increase in their popularity.

When you buy a stock, however, you’re investing in a single company (like Apple or Microsoft). When you buy an ETF, you’re buying a collection of stocks (such as the Nasdaq Index or the technology sector).

Simply put, ETFs offer broad diversification, which leads to smoother returns. Stocks, on the other hand, are much more likely to whipsaw (both to the upside and the downside). Investors may make a much higher return on a single stock, but that potentially higher return comes with significant risk.

ETFs vs Index Funds

ETFs and index funds are very similar. They are both low-cost, diversified, and passive forms of investing in a wide variety of stocks, bundled into a single investment.

But, as mentioned above, ETFs can be traded throughout the day like stocks. Index funds, conversely, can only be bought and sold at the price set at the end of each trading day.

This difference in the way they’re traded also leads to ETFs being more tax efficient.

Always be sure to note each fund’s (ETF, index, and mutual) expense ratio — a percentage annual fee that is your ongoing cost for owning the fund.

The Bottom Line: ETFs

Exchange-traded funds are a simple yet powerful tool for investing.

A small recurring investment set up early on in your working career can propel you towards a retirement that anyone would admire.

All this while your ETF:

- does all of the heavy lifting

- Generates market average returns

- leaves you with none of the stress

Plus, your returns will be beating 90% of the world’s highest-paid financial professionals.

This is one time it’s best to just be average.