The DIY Debt Elimination Worksheet

In This Article

Do you ever feel overwhelmed by the debt you’re facing? Like you’re barely staying afloat with the credit card, student loan, mortgage or other payments you’re making? Maybe you feel like your mounting pile of debt is so large that you’ll never pay it off? Today’s the day things start to change for you.

Do you ever feel overwhelmed by the debt you’re facing?

Like you’re barely staying afloat with the credit card, student loan, mortgage or other payments you’re making?

Maybe you feel like your mounting pile of debt is so large that you’ll never pay it off?

Today’s the day things start to change for you.

Take a deep breath, sit up straight, and let’s formulate a game plan so that you know how to get out of bad debt as fast as possible — and so that you can turn your personal finances around.

How To Get Out of Debt

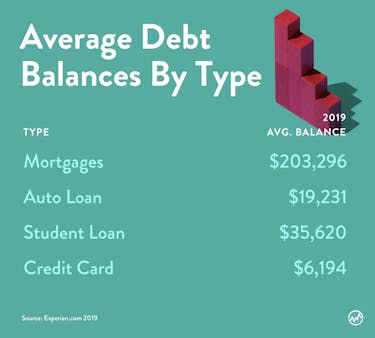

Debt exists in many shapes and sizes:

- Credit card debt

- A mortgage

- An auto loan

- A student loan

- A loan from a bank

- Money drawn on a home equity line

- A loan from a life insurance policy

- A medical bill

- A legal bill

- Any money you owe to someone else (usually with interest)

If you have one or more of the above, you’re certainly not alone.

The fact is, 8 in 10 Americans have debt.

What’s more, the typical American household has an average debt of $137,063.

Depending on whether you fall above or below that $137,063 mark, hearing this number may make you feel better — or horribly worse (sorry!) — about your own debt situation.

Here's the good news: you can overcome any amount of debt.

Let’s look at how to get out of bad debt.

Rethinking Debt: Bad Debt vs Good Debt

If you’re like most people, you’ve been conditioned by well-intentioned parents, teachers, mainstream media, and maybe a “financial expert,” to see debt as your mortal enemy.

“Debt-free is the way to be!” they say. Which has a nice ring to it, but in reality, not all debt is created equal.

There’s certainly bad debt. And you need to know how to get out of bad debt.

But there’s also good debt. And most debt can be good or bad, depending on how you use it.

Bad Debt

Bad debt is the breed of debt that’s been keeping you up at night, and it’s what most people think of when they think of debt.

Bad debt is simply money you’ve borrowed to buy something that doesn’t put money right back into your pocket.

When you use money that isn’t yours (e.g. a credit card) to buy something you couldn’t otherwise afford like:

- That purse you’ve had your eye on

- Tickets to the football game

- That top-of-the-line massage chair

Or anything that isn’t going to increase in value or produce cash flow for you.

That’s bad debt.

Spend $200 on a night out that you can’t afford, put it on your credit card, make minimum payments until it’s paid off, and your actual cost for that night – including interest – will end up being around $332.

Yikes. Hope you had a blast with the girls.

Again, if you have loads of bad debt, fear not!

In just a minute, we’ll cover a fail proof strategy that will help you learn how to get out of bad debt — as quickly as possible.

But first, it’s important you understand the good kind of debt.

Good Debt

Good debt is money you’ve borrowed to make an investment in a cash-producing asset.

Good debt is “good” because what you’re using it for makes you more money than the debt costs you.

Here’s an example:

Your friend Megan loans you $100,000 to buy a house.

You rent out the house to a nice little family called The Smalls.

Each month, you collect $1000 in rent from The Smalls and you give Megan a $440 payment on the loan.

What’s your profit per month?

$1000 Collected in rent from the Smalls

- $440 Loan payment to Megan

_________________

= $560 Profit

You used Megan’s money to make you an extra $560 a month. The loan from Megan is good debt.

Keep making loan payments until the loan is paid off, you’ll own the house free and clear, and now the entire $1000 in rent from the Smalls is yours to keep. Every single month. For the rest of your life.

Let that sink in.

Go back and read it again if you need to.

You used debt to buy an asset (a house) that generates cash flow in the short-term and builds wealth in the long-term.

It sounds like an overly simple example (and it is), but it illustrates a principle that successful real estate investors use all the time. They use good debt – in the form of other people’s money (banks, private lenders, hard money lenders, etc) – to build wealth for themselves.

And you can too!

Down below, we’ll look at a couple other examples of good debt, and how to leverage good debt to help you pay off bad debt and start building wealth for yourself and your family.

But first, let’s review.

Distinguishing Good and Bad Debt

Now you know, debt can be good or bad, depending on how you use it. Let’s dig in a bit more. This can be counterintuitive.

Here’s an example:

For the past few years, you’ve been saving money. Not for any specific reason, but just because you know it’s the smart thing to do.

You decide today’s the day you open up your savings account and inside you find a whole $30,000.

You could really use a new car, so you take the $30,000 you’ve saved and head down to the dealership where you find a nice vehicle for sale.

After a bit of negotiating, you talk the salesperson into selling you the car for $30,000.

“How will you be paying for the car today?” She asks.

You have two options:

Option 1: You can pay $30,000 cash and use all of your savings.

Option 2: You can put $3,000 cash down, then pay $500 a month for the next 5 years.

If you take Option 1, the car is yours today, debt-free.

If you take Option 2, you’re in debt for the next 5 years, and you end up paying a total of $33,000 ($3,000 down payment + $500 a month x 60 months = $33,000).

So the question is: why would you ever go into debt when you can easily afford to pay cash for the car?

The answer is: because even a car loan can be good debt.

If you think about it, by only paying $3,000 cash up-front, you’re keeping $27,000 cash in your pocket, and you can do a lot of good things with that $27,000.

Say you take that extra $27,000 and invest it into your friend Max’s business. Max immediately uses the money to grow his business, and he starts paying you $920 a month return on your investment.

So each month:

- You get your $920 from Max

- You pay $500 toward your car loan

- You profit $420

Within 5 years, the car loan is entirely paid off, you’ve been profiting $420 a month the entire way. Now that the car loan is out of the way, the entire $920 a month is yours to keep.

Again, let this example sink in.

Even though you could have paid cash for the car, you went into debt instead and you turned it into good debt by investing it in an asset (Max’s business).

Now, had you taken out the car loan then blown the $27,000 on a little boat and a little jet ski to go with your little car, you would have accomplished just the opposite. You would have created bad debt.

But you didn’t!

And herein lies a secret of the wealthy.

Ready for more?

Debt Secrets of the Wealthy

Most people work, they earn income, and then they use that income to pay their expenses (little cars, little boats, little jet skis, and everyday living expenses).

That’s just how most people go about life. Work to make money, and use that money to pay expenses and maybe take a vacation now and then.

But that’s not how wealth-minded people think.

Wealth-minded people use their income to buy assets, such as:

- businesses

- real estate

- stocks

- education

Then, in the short run, the cash flow from those assets is what pays their expenses.

And in the long run, those assets build real value and wealth.

That’s just one of many ways wealthy people think differently than everyone else.

It’s how they got wealthy, after all. They didn’t just do what everyone else was doing. They didn’t follow traditional financial advice.

Had they followed the traditional path, they would have ended up where people traditionally end up: living paycheck to paycheck, stressed out, feeling like they’re never getting ahead, and hoping and praying they’ll be able to retire one day.

But they didn’t. They thought differently, they acted differently, and they ended up wealthy because of it.

So if you have aspirations of becoming wealthy one day, it’s important you start thinking how wealthy people think. It’s important you know the difference between bad debt, good debt. Then you can start using good debt to your advantage!

In the example of the car loan above, you (wisely!) bucked the advice traditionally given by financial gurus, advisors, and mainstream media — who see “car loan” and simply, without hesitation, toss it into the bad debt category.

Instead, you recognized an opportunity to go into debt (a low-interest car loan) and turned that debt into a good investment (a high-return investment).

In doing so, you thought like wealthy people think. And you invested like wealthy people invest. Good job!

You see, wealthy people view debt differently in general.

Wealthy people actually love debt.

Bring on the debt! The good kind, that is, because here’s the truth about your debt:

- The higher you can raise your credit card limit

- The larger you can extend a home equity line of credit (HELOC)

- The more you can sock away into a permanent life insurance policy that you can borrow from later

- The more private lenders you can create relationships with

- The more you can maximize the debt you have available to you

The greater your ability to take advantage of great investment opportunities that come your way.

Like wealthy people, you should be acquiring as much debt capacity as your credit allows. Don’t wait until you need money to try to acquire it. Do it now.

- Increase your credit card limits

- Open up a HELOC

- Create a permanent life insurance policy and start saving in it

Do it all now before you need the money. That way, when you do need it, you have that debt at the ready and you can use it for good.

Make sense?

Now you may be sitting there thinking . . . “This is all well and good. I get the good debt / bad debt thing. But seriously, I’m up to my eyeballs in bad debt right now. Help me get out of it, like, today.”

We get it, you’re stuck. Let’s get you unstuck.

How To Get Out of Bad Debt So You Can Start Racking Up Good Debt

There are lots of popular debt payoff strategies out there (with weather-related names for some strange reason) that help you know how to get out of bad debt, such as:

- Debt Snowball

- Debt Avalanche

- Debt Tsunami

- and more

It’s as if the financial gurus are locked in a battle of meteorological one-upmanship.

Each of these strategies is a little different.

All of them can be effective. But none of them are perfect. We’ll get to the perfect solution in a minute.

But first, let’s look at each of these mainstream strategies, and how they might play a small role in your personal debt reduction gameplan.

Popular Get-Out-of-Debt Strategy #1: The Debt Snowball

Popularized by personal finance guru (and Tennessee castle owner) Dave Ramsey, the debt snowball method prioritizes paying off your smallest debts first regardless of what the interest rate is.

To employ this strategy, you’d open up a spreadsheet and list all your debts – your mortgage, your credit card balances, any outstanding loans – by order of outstanding balance, smallest to largest.

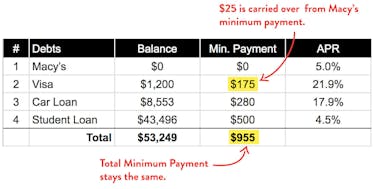

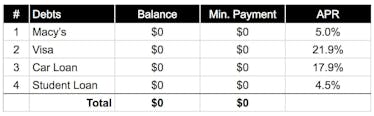

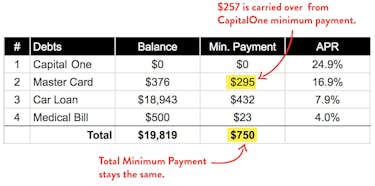

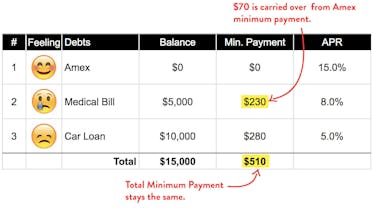

Then each month, you’d focus on paying as much as you can toward Debt #1, while making minimum payments on the other debts.

Once you pay off the Debt #1, you’d cross it off and roll the amount you were paying toward Debt #1 into Debt #2 then you’d put all your focus & money toward paying off that debt.

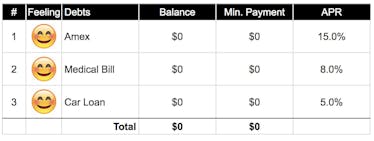

Then you just keep “snowballing” (rolling from one debt to the next) until each debt is paid off.

Why the Debt Snowball is Good:

The Debt Snowball method plays off the positive emotion you feel when you eliminate a debt.

It feels good to cross a debt off the list and by focusing on your smallest debt first, it allows you to experience that feeling sooner.

It’s a simple brain trick meant to give you little shots of motivation along the warm & fuzzy road to debt freedom.

Why the Debt Snowball is Bad:

- It’s expensive. If you’re not the “hug yourself” type, and you’re not a fan of brain fakes, then the Debt Snowball method just costs you more money.

By ignoring a $1,200 debt at 17% interest and focusing, instead, on paying off a $50 debt at 5% interest, you continue racking up interest charges on that $1,200 debt.

And at 17% it racks up mighty fast. - It’s slow. It’s a fixed strategy that underestimates your ability to boost your income and leverage good debt to accelerate your debt payoff timeline.

The 6-Step WealthFit Debt Strategy (which we’ll get to shortly) has greater potential to get you out of bad debt faster and keep you there. - It’s incomplete. The Debt Snowball assumes an “all debt is bad debt” view of the world. But as you now know: not all debt is bad!

The 6-Step WealthFit Debt Strategy is just that.

Popular Get-Out-of-Debt Strategy #2: The Debt Avalanche

As opposed to the Debt Snowball method, The Debt Avalanche method zeros in on your highest interest rate debt first, while, again, maintaining minimum payments on your other debts.

So with The Debt Avalanche, you’d prioritize your list of debts like this:

That credit card debt of $2,000 at 16% gets priority well before that $50 medical bill at 4%.

Once you pay off your highest-interest rate debt, then you redirect your funds towards the next highest-interest rate debt.

As you pay off each debt, the next payment grows and grows until it begins to (yep, you guessed it!) “avalanche.”

And you might actually cross off that $50 medical bill early, having knocked it out with minimum payments while you were focused on your higher interest debts.

Why the Debt Avalanche is Good:

By paying down your highest-interest rate debt first, you minimize your total interest payments in the long run.

Why the Debt Avalanche is Bad:

- The feelings aren’t there. If your highest-interest rate debt is also your largest debt, then it may take a while to cross it off the board and feel those warm fuzzies that The Debt Snowball method gives you.

- It’s slow. Again, the 6-Step WealthFit Debt Strategy can be much faster.

- It’s incomplete. The 6-Step WealthFit Debt Strategy takes a much bigger, wealth-focused approach.

Popular Get-Out-of-Debt Strategy #3: The Debt Tsunami

Another oft-touted debt paydown strategy is the Debt Tsunami.

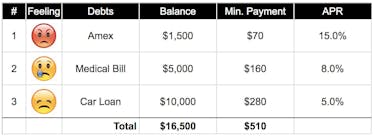

Like the Debt Snowball, the Debt Tsunami takes an emotional approach: it prioritizes debts that have the biggest psychological impact on you.

So essentially, you can ignore the interest rate, ignore the total payoff amount, and simply prioritize your debts by how sad they make you.

For example, if you have a car loan of $10,000 with a 5% interest rate, a $5,000 medical bill at 8% interest rate and a credit card balance - for which you feel guilty about because you overspent - of $1,500 at 15%, the Debt Tsunami method says to pay off the credit card balance because it is having the most psychological impact: unhealthy guilt.

After that is paid, the next step is to pay off the next most bothersome debt, and so forth.

Why the Debt Tsunami is Good:

Like the Debt Snowball, you’re banking on the emotional satisfaction you feel as you eliminate the debts that give you the most guilt.

And for some touchy-feely types, it works perfectly.

Why the Debt Tsunami is Bad:

- It’s too emotional. The debt that should give you the most guilt is the one with the highest interest rate. So if at all possible, recalibrate your emotions, take what the debt was used for out of it, and look at the numbers alone.

Because you know what REALLY feels good? Saving yourself hundreds of dollars in interest payments. - It’s slow.

- It’s incomplete.

Popular Get-Out-of-Debt Strategy #4: Debt Snowflaking

Even though a few bucks here and there may not seem like it would make a difference when facing a double digit balance, according to the Debt Snowflake method, it can. The Debt Snowflake method sprinkles small extra payments — $10 here, $4 there — towards your debt.

Let’s say you have a credit card balance of $2,000 with an interest rate of 17 percent. If your minimum payment is $100, it would take you 24 months to pay off the balance. Plus, you would pay $368 in interest.

If you applied the Debt Snowflake method, you could shorten both the interest charges and the repayment term. Let's say by car pooling and cutting out eating out you saved an extra $40 a month.

If you applied that extra $40 a month to your debt payments, your repayment term would be 17 months and you'd pay $250 in interest. Applying your small savings each month gets you out of debt two months earlier.

Plus, if you look for more ways to save, your snowflakes can accumulate that much faster.

Why Debt Snowflaking is Good:

Anyone can utilize the Debt Snowflake strategy to shorten their repayment term. All that is needed is a saving mindset.

Why Debt Snowflaking is Bad:

- It’s slow.

- It’s incomplete.

Popular Get-Out-of-Debt Strategy #5: Debt Consolidation

Debt consolidation takes high interest debt from multiple sources and merges it into a single, low interest payment.

Review your spending habits to understand what went wrong.

What put you in debt in the first place? Adjusting your spending is critical for building wealth. If you make uninformed financial decisions over and over again, then consolidation of existing debt will lose you even more money.

Let’s review the best consolidating options:

- The best option is a 0% interest balance transfer. Chances are that you’ve received some of these promotions flooding your mailbox. Many credit card companies will provide 0% interest for anywhere between 12-18 months if you transfer your balance. While there is a fee to do this dependent upon the company and the balance, that fee is minuscule compared to the amount you’ll save by not paying high rates of interest.

- A fixed-rate personal loan is another option. This is where you use another loan to wipe out your debt, and then you pay back the loan in installments over a set term.

- If debt exceeds more than half your income and your credit isn’t good enough to qualify for a 0% transfer balance, there’s also riskier options, such as a home equity loan or 401k loan. Although interest rates are relatively low, these strategies require putting your home and retirement at risk, two options we don’t recommend. 401k and home equity loans are great tools (see below), just not for debt consolidation.

Why Debt Consolidation is Good:

Debt Consolidation — especially when transferring a credit card balance to 0% APR — provides you extra time to pay off your high-interest debt.

Why Debt Consolidation is Bad:

- It restructures your current situation, but it doesn’t help you get ahead.

- It’s slow.

- It’s incomplete.

Popular Get-Out-of-Debt Strategy #6: Bankruptcy

If it’s going to take over five years to pay off debts, the last option is bankruptcy, a strategy only for those needing to start over financially. In short, it can be a nightmare of a situation.

After bankruptcy is filed, a court proceeding decides whether or not to discharge debts. If approved, valuable assets may be given up, and collection agencies and creditors are required to discontinue contact.

Filing for Chapter 13 will appear on your credit report for 7 years and filing for Chapter 7 will be on your record for 10 years.

Also, it’s nearly impossible to obtain credit immediately afterwards. When you do finally obtain credit years later, the interest rates will be very high, and qualifying for a mortgage will be impossible for about 5-7 years.

Why Bankruptcy is Good:

It bails you out.

Why Bankruptcy is Bad:

- Many reasons

- It’s very slow

- It’s very incomplete

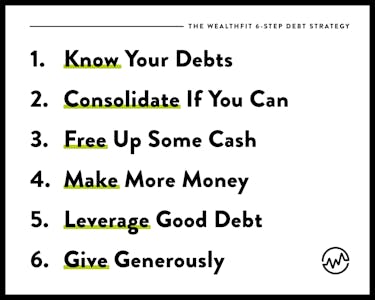

The 6-Step WealthFit Debt Strategy: The Best Way to Permanently Get Out of Bad Debt and Start Building Real Wealth

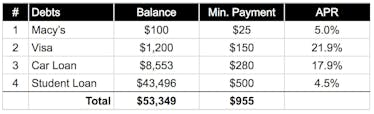

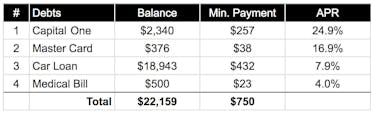

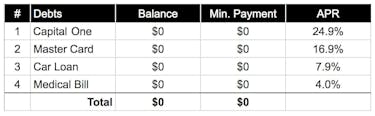

Step 1: Know Your Debts (Time to Complete: 10 Minutes)

Before you can start strategically paying off debt, you need to know exactly what your debt situation is.

So open up a spreadsheet right now, take 10 minutes, look up each debt you have and list the following:

- Your outstanding balance

- Your interest rate

- Whether it’s good debt or bad debt

- The minimum monthly payment

- The amount you can afford to pay

Remember:

- Bad debt is (typically high-interest) debt you used to buy liabilities. It’s debt that’s costing you money.

- Good debt is (typically low-interest) debt you used to invest in a cash-producing asset. It’s debt that’s making you money. You’re not going to rush to pay off good debt. Because (now that you’re thinking like the wealthy) you know that if you have an extra $1,000, it’s better to invest it in asset that returns 10% than it is to put it toward a debt that only costs you 4.7%. The cash flow from the 10% investment simply allows you to pay off the 4.7% debt faster.

Now sort the sheet by highest interest rate first, and you should end up with something like this:

This is the order in which you’ll be knocking out your debts.

Once you’ve created your spreadsheet, save it somewhere where it’s not going to distract you regularly (i.e. not smack dab in the middle of your desktop).

Remember, your debt isn’t going to be a distraction to you anymore. It’s not going to control you anymore.

So tuck your spreadsheet away in a folder somewhere. Then just set a reminder on your phone to pull it out and update it monthly.

All you need is 10 minutes a month. Be conscious of your debt, but don’t dwell on it.

Step 2: Consolidate If You Can (1-2 Hours)

Transfer outstanding credit card balances on onto your lowest-interest card or – if your credit score is 690 or higher open up a new 0% APR card and transfer all your outstanding balances there.

If your credit score isn’t above 690, THEN your best option is to consolidate with a personal loan from a credit union.

Step 3: Free Up Some Cash (1-2 Hours)

Your next step is to look for opportunities within your existing lifestyle and living expenses to free up some extra cash.

For example:

Eliminate Unnecessary Subscriptions

Review your most recent credit card statements, identify any products you’re paying for that you don’t use, and cancel them.

Switch to Streaming TV

Cable TV is wasting your money and your attention. You’re paying 5X what you need to for content that’s 30% mind-rotting commercials.

This is a no-brainer. You’re paying $50+ for cable, when you’re already paying for the internet.

Canceling your cable is a big step. Try replacing it with a streaming service like Netflix ($12/month) and instantly save yourself $450 per year and millions of brain cells. Or, consider saving even more money by eliminating this service completely.

Slash Your Cell Phone Bill

For cell service providers (and most companies) it costs MUCH MORE to acquire new customers than to keep existing customers. If you keep this in mind, you’ll release all the power in the world to negotiate with your cell service provider.

But before you negotiate, take a look at your usage. Wifi is the cellular industry’s biggest enemy. You’re probably paying for data and minutes you don’t use.

Everything on your phone can operate on data alone.

And nearly everywhere you go, you have free wifi.

So why are you paying for 10GB of data per month?

Start by reducing your usage payments, take it down to the lowest tier, and turn off the apps on your phone that use the most data.

Next, give your cellular provider a call.

Tell them you’re happy with the service, but the cost is just too much. If you want to go the extra step: nix the smartphone altogether. It might be an adjustment, but it will save you a bunch of money.

Restructure Your Insurance

Look for ways to save on your health, dental, vision, auto, umbrella, and other coverage. If you’re with Geico, get quotes from AllState, Farmers, and State Farm. Use them as leverage to negotiate with your Geico insurance agent. Be transparent that your goal is to maintain great coverage, but save on premium payments. Have her present you a couple options in an attempt to keep your business. You have the power and leverage.

Refinance Your Mortgage

If you’re a homeowner, walk into a bank today, sit down with one of their mortgage people, and be straightforward. Your goal is to lower your monthly mortgage payment. You’re trying to free up cash flow each month that you can put toward debt and/or invest with. Have them present you 2 or 3 different refinance options, then say “thanks, I’ll think about it,” and walk out.

Then do the exact same thing at a second bank so you have twice the number of options to consider. If the options are similar with each bank, don’t be afraid to start refinance applications at both. One bank inevitably will be smoother to work with, and you can cancel the application at the other bank.

Utilities

Here’s a list of 40 expense cutting options.

Bill Cutting Services

If nothing else, try a service like BillSmart or BillCutterz.

Go to their website and upload your bills, then they call and negotiate lower rates for you. The best part is they only get paid if they save you money (typically 40-50% of the money they save you over the first 6-12 months).

Regardless of whether you do it yourself, use a bill cutting service, or both. After you’ve found some extra money, put it all toward your #1 priority debt until it’s gone. Then move on to the next one.

Step 4: Make More Money

Steps 1-3 are all necessary exercises in understanding your debt, prioritizing the order in which you’ll pay it off, and freeing up cash flow to help you get started.

The problem with most mainstream personal finance advice and weather-pattern debt strategies is that this is where they leave off.

In doing so, they fall short.

And they sell you short.

Because a true debt strategy is BIGGER.

It’s holistic.

It takes good debt and bad debt into consideration.

It believes in your ability to not just “live within your means,” but to get out there and expand your means.

It trusts in your ability to not just become debt-free, but to become truly wealthy in the fastest possible time.

Steps 1-3 should take no more than 4 hours initially, then 10-60 minutes each month. That’s how much total time should be allocated to reassessing your debt situation and “managing your money” on a regular basis.

The rest of your time should be focused on making more of it. Because, the reality is, you can play with the numbers, consolidate your debts, and manage your money all you want but . . .

Plain and simple. When you’re bringing in loads of cash each month, bad debt becomes irrelevant because you’re able to:

- Pay off your credit cards in full every month

- Buy cash-producing assets

- Have plenty of “fun money” left over

- Have even more money to give away to the people and the causes that you care about (we’ll get to that more in a minute)

Because that’s what you truly want at the end of the day, isn’t it? It’s not merely to get your head above water and get out of debt. It’s to start building real wealth for yourself and your family.

It’s to create passive income so that you can stop trading your time for money and start doing the things you love to do. It’s to retire early (if you want) rather than waiting until you’re 65 years old and burnt out.

It’s to have a lasting impact on the people (your kids, your family, your community) and the causes (church, charities, social movements) that you care about.

When wealthy people find themselves in a tight financial situation – like you may be in right now – they don’t focus on strategizing within it. They focus on growing out of it.

They’re not focused inside the box. They’re focused on thinking, strategizing, and making moves outside the box.

Heck, they’re focused on shattering the damn box!

Start making more money so you put bad debt in the past for good.

You can do it, my friend. Immediately.

Here’s how:

1 — Negotiate a Higher Salary (GOOD)

If you’re currently employed, don’t be afraid to ask for more money.

Just keep in mind that you represent an investment the company has made in you. Your company has agreed to trade you $(Insert Your Salary) in exchange for the very best effort of your head, hands, and heart. And it’s not just salary, a company's investment in an employee includes salary, benefits (health insurance, disability insurance, workers compensation), and overhead costs (equipment, office supplies, travel, meals).

And all your hard work is expected to produce at least 2X your salary. For most companies, the expected return is more like 3X-10X your salary.

A company only exists if it’s profitable on its investment in each of its employees. If you represent a net negative investment, then why should you get a raise?

The more you can see things from your employer’s perspective and show profitability as a direct result of your unique work, the greater your chances of landing more money.

If they’re unable to bump your salary right now, then be prepared to propose a backup roadmap.

Your Boss: “I appreciate you coming in here today, John, I really do. But I’m sorry … we’re just unable to give you a raise at this time.”

You: “Okay, I understand. Then how about this …”

(Pull out your beautifully prepared spreadsheet)

“If I can increase sales by $100,000 over the next 3 months, would you consider giving me a $10,000 raise?”

If it’s not sales, then show whatever metric your performance is typically measured by. Present a clear, win-win roadmap that gets you AND the company exactly what they want.

But time your ask wisely. A win-win roadmap means nothing if the paper's on fire. The worst thing you can do is ask for more money when your company is struggling, and your boss is stressed and frustrated.

Make your ask when you know the company has had a strong financial quarter . . . or is coming off a successful marketing campaign . . . or just scored a big, new client and is riding high. This way, it's more likely that your boss will be in an agreeable mood and willing to hear you out.

When you do approach your boss, approach the conversation with tact, grace, and humility. Show that you have the company’s best interests in mind and you can’t go wrong. Give it a shot.

2 — Start a Side Hustle (BETTER)

There’s an endless number of things you can do these days, outside your full-time job, with your current skill set and your current schedule, to earn an extra $100-$1,000 a month. Here are a few:

- Become a consultant. There’s likely something you’re good at that has value to other people or companies. Landing your first consulting gig may be as simple as reaching out by email to a handful of potential clients. As you get that first gig under your belt, use it as leverage to command a little higher rate on your next consulting gig. If you’re employed full-time, just be sure you’re not violating any of your company’s terms by consulting on the side.

- Teach english with VIPkid

- Drive for Lyft or Uber

- Rent out your car for Turo or HyreCar

- Offer caregiving services on Care.com

- Sell handmade crafts on Etsy

- Wedding photography

- Offer dog walking services on Wag

- Catering

- List your house On Airbnb

- Writing, editing, and blogging

- Proofreading on UpWork

- Craigslist Gigs

- Teaching Online via Udemy

3 — Become an Entrepreneur (BEST)

As far as income-boosting strategies go . . .

Negotiating a higher salary is GOOD.

Starting a side hustle is BETTER.

Becoming an entrepreneur and launching your own business is the BEST.

It’s the only course of action that has the potential to:

- Shatter your “glass ceiling” and offer you limitless earnings potential

- Transform your financial situation and get you out of bad debt overnight

- Generate passive income

- Allow you to quit your current, full-time job and do something more in line with your passions

- Create an asset (a business) that you can sell for millions

Starting a business doesn’t need to be a big, daunting thing! It can be a micro business to start, and it can evolve into something bigger if you want it to.

So ... that business idea you’ve had in the back of your head for a while now?

Now may be the time you set your fear aside, saddle up, and GO FOR IT.

Doing so may be the single most rewarding decision you’ve ever made and the catalyst that eliminates your debt and creates wealth for your family for generations to come.

Step 5: Leverage Good Debt

As we’ve discussed, the biggest disservice typical financial experts do is preaching a “debt-free” philosophy.

In encouraging you to cut up your credit cards, they’re stifling your path to wealth and ignoring the tremendous advantage that good debt can offer you.

Here are a few ways you may be able to start leveraging good debt to help get you out of bad debt faster than you thought possible:

- Raise Your Credit Limit. Pull out your credit card right now, flip it over, call the number on the back, and request a credit line increase. Aim high. Double whatever your current limit is. When they ask why, tell them it’s to start a business and do some investing . . . then actually use it to start a business and do some investing.

They may boost your limit on the spot, they may not. Either way, set a reminder on your calendar to call back in 6 months and do it again. Again, having more credit available to you only improves your ability to move on good opportunities and invest it in cash-producing assets.

How To Turn It Into Good Debt: Use it to attend a life-changing seminar (like Fortune Builders, Traffic & Conversion Summit, or Unleash the Power Within), attend for 3 days, launch your own business as a result, and pay off your bad debt a thousand times over. - Open Up (or Increase) a HELOC. If you own a home and have plenty of equity, then go down to the bank today and apply for a Home Equity Line of Credit (HELOC).

If you’re able to create a new $100,000 line at a low introductory interest rate, for example, it offers you countless opportunity to invest it, generate cash flow, and use that cash flow to pay off any bad debt.

How To Turn It Into Good Debt: Use your new HELOC to buy a rental property from a reputable turnkey provider (like Memphis Invest or JWB Real Estate Capital). Use the cash flow from the rental to make your HELOC payment and pay off any bad debt. - Create a Relationship With a Private Lender. There are over 15,700,000 millionaires in the U.S. on the lookout for great places to invest their money. If you can find the ones in your area (find private lenders) and present the right opportunity with confidence and authority, then you’ll open up a door to funding for your next business or investment.

How To Turn It Into Good Debt: Say you find a private lender, and he agrees to loan you $100,000 at 12% interest. Plus a $3,000 fee for giving you the loan.

Over the next 6 months, you use the money to buy, remodel, and sell a piece of real estate, pay back the loan, and pocket a handsome $62,624 profit.

$62,624 Profit

- $6,000 Interest cost on the loan ($100,000 x 12% interest x 6 month hold time)

- $3,000 In miscellaneous fees for getting the loan

- $5,000 In Holding Costs (Property Insurance, Utilities, etc)

- $5,000 Real Estate Agent Commissions (not always needed)

____________

= $43,624 net profit

You made a homebuyer happy by providing them with a beautiful, newly remodeled home.

You made your private lender happy because you paid him $9,000 to borrow his money for 6 months.

And you made yourself very happy because you used good debt to earn yourself $53,624 in a 6-month timeframe. Which should be plenty to take care of any bad debt you have.

Step 6: Give Generously

The final step in the 6-Step WealthFit Debt Strategy is to give money away.

“Wait a second . . . ” you ask.

“How in the world will giving money away help me get out of debt?”

It’s definitely counterintuitive … but, as many wealthy people will attest, it’s as proven as every scientific strategy above.

Call it “karma.”

Call it “what goes around comes around.”

Call it God (I do.)

Give money away before you feel you have the means to do so. If it makes you uncomfortable ... perfect. It should.

Do it consistently, give credit where credit’s due, and watch your bad debt miraculously disintegrate.

Now Go Make It Happen!

You have the opportunity, right now, to change your outlook on debt (and your entire financial future) forever.

Now that you know how to get out of bad debt, the next step is to take action. Your financial situation isn’t going to change without massive action on your part.

So let’s do it!

How do you plan to use The 6-Step WealthFit Debt Strategy?

What’s the biggest “aha” you got from this article?

Tell us on social media, and share this article with someone you care about!

Once you have your debt strategy in place, don’t stop there! There are more ways to improve your personal finances so that you can live a life of financial freedom.