Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

Home is where the heart is— but not all of us can afford a home. Or maybe we just don’t think we can. Getting an FHA loan can be your ticket to becoming a homeowner without the expense of a giant down payment.

Whether it’s your first time or your fifth time, buying a home is a big commitment. Not only are you picking a place to live, but you’re also taking on a giant financial responsibility.

For many homebuyers, the thought of applying for a mortgage and coming up with the money for a down payment can be nerve-wracking— if not downright terrifying. It might be even more challenging if you have a bad credit.

The good news is that it’s possible to buy a home with as little as a 3.5% down payment. It might sound impossible, but it’s actually pretty simple:

Get an FHA loan.

What is an FHA Loan?

FHA loans are designed to help people who are unable to qualify for traditional bank loans so that they can still achieve their dreams of homeownership.

FHA loans are government-backed mortgage loans. They’re issued by the Federal Housing Authority (FHA), a branch of the United States Department of Housing and Urban Development (HUD). Essentially, they’re loans from the government that make it easier for average folks to become homeowners.

You can use an FHA loan to buy a foreclosed property, foreclosed homes, or even a short sale. Even better, there is no limit on the number of FHA loans you can take out in a lifetime— just as long as you meet the qualifications.

What Are the FHA Home Loan Requirements?

The requirements for an FHA loan are looser than the qualifications for traditional bank loans. Here’s a rundown of what the FHA wants from you before you can take out an FHA loan:

Proof of reliable income

Proof of reliable income can come in the form of pay stubs or recent tax returns. Ideally, you should have two years of steady employment under your belt with pay that has either stayed the same or increased over time.

No bankruptcies within two years of your loan application

Some HUD properties (specifically foreclosures) might require that you be out of bankruptcy longer than two years, but you’ll need to prove that you’ve gone at least that long before you can be considered for an FHA loan.

A minimum credit score of 500

While traditional loans usually require a credit score of 620 or higher, an FHA loan only asks for a credit score of 500 to make you applicable for a loan.

Typically, a buyer with a credit score below 500 would not qualify for a loan with the FHA. However, there may be some wiggle room if you have insufficient but meet the other requirements.

If you need to boost your credit score, you can use a simple trick and buy credit score tradelines. It will dramatically increase your chances of getting a better deal on your purchase.

A down payment between 3.5% and 10%

This is based on your credit score. In order to qualify for the 3.5% down payment, your score must be 580 or higher. Otherwise, the HUD will likely ask for a higher percentage as a way to combat the risk of approving your loan.

Mortgage insurance with an up-front payment of 1.75% of the loan limit and a mortgage insurance premium between .45% and 1.05% annually

Recipients must pay for mortgage insurance. That’s because the FHA promises its lenders that it will reimburse them in the event that an FHA borrower defaults on their loan. Mortgage insurance protects the FHA from any financial loss at the hands of an FHA loan foreclosure.

A commitment of one year

FHA loans are available only to buyers who plan to live in the home they are purchasing for at least a year. In other words, they are not an immediate option for real estate investors. If you are looking to invest in real estate and want to consider an FHA loan, you are going to have to wait for at least a year before you can use your new home as a rental property.

You should also know that while the qualifications aren’t as strict as those for a traditional bank loan, you may have fewer options when it comes to the type of loan you get or the term of your loan. For example, the FHA offers loan terms between 15 and 30 years and offers only fixed-rate loans.

Every other aspect of the home buying process is the same as it would be with a loan from a non-FHA lender. You can still use a licensed real estate agent, get pre-approved for a loan, and negotiate with the sellers for the best possible price. You may buy a foreclosure with an FHA loan as well, provided you plan to live there.

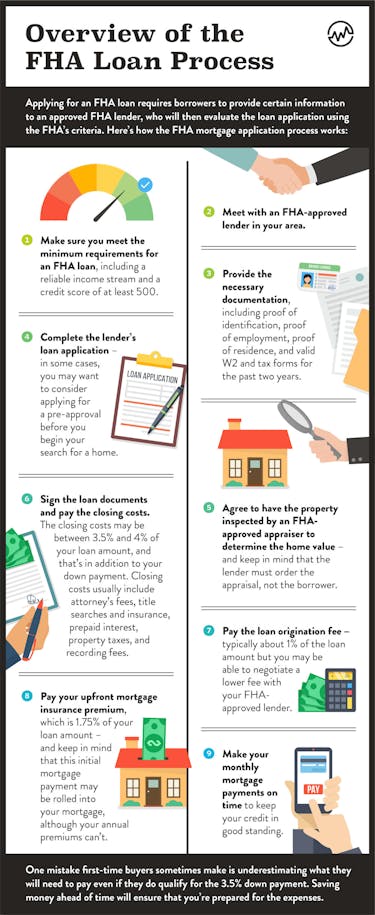

Overview of the FHA Loan Process

Applying for an FHA loan requires borrowers to provide certain information to an approved FHA lender, who will then evaluate the loan application using the FHA’s criteria.

Here are the steps for getting an FHA loan:

- Make sure you meet the minimum requirements for an FHA loan, including a reliable income stream and a credit score of at least 500.

- Meet with an FHA-approved lender in your area.

- Provide the necessary documentation (proof of identification, proof of employment, proof of residence, and valid W2 and tax forms for the past two years).

- Complete the lender’s loan application – in some cases, you may want to consider applying for a pre-approval before you begin your search for a home.

- Agree to have the property inspected by an FHA-approved appraiser to determine the home value.

- Sign the loan documents and pay the closing costs. The closing costs may be between 3.5% and 4% of your loan amount (that’s in addition to your down payment). Closing costs usually include attorney fees, title searches and insurance, prepaid interest, property taxes, and recording fees.

- Pay the loan origination fee – typically about 1% of the loan amount but you may be able to negotiate a lower fee with your FHA-approved lender.

- Pay your upfront mortgage insurance premium, which is 1.75% of your loan amount – and keep in mind that this initial mortgage payment may be rolled into your mortgage, although your annual premiums can’t.

- Make your monthly mortgage payments on time to keep your credit in good standing.

One mistake first-time buyers sometimes make is underestimating what they will need to pay even if they do qualify for the 3.5% down payment. Saving money ahead of time will ensure that you’re prepared for the expenses.

Example FHA Loan Expenses

There are expenses associated with FHA loans. Let’s look at what they would be for a $300K FHA loan on a foreclosure, assuming the buyer has a credit score that qualifies them for the 3.5% down payment.

The down payment would be 3.5% of the loan limit, or $10.5K.

The closing costs would be somewhere between $10.5K and $12K depending on the lender, their attorney fees, and other variables.

Their loan origination fee would be $3K unless they negotiated with their FHA-approved lender for a lower fee.

Their up-front mortgage insurance premium would be $5.25K, which they could add to their loan amount if they choose.

Their mortgage insurance annual premiums would be between $1.35K and $3.15K.

That means that, in total, the upfront costs associated with their FHA loan would be between $29.25K and $30.75K. Keep in mind that $5.25K of that could be financed as part of the FHA mortgage.

If they did not qualify for the 3.5% down payment, the maximum down payment for that same $300K loan would be $30K. The other payments would remain the same. That would put the total costs between $48.75K and $50.25K.

The Best Option for You?

While the costs outlined here may seem a little steep, an FHA loan is your best bet if you’re a first time homebuyer, have bad credit, or make low to medium yearly income. And you won’t be alone. Approximately 46% of all first-time homebuyers bought their houses with an FHA Loan in 2017.

Getting an FHA loan now doesn’t mean that you won’t be able to qualify for a traditional bank loan in the future. So for many people, it’s the best option to get their foot in the door of their first home.