The DIY Debt Elimination Worksheet

In This Article

Are you sinking in the financial quicksand of debt?

Can you not afford to pay your bills or even make ends meet without increasing the amount you owe?

Does it seem like such a high amount that you can’t fathom paying it off?

There are debt relief options. Maybe you’ve tried one, maybe you’ve tried them all. If you’re ready for the last resort option, it’s time to talk about bankruptcy.

Let’s be honest from the start: there’s a stigma around bankruptcy. Many believe that it’s embarrassing to file for bankruptcy, because it’s admitting financial failure.

We here at WealthFit will be the first to tell you that what isn’t embarrassing is getting your debt — and your personal finances — in control.

In this article, we’re going to break down:

- What bankruptcy is

- Answering the questions “What are the advantages of filing bankruptcy?” and “What are the downsides of filing for bankruptcy?”

- Frequently asked questions about bankruptcy

- Alternatives forms of debt relief

Let’s get started!

What Is Bankruptcy?

In its simplest terms, bankruptcy is a beautiful option to start over financially. It’s a refresh. A re-do. A clean slate.

Bankruptcy is a legal process that allows individuals or businesses to seek relief for their debts, at the same time providing creditors the opportunity for repayment.

These debts can be from:

- Losing employment

- Excessive spending over time

- Health costs incurred from a hospital visit

How Bankruptcy Works

In order to obtain this “clean slate”, you have to do something in return.

Depending upon the type of bankruptcy you file, you:

- repay your creditors over time

- your non-essential assets (such as property and items of value you own) are sold used to repay your creditors

Bankruptcy cases in the United States are handled using federal courts, and the decisions are made by a bankruptcy judge. These decisions include whether a debtor is eligible to file bankruptcy and whether the person should be discharged of their debts

After that, a trustee will be appointed to manage the process.

Throughout this process, you will be required to take courses related to the bankruptcy process and credit.

Types of Bankruptcy

Though there are many types of bankruptcy, the most common ones are:

- Chapter 7

- Chapter 11

- Chapter 13

We’ll look at each in depth in depth next.

Chapter 7

If you're behind on your bills, and you can’t afford monthly payments or even living expenses, Chapter 7 may be an option for you.

Simply put, Chapter 7 is known as a form of “personal restructuring”.

According to Credit.com, “Chapter 7 is the most common type of bankruptcy and is often referred to as a straight bankruptcy.”

Instead of paying back creditors with money from your own pocket, your assets are liquidated or sold, and those proceeds are then used to pay the debt that you owe.

If you decide to file Chapter 7, you will fill out a 70-90 page document that is then filed with the court. This information will include:

- Your income

- Your assets

- Your debt

- Your recent financial transactions

It's critical to truthfully disclose everything in this document — if you don’t, it can be a crime with severe penalties.

Advantages of Filing Chapter 7 Bankruptcy

Next, we’ll answer the question “What are the advantages of filing bankruptcy?” in relation to Chapter 7.

Protection from Creditors

When your case is filed with the bankruptcy court, it creates what’s called an automatic stay. By law, this stops creditors from:

- collecting payments

- garnishing your wages

- foreclosing on your home

- repossessing property

For many seeking debt relief, this alone is a tremendous psychological victory.

Clean Slate

Filing Chapter 7 bankruptcy wipes out your unsecured debt, including:

- credit card debt

- medical bills

- personal loans

You Can Keep “Exempt” Property

The law protects “exempt property”, such as your house, from your creditors.

This means that you may be able to keep your house as long as you continue to make the required monthly payments.

Disadvantages Of Filing Chapter 7 Bankruptcy

Next, we’ll answer the question “What are the downsides of filing for bankruptcy?” in relation to Chapter 7.

Secured Debts Do Not Go Away

Even by filing Chapter 7, your secured debts are not erased. Secured debts are only discharged if you decide to give up the asset, such as a home loan for your house.

Debts that do not go away include:

- alimony or child support

- tax debts

- student loans

Lower Credit Score

Chapter 7 is one of the longest-lasting penalties you can receive on your credit report. It can last 7 to 10 years.

That drop can be around 130 and 200 points, depending on where your credit was before filing for bankruptcy.

Does Not Protect Others

Chapter 7 does not wipe out the debt for anyone else, such as a cosigner.

Filing Bankruptcy Can Be Expensive

Fees for bankruptcy can include:

- a $335 filing fee for Chapter 7 cases from the bankruptcy court. If you don’t pay it in full, your case will be dismissed, or thrown out by the court (in the event that you have little to no income, you can apply to have your court fees waived)

- attorney fees

- cost of taking the required credit counseling courses

Chapter 11

Chapter 11 bankruptcy, best described as a reorganization plan, is used by large businesses to help them continue to stay in business as they pay back their creditors.

Filing Chapter 11 involves submitting a reorganization plan to restructure debts to help repay creditors over time.

This plan must be made in the best interest of the creditors, not the company or individual filing.

Advantages of Filing Chapter 11 Bankruptcy

Next, we’ll answer “What are the advantages of filing bankruptcy?” in relation to Chapter 11.

Your Business Can Continue to Operate

When you file for Chapter 11, your business is allowed to operate as it creates a plan of reorganization. This keeps the doors open and the employees employed.

Relief From Creditors

Similar to Chapter 7, after filing Chapter 11, the bankruptcy court issues an automatic stay that keeps creditors from attempting to collect repayment from the business.

By law, creditors have to cease all collection activity.

Pay Less Debt Over Time

The debt reorganization plan often involves paying a reduced amount that is owed, along with reduced interest rates.

Small Business Or Large Business Can File

While Chapter 11 is often the choice for large corporations, small businesses can file under this form of bankruptcy as well.

Sell The Business Without Liability

Filing for chapter 11 bankruptcy allows the business owner to sell his or her business free and clear of:

- claims

- liens

- other potential liability

According to Blalock Walters, a buyer usually in a Chapter 11 context may be willing to pay significantly more to acquire the Chapter 11 debtor’s business (or assets) compared to a sale of the business outside of Chapter 11 bankruptcy.

Disadvantages of Filing Chapter 11 Bankruptcy

Next, we’ll answer the question “What are the downsides of filing for bankruptcy?” in relation to Chapter 11.

High Costs

Chapter 11 can be costly, with large filing and legal fees.

Loss of Control

When a business files for Chapter 11, it loses control over business decisions that are viewed outside the “ordinary course of business”.

Before a business that has filed Chapter 11 can make a decision outside the “ordinary course of business”, permission from the bankruptcy court is required. Some common examples of business decisions that may be considered outside the “ordinary course of business” include:

- sale of assets

- a potential settlement with a creditor

- obtaining credit

- the hiring of professionals (e.g., attorneys, accountants, and consultants).

Loss of Privacy

When you file Chapter 11, you have to provide detailed documents with the bankruptcy court listing your financial information.

These documents then become public record and are available to anyone who reviews the court files.

However, some sensitive information, such as social security numbers, will not be public record.

Plan Must Be Approved

Creating and instituting a reorganization plan hinges on feedback from the creditors.

The court can reject a proposed debt reorganization plan if it finds that it is not realistic, or if there is no belief that the business can return to profitability after bankruptcy.

Does Not Discharge Personal Guarantee

What is often a misconception, Chapter 11 does not discharge the business owner’s personal guarantees.

Personal guarantees are only discharged if a business owner personally files for bankruptcy.

Chapter 13

Unlike Chapter 7, Chapter 13 bankruptcy is used in hopes of preventing the liquidation of someone’s assets, such as the sale of a home.

Chapter 13 bankruptcy requires a repayment plan to creditors over a three or five-year period.

Advantages of Filing Chapter 13 Bankruptcy

Next, we’ll answer the question: “What are the advantages of filing bankruptcy?” in relation to Chapter 13.

Assets Not Sold

When filing Chapter 13, you can retain your property and other assets since your assets will not be sold.

More Time To Pay And Pay Less

Chapter 13 provides more time to make payments.

Plus, over that time, you’ll likely pay less. Once you finish a repayment plan under Chapter 13, creditors can't obligate you to pay them in full.

Avoid Foreclosure

Chapter 13 offers the ability to save a home from foreclosure.

Co-signers Can Be Protected

Creditors may not seek to collect a debt from a “co-debtor,” which could be a relief for those who agreed to help shoulder liability.

Disadvantages of Filing Chapter 13 Bankruptcy

Next, we’ll answer the question “What are the downsides of filing for bankruptcy?” in relation to chapter 13.

Lowers Credit Score

Like other types of bankruptcies, your credit score will drop once you file, which can have significant negative effects. Interest rates and fees on loans will typically be higher as well.

Chapter 13 stays on your credit report for seven years.

Income Directed to Payments

During your repayment plan period, any disposable income you have after taking care of necessities (necessities include food, shelter and health care) goes to paying off your debt.

Because of this, vacations or other luxuries will be hard to come by — if not impossible — during the repayment period.

Time

It can take three to five years for you to repay your debts under a Chapter 13 plan.

No Second Chances

Because missing payments could potentially lead to a dismissal, there’s pressure to keep up with payments over the three to five years of the plan.

If dismissal occurs, you could lose assets you were trying to protect in the first place. We'll discuss reasons for a dismissal next.

Doesn’t Discharge Unsecured Debt

Similar to Chapter 7, Chapter 13 will not allow you to get rid of unsecured debt, such as taxes, student loan debt, alimony and/or child support.

Reasons for Your Bankruptcy Case To Be Dismissed

Receiving a discharge of debts isn’t guaranteed when you file for bankruptcy.

To do so, you’ll have to meet certain requirements or face the prospect of a dismissal, which will not only lift the protection of the automatic stay but also make you liable for your debts you’ve been seeking relief from.

Reasons for dismissal include:

- Not telling the truth on your financial information

- Not completing the mandated courses, such as a credit counseling course

- Refusing to pay court fees

- Not attending court hearings with your creditors

- In the case of Chapter 13, not making your repayment plans

If you do file for bankruptcy, whether it’s Chapter 7, 11 or 13, ensure that you follow each and every requirement.

Bankruptcy FAQs

Next, we’ll look at the most commonly asked questions about bankruptcy.

What If You Need A Car During Bankruptcy?

If you finance a car during bankruptcy, you will face sky high interest rates. Because of this, you shouldn’t be financing a car at all.

Instead, you should be saving money until you can buy an affordable car.

That’s why it’s important to find a place to live strategically. If you live near your job, you can either walk or use public transportation.

If you need a ride somewhere, such as a doctor’s appointment, you can use ride-sharing, and if you need a car for a day, you can do so for as little as $30/day on Turo.

What If You Need A New Residence During Bankruptcy?

If you need to find a residence to live during bankruptcy, we recommend finding a place where a credit check is not required, such as sublets.

Using resources like Craigslist, you can look for sublets where you’re assuming a lease or leasing from someone who already has a lease in place.

How Do You Know When It’s Time To File For Bankruptcy?

While many people may be looking for a number, there is no specific amount of debt that points to declaring bankruptcy.

Here’s what does: if you can’t pay your current debt, and you’re borrowing money to pay another creditor, you’re compounding the issue, and you’re digging yourself into a deeper “debt” hole.

Does Bankruptcy Mean Out of Business?

Bankruptcy does not mean a company is out of business.

If you file Chapter 11, you can continue to stay in business after you declare bankruptcy.

Does Filing Bankruptcy Clear All Debt?

Filing for Chapter 7 or Chapter 13 will wipe out your unsecured debt, but it will not delete your secured debt.

Alternatives to Bankruptcy

If you’re not ready to file bankruptcy, but you do need debt relief, there are several alternatives to bankruptcy, each with their own advantages and disadvantages. Remember: bankruptcy is a last resort, while the following options are easier and more simple to attempt.

Debt Settlement

In the credit card realm, full debt forgiveness is rare, but partial debt forgiveness is a possibility.

Debt settlement involves negotiating with your creditors to allow you to pay a portion of what you owe to clear your debt.

While this can help you save money in the long run and avoid bankruptcy, there are downsides. It can also:

- hurt your credit score

- give you a poor credit reputation, making it hard to acquire more credit or acquire low-interest rates

- increase your tax bill since forgiven debt is taxable income

You can read more about debt settlement and whether or not it's right for you here.

Debt Consolidation

Debt consolidation involves taking on a new loan to pay for other existing loans, combining the debt into a single and large amount in the process.

The reason debt consolidation exists is to have one payment and a lower interest rate.

Debt consolidation loans are offered by credit card companies, but keep in mind that debt consolidation loans can involve higher interest than the combined debts they pay off.

Plus, this doesn’t find a solution to the bad credit card decisions that got you in debt in the first place.

If you’re seriously looking at debt consolidation, we recommend using a credit union, where you can expect:

- higher interest rates on deposits

- lower interest rates on loans

- lower fees

You can get a personal loan from a credit union with an interest rate that’s significantly lower than your credit cards.

Learn more using a credit union for debt consolidation here.

Credit Counseling

Another option instead of bankruptcy is credit counseling, where you can sit down with a professional and discuss your financial situation.

With non-profit Consumer Credit Counseling Service (CCCS), the cost for this meeting is $0. After all, it’s called free credit counseling.

But some do charge a fee, so be sure to ask upfront.

Learn more about how to find a credit counselor for free here.

The WealthFit Debt Strategy

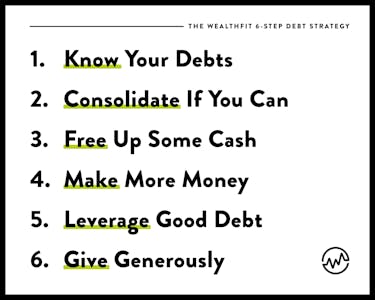

Another debt relief option is the 6 step WealthFit debt strategy.

The strategy begins by knowing and understanding your debts. This includes:

- knowing exactly how much you owe

- knowing the interest rates associated with each loan

Next, consolidate and simplify your debts if you can, such as utilizing a balance transfer.

After that, free up some extra cash using proven money saving techniques. This extra cash can be used to pay down your debt.

There’s truly no ceiling to how much money you can make, if you’re willing to hustle. The next step is finding ways to boost your income, and then use that additional income to pay towards your debt.

Next, leverage good debt to help get you out of bad debt faster than you originally anticipated. For example:

- raise your credit limit, launch your own business using that credit limit, and then pay off your debt with your new income

- Apply for a HELOC and use a low introductory interest rate to buy an investment property, generate cash flow, and use that cash flow to pay off any high-interest debt

The final step in the WealthFit debt strategy is to help people in need or causes by giving.

Read more about the 6-step WealthFit debt strategy here.

Is Bankruptcy Right For You?

Before you decide if bankruptcy is right for you, it’s best to know the answer to the questions “What are the advantages of filing bankruptcy?” and “What are the downsides of filing for bankruptcy?”

At the end of the day, choosing bankruptcy or a different debt relief strategy comes down to you and your financial situation.

- If you have no way to pay your debts, and it’s only going to get worse in the future, you can undergo a “personal restructure” with Chapter 7.

- If your business is deep in debt and needs restructuring, you can file for Chapter 11 bankruptcy and continue to operate.

- If you don’t want any of your personal assets sold, and you’re willing to pay back your debt over a 3-5 year period, you can file for Chapter 13.

Whatever you choose, whether that's a type of bankruptcy or a different debt relief option, don’t turn a blind eye to your debt and plan on dealing with it sometime in the near future.

Continued Learning: Debt Strategy

Now that you know answers to the questions “What are the advantages of filing bankruptcy?” and “What are the downsides of filing for bankruptcy?” and other debt-relief options, here are additional (and free!) WealthFit approved resources to help you tackle your debt.

- Find out how to graduate from college debt-free

- Here are 11 rules for marrying someone with student loan debt

- Is Dave Ramsey’s “Debt Snowball” method right for you?

- Here’s why you need an emergency fund

- Stuck in a bad car loan? Here’s how to get out of it