51 Little-Known Tax Deductions

In This Article

And it’s true. There are endless possibilities to pursue when it comes to side gigs and passion projects that can help you make some extra cash — tutoring, freelancing, dog walking . . .

While you may be focused on the additional income stream, there is another significant benefit to side hustles:

They don’t just help you earn more money. They can also help you keep your money — if you know the process.

That’s right. Starting a business on the side can give you serious financial advantages when it comes to taxes.

Ready to take the entrepreneurial plunge to make more and keep more? Let’s dive into full-time job and side business taxes.

[DOWNLOAD: Get a list of 50+ little-known side hustle deductions to make sure you maximize your deductions, and minimize your taxes!]

Pick a Business Structure

The first step to maximizing your savings from full-time job and side business taxes: consider your business structure.

The way you structure your business impacts your taxable income. This means that there’s real value in creating a business for tax purposes.

Understanding how each structure works will help you decide which to pick.

- Sole Proprietor: This is going to be the simplest business structure. It’s the default structure when you don’t register your business as anything else.

- Partnership: When two or more people run a business, they can form a partnership. Partners can be personally liable for the debts of the business unless they are limited partners.

- Limited Liability Company (LLC): Once you file with the state your business can become a separate entity from you, meaning that you are personally protected from any business liabilities. LLC’s can choose to be taxed as a partnership, a sole proprietor (if there’s only one member), or an S Corp.

- S Corporation: This is a corporation that has met specific criteria and filed paperwork with the IRS to be taxed as an S Corporation. If you set up your business as an S Corporation, you’re personally protected from liabilities like with an LLC. For tax purposes, you’re both considered an employee and an owner.

- C Corporation: With a C corporation, the owners and the business entity are taxed separately.

Let’s look at each structure more in depth next.

Keep It Simple as a Sole Proprietor

When you first started side hustling, you probably started as a sole proprietor. That’s a fancy tax talk way of saying you were making money that you claimed on your personal tax returns. That’s it. As a sole proprietor, you aren’t a legal entity. That makes this the simplest way to structure a business.

But it’s important to realize that you’re going to need to pay taxes on the money that you earn because an employer isn’t withholding taxes for you. If you’re not setting money aside for this as you earn it, this could come as a big, expensive surprise come tax season.

Tax Flexibility with an LLC

Once your business starts to grow, it could evolve into an LLC or S corporation. An LLC is a limited liability company. By structuring your business this way, you create a business entity separate from you. As an LLC, you are protected from business liabilities. That means if something happens to your company, no one can go after your personal assets.

In addition to helping you cover your assets, you’ll also have flexible tax reporting options with an LLC. Individual LLCs are automatically considered sole proprietorships unless you designate otherwise. That means you will have to report incomes and expenses on your personal tax return. If your company is profitable, you’ll have to pay personal income tax on those profits. You are also required to pay Medicare and Social Security taxes.

But creating an LLC gives you options. That means that you can also claim an S corporation status. If you do that, you are no longer a sole proprietor in the eyes of Uncle Sam. You also aren’t just a business owner anymore; you’re also an employee.

As an employee, you’re entitled to a salary. That salary is a business expense, which means your business is paying taxes on a smaller profit, and you only need to pay employment taxes on the salary you claim.

Other Options

Some small business owners may decide to create partnerships or C corporations, although both are less common when it comes to side hustles.

Partnerships are similar to sole proprietorships, but they involve two or more partners. States each have their own rules on partnerships. But in every case, a partnership agreement will outline how partnership interest is shared.

If you decide to set up your business as a C corporation, the owners and the business entity are taxed separately. Under this structure, you also pay corporate income tax. It’s unpopular for a reason. That’s a lot of taxes.

What Are The Big Differences?

Claiming business losses on personal taxes is possible with LLCs, S corporations, and partnerships. This is not true for C corporations.

If you are looking for a way to keep more money in your pocket after your full-time job and side business taxes, an LLC may be the best way to go.

Before you make a final pick for a business structure, do two things.

- Review the details from the Internal Revenue Service (IRS).

- You also need to decide if now is the right time to consult a tax expert.

Yeah, we know: it seems counterintuitive. You are trying to make money, not spend money — but creating the right business structure can help you get things right financially.

Missteps can result in overlooked options, possible penalties, and other fees. Sometimes it pays to reach out to a pro.

Bringing Your Spouse Into The Business

We’ve all heard it: don’t mix business and pleasure. However, it’s fairly common for spouses to support small businesses together. As a company starts to grow, business owners often want to involve their spouses financially.

Your business structure will determine how you are able to pay your spouse. Under a partnership, your spouse can claim some of the net income. If your spouse is a part-owner, he or she can receive dividends from a C corporation. In these instances, your spouse is not considered an employee.

How you pay your spouse depends on how much involvement they have in the business and what your business structure is.

If your spouse has some involvement in the business as an owner and:

- The business is a partnership or LLC, each person's share of income will pass through to your individual tax return (Form 1040). You’ll need to pay both self-employment and income tax on that income.

- If the business is an S Corp or an LLC taxed as an S Corp, you and your spouse can both earn a salary and take owner’s distributions. On the salary you and your spouse will pay payroll tax and income tax. On the distributions, you and your spouse will only pay income tax.

- If the business is a corporation, you and your spouse will pay tax on the salary and dividends that are received.

If your spouse isn’t involved as an owner but as an employee, they’ll pay income taxes based on their salary.

As an employee, your spouse would be able to earn Social Security credits. Additionally, he or she could also receive retirement benefits. There are tax implications, though. If your spouse is an employee, employment taxes will be withheld from his or her salary.

A tax professional can help you explore your options and see which model would be the best fit for your business . . . and your marriage.

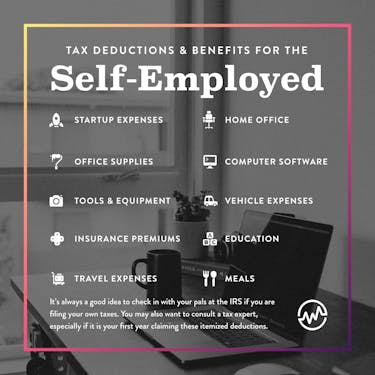

Top 10 Tax Deductions and Benefits for the Self-Employed

Once you have a plan for creating your business, it’s time to talk money. Specifically, it’s time to learn how you can keep more of your money at tax time instead of paying full-time job and side business taxes. Here are the top 10 tax deductions you may be able to claim after creating a small business.

Startup Expenses

Launching a business is hard work. In the first year of your business, you may be able to claim certain deductions. Deductions come from expenses related to creating your business, preparations to launch your business, and organizational costs. Organizational costs are fees related to picking a business structure.

The IRS gives more specifics in Publication 535 on how much you can deduct as a startup expense. The short version to see if you qualify is twofold: Your total startup costs are under $50,000; and you are deducting $5,000 or less in startup expenses and $5,000 or less in organizational costs.

Home Office

If you thought the only benefit to working from home was being able to take a conference call in your pajamas, you have another thing coming. Enter the home office deduction. If you use a portion of your home exclusively for business, you can qualify. It just has to be the primary location of your business. Looks like you just found another reason to skip the morning commute.

Once you determine that your definition of a home office matches up with the definition from the IRS, you have a choice to make. You can either use the simplified option or the regular method to determine how much gets deducted.

Office Supplies

You know how to deduct a home office. The next tax deduction to consider is office supplies. This can include anything that helps you get down to business. There are big-ticket items like computers and printers. But then there are other items like toner and paper qualifying as well. They add up, so don’t forget them.

And remember: your new flat screen TV is not a business expense.

Computer Software

Any software you use to run your business is now tax deductible. Examples of this are POS software or accounting software.

Tools

Tools and equipment are different in the eyes of the government. Tools are items necessary to do your job. Think monkey wrenches and cookie sheets. But there’s a catch. In order to qualify for a deduction, the tools have to amount to 2% or more of your adjusted gross income (AGI).

Vehicle Expenses

When it comes to vehicle expenses, you have two options: you can use the IRS standard mileage rate or you can make a deduction based on your actual costs. Fuel, repairs, and other travels expenses (think tolls) all count. Keep the receipts to put this money back into your pocket.

Insurance Premiums

If the IRS had a mantra, it would be: ordinary and necessary. That’s all you need. What works for one business might not work for you. Still, you may be able to deduct car, health, and even malpractice insurance premiums.

Education

Know you need to keep learning to keep your business growing? The Internal Revenue Service will determine if your education counts as a business expense based on whether or not the workshop, conference, or coursework provides skills necessary for your small business.

Travel Expenses

Before you pack your bags and book a trip to Disney, know this: the IRS looks hard at travel expenses and has a very specific definition of “business travel.” To qualify as business expenses, your traveling needs to be planned well in advance and serve a concrete purpose related to your business.

From skill acquisition to client outreach, the purpose behind each business trip can vary. But the key is that your travel focuses on business activity. If that’s the case, you can really rack up the tax deductions. Everything from transportation costs, like airfare and Ubers, to lodging expenses should qualify.

Meals

We’ve all got to eat. When it comes to eating out while traveling for business or entertaining clients, you have more tax deductions on your hands. What you claim depends on your paperwork: the actual receipts or your event calendar. If you save receipts, you can claim half of the cost of the actual meal. However, if you only have a record of your appointment, you can use it to claim 50% of the standard meal allowance.

It’s always a good idea to check in with your pals at the IRS if you are filing your own taxes. You may also want to consult a tax expert, especially if it is your first year claiming these itemized deductions.

If you have utilized each of these tax benefits already and are still looking to save money in this area, learn how to pay less taxes and legally reduce your taxes by up to 40%.

Bring the Receipts

When it comes to tax deductions for your small business, there is nothing more important than collecting your receipts. Regardless of which deductions you are choosing, you want to make sure you can complete your return accurately. In the event of an audit, receipts are essential. If you aren’t sure which deductions you qualify for, reach out to a tax expert.

The easiest way to stay organized with your receipts is to use a bookkeeping system. Many of these systems allow you to snap a photo of the receipt and upload it, which means you don’t have to keep a shoebox full of disorganized receipts.

Set aside time at the end of each month to log your expenses and organize your receipts. While this isn’t the most fun thing to do, you’re probably not going to remember what a receipt is for six or eight months after the fact.

Let’s Do the Tax Math for Full-Time Job and Side Business Taxes

There’s no need to start having flashbacks to your high school calculus class. Doing math at tax time can be overwhelming. But it’s actually quite simple to see how different business structures impact full-time job and side business taxes.

To illustrate the point, let’s use the 2016 median household income of approximately $59,000.

Scenario 1 - Full-time employee with no side hustle

You work a typical job and get paid a salary as a W-2 employee. You’ll pay income taxes and payroll taxes on the entire $59,000. You don’t have a side hustle and there are no extra business tax deductions to take.

- Pay income taxes and payroll taxes on the entire $59,000

Scenario 2 - Sole Proprietor

Now let’s say you’ve started your side hustle. Maybe you’re just getting started, or you’re trying to keep it simple. For whatever reason, you have sole proprietor status this year at tax time. You bring in $39,000 with your regular job and $20,000 from your side hustle.

But, because you have a business you also have business deductions. That home office of yours? Deduction. The computer you bought to start your business? Deduction. Any time you hit the road or have a business meal? Deduction. You end up with $5,000 worth of deduction.

Now, instead of paying income taxes and payroll taxes on the entire $59,000 like in scenario 1, you:

- Pay income and payroll taxes on $39,000 from your regular job

- Pay income and self-employment taxes on $15,000 from your business

- Don’t pay taxes on the $5,000 deduction

Scenario 3 - LLC taxed as an S Corp

You file to become an LLC and the IRS lets you decide: do you want to be taxed as a sole proprietor or as an S Corp?

You go with being taxed as an S Corp. Your business makes $20,000, has $5,000 worth of deductions, and you pay yourself a salary of $10,000. You also earn $39,000 from your full-time job.

Now, your tax scenario gets even rosier:

- Pay income and payroll taxes on $39,000 from your regular job

- Pay income and self-employment taxes on your $10,000 side hustle salary

- Pay only income taxes (no payroll or self-employment taxes) the additional $5,000 of business profit

- Don’t pay taxes on the $5,000 deduction

How Do Business Losses Impact Your Taxes?

Can business losses offset personal income? They can, and they do.

But it’s important to know more about how business losses impact your tax filing status and your tax returns. Let’s explore this topic with a Side Business Loss Q & A.

How many years can you claim a business loss on your taxes?

Claiming business losses on personal taxes is OK as long as it isn’t a yearly occurrence. The IRS distinguishes between a business and a hobby. A business qualifies for tax deductions; a hobby does not.

One loss on your personal taxes isn’t unusual. But businesses are designed to yield a profit. If you show a loss three out of five years, you will likely be flagged by the IRS. If your business isn’t wildly profitable, you may consider claiming fewer expenses on a tax return one year to show a small profit.

Can I claim business expenses without income?

That depends. Are you enjoying a hobby or running a business? It’s poor form to answer a question with a question, but that is how the IRS will determine whether or not you can claim business expenses without income.

During the lean startup phase or during a severe economic downturn, your business may not generate any revenue. But it is important to show a profit, no matter how small, after the first two years to avoid being flagged.

Will I get a tax refund if my business loses money?

Not to go all Negative Nancy on you, but there’s a theme here. Businesses lose money sometimes. If it’s the first year you’re running your business, there’s a chance that you might find yourself looking at a NOL, or a net operating loss.

In short, a NOL means your deductions are more substantial than your income. To know if you’re looking at a NOL for sure, you can use form 1045.

Without taxable income, you won’t be able to deduct a business loss for a refund. It is also true that you might experience a loss even with multiple income streams. If your loss is greater than your income from other sources, you can take a deduction. However, your deduction is limited to the amount of your income.

What about that extra money you weren’t able to deduct? You can actually carry over the loss into future tax years. Carrying a loss forward can reduce your taxable income for a significant amount of time depending on its magnitude.

Final Thoughts on Managing a Full-Time Job and Side Business Taxes

When it comes to growing your net worth, there is a lot of talk about making more income. Whether it’s landing a raise at your full-time job or adding another passion project to your schedule, you will bring in more cash.

However, the real secret to growing your wealth is to make sure you keep more of the money you make — especially with your full-time job and side business taxes.

Starting a side business to reduce your taxes is one way you can do that.

Business structures and tax deductions can seem complicated at first, and it’s inevitable you’ll make mistakes with your small business. But do the research, prepare as much as possible, and make the hard decisions now.

These decisions will benefit your business now and in future years.