Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

- What Is Hazard Insurance?

- How Much Does Hazard Insurance Cost?

- What Does Hazard Insurance Cover?

- What Does Hazard Insurance NOT Cover?

- Hazard Insurance Versus Homeowners Insurance

- How Much Will Hazard Insurance Pay?

- Is Hazard Insurance Required?

- Other Types of Homeowners Insurance

- What Kind of Hazard Insurance Is Right For You?

There’s a lot to think about when buying your first home: finding the exact house that you’re looking for, ensuring it’s in the right condition, and getting the best deal on that property. What comes after that is arguably more important than each of these steps: protecting your investment.

Let’s face it: finding the best insurance for your house can be confusing and expensive task.

A few situations can occur during this process:

- You only pay for the insurance that is required, lowering your overall cost but taking on significant risk. In the event of damage or loss, you face paying for a majority of the damages, which can add up to hundreds of thousands of dollars

- You overpay for a policy that includes items that, based on your location and your house, you don’t need and/or utilize

- You become confused looking at potential insurance policies, and in your confusion, you purchase the wrong one for your homeowner needs

The only way to avoid these situations — and to avoid overpaying — is to understand what kinds of home insurance exists to protect you and what exactly you’ll need if a disaster strikes.

Read further to learn about a type of insurance that sparks confusion and questions: hazard insurance. In this article, we will also detail whether or not you need it and how it differs from homeowners insurance.

What Is Hazard Insurance?

Hazard insurance is part of your homeowner’s insurance policy (insurance that covers your property in the event of losses and damages to your house or assets inside the house) that specifically refers to protecting three things from hazards:

- your home

- your garage or any other separate structure

- your personal belongings

It’s critical to understand that hazard insurance, though, is not synonymous with homeowner’s insurance. Why? Homeowners insurance also includes other kinds of coverage, including:

- additional living expenses that may be required if your home is damaged

- medical payments on your behalf if you are injured

- liability payments if other people in your home are injured

To put it simply, hazard insurance is one part of the umbrella that is homeowner's insurance.

How Much Does Hazard Insurance Cost?

After you understand what is hazard insurance, the next thing you’ll want to know is how much it costs.

The cost of hazard insurance is factored into the cost of your homeowner’s insurance, and it will depend on factors such as:

- what kind of coverage you purchase

- the value and age of your home

- any security features you have installed

For example, a house made of brick is considered more structurally sound than a house made of wood, so the cost of hazard insurance — and your overall homeowner's insurance — may be less.

Your personal credit score and insurance score, as well as any previous claims, will also play a role, similar to if you were looking to buy car insurance.

The average cost of homeowner’s insurance across the United States is about $100 per month. Again, since hazard insurance is part of homeowner’s insurance, it’s included in the price.

What Does Hazard Insurance Cover?

When you’re examining what is hazard insurance, it’s important to understand there are two types of hazard insurance.

The first is called an “open perils” or “all-risk” policy and the second is a “named peril” policy. Read further to learn their one key difference.

Open Perils or All-Risk Policy

An open perils or all-risk policy covers every possible type of peril that may befall your home with the exception of specific perils named in the policy.

Because it covers so many perils, this option is typically more expensive than the next option.

What Does All Risk Hazard Insurance Cover?

Generally speaking, an all-risk or open hazard insurance policy will cover any risk that is not named in the policy. So, the sky is the limit as to what may or may not be covered.

Some policies will cover the structural collapse of your home, no matter the cause. Others will insure you from the seep of mold, fungus, or wet rot.

Named Peril Policy

A named peril policy only provides coverage in the event that a specifically named hazard damages your home.

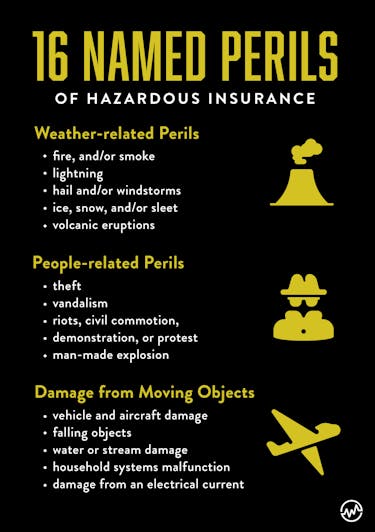

Typically, 16 hazards are covered under a named peril policy.

What Are The 16 Named Perils?

What does hazard insurance cover with those 16 named perils?

Weather-related perils includes damage from:

- fire and/or smoke

- lightning

- hail and/or windstorms

- ice, snow, and/or sleet

Volcanic eruptions might also fall into this category if you live near one.

People-related named perils includes damages from:

- theft

- vandalism

- riots and civil commotion — also known as a demonstration or protest

- explosions, whether man-made or caused by something that man-made, are covered as well

When it comes to damage from moving objects, named perils include:

- vehicle and aircraft damage

- falling objects

- water or steam damage

- household systems malfunction (such as when your HVAC unit freezes)

- damage from an electrical current

While this list of 16 named perils may seem exhaustive, there are some glaring omissions that you need to heed if you live in an area that’s prone to certain types of natural disasters.

For example, structural collapse and mold are byproducts of flooding. Floods are not covered under a named perils policy.

So if you live in a floodplain, you will probably be required to purchase a special policy that covers flood damage by your mortgage company when buying a home.

Structural collapse also happens during earthquakes. California residents take note; your mortgage company will require you to purchase earthquake-specific coverage.

What Does Hazard Insurance NOT Cover?

Even if you opt to purchase an all-risk hazard insurance policy, some things are never covered. That’s why it’s important to understand what is hazard insurance — and also what it’s not.

For example, damage due to war, government action, or nuclear hazard is not going to be covered even under an all-risk policy.

When we’re talking about the United States, those things may seem far-fetched, but other risks are far more common and you still can’t use hazard insurance for protection.

Many self-imposed risks are excluded from all-risk policies, like damage caused by your pets, however loveable, or by any less welcome rodents or pests that decide to invade your home.

Then there are gap areas, where hazard insurance will cover damage sometimes but not all the time.

A common gap area exists when your house is either under construction or vacant and awaiting sale to a new owner. Theft from or vandalism to a house that is being built, or has been unoccupied for more than 60 days, is not covered by an all-risk policy, even if the policy does cover theft for a currently owner-occupied house.

In other cases, what hazard insurance covers is a little hazier. Take water damage, one of the 16 named perils if the damage is sudden, but not considered a peril if it occurs over time.

Who decides how long it took the damage to occur?

What period of time constitutes “over time” rather than being sudden?

The answers to these questions (and the overarching question of what is hazard insurance) are located in the fine print of your hazard insurance policy, and even if you aren’t in a floodplain or a hurricane-prone region, it’s important to read. After all, everyone has a bathtub.

Hazard Insurance Versus Homeowners Insurance

Another element of understanding what is hazard insurance: comparing it to homeowners insurance.

Even though hazard insurance is part of your homeowner’s insurance policy, it isn’t the only thing under the umbrella.

While hazard insurance covers the cost of damage to your home, the other major portions of homeowner’s insurance cover payments made to replace your belongings, and for you and other people who might be injured if your home is damaged. This includes:

Medical Payments

Medical payments covered under a homeowner’s insurance policy can be paid either to you and your family, or to anyone visiting your home that is injured on the premises.

There is a limit on medical payments made by your homeowner’s insurance company. The limit is similar to medical payments made by your car insurance company if you are in an accident and either you or the other party is injured. It’s usually between $1,000 and $5,000.

Personal Liability Coverage

As with car insurance, there is a separate personal liability component of homeowner’s insurance in addition to medical payments. The limit is much higher, usually starting at $100,000 and phasing out at $500,000.

Personal liability coverage insures you against everything from basic medical bill payments, to “pain and suffering” damages and even death benefits if someone is severely injured while visiting your home.

What’s the difference between personal liability coverage and hazard coverage?

If someone is visiting your home and a window shatters and hurts them due to a lightning strike, the damages they suffer will be covered by a named peril hazard insurance policy because lightning is one of the 16 named perils.

But if a window breaks because your son misaims a baseball, hurting your visitor in exactly the same way, the damages will be paid under your personal liability coverage, because the injury was caused by you, not by the weather.

Keep in mind; if you injure somebody on purpose, even personal liability coverage won’t kick in.

How Much Will Hazard Insurance Pay?

The payout from your homeowner’s insurance company for hazard insurance depends on your policy limits.

Remember: the idea is that insurance pays the cost of replacing your home if disaster strikes.

For example, if you have an older home that would cost more to repair, you generally pay more upfront for your policy premiums and choose a lower deductible (the amount you have to pay before insurance starts to cover your expenses) before your hazard insurance kicks in to pay hundreds of thousands of dollars in repair costs.

Is Hazard Insurance Required?

If you are buying a home and you plan to finance the purchase with a mortgage, your lending company will almost always require a minimum level of hazard insurance included in your homeowner’s insurance policy.

Here’s how it works: many lenders will require you to pay the first year of insurance premiums upfront. Some continue to include the premiums as part of the monthly mortgage payment you make for the term of the loan.

The premium payments go into your escrow account, and the lender pays the insurance company directly.

If you live in an area particularly prone to a certain type of risk, like floods or earthquakes, lenders will require you to buy hazard insurance coverage that insures against the risk.

Other Types of Homeowners Insurance

You can add tangible items to your homeowner’s insurance policy using a rider.

Popular riders cover:

- jewelry

- artwork

- antique or high-value furnishings

- high-end designer clothing

One of the most common add-ons in the United States is coverage for engagement rings.

Tip: You don’t have to obtain car and homeowner’s insurance from the same company, but if you bundle them together you can sometimes get a discount and save money.

What Kind of Hazard Insurance Is Right For You?

After you understand what is hazard insurance, the next step is deciding what kind of hazard insurance is right for you. This requires taking many factors into account.

It’s important to consider this issue upfront because the cost of your homeowner’s insurance and the hazard insurance policy contained within could affect how much you can afford to pay for a new home.

Due to recent natural disasters, the United States government is now requiring lenders in some areas of the country to mandate higher-cost insurance policies for both new home buyers and current residents.

And even if you aren’t looking for a home in a high-risk area, it always pays to do your homework about what is hazard insurance. After all, disasters are never planned. But having the right type of hazard insurance in your homeowners policy can prepare you for the worst — and lets you rest easy, knowing your family and your investment is safe.

Taking the time to examine your options could save you thousands of dollars down the road and it will keep you from overpaying for a policy.