Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

“How many stocks should I own?”

This is a question that many stock investors, both new and experienced, have wondered.

Determining an answer not only can help increase your return on investment; it’s also a powerful tool of risk management.

In this article, we’ll help you decide how many stocks you should own by breaking down:

- factors that need to be considered when deciding how many stocks to own

- an original study conducted on diversification

- why diversification is your roadmap for success in the stock market

Let’s get started!

Stock Quantity Factors To Consider

Though there are several different factors that help you answer this question, the most important factors that you, as an investor, need to consider are:

- your time horizon

- risk preference

We’ll look at each one next.

Time Horizon

Your time horizon should dictate the number of stocks in your portfolio.

The closer you are to reaching your goals (like retirement), the more stocks you should own in your portfolio.

The further you are from reaching your financial goals, the fewer stocks you should own.

This boils down to being more conservative when your time horizon is short and taking on more risk when you have a longer time horizon.

Risk Preference

Each individual investor has a particular risk preference — some investors may be comfortable with risk, while others have a strong distaste for it.

Knowing what your risk preference is will aid you in answering our question, ‘how many stocks should I own?’.

The investor with a higher risk preference will be better off with having fewer stocks in their portfolio than the investor who is not comfortable with risk.

But what do some of the experts believe?

- Benjamin Graham said the number should be between 10 and 30.

- Ray Dalio says it should be in the range of 15 to 20.

- Warren Buffet puts it at 5 to 10.

Combining what these 3 successful investors say, we can get a range of about 10 to 25. This gets us at the high end of Warren Buffet’s suggestion but still less than Benjamin Graham’s maximum. Ray Dalio falls right in the middle.

The longer the time horizon and the riskier an investor is, the closer the number of stocks should be to 10, whereas the shorter the time horizon and the less risky an investor is, the closer the number of stocks should be to 25.

Experimentation with Number of Stocks

I conducted an experiment to answer the age-old question of how many stocks should I own. I created a model that allows you to see how your portfolio performs over time based on a set of assumptions and inputs that you assign to it.

I assumed each stock had an annual return and standard deviation (risk) of 10%. The power of diversification is shown by creating a portfolio.

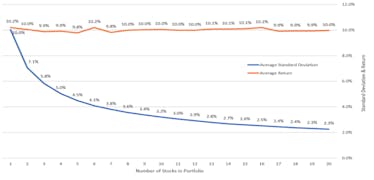

Each time a stock is added to the portfolio the standard deviation and risk of the portfolio falls. However, when the number of stocks in the portfolio reaches 16, the standard deviation starts to plateau.

The chart below illustrates this.

The return of the portfolio (orange line) stays at 10%.

But, as the number of stocks in the portfolio increases, the standard deviation (blue line) falls.

This simulation was repeated 100 times, so these results are an average of all the simulations.

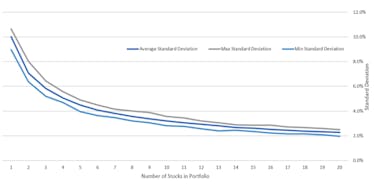

The biggest swings were in the returns. The standard deviations remained didn’t experience the big ups and downs that the returns did.

The 2 graphs next illustrate the minimum, maximum, and average returns and standard deviations.

Based on this experiment, the best number of stocks was 16.

At this point, there are no more gains to be made as you try to diversify your portfolio.

Remember, even though the risk is falling, the annual return is remaining constant.

The Importance of a Diversified Portfolio

Diversification is important for investors because it allows you to substantially reduce your risk, while having no impact on your return.

But can you actually diversify your portfolio?

You can create a diversified portfolio by calculating the correlation between the stocks in your portfolio.

You want to find stocks that have no or very little correlation between them. Correlation calculates how a set of “2 time series” moves over time.

If the 2 time series move in the same direction each time, there will be a positive correlation. If the time series move in the opposite direction each time a new data point is added, there will be a negative correlation.

In the model that I created, the correlation between the stocks was almost exactly 0 (the range of correlation is always between -1 and +1).

While this is not realistic, it shows the importance of diversification to stock investing.

Diversification is not achieved by just adding stocks to your portfolio.

It goes deeper than that.

If you want to diversify your portfolio, you need to have a mix of stocks that have very little to do with each other.

If you only have technology stocks or large-cap stocks, your portfolio won’t be very diversified, even if you have many stocks.

Why?

It is because stocks in the same industry or size tend to move in the same direction over time, and therefore have high correlation between them.

There are thousands of stocks that you can invest in, so calculating the correlation between this many stocks is time-consuming.

Instead, there is a much easier way to invest in stocks with low correlation.

The easiest way to have a diversified portfolio is to invest in companies from different sectors (technology, energy, consumer, etc.), companies of different sizes (mega-cap, large-cap, medium-cap, small-cap), and companies with different characteristics (dividend or no dividend, growth or value, etc.).

This will allow you to capture the benefits of diversification without spending unnecessary time calculating the correlation between thousands of individual stocks.

How Many Stocks Should I Own?

The number of stocks that you own comes down to your tolerance of risk and your time horizon.

According to our 3 stock investing experts, we set a range of 10 at the low end to 25 at the high end.

We can then get this down to 4 categories of stock investors depending on their risk tolerance and timeframe.

Let’s take a closer look at each.

High Risk Tolerance and Long Time Horizon

The first category is an investor with a high risk tolerance and long timeframe. This stock investor has a long time to reach their financial goals and is comfortable taking on a lot of risk.

Because of this, they can be very risky with their portfolio and invest in only a handful of stocks. This investor should have about 10-14 stocks in their portfolio.

Low Risk Tolerance and Short Time Horizon

On the other end of the spectrum, we have an investor with a low risk tolerance and short timeframe.

This investor would want to almost over diversify and hold somewhere between 21-25 stocks.

High Risk Tolerance and Short Time Horizon

The next investor is the high risk tolerance and short timeframe investor.

While this investor can accept risk, there is not a lot of time until their financial goal. That would put them in the 15-20 stock range.

Capital preservation still needs to be at the front of their mind.

Low Risk Tolerance and Long Time Horizon

Lastly, we have the low risk tolerance and long timeframe investor.

This investor still wants to account for capital preservation, because even though there is a long time until their goal is reached, they have a low tolerance for risk.

This investor would be in the 15-20 stock range.

The Bottom Line: How Many Stocks Should I Own?

To determine how many stocks you should own, first examine your time horizon and risk preference.

Next, examine stock sectors and find stocks that are uncorrelated.

The ranges recommended in this article are not set in stone, but they provide a good start to get you thinking about the number of stocks to put in your portfolio.

Just doing these 3 things will set you apart from an average investor and give you a leg up on investors who randomly select stocks.