Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

- When Is The 2022 Tax Deadline?

- What Is An IRS Tax Extension?

- What Happens If You Miss the IRS Tax Extension Deadline?

- When is the Business IRS Tax Extension Deadline?

- Should You File an IRS Tax Extension?

- How To File An Extension

- How To Stay On Top of Your Taxes in 6 Easy Steps

- IRS Tax Extension Deadline

While there are some deadlines that can be negotiated, the IRS tax deadline isn’t one of them.

What do you do if tax day approaches and you suddenly realize you’re not ready to file? Do you have to rush through your taxes at late hours of the night and attempt to get them in on time, or is there another option?

Those who need additional time can file an IRS tax extension.

How common is an IRS tax extension? In 2020, about 14.6 million taxpayers filed extensions.

In other words, one in ten taxpayers asked for an IRS tax extension in 2020.

But how do you file an IRS tax extension and is it the right move for you? We cover everything you need to know about an IRS tax extension in this guide.

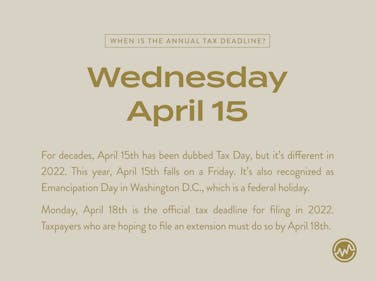

When Is The 2022 Tax Deadline?

For decades, April 15th has been dubbed Tax Day, but it’s different in 2022.

This year, April 15th falls on a Friday. It’s also recognized as Emancipation Day in Washington D.C., which is a federal holiday.

Monday, April 18th is the official tax deadline for filing in 2022. Taxpayers who are hoping to file an extension must do so by April 18th.

While the pandemic has led to tax deadline extensions for the past few years, taxpayers can expect a more ‘normal’ tax schedule this year. No automatic extensions are in place this year for Covid-19. Here are a few of the extensions to expect in 2022:

• April 19: Taxpayers in Maine and Massachusetts in observance of Patriots’ Day

• May 16: Victims of storms in Illinois, Tennessee, Kentucky, and Colorado

Taxpayers who file for an extension have until October 17, 2022 to file.

What Is An IRS Tax Extension?

If the April 15th deadline is coming up too quickly and you need more time to file, you can file for an IRS tax extension deadline.

This automatic extension gives you an additional six months to file your taxes in most situations. Rather than submitting your tax return by April 15th, you’ll have until October 15th to finish your taxes.

Again, if October 15th falls on a Saturday, Sunday, or holiday, your extended tax return will be due on the next business day.

While you may have an additional six months to complete your tax return, you don’t get additional time to pay taxes due. You’ll need to pay any taxes due by April 15th to avoid being charged any interest or penalties.

What Happens If You Miss the IRS Tax Extension Deadline?

If the April 15th deadline is coming up too quickly and you need more time to file, you can file for an IRS extension deadline.

This automatic extension gives you an additional six months to file your taxes in most situations. Rather than submitting your tax return by April 15th, you’ll have until October 15th to finish your taxes.

Again, if October 15th falls on a Saturday, Sunday, or holiday, your extended tax return will be due on the next business day.

While you may have an additional six months to complete your tax return, you don’t get additional time to pay taxes due. You’ll need to pay any taxes due by April 15th to avoid being charged any interest or penalties.

Failure To File Penalty

So, what happens if you don't file for an IRS tax extension and you don't file your taxes by the proper date?

If that happens, then you'll likely get hit with a failure to file a penalty on top of the taxes you already owe.

The failure to file a penalty is steep — 5% of your unpaid tax balance charged monthly.

If you file more than 60 days late, you’re subject to a minimum late filing fee of the lesser of 100% of the tax that you owe or $435.

If you’re facing a dual penalty (both a failure to file and failure to pay) in the same month, then your failure to file penalty will get reduced by the amount of your failure to pay penalty for that month.

In other words, you’ll pay a combined penalty of 5% for each month you’re delinquent.

Further, the IRS does charge interest on all your penalties.

You may have the opportunity to remove a failure to file penalty if you can show to the IRS that you acted in good faith and had reasonable cause for why you couldn’t file and pay your taxes.

Failure To Pay Penalty

The Failure to Pay Penalty is also something to avoid.

If you don’t pay the taxes on your return by either the specified due date or the approved extended due date, then you’ll likely get hit with a failure to pay penalty. You’ll know that you owe this penalty to the IRS because you’ll receive a letter in the mail. Like other penalties, it’s important to note that the IRS charges interest on these penalties.

You’ll be charged 0.5% of the total amount due for each month or part of the month that you don’t pay your taxes.

The maximum penalty is 25% of your total tax due.

If you are hit with both a failure to file and a failure to pay penalty, the total amount you can be charged each month for both fees is 5% each month. The maximum total combined fee is 47.5% of the tax due — 22.5% late filing and 25% late payment.

The IRS also charges interest on your unpaid taxes. You’ll be charged the federal short term interest rate plus 3%.

With all these penalty fees and interest charges, if you miss the deadline and don’t file for an IRS extension deadline, you could be looking at an exorbitant tax bill by the time you finally file.

It's possible to reduce or remove a failure to pay penalty if you can show reasonable cause for why you didn’t pay your taxes on time.

You also have a right to dispute the penalty.

If you know you can’t pay off your penalty, then work with the IRS and apply for a payment plan.

Doing so can help you pay off your full tax debt over time without incurring further penalties.

When is the Business IRS Tax Extension Deadline?

The business tax extension deadline remains the same for C corporations and individuals, which is April 18, 2022.

S corps and partnerships, though, need to file their business taxes or an extension by March 15, 2022.

Should You File an IRS Tax Extension?

There can be many reasons why you’re not ready to file your taxes by the deadline. This can include:

- Lost paperwork, such as waiting on a W2

- Traveling extensively

- Facing an illness or dealing with a death in the family

The IRS extension deadline can help you avoid late filing penalties. But before you decide to file an extension, you should weigh the pros and cons of that decision.

Pros Of Filing For An IRS Tax Extension Deadline

- You have an extra six months to get all of your documents in order and track down any missing documents that you need.

- You can improve the accuracy of your return if you wait until you have all of the information that you need to file properly.

- You can avoid being charged late filing penalties if you know that you can’t get your return in by the April 15th deadline.

- Self-employed persons have additional time to fund their retirement plans. Contributions can be made up until the extension deadline.

Cons Of Filing For An IRS Tax Extension Deadline

- With an IRS extension deadline, you’re given an extension to file, but not to pay. Any tax due must be paid by the April 15th deadline or you might be charged a late payment penalty and interest on the amount due.

- It gives you more opportunity to procrastinate. If you’re not going to use the extra six months to file a more accurate return or get information that you need, you may just be procrastinating again until October 15th, meaning that filing taxes will be on your mind for another six months.

How To File An Extension

If you decide that you need to file an extension, know that the IRS has made filing for an extension a simple process. There are two ways to file for an IRS extension deadline.

Make A Payment

When you make a payment for all or part of your estimated tax due using Direct Pay or the Electronic Federal Tax Payment System, you can mark that this payment is for an extension of your tax filing.

File Form 4868

You can file Form 4868 online or by mail to request an automatic extension. To complete the form, you’ll need to estimate your tax liability for the year and file by the April 15th due date.

Because filing an IRS extension deadline is easy and simple to do, if you know you need an extension, don’t delay. File for one now and start getting everything ready for your new tax deadline.

How To Stay On Top of Your Taxes in 6 Easy Steps

Even if you do file an extension and get an extra six months to file your taxes, you don’t want to be scrambling to complete them.

Taxes can be complex and confusing, especially if you don’t stay on top of them throughout the year. Unfortunately, too many people leave preparing for their taxes until just before the deadline. Not only does this create unnecessary stress, but it could mean that you’re missing important information — and filing your taxes with incomplete information.

Don’t leave prepping for your taxes until the last minute. Here are 6 simple and easy ways to stay on top of your taxes during the year so that you don’t have stress and file an extension.

Create Calendar Reminders

Don’t let April 15th sneak up on you. Create calendar reminders for a few specific dates. These include:

- January 31st: Many of your required tax forms (eg W-2’s, 1099’s, 1098’s etc) should have been sent to you by this date. If you’re missing any, be sure to follow up to get them quickly.

- Early February: If you are working with an accountant to file your taxes, call to confirm an appointment with them in March to get your tax return started.

- March: Choose a date early in the month to review your tax return information and estimate your tax liability. If you are going to owe money, knowing that in advance of the April 15th deadline will be helpful.

- April 15th: Make sure this date is in your calendar as either the last day to file your return or to file for an extension. But don’t feel like you need to wait until this date — you can always file earlier.

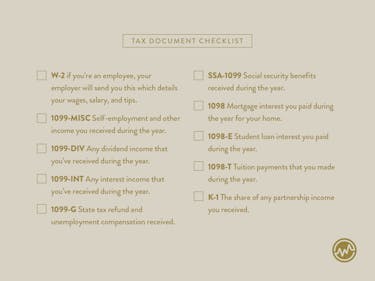

Tax Extension Deadline: Have A Checklist Of All The Documents You Need To Collect

Each year, you’re sent documents that show your income or expenses. The sender of these documents also files a copy with the IRS. These documents are key to completing your tax return so you’ll want to keep a checklist to ensure you receive everything you need.

To help you get started, here are some common documents you might receive:

Aside from these documents that you’ll be sent prior to tax time, you’ll also want to keep track of other documents that you’ll get during the year. These include:

- Property tax payments

- Receipts for charitable contributions

- Childcare expenses paid (as well as provider’s tax ID number)

- Medical receipts

- Capital gains and losses statement

Stay Organized

During the year you’ll likely collect a lot of documents and receipts that may be useful at tax time. The best thing to do is to have a designated folder to keep them in.

If you itemize taxes, are self-employed, or own a rental home, there are a number of receipts that you’ll be collecting each month.

Organization is going to be the key to file your taxes easily and accurately.

Use The Paycheck Check-Up Tool

Our tax system is a pay-as-you-go tax system, meaning that you pay taxes throughout the year as you owe them. The IRS doesn’t want to receive just one payment at the end of the year. If you don’t pay enough in taxes throughout the year, you could end up with a huge tax bill as well as an underpayment penalty.

During the year, you should be paying taxes to the IRS either by having your employer withhold taxes from your paycheck or by making estimated tax payments (or both).

To make sure that you’re having enough withheld during the year and also not withholding too much, the IRS has a Paycheck Checkup tool. This tool will help you estimate whether you’re withholding too much or too little, so you can make adjustments before tax time rolls around.

Set Aside Money

By using the Paycheck Checkup tool from the IRS, you’ll hopefully be paying the right amount to the IRS during the year. But just in case you’re not, it’s good to have a strategic cash reserve so you can pay an unexpected tax bill.

Remember, any tax that you owe is due by April 15th, regardless of whether you file for an extension. Set aside some money throughout the year to make sure that if you do need to pay more in taxes, you’re able to do that by the deadline and you won’t have to pay any penalty fees.

Meet With An Accountant Early

If you do decide that you want professional help filing your taxes, don’t wait until March to find an accountant. Start your search early — summer is a great time to look. Not only will you have time to meet with accountants since their workload will be slower, you can also take the time to consider a number of different accountants to decide who you’d like to work with.

If you already have an accountant, plan to meet with them during the year to ask for advice on any big financial changes. Maybe you’re selling a home or starting a business. Your accountant isn’t just there to help you file your taxes; they can help you make strategic moves during the year to help you reduce your tax bill.

IRS Tax Extension Deadline

The tax deadline isn’t optional. The IRS will impose penalty fees on people who miss it and haven’t filed an IRS tax extension requesting more time.

Don’t give the IRS more money than you need to — file for an IRS tax extension if you think there’s any chance you might miss the April 15th deadline, and prepare the next time around to file your taxes early.

If you have other questions about taxes and how to file them — such as filing taxes as a business for the first time, or how tax write-offs work — read over our guide.