Real Estate Note Investing

How To Buy Non-Performing Notes from Banks & Hedge Funds

In This Article

Do you want to invest in real estate, but you don’t want to deal with the hassle of buying, selling, or managing a property?

There is one type of real estate investing that provides passive income, the opportunity to focus on the business side of real estate investing, and does not require maintaining a property.

This is called real estate note investing.

In this article, we'll break down the nuances of real estate note investing so that you can decide if it's the right investing avenue for you.

What Is Real Estate Note Investing?

Before we get started on real estate note investing, let’s first explain what a real estate note is.

Keep in mind that the term “real estate note” may also be referred to in some circles as a “mortgage note”.

When someone buys a property but doesn’t have the means to pay cash for it, he or she will be asked to sign a mortgage and a promissory note by their lender. The buyer will then pay part of the price as a down payment, but will be required to sign legally binding documents that require them to pay the remaining amount off over time.

Promissory notes are essentially a contract that the buyer signs where he or she guarantees to repay their debt.

Now that we’ve explained a real estate note, let’s look at real estate note investing, also referred to as “note investing” and “investing in mortgage notes”.

Real estate note investing is the process of purchasing the debt and its security instrument.

Once you invest in a mortgage note, you become the lender, which means that you begin collecting payment from the borrower.

Typically, those who participate in real estate note investing do so by purchasing these real estate notes at a discounted rate. This allows the investor to make more money than they invested when the borrower pays them back the full amount they had originally agreed to pay.

Next, we will look at the advantages and disadvantages of note investing.

The Contract For Deed vs. Mortgage

When engaging in real estate note investing, you will undoubtedly encounter the terms “deed” and “mortgage.”

What does each one mean? And what’s the difference?

A traditional mortgage contract involves only two parties — the borrower and the lender. These mortgages are very simple investments, given that you simply need to purchase the agreement from the lender.

Deeds can be a bit more complicated because they involve three parties.

A deed is a contract between:

- a borrower (trustor)

- lender (beneficiary)

- and a trustee

The trustee holds the title to the real estate and can sell it if the borrower defaults.

As you can imagine, real estate note investing is a bit more challenging when you have to negotiate with both a lender and trustee.

Real Estate Note Vs Lien: What’s the Difference?

You may wonder what the difference is between a real estate note and a lien when exploring real estate note investing.

A real estate note, or promissory note, is the written agreement between a borrower and a lender that contains the details of a property loan. The borrower agrees to repay the loan as per the terms of this note.

The financed property serves as collateral for the loan. Therefore, the bank holds a lien on the property until the loan is repaid in full.

A lien gives the lender the legal right to seize the property if the borrower does not repay the loan as agreed in the note.

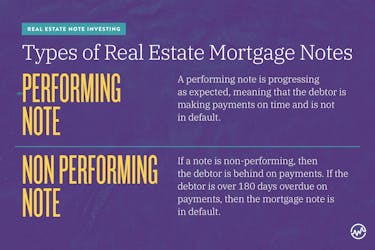

Types of Real Estate Mortgage Notes

Before you begin real estate note investing, it is crucial to understand the several types of notes available. Generally, notes will be classified as performing or non-performing.

Performing Note

A performing note is progressing as expected, meaning that the debtor is making payments on time and is not in default.

Non Performing Note

If a note is non-performing, then the debtor is behind on payments. If the debtor is over 180 days overdue on payments, then the mortgage note is in default.

Real Estate Note Investing: Advantages

Advantages of real estate note investing include:

- Passive income

- Lower recurring expenses since investors don’t have to pay real estate agents or property managers

- an opportunity for the investor to make a higher return on investment, since he or she will be able to control the interest rates of the loan

- Versatility – investors have the same options with notes as they do with properties. They can sell, flip, and/ or use a note for collateral.

- Less competition – there aren’t as many investors working in this niche

- Easier to manage – these investments can be managed from a smartphone or computer without visiting the property as you would with an investment property.

- Investors can make profits without a need for maintenance

Real Estate Note Investing: Disadvantages

Real estate note investing also carries with it its share of risks. These risks include:

- The chance of the homeowner defaulting on the loan, putting the note investor at risk of losing money

- The property can go to auction, and the investor might lose money if the property sold for less than they paid for the note

- It can be challenging to measure the profitability of investing in mortgage notes accurately

- Notes are not insured by the Federal Deposit Insurance Commission

- You’re investing in paper contracts, so liquidity is limited to selling the contract

- The terms of the contract, such as interest rate, down payment, and duration of the loan, are dependent on the borrower’s acceptance of each. Therefore, it’s difficult to determine the profitability of real estate note investing beforehand.

- The property is already collateral on a loan, so investors must have access to other funds.

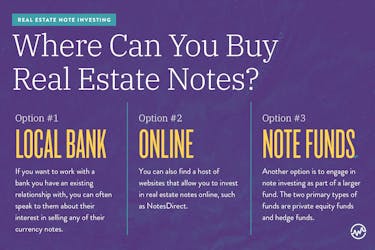

Where Can You Buy Real Estate Notes?

There are several options both locally and online if you’re looking to buy real estate notes and start real estate note investing.

Buying Real Estate Notes Option #1: Local Bank

If you want to work with a bank you have an existing relationship with, you can often speak to them about their interest in selling any of their currency notes.

Buying Real Estate Notes Option #2: Online

You can also find a host of websites that allow you to invest in real estate notes online, such as NotesDirect.

Buying Real Estate Notes Option 3: Note Funds

Another option for real estate note investing is doing so as part of a larger fund.

The two primary types of funds are:

- private equity funds

- hedge funds

Regardless of which fund you partner with, the basic premise is the same.

When contributing to a fund, the goal is to pool your money with other investors. The combined assets of multiple investors allow you to acquire a share of a group of loans from large financial institutions.

Before you buy notes, it’s essential to research your options and choose the one that will not only provide you the greatest return on investment, but it's right for you and your investment goals.

3 Real Estate Note Investing Strategies

Next, we'll discuss three real estate note investing strategies to help you decide what's best for you.

Real Estate Note Investing Strategy #1: Buying Notes

This real estate note investing strategy is one of the easiest methods in real estate note investing, and it works the same as being a landlord. Instead of purchasing property, investors buy notes and collect the payments.

If the note is non-performing, the investor can restructure the loan with the borrower’s cooperation and perhaps increase the profit received in each monthly payment or shorten the time it takes to repay the loan.

This investment strategy is the easiest one for earning passive income with real estate note investing.

Real Estate Note Investing Strategy #2: Rehabbing Notes

Rehabbing notes works the same way as rehabbing a property. Investors purchase non-performing notes at a low price since the borrower is in default. Then, they rehab it.

The investor re-negotiates the loan with the borrower — perhaps to terms that the owner can better afford.

After the borrower is making scheduled payments again and the note is performing, the investor sells the note for profit to another investor.

Real Estate Note Investing Strategy #3: Renegotiating the Note

With this real estate note investing strategy, investors can buy non-performing notes and become the primary lienholder of the property. If they desire, investors can attempt to restructure the note with the owner so that it’s performing again and then implement another strategy such as note flipping or holding. But, re-negotiating at this point may be hard to do.

Owners usually aren’t easy to contact when their property is on the verge of foreclosure. If the loan can’t be restructured and remains in default, the next move by the investor is to foreclose on the property due to the status of the loan.

This results in the investor becoming the owner of the property for 10% to 30% of its actual value.

Keep in mind that this real estate note investing strategy is not easy, and it requires a lot of time and effort.

Real Estate Note Investing: The Bottom Line

Investing in mortgage notes provides an opportunity to make money in real estate without the headaches of property management.

As is the case with any type of investing, real estate note investing comes with risk.

Before getting started with real estate note investing, it’s important to continue your education so that you can minimize your risk and maximize your profit.