Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

- What Is Owner Financing?

- Why Choose Owner Financing?

- Owner Financing: Advantages for Buyers and Sellers

- Owner Financing: Disadvantages for Buyers and Sellers

- Types of Owner Financing Agreements

- How to Find Owner-Financed Homes

- What is in a Owner Financing Contract?

- Owner Financing Example

- Owner Financing FAQs

- Is Owner Financing Right for You?

Real estate investing can be difficult for beginners. For buyers who are looking for investment or rental income properties, negotiations can be mind-numbing, taking time and involving multiple third parties — not to mention all of the additional approval processes and closing expenses they can entail.

There is a different option that doesn’t require a bank loan: owner financing.

In this article, we will break down the intricacies of owner financing to help you decide if it's the right method for your situation, whether you are a buyer or seller.

What Is Owner Financing?

Real estate investors often finance their purchases of income-generating properties through traditional mortgage loans.

These arrangements involve third-party financial institutions who issue the loans. They also tend to require a drawn-out approval process and lengthy amortization periods.

Owner financing is an alternative arrangement.

Under the owner financing structure, an agreement is established between the buyer/investor and the property seller directly — no banks, outside lenders, or other third-party financial services are required.

Under owner financing terms, the seller agrees to accept installment payments for the sale of their property until the investor has paid the balance off in full.

Instead of giving the investor money (as in a traditional mortgage), the seller issues a line of credit.

An owner financing agreement will tend to have more flexibility than a traditional purchase agreement.

Repayment periods can be as short as five years or as long as 30 — or any period in between.

Where it’s legal to do so, many sellers choose to negotiate balloon payments for lump-sum cash infusions near the end of the loan, getting their money more quickly, which can also help investors to receive faster returns on their investment.

Keep in mind that seller financing works best when the seller owns the property; a mortgage on a property creates extra complications.

Why Choose Owner Financing?

Investors may seek to acquire owner financed homes if they’re looking for quick fix-and-flip opportunities and more affordable terms and interest rates.

For sellers, owner financing is an easier way to earn immediate passive income and gain faster (and potentially larger) payments that go straight into their pockets.

Owner financing may be a good option for sellers whose properties don't qualify for bank financing because of a low credit score.

Owner financing is also a possibility for sellers who want to lower capital gains taxes by stretching tax payments out over many years, rather than having them all due in a single fiscal year.

With owner financing:

- Investors can act more quickly to renovate homes for fix-and-flips or rental opportunities

- Sellers can generate a steady stream of passive and residual income

- Both parties stand to gain from more manageable tax structures

Owner Financing: Advantages for Buyers and Sellers

An owner financing agreement can provide both buyers and sellers with advantages over traditional loan agreements, such as:

- Easier, less stressful negotiations between parties with no banks involved

- Easier qualification process for buyers

- Shorter amortization periods

- Faster closing with fewer costs

- Higher interest rates for sellers

- Less expensive repairs or upgrades for sellers

- Return of property to the seller in the event of a foreclosure

Owner Financing: Disadvantages for Buyers and Sellers

Although they’re methods for acquiring investment properties, there may be some drawbacks to owner financed homes, such as:

- More intensive paperwork

- Difficulty in finding sellers who will opt to accept an owner financing agreement

- Sellers have to manage loans themselves

- Sellers may face sizable down payments, higher interest rates, and shorter repayment periods

- Sellers receive less cash upfront and might have trouble collecting payments

- Homes with existing, underlying mortgages may not be able to be owner financed

- Sellers face higher foreclosure risks

Types of Owner Financing Agreements

One of the best benefits of an owner financing agreement is the freedom for buyers and sellers to negotiate terms between themselves.

Parties in owner financed home agreements have several options for setting up the agreement, which include:

Mortgages

A mortgage owner financing agreement occurs when the owner provides a mortgage to the buyer for the partial or full purchase price of the property. We’ll look at each one next.

Full Price Agreement

In the case of a full purchase price agreement, the owner of the property provides a mortgage to the buyer.

Partial Price Agreement

In the case of a partial purchase price agreement, the owner of a property provides a portion of the purchase price of the property. This is used in the event that a buyer could not get funding for an entire mortgage.

Installment Contract

A viable alternative to the traditional mortgage type of owner financing, an installment contract is an agreement between a property owner and a buyer where the buyer agrees with the seller to pay in installment for the price of a property, including the interest over a specified time frame.

In the case of an installment contract, the property title remains with the seller until the buyer has completely paid the property's purchase price, including the accrued interest.

Deed of Trust

A deed of trust is used when a buyer collects a loan from another party to pay for a property. A trust deed, as it is also called, represents an agreement between the two parties involved.

The property is held in trust by an independent and neutral third party until the borrower (the buyer) has fully repaid the loan to the lender (original home owner).

How to Find Owner-Financed Homes

Not all sellers are amenable to owner financing agreements, but investors have a few ways to find those who are, which include:

- Retaining a real estate agent

- Searching for sellers on real estate websites (Mashvisor, Do Hard Money, The Real Estate Guys, etc.)

- Consulting publicly accessible MLS websites

- Looking for “For Sale By Owner” or “For Rent” signs

- Searching through public eviction notices at a local courthouse

- Networking at real estate events and conventions

Once you’ve found the right owner-financed homes, you’ll want to explore the terms of an agreement.

Inexperienced sellers who may have just searched for, “How to sell a house by owner” may not be as familiar with the process, so it can be helpful to know upfront what terms you want to pursue.

Lease Options or Purchase Agreements

The parties agree that the buyer will lease the investment home and retain the option to purchase it outright for an agreed-upon price.

At the end of the term, the buyer can either complete their purchase (with some or all of their regular lease payments to be used toward the final price) or opt to forfeit their lease.

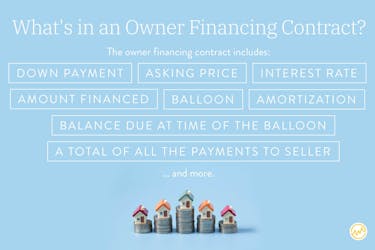

What is in a Owner Financing Contract?

An owner financing contract works similar to bank financing, but the primary difference between both financing structures is that in the case of owner financing, the buyer repays the seller — not the bank.

The owner financing contract specifies:

- a down payment

- asking price

- interest rate

- amount financed

- balloon

- amortization

- balance due at the time of the balloon

- a total of all the payments to the seller

Keep in mind that the owner financing contract can also be referred to as “seller carryback”, since the property owner holds or carries back the financing.

Owner Financing Example

Let’s look at an owner financing example.

A seller lists a property that is worth $200,000.

You can make an offer at a full price and request for an owner financing contract with about 15% down, which is $30,000.

A seller with no mortgage on a particular property can decide to accept your offer. The seller would then require you (buyer) to pay about $1,247 monthly while he (seller) makes a return of 8%, which can amount to $224,532 in 10 years.

Owner Financing FAQs

Here are some of the most commonly asked questions associated with owner financing.

Q. Who holds the title in seller financing?

In seller financing, the owner of the property retains or holds the title. After the loan is paid, the seller signs a deed that transfers ownership of the title to the buyer.

Q. Do you use a title company for owner financing?

Although it may not be required by your state to use a title company or title insurance, a title company and/or title insurance can protect you from costly issues relating to past ownership.

Because of this, it is highly recommended. To learn more about title insurance, click here.

Q. Does owner financing go on credit?

In most cases, owner financing does not go on your credit because the property owner is not providing a monthly mortgage payment report to credit reporting agencies.

However, keep in mind that there may be some exceptions if the property owner is a business entity that fulfills the credit reporting requirements from the credit bureau.

Your credit score can be damaged if you default on your payment and the property owner hires the services of a debt collection agency. The agency will report your debt to the national credit reporting agency.

Q. Can you do seller financing if you have a mortgage?

A house with a mortgage can be sold using seller financing but only if it does not violate the terms of agreement with the current mortgage.

For example, mortgages with a due-on-sale clause may cause the original lender to demand outright payment of the remaining loan if the mortgage lender finds out about the owner financing contract.

In the situation of a mortgage, both the buyer and the seller need to know the terms of the agreement.

Q. What are IRS rules on Owner Financing?

The Internal Revenue Service has specific rules guiding owner financing contracts, including:

- You must report all interest you receive from an owner financed mortgage to IRS by filing a Schedule B form

- You can spread the capital gains on taxes when using seller financing to sell a home

Is Owner Financing Right for You?

While a well-crafted owner financing agreement can be tailored into a win-win situation for both sides, owner financing is not without risk.

If you decide that owner financing is right for your situation, whether that’s buying or selling a property, the best way to reduce that risk is to increase your education about owner financing through additional real estate investing resources and training.