Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

- What Are Probate Real Estate Properties?

- The Probate Real Estate Process

- How Probate Real Estate Can Be Avoided

- What Is Probate Real Estate Investing?

- Advantages of Investing in Probate Real Estate

- Disadvantages of Investing in Probate Real Estate

- Getting Started: 4 Ways to Find Property in a Probate Real Estate Sale

- Buying Property Through a Probate Real Estate Sale

- Common Questions About Probate Real Estate

- Investing In Probate Real Estate

Investing in real estate can require a large dollar amount, large enough to discourage many people from doing their first deal.

But for someone looking to get started in the field with a small, out-of-pocket budget, investing in probate real estate may be the answer.

But what is probate real estate? And how can you invest in probate real estate the right way?

In this article, we will explain:

- What probate real estate properties are

- The ins and outs of probate real estate investing

- How to find probate real estate leads

- and more

If you’re ready to learn about probate real estate investing, let's get started!

What Are Probate Real Estate Properties?

First, let's explore what a probate real estate property is.

A “probate asset” is a property or object left behind by a deceased person.

Anything can be a probate asset, such as:

- cars

- jewelry

- furniture

- stocks

- other personal belongings

Though most professionals use the term in reference to probate real estate.

If the deceased was the sole owner of the real estate property when they died or left no will, the property goes to probate.

That’s the name for the court process of distributing the deceased’s holdings.

Once a property goes into probate, the probate court either:

- names an executor

- oversees the probate sale of the deceased owners’ real estate by itself

Next, we'll look at the probrate real estate process.

The Probate Real Estate Process

1. Executor of the Estate

The probate process begins with the appointment of an executor. An executor may be named in the will, or the court will appoint an administrator if one has not been named. The executor or administrator is responsible for determining the value of the estate’s assets, paying any debts of the estate, and distributing — or selling — personal property, including real estate.

2. Real Estate Agent

Before the estate property can be sold, the executor or administrator will need to hire a local real estate agent. The agent should be experienced in probate sales due to the lengthier and more complicated process.

3. Property Appraisal

The executor or administrator will work with the real estate agent to determine a listing price. Typically, an appraisal is done and the real estate agent will help set the listing price. Often in a probate sale, the property is listed below the market value. It may be sold “as is” and may require renovations. In spite of these factors, a probate sale can be a great deal for bargain hunters.

4. Property Listing

The agent will then list the probate real estate property as they would any other property. They market and show the property the same as with a traditional home sale, to try to bring in the best purchase price.

5. Offers and Notice

When an offer comes in on a probate real estate property, this is where the process differs from a traditional home sale. Offers must include a 10 percent deposit and the heirs are notified. Next, the executor or administrator must petition the court for approval.

6. Court Approval

The court approval process can take some time. You may have to wait 30 to 45 days or longer to get a court date. During this waiting period, the house may continue to be marketed and other interested buyers may be able to bid on the house. Depending on the state, all interested buyers may show up at court and the property will sell to the highest bidder.

How Probate Real Estate Can Be Avoided

Selling a property through probate can be a long and complicated process. Even with a will, probate cannot be avoided. This process can be simplified for heirs with some advanced planning by the owner. Read on to learn three ways to avoid the probate process.

1) Living Trust

A revocable living trust is a common way of avoiding probate.

With a trust, an individual determines which of their assets will be placed in it. The assets may include real estate, bank accounts, investments, and personal property.

Once placed into a trust, the individual is no longer considered the owner of the assets — the trust assumes ownership, but the individual still retains control over them.

Then upon the individual’s death, the assets are transferred from the trust to the heirs, bypassing probate court.

2) Joint Tenancy

Joint tenancy is another often-used way to avoid probate.

Property owned jointly with another person passes directly to the surviving owner without going through probate.

There are different types of joint tenancy so you will need to decide which is best for your situation, depending upon if you are married, buying property with a friend, or looking to add an heir as an owner to avoid probate.

3) Life Estate Deed

A life estate deed is used to change the ownership of a property without going through probate, without needing a will, and helps to avoid gift tax.

After signing the life estate deed, the owner becomes a tenant of the property for the remainder of their life. When they die, ownership automatically passes to whomever they have designated.

One drawback is that the owner will still be responsible for the property taxes but will have no control over the property, such as the ability to sell or take out a mortgage.

What Is Probate Real Estate Investing?

Often, the holder or executor of a piece of probate real estate, such as a family member or friend, has an incentive to sell for a handful of reasons:

- They may decide not to live in the property

- They might not want the responsibility of ownership long-term

When any of these happen, the property is put up for probate sale — and that’s a big opportunity for real estate investors.

Why?

Because the probate property is likely to be priced much lower than others in the surrounding area.

The heir or executor usually wants to unload the property as soon as possible for two reasons:

- so that they can avoid paying taxes and fees on it

- so that they can get the value out from the house

Because of these factors, probate properties are often “priced to move.”

On top of that, property in a probate sale often has no outstanding mortgage due, simply because the departed owner might have been older or paid off the mortgage in full.

With a low base price, the investor can better afford to “fix and flip” — renovate and resell — a probate property.

As a result, they’re likelier to see greater profit from a probate sale than they might with a standard real estate purchase.

Sellers for probate properties are often less emotionally invested, too, which can make them more willing to negotiate.

Of course, property in a probate sale is not a totally risk-free investment.

Keep in mind:

- The legal process of transferring ownership may take a while.

- The property will usually be sold “as-is,” making renovations in some cases expensive.

But a well-executed probate sale can create a win-win for all involved parties, investor and seller alike.

Advantages of Investing in Probate Real Estate

A probate property is likely to be priced much lower than others in the surrounding area.

The heir or executor usually wants to unload the property as soon as possible for two reasons:

- so that they can avoid paying taxes and fees on it

- so that they can get the value out from the house

Because of these factors, probate properties are often “priced to move.”

On top of that, property in a probate sale often has no outstanding mortgage due, simply because the departed owner might have been older or paid off the mortgage in full.

With a low base price, the investor can better afford to “fix and flip” — renovate and resell — a probate property.

As a result, they’re likelier to see greater profit from a probate sale than they might with a standard real estate purchase.

Sellers for probate properties are often less emotionally invested, too, which can make them more willing to negotiate.

Disadvantages of Investing in Probate Real Estate

Of course, property in a probate sale is not a totally risk-free investment.

Keep in mind:

- The legal process of transferring ownership may take a while.

- The property will usually be sold “as-is,” making renovations in some cases expensive.

But a well-executed probate sale can create a win-win for all involved parties, investor and seller alike.

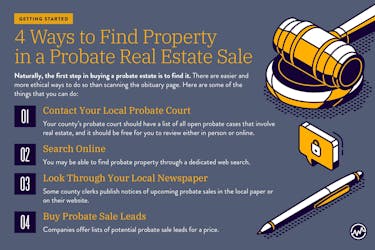

Getting Started: 4 Ways to Find Property in a Probate Real Estate Sale

Naturally, the first step in buying a probate estate is to find it.

There are easier and more ethical ways to do so than scanning the obituary page.

Here are some of the things that you can do.

Contact Your Local Probate Court

Your county’s probate court should have a list of all open probate cases that involve real estate, and it should be free for you to review either in person or online.

Search Online

You may be able to find probate property through a dedicated web search.

Look Through Your Local Newspaper

Some county clerks publish notices of upcoming probate sales in the local paper or on their website.

Buy Probate Sale Leads

Companies offer lists of potential probate sale leads for a price.

Buying Property Through a Probate Real Estate Sale

Direct mail marketing is an effective way to open up discussions with the seller.

It’s a common real estate tool because of its higher rate of response.

You’ll want to be a little more sensitive with direct mail messaging in a probate sale. After all, the recipient is likely coping with a loved one’s loss.

When the seller accepts your offer, you’ll issue a standard real estate contract.

Set a timeline for the transaction with the title company or the seller’s legal representatives.

The court may require the entire probate legal process to conclude before the sale is finalized, so be patient while it plays out.

Buying Probate Real Estate Through the Court

In cases where the departed didn’t leave a will, the presiding court officer may be left in charge of selling the probate real estate.

The court will hire a real estate agent, who will list the property for probate sale after it’s been appraised.

You, the investor, must make an offer and provide a down payment, usually about 10%, as a deposit.

If the court approves your offer, they’ll send notice to the departed’s heirs or other interested parties.

They’ll have 15 days to respond or reject the offer.

If they don’t do either, the court will either set a hearing date or simply opt to move forward.

Pursuing a probate sale can be difficult because of the sensitivity involved. But when it's handled the right way, probate real estate has benefits for investors that are too promising to ignore.

Common Questions About Probate Real Estate

Next, we’ll explore a few of the most commonly asked questions about probate real estate.

Q. How Long Does a Probate Real Estate Sale Take to Complete?

The American Bar Association says that the probate process takes an average of six to nine months to complete.

Each probate sale is unique, however.

In rare cases, complex legal steps may stretch transactions to a year or longer.

Q. How Do You Sell Probate Real Estate?

Once appraisal is done and the court has decided that a probate sale of real estate can proceed, the real estate agent can market it just as they would with any other sale property.

Probate courts move at their own speed, so be prepared to wait through the proceedings for the judge to approve any sale.

Q. What is Intestate Probate?

Intestate means dying without having a will. With or without a will, when a person dies, their estate usually goes through probate. If there is no will, the probate court will make decisions on how to distribute a person’s assets.

The intestate probate process may be longer and more complicated than going through probate with a will. The court-appointed representative will need to determine who the heirs are and how to distribute the assets, including real estate.

Q. What If Someone Still Lives at a Probate Real Estate Property?

If a person who doesn’t own the home still resides on a property in on a piece of probate real estate, the executor or court can request that they vacate the property.

If the resident refuses, the court may initiate eviction proceedings.

Investing In Probate Real Estate

The biggest reason why the probate real estate market is such a strong investment is simple: it can be overlooked by other real estate investors.

That means that probate real estate has more entry points for investors with the time and initiative to get involved.

With highly motivated sellers and tighter legal oversight, a probate sale is an opportunity for an investor to make lucrative gains.

It’s also a chance for the departed’s family and loved ones to bring closure to a difficult time and earn a little financial reward for themselves.

Before you get started on your first deal, we encourage you to mitigate risk by continuing your education about probate investing and real estate investing with these additional resources:

- Are you a new investor? Here is a beginner’s guide to real estate investing

- Fixing a house? Check out this ultimate house rehab checklist

- Build a rental property empire using this proven strategy

- Find out how to fix and flip a property in 7 steps

- Learn what real estate title insurance is — and whether or not you need it