The Stock Investor’s Quick Start Bundle

In This Article

When looking for the next stock to invest in, there are several analyses stock investors can run.

Sharpe Ratio. P/e Ratio. Earnings Per Share. Par Value.

As you complete your due diligence before investing, you may use any or all of these ratios to look at the long-term financial prospects. However, you also need to know about a company's short-term ability to pay its debts due.

In other words, you will want to know their short-term solvency.

If all debt collectors come knocking tomorrow, will there be panic?

That's where the quick ratio comes in.

In this article, we’ll break down the intricacies of the quick ratio to help you understand the short-term financial health of a company — and whether or not it’s the right company for you to invest in.

What is the Quick Ratio, and How Is It Used?

The quick ratio, also known as “the acid test”, measures how the company's liabilities stand against its assets.

For assets to be included in the quick ratio calculation, they have to be converted into cash within 90 days. You can find these numbers in a company's balance sheet.

Why 90 days?

Anything that takes longer is not helpful for this ratio calculation. Even if they are particular assets, such as government bonds that mature within one year, a company cannot convert them into cash quickly enough to pay off short-term debt.

By its nature, the acid test is a snapshot of a company's financial status at a specific moment in time.

Although beneficial to know, calculating the quick ratio trend over the years gives you more useful additional data to judge a corporation's health by.

Quick Ratio Formula

You calculate the quick ratio by adding up all the current assets and dividing them by the current liabilities.

Quick Ratio = Cash and Cash Equivalents + Current receivables + Short-Term Investments divided by Current Liabilities.

Keep in mind that another ratio used for similar purposes — known as the Current Ratio — is similar, except that it also includes inventory in the assets, whereas the Quick Ratio does not.

This means that the Quick Ratio is a bit more conservative than the current ratio, and it will depend on the type of company that should be used.

For example, a supermarket or retailer would show a more accurate picture with the current ratio, whereas you should use the quick ratio calculation for a service company.

What is a Good Quick Ratio for Stocks?

A quick ratio of 1 means that a company has enough assets to cover its debts and indicates a healthy company.

Any higher than one means that a company has more than enough to pay off its short-term liabilities and also that it may not be very efficient in managing its liquid assets.

If the ratio is lower, the company is in trouble. Their assets, including accounts payable, are not enough to cover their liabilities, meaning they have to count on unrealized sales to pay their liabilities. Depending on the type of trading and investing you do, this can be good or bad. If you do short selling or trade on the downtrend, you may want to use this as an indication to trade.

Quick Ratio Example

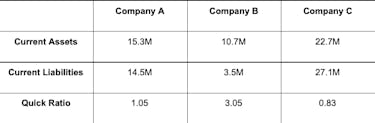

To further explain the ratio, let’s take a look at an example.

Company A

In the above examples, company A has a healthy quick ratio of 1.

That means they have enough cash or cash equivalents to pay off any short-term debt.

Company B

Company B can also pay back their short-term liabilities, but a ratio of higher than one may mean that they do not manage their assets very well and leave money on the table instead of investing it wisely — something you should think about if you’re buying a piece of their company in the form of stocks.

Company C

Company C cannot pay off their current debts with their current assets since they have a quick ratio of less than 1.

This could mean trouble if something unexpected happens and they need to liquidate their debts.

The Bottom Line: Quick Ratio

The quick ratio is a simple formula that gives you insight into a company's short-term financial health.

Knowing this number does not give you a definitive answer whether a company is healthy or not — but it does give you an indication.

If you review the ratio trend over time, you can see if the number is usually less than one or an outlier.

It can also give you an insight into potential financial management issues. If the quick ratio is much higher than 1, it can show the company is not managing its liquid assets as efficiently and profitably as possible.

Like any other type of analysis and ratio calculation, this ratio gives you information that can help you make better-informed stock investing decisions.