Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

- Real Estate Investing for Beginners: What’s So Special About Real Estate?

- The Top 5 Reasons to Start Investing in Real Estate

- How To Make Money In Real Estate

- Different Seller Niches To Target

- Here Are a Few Other Unique Approaches to Consider

- 9 Ways to Start Investing In Real Estate . . . Even if You’re Short on Cash

- Getting Started: Real Estate Investing For Beginners

Real estate happens to be the #1 alternative asset trusted and owned by the overwhelming majority of millionaires. But it’s not just a game that millionaires play.

You can play the real estate investing game too. Starting not only in 2023, but today.

In this real estate investing for beginner’s guide, we’ll be demystifying the entire real estate investing process.

- We’ll show you real and simple steps you can take (today) toward flipping your first house or buying your first rental property so that you can understand real estate for beginners.

- We’ll reveal 9 sources of funding you can use to buy your first (or next) deal. Hint: banks are not one of them!

- We’ll help you formulate a personalized game plan for success in 2023 in real estate that’s unique to your background, local area, and financial goals, along with additional real estate investing for beginners resources.

We’ll walk through the real estate investing process step-by-step so you’ll be well-positioned to find and profit from investment properties in your local community in 2023 and beyond.

If you’ve tried your hand at flipping a piece of real estate but missed the mark, read on.

If the only property you’ve ever invested in is your own home, read on.

If this is the first day you’ve even thought about real estate investing, read on.

If you have little or no real estate investing experience, read on.

Even if you have zero dollars to invest, READ ON.

This guide is for YOU. It will propel you toward your first (or next) real estate deal and put you on an unwavering path to success.

If you’re ready to learn about real estate investing for beginners, let’s get started.

Real Estate Investing for Beginners: What’s So Special About Real Estate?

Chances are, you’re familiar with more than a few traditional investment methods:

- stocks

- bonds

- mutual funds

- simple savings

- investment accounts

While these go-to methods have long dominated the landscape, they don’t hold a candle to real estate investing.

No matter how you slice it — no matter the market, no matter the economic climate, no matter your experience level or budget coming in — real estate investing makes sense.

Let’s break down real estate investing for beginners.

Real Estate vs Stocks

Everyone knows someone who’s done well in the stock market.

Over the last 70-plus years, the best performing stocks have generated significant returns, often double-digits year after year. In fact, the average rate of return for the stock market was 7% between 1950 and 2009.

Not too shabby.

But building wealth with stocks is by no means a guarantee.

In 2017, 168 of the 500 “S&P 500” stocks declined.

40 of those 168 declined by at least 20%.

Even modest investors have likely experienced the ups and downs and have seen first-hand the volatility in the marketplace. Even though you’re a “stakeholder,” the minute you buy a share, you have limited control over what happens next.

Between a company’s executives, majority stake owners, marketplace shifts and overarching economic twists and turns, there are countless forces influencing how your shares perform.

From the moment you invest money in stocks, you’re at the mercy of the market.

Not so with real estate investments.

Here’s something important to realize when discussing real estate for beginners: Whether you wholesale, rehab, buy and hold or tap into some other powerhouse strategy, YOU call the shots — from which properties to invest in . . . to which renovations to tackle . . . to what exit strategy to employ.

Sure, the market will dictate some aspects of your short and long-term valuation and profits. But for the most part, you’re in the driver’s seat.

It’s the opposite of playing the stock market.

Since 2000, real estate has outperformed the stock market by 2 to 1 (10.71% for real estate investments versus 5.43% for stocks).

By taking charge of your investments with real estate investing and not relying solely on the market and the decisions of others, you’re better positioned to profit — and that’s key to lasting wealth and financial freedom.

Real Estate vs Bonds

Bonds can be a safe bet — in exchange for that safety, though, you’ll be generating lower returns over time.

By committing to a fixed rate of interest, you commit to the same low rates of return.

The perks are clear, but so are the downfalls. Inflation is never a consideration, meaning your returns actually decline in value over time. Who cares if your bond is giving you a 2% return when inflation is 3%. You’re still losing!

Plus, if the market spikes, you have no chance of reaping benefits. Flip or rent your property at the right moment in time as a real estate investment, and it’s easy to generate a significant ROI — income that naturally grows with inflation and ongoing economic upturns.

Real Estate vs Gold & Silver

While it’s a completely different investing platform, gold is similar to bonds in that it’s conservative, reliable, and more focused on wealth preservation versus growth.

But with gold, you can’t spend a little, and leverage the whole. You can’t pay 20% down on gold and own more of it.

Gold isn’t going to bring you any income. You can’t rent out your gold for cash the way you can with real estate.

Finally, gold isn’t going to help your taxes.

As with other traditional investments, there’s no leverage, no cash flow, and no tax advantages.

But there’s all of these — and more — with real estate investing.

Real Estate vs Certificates of Deposit (CDs)

Like bonds, you’re committing to a fixed rate of return over time — there’s no room for appreciation or increased profits.

While some CDs deliver upwards of 6%, a three-year standard CD is paying less than 0.5% right now. That’s virtually nothing if you’re looking to grow your wealth.

Invest in real estate and you can expect upwards of 4% appreciation per year on average, plus 8% to 12% in annual returns if you rent out your property.

The Top 5 Reasons to Start Investing in Real Estate

So now you know, real estate has some serious advantages over other investing strategies.

But that’s not all.

Here’s the top 5 reasons to start investing in real estate.

Reason #1 To Start Investing in Real Estate: It’s a Hedge Against Inflation

For many of these traditional investment options, inflation is a serious concern — and a serious problem.

When it comes to stocks, bonds, mutual funds, and CDs, investors need to consider how constant and compounded inflation factors into the equation. Even if the value rises over time, those increases may or may not keep pace with inflation.

The average annual inflation rate is about 2%. If your investments aren’t gaining more than 2% a year in value YOU’RE LOSING MONEY.

Real estate investing has a natural hedge against inflation.

Property naturally reacts in proportion to inflation. When inflation rises, rents and home prices also rise. The end result is that your investment is always in-step or ahead of the real-time marketplace trends and values. That keeps you from having to worry about the long-term value of your real estate investments should you choose to buy and hold.

Reason #2 To Start Investing in Real Estate: The Power of Leverage

Another huge perk real estate offers you is the ability to leverage funds.

In real estate investing, you’ll be able to put down a small percentage of the purchase price — or zero dollars if you opt to wholesale, or use other people’s money, and walk away with the investment in full.

In other words, you’re buying hundreds of thousands of dollars in real estate for a fraction of the price.

Real estate is the only investment vehicle where you can put just $20K down and own a piece of property worth $100K.

Try buying $100K worth of stocks, bonds or gold for $20K. You’ll get laughed right out of the bank.

Many beginner real estate investors opt for exit strategies that require little to no capital, taking full advantage of leverage to make their investing goals an immediate reality.

Should you opt for an alternative method and need to finance your purchase, you’ll also have the added benefit of building equity. Each payment you make toward that loan helps you boost your wealth and create equity.

Reason #3 To Start Investing in Real Estate: The Cash Flow!

Investing in real estate has the unique ability to create significant long-term cash flow.

For many, this is the single-biggest reason to invest in real estate and become a real estate investor. There’s no limit to your annual or ongoing returns. It’s not uncommon for long-term real estate investments to return 15%, 20%, 30% or more yearly.

If you’re wholesaling, hone your search and negotiating skills and it’s not hard to flip a contract with a jaw-dropping assignment fee — $10K, $20K or even $50K or more in just a few weeks time.

Reason #4 To Start Investing in Real Estate: Diversification

Real estate investing has also become central to countless investors’ diversification strategies.

Since the 2008 recession, stock market participation has experienced a double-digit dip, with just half of Americans investing in the stock market today.

People lost big during the recession and during the Covid-19 Pandemic, so now they’re being smarter and more strategic about their investment portfolio. For many Americans, that means integrating real estate into their financial mix.

Given the significant differences and influences in real estate versus traditional investments, it’s easy to see how integrating properties can safeguard your wealth in the short and long-term.

Bringing in real estate investments instantly diversifies and balances your portfolio. By integrating a variety of assets and investments, you are mitigating risk while setting yourself up for maximum returns as a real estate investor.

Reason #5 To Start Investing in Real Estate: The Tax Advantages

Then, there are the unparalleled tax benefits of investing in real estate. Not only are there lucrative (legal) ways to mitigate losses, but there are seemingly endless tax incentives, write-offs, perks, and deferments.

These include:

Significant Deductions

As a real estate investor, it can feel like there’s no limit to your welcomed write-offs. Tap a real estate-friendly accountant, advisor or bookkeeper and they’ll be able to steer you toward a variety of deduction opportunities, including some that may be market or exit strategy-specific.

These deductions could include:

- Travel Expenses

- Employees, Freelancers, Vendors and Independent Contractors

- Office Expenses

- Marketing Fees

- Self-Employment Taxes

Depreciation On Investment Properties

Over time your property will naturally lose value because of basic wear and tear.

That’s depreciation.

While everyone expects depreciation on a property, wear and tear leads to necessary repair work or cosmetic upgrades (like paint, hardware, and tiles). Once incurred these costs can be deducted.

In the meantime, though, you can deduct depreciation using the Modified Accelerated Cost Recovery System (MACRS).

On a single residential property, for example, an investor can deduct depreciation for 27 ½ years. For a commercial property, that number jumps to 39 years. Even if you’re making money on the property, you can still deduct for depreciation.

Capital Gains Considerations

Whenever you flip a property as a real estate investor, you’re generating capital gains.

Capital gains are profits generated when a property or major investment is sold.

Typically, these profits are taxed as short-term capital gains or long-term capital gains depending on how long you held them.

And, from there, there’s also a capital gains exclusion, enabling homeowners to forego paying taxes on some profits from their real estate transactions. If losses are greater than gains, you can also offset other income!

Taking Advantage Of The 1031 Exchange

While not as well-known, the 1031 Exchange is a great way to keep your real estate investing moving forward while mitigating some of the hefty expenses. Under this tax code, investors can “swap” one real estate asset for another, without paying taxes on the sale.

In other words, if you take advantage of a 1031 Exchange, you can take the gains from one investment sale and immediately apply it to another purchase and not pay taxes until you sell this second property.

How To Make Money In Real Estate

By now, you’re probably starting to get a sense of the diverse — and tremendously lucrative — opportunities that exist under the real estate investing umbrella for real estate investors.

So the BIG question: how do YOU make money as a real estate investor, now and in the future?

There really isn’t a short answer to this question.

For every unique real estate investor, there’s a unique path to lasting wealth and financial freedom.

Your job is to take it all in and really understand your goals, what’s motivating you and where you fit into this epic real estate investing landscape.

Here, we’ll outline 3 Core Investing Strategies, Types of Properties, and Contrast Commercial and Residential Property to help you get a sense for how the market works and what makes sense for you today and tomorrow.

3 Core Investing Strategies

It’s clear real estate investing is a great way to achieve lasting wealth and financial freedom.

While there are countless ways to make money as an investor, the majority of successful entrepreneurs focus on three key strategies:

1. Real Estate Wholesaling

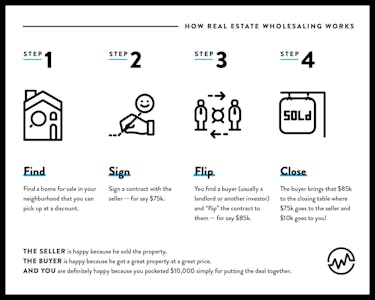

When you “wholesale” a property you find a “motivated seller,” negotiate a great deal, and get the property under contract. Then, instead of closing on the property, you find an end buyer — usually a rehabber or landlord — and sell them the contract.

That buyer then takes the property to close, at which time you’re paid a fee for your time and for negotiating the deal. This fee can range anywhere from $500 to $50K depending on the terms of the deal.

As a wholesaler you rarely take ownership of a property but, instead, make money flipping the contract, not the property itself.

There are a few different benefits of being a wholesaler. For one thing, you can make money pretty quickly. Negotiate a deal in a week or two and you could be cashing a check in a month’s time.

This method is also useful if you have limited capital or a low credit score. Because you’re not actually purchasing a home, nobody’s checking your credit or expecting 20% down.

However, as with any other real estate investment, wholesaling doesn’t come without its risks. Income isn’t a guarantee and you always face the possibility that you’ll struggle to find a buyer.

To prevent that scenario, you’ll need to develop a solid list of potential buyers.

2. Real Estate Rehabbing

As a “rehabber,” you’re simply buying an investment property, making major or minor improvements, then to complete your real estate investment, selling it for a higher price.

A typical rehab deal (or “fix and flip”) can take anywhere from a few weeks to several months, and in 2020, the average fix and flip deal generated a gross profit of $66,300.

If you enjoy working with your hands, real estate rehabbing might be your ideal investment. It gives you an opportunity to engage in physical labor before earning a quick profit. You also may enjoy the amount of control you keep over the entire process of rehabbing a home.

However, anyone considering real estate rehabbing should be aware that the costs can add up pretty quickly when you’re fixing up a home. This is especially true if the changes you’re making aren’t DIY and you need to hire outside contractors.

3. Cash Flow Investing

As a “cash flow investor” you’re buying and then renting out a property for ongoing cash flow, either to a long-term tenant or short term renters.

The benefits here are obvious — if you can find renters, you have a direct stream of month-to-month income. Plus, as with other real estate investments, the value of your property is bound to rise over time.

If you chose this route of real estate investing, remember that you’ll be responsible for making timely repairs and handling any emergencies that crop up. You’ll also be in charge of finding renters or tenants to make sure your property is filled year-round, as well as taking out a landlord insurance policy.

What Types of Properties Should You Invest In?

When discussing real estate investing for beginners, it’s important to understand the diverse property niches that exist in the marketplace.

While strategic property niches can vary by area and market conditions, most real estate investors tend to focus on one or more of the following types of properties:

Property Type #1: Single-Family Homes

Single-family homes are the most common type of property in a given marketplace. Three in five properties in the U.S. are single-family homes — an important fact to understand when discussing real estate investing for beginners.

Your exit strategy (how you plan to make money on a property) as a real estate investor will likely dictate whether or not you get involved in single-family homes and the types of properties you go after.

Typically, most real estate investors focus on more affordable or distressed single-family homes in desirable or up-and-coming neighborhoods.

Property Type #2: Condos & Townhouses

Condos and townhouses are units that exist within a larger complex (like a community or building). In higher-priced markets such as urban epicenters and popular suburbs, these can be good initial investment opportunities for real estate investors.

They’re cheaper, easier to come by, and always in-demand by entry-level retail buyers who want the community without the hefty price tag.

Keep in mind these properties often come with a host of additional expenses and considerations, such as homeowners association fees or board approvals. Be sure you’re crystal clear on what it takes to invest in, rehab and flip these properties.

Property Type #3: Duplex, Triplexes and Quads

These properties are similar to single-family properties because they’re residential. However, because they’re two to four-unit properties, there’s often significantly more cash flow potential for real estate investors.

Not only is there a revenue upside to these properties, but if you’re planning to finance them, many banks and lenders will offer more favorable loan terms. If you’re planning to tap into that all-important leverage to finance your first or next deal, this property niche could be a great go-to.

Property Type #4: Apartments

For most beginner real estate investors, apartment buildings with 5 to 100 units are good bets.

In these cases, you won’t likely be competing with big developers or holding companies. At the same time, you’ll have enough units to generate meaningful cash flow, often from day one.

While these investments can be more expensive if you’re planning to rehab or buy and hold, many banks and lenders will happily consider a beginner real estate investor if the numbers make sense.

In every market, people are looking for affordable rentals. If you can be that solution as a real estate investor, lenders will be ready, willing and able to help you connect the financial dots.

Property Type #5: Commercial Spaces

Commercial spaces can be anything used for business or commercial purposes, such as:

- retail spaces

- office buildings

- industrial parks

- warehouses

- and more

While many new real estate investors steer clear of these properties, done right they can be tremendous investment opportunities.

For example, a retail space may come with a solid 15, 20, or even 25-year lease.

Lock down that space as a landlord and you’ll have a steady income stream for decades.

In many cases, you’ll even be able to cook up a “net lease” which requires tenants to pay rent as well as:

- property taxes

- maintenance

- insurance

This instantly helps you generate positive cash flow quickly and easily.

Again, it’s important to understand the ins and outs of these properties as well as local and state regulations and policies going in, including usage specifications, codes and taxes. Working with a real estate investor-friendly agent and attorney can help your due diligence for finding the best investment opportunities.

Weighing Your Options: Commercial vs Residential Investment Properties

While you’ll want to do your due diligence no matter which real estate property niche you choose, commercial and residential properties tend to come with concrete benefits and considerations. Understanding these going in will help you determine how to kick off your search and create a path to real estate investing success.

Why Commercial Investing?

While many first-time investors dodge commercial investment properties, there are lots of perks tied to these buildings and spaces. Keep this in mind when talking about real estate investing for beginners.

For starters, you’ll often generate higher returns more quickly — these spaces tend to be larger and command more rental revenue from day one.

Central to this revenue are highly qualified and long-term tenants. Get a grocer, drug store or major retail chain in your commercial space, and you could be looking at years or even decades of consistent rent payments—plus the opportunity for well-structured net leases.

There are challenges in commercial investing. Commercial loans are seen as inherently risky, leading to higher rates and shorter terms. To qualify, you’ll have to show a compelling business plan, and a strong credit score. You’ll need to give a clear real estate investing plan showing what happens next, from who’s tackling the rehab work and maintenance, to how you’re going to make this property cash flow-positive.

Why Residential Investing?

Residential real estate investing tends to feel more comfortable for new investors. For many, investing in residential real estate seems more accessible and attainable. Beyond that, residential real estate can be simpler. Residential real estate tends to come with lower price tags and less money down with financing. There also tends to be fewer restrictions.

Another advantage is that residential real estate offers many financing options from banks, lenders, hard money sources and private money providers. Because there are so many options, it’s often easier to find and lock down a loan at a competitive rate and with highly favorable terms than it is with commercial financing.

Different Seller Niches To Target

Now once you’ve determined the type of property or properties you want to invest in, you need to determine how you’re going to acquire these properties — specifically, what seller niche or niches you’re going to leverage to secure the right investment properties for your portfolio.

For every property niche, there are many ways to come into a property. Too often, new real estate investors assume the purchase or investment process mirrors retail buying — that they work with an agent, find a great property, make an offer and sign on the line. The reality is that while that happens, these cut-and-dry deals can often be few and far between.

Understanding the diverse and high-value seller niches can help you steer toward the most lucrative deals with the most favorable terms, every single time.

In most cases, you as a real estate investor will be looking for sellers who are highly motivated, who don’t just want to sell their property but NEED to sell. When sellers need to sell, many will be willing to sell their property significantly below market value. Most of these situations involve someone who has a sizeable financial, situational, or property-related problem.

Here are some of those listed below:

Properties In Pre-Foreclosure

The majority of properties are financed. The owner has a mortgage or other financing structure in place and is making ongoing payments to satisfy the terms of the loan. Sometimes, a property owner can’t or simply doesn’t make those contractually-obligated payments.

When that happens, the bank or lender will take decisive steps to get the loan current. If the loan holder doesn’t follow through, then the lender can move to take ownership of the property. This is called a “foreclosure.”

Before a property is officially foreclosed on, it enters a period of “pre-foreclosure.” During this time, the property owner is being pushed to catch up on payments at the risk of losing their home, investment property or commercial space. In most cases, the owner doesn’t want formal foreclosure proceedings to happen, so often, owners in pre-foreclosure are eager to sell, especially to a real estate investor who comes to the table with a quick, contingency-free cash offer.

Many owners in pre-foreclosure will work with their bank or lender to work out a “short sale.” Short sales are agreements to sell a property for less than what’s owed on it. Banks and lenders will often agree because they don’t want a property on their books. If you can get in on these properties, you can easily walk away with a below-market deal.

Properties In Foreclosure

After this stage comes the official foreclosure. To get your hands on foreclosure properties, you’ll need to research the policies and processes in your state. In many states, foreclosures go to auction and anyone can come, prove funds and bid. In others, interested buyers can reach out to the bank, county or other governing body to take possession of foreclosed properties. Done right, it’s easy to secure a below-market price on a foreclosure property.

Bank Owned/REO Properties

When a bank or lender takes back a foreclosed property, it’s considered “bank-owned” or “real estate owned” (REO). Banks make money on the interest from property loans, not from the property itself.

As a result, REO properties are often priced to move. If you have a clear-cut business plan for financing an REO deal, banks will be eager to discuss next steps. Working with your agent, an REO specialist at a specific bank or lender, or browsing foreclosure listings online, you’ll often be able to find bank-owned properties at great rates.

Homeowners In Bankruptcy

When a property owner files for bankruptcy, they often want or need to sell any residential or commercial properties in their name. While it’s not always a condition, the two often go hand-and-hand, making an owner particularly motivated and ready to cut a deal. These property owners are often easy to find through direct mail lists or through your agent.

Estate Sales Or Probate Properties

After a person dies, their assets are divided among heirs as outlined in their will. Often, those heirs aren’t willing or able to take care of the property, which makes them a very motivated seller. By offering a quick cash close, you can often engage and activate owners of probate properties.

Homeowners In Divorce

Divorces don’t mandate properties be sold. However, in many cases a couple or a judge determines all assets need to be liquidated and divided. That may include personal and real estate investment properties. In these situations, couples can be very motivated to get a deal done so they can finalize their divorce and move on with their lives. If you can be that solution, you can often secure a solid deal with a quick close.

Delinquent Taxes

All properties come with property taxes, paid to local municipalities. If these taxes aren’t paid, the local government can issue a lien on the property to try to get back payments. Like banks and lenders, local governments have no interest in taking ownership of properties, so they sell or auction tax liens to interested real estate investors.

If you choose to invest in liens, you’ll become the lien holder. So in other words, the property owner needs to pay you the back taxes plus a double-digit interest rate. If they don’t redeem their property in a set period of time, you get the deed and can take possession of the property for pennies on the dollar.

Code Violation Properties

Sometimes, the costs to keep a property up to code are too high and homeowners can’t afford to tackle the required work or maintenance. This is often the case with major issues — fires, water damage and wind, for example. If problems aren’t fixed, towns and local governments can issue citations and demand repairs be made. Between the fines and the actual repair costs, fees can grow tremendously and make it impossible for the property owner to manage.

By taking these distressed properties off of the owner’s hands and either assigning the contract to a rehabber or handling the work yourself, you’ll help them solve a huge problem.

Now, depending on your goals, capital, market conditions and timing, there are plenty of other ways to profit from real estate investing.

Here Are a Few Other Unique Approaches to Consider

Airbnb & Short-Term Rentals

With sites like VRBO, HomeAway and Airbnb, it’s easy to find short-term tenants for vacation and residential properties. The best part is that any space is fair game. The options are endless and the terms are completely up to you. YOU set everything from price to minimum stay.

Many real estate investors opt for this approach because if they can keep their property full, the monthly income can be substantially more than renting to one tenant. For example, a prime Manhattan studio might rent for $4K per month. On Airbnb, it’s not uncommon to charge $250 to $300 or more per night.

Long-Term Rentals

While short-term rentals can command more monthly income, there’s less consistency. You’ll need to keep your space filled to ensure you’re driving revenue. With long-term rentals, you’ll have less turnover and more trust with tenants. What’s more, most long-term tenants tend to pay utility bills on their rentals, crossing one more cost off of your list.

Vacation Rentals

Vacation rentals can be very lucrative if you can consistently keep them filled, but it’s important to understand the risks going in. If it’s a total hotspot, you may be able to make a year’s worth of solid rental income in a month or two. If not, you could wind up with a property that doesn’t pay the bills.

Student Housing

Millions of college students live off-campus, and many will pay a premium for convenient, quality housing near those campuses. If you’re close to a campus and affordable to a student on a budget, you’ll always have a built-in renter base. What’s more, with increased demand comes increased rents, which is a huge plus for many investors. Another perk is that you likely won’t invest as heavily in maintenance and repairs. Because you’re renting to students, you won’t necessarily need to keep your property in perfect condition.

Scouting

If you have no capital but a keen understanding of your immediate market, be a scout. Scouts seek out properties on and off the market for a wholesaler or rehabber to purchase. By casting a wide net and tapping into virtually every property-scouting method out there — MLS and online listings, bandit signs, FSBO mentions, local advertising, and driving for dollars — scouts are often the first to unearth a quality property that’s keen to sell. When their investor buys, they get paid.

Tax Liens

Buy a tax lien and you can secure a property for a fraction of the price if the property owner doesn’t redeem that lien. Worst case, you’ll get paid back for the delinquent taxes with a hefty interest. Best case, the owner doesn’t make good on their lien and you land a property for thousands or even hundreds of dollars.

Crowdfunding

If you’re short on capital but high on motivation, crowdfunding through services like RealtyMogul or Crowdrise can be the way to go. Crowdfunders pool cash and resources from several investors, increasing the availability of funds and enabling individuals to have their hands in multiple properties in less time.

Becoming a Lender

Often, we think about real estate investors as banks and more traditional lending sources, but anyone can technically become a lender. Private money lenders are lenders who leverage their own cash and capital to fund real estate investing deals. They can set the terms — how much to lend, repayment terms, rates and more. Like crowdfunding, many private money lenders fund a piece of a deal, while others fund everything — for a price.

Though many people come to real estate investing without capital, some have the capital but opt not to take on the heavy lifting. For them, private money lending makes sense and enables them to diversify and immediately benefit from the real estate market without finding, fixing or flipping properties.

9 Ways to Start Investing In Real Estate . . . Even if You’re Short on Cash

Something important to think about when discussing real estate for beginners: If you’re like many first-time real estate investors, you’ll look for ways to jumpstart your real estate investing career without spending much ... if anything. That’s where this section picks up. Now that we’ve unpacked the various seller and property niches, it’s easy to spot the right opportunities for you and your growing business, even if you’re low on capital.

Do you know how much money you really need to become a real estate investor and start investing in real estate? It’s probably less than you think.

The goal is to help you generate income from real estate investing now. With many of these approaches, it’s easy to flip your first deal in weeks without putting down anything. If you have the time, the talent and the desire to excel, you can start flipping properties for massive profits and use those profits to fuel your business and your lifestyle.

There are plenty of real estate investors who slide right into one or more of these methods and stick with it for the long haul — if it’s not broke why fix it, right? There are plenty of others who use these low and no-cost methods to build up meaningful capital and credit and, with that, dig into some of the more advanced, higher cost methods for building a real estate investing fortune.

The choice is yours but, for now, focus on these methods for driving serious revenue without serious cash in the bank.

Assignments

Assignments — also called “wholesaling”— are a common first money-making step for new real estate investors. With this strategy, the wholesaler finds a property and negotiates the final terms, including sale price, contingencies and closing timelines.

Once the property is under contract, your job as a real estate investor is to find a cash buyer — usually a rehabber or landlord — to assign the contract to. That end buyer takes over the exact terms of the contract, puts down any required deposits and sees the deal through to close.

At close, the cash buyer takes ownership of the property and you get an assignment fee for your work. Often, these fees are in the $5K to $10K range but can easily be more depending on your location, the property sale price and how well you negotiated the pricing and terms.

Assignment Pros

Wholesaling is simple and requires little to no capital. While you’ll likely have to put some money down to confirm your purchase agreement, it can be done with $10 to $20. Unlike down payments, there’s no set requirement for money. It’s simply a best faith cash deposit that confirms the sale is moving forward. Here are some key advantages of assignments:

- Because you’re working with a cash buyer, you can close very quickly. After determining your marketing approach and creating a solid cash buyer list of area investors and rehabbers, you’ll be able to lock down someone to assign to in days, if not hours. When that happens, it’s easy to close a deal within one to two weeks. Even in the beginning, most wholesalers have no trouble closing within four to eight weeks.

- You don’t have to worry about credit history or credit scores since you aren’t taking out a loan.

- You won’t need to deal with banks or lenders. You’ll simply assign the contract to a cash buyer and collect your assignment fee at close.

- More often than not, you’ll be working with real estate investors who become repeat buyers. They see the value you bring to the table and are happy to keep buying from you and keep paying your assignment fee as long as you keep bringing the value.

Assignment Cons

- Once you’ve negotiated the terms, there’s very little wiggle room or room to go back. Often, the only thing you can negotiate is your assignment fee, and that’s not something we want to get into the habit of doing.

- If you can’t find a cash buyer, you could be on the hook to either move forward with the deal or surrender your deposit. Do that too many times and it could seriously damage your reputation as a real estate investor.

- You’re reliant on cash buyers or buyers with an ability to turn hard money loans fast. This requires hard work to find these buyers, especially in the beginning.

Hard Money

“Hard money” isn’t hard to come by at all. If you have a solid deal on the table, you’ll have no trouble finding a hard money lender to back your deal. Because hard money functions like an all-cash transaction, it’s easy to find a seller or wholesaler willing to cut you a serious deal in exchange for a quick cash close.

Hard money comes from hard money lenders. These organized lenders are licensed to loan to real estate investors and rehabbers.

Hard money lenders look specifically at the equity in a property versus digging into your finances and credit history. If you can show there’s significant value in this deal, hard money lenders will gladly hand over the cash.

That said, there are some specific terms to getting hard money loans. In most cases, hard money lenders will only loan 60% to 75% of the property’s after repair value (ARV). This is the estimated property value after repairs and rehab work is complete.

For example, if you went into contract on a real estate investment property for $100,000 but calculated its ARV to be $120,000, a hard money lender would likely loan you $72,000 to $90,000 — 60% to 75% of the $120,000.

If you have a solid upside in the property, you may be able to get a hard money lender to cover the cost of the purchase plus the rehab work.

For example, if this same property had an ARV of $160,000, you could likely borrow up to $120,000. But, in most cases, you’ll be responsible for securing or providing at least some additional funding.

Hard Money Pros

- These loans are built for real estate investors, so they can be approved and funded very quickly, often with a fraction of the paperwork and legwork of traditional bank loans and mortgages.

- Lenders won’t worry as much about your credit or credit history. If your deal is heavy on the equity side, you’ll likely find a hard money lender.

- You may be able to get a hard money lender to fund the purchase and the rehab work.

Hard Money Cons

- Hard money typically comes with a more significant price tag. Expect to pay three to five points upfront plus upwards of 15% interest for the life of the loan.

- For the life of the loan, assume 12 months for hard money, though that timeline could vary depending on your lender.

Seller Financing

Also called “owner-financing,” seller financing means the seller is acting as the bank. As the buyer, you’ll make monthly payments to that seller, just like you would a traditional bank or lender.

Many real estate investors with limited capital are hot on this approach because it’s private. The seller can set the terms as far as down payments, loan duration and interest rate. In most cases, the buyer will assume the second mortgage on the property, helping the seller get out from under the property while creating a consistent revenue stream for that previous owner.

Seller Financing Pros

- Because the seller is dictating the terms of the deal, it’s possible for you, the real estate investor, to get a very buyer-friendly arrangement — little to nothing down, great rates and more flexible conditions.

- There’s never the same level of underwriting as with a bank or traditional lender. If the seller approves, you’re in.

- Sellers are more likely to consider unique conditions, requests and terms than traditional lenders.

- Once you’re done with your rehab work, it’s often easy to get a mortgage or loan and “buy out” the seller in a fraction of the time.

Seller Financing Cons

- Because you aren’t dealing with a bank or lender, you don’t have some of the same securities — i.e. a bank-ordered appraisal or mortgage contingency. If you miss something in your walk-through or inspection, you could have to deal with those challenges in the long-term.

- There’s no guarantee a seller will issue favorable terms. Depending on your circumstances, a seller could try to take advantage of your desire to buy and/or lack of financing options.

Subject To Deals

Similar to seller financing, with a “subject to” agreement, the new buyer/investor assumes ownership of the property and takes over the terms of the existing mortgage or loan. However, the seller remains on the title and remains the mortgage holder until you’re able to pay off or refinance the loan in full.

While the mortgage lender can call a loan due, it’s not common. At the end of the day, a lender wants their money. They definitely don’t want to take ownership of a property should the owner not be able to pay in full.

When structuring subject to real estate investment deals, look for distressed sellers — someone who needs to get out of their property and financing ASAP that also wants to avoid a short sale or foreclosure.

Subject To Pros

- There’s often no need for upfront capital — you’ll simply assume the owner’s monthly payments. However, there are usually no fees beyond that monthly payment — no agent fees, closing costs, etc.

- Because these properties never hit your credit report, it’s possible to scoop up multiple subject to deals at the same time.

Subject To Cons

- Subject to deals tend to come with a lot of paperwork and legal legwork.

- The lender could call a loan due, leaving you on the hook for a significant amount of money to avoid foreclosure.

- You’re paying the seller and the seller is paying the mortgage lender. In most cases, it’s a smooth transaction, but there’s always risk when you involve another person. It’s your job to ensure the owner pays the loan. Be sure to ask for proof every month.

Rent-to-Own Properties

As the name suggests, in these real estate investment scenarios the renter becomes the owner. Ideal for investors or retail buyers with limited — or no — capital, rent to own agreements enable the buyer to rent from the current owner for a set period of time. Typically, this time period ranges from 12 to 36 months. At the end of that period, the tenant can exercise the baked-in purchase option and move to purchase the property.

In most cases, the renters pay a non-refundable “option consideration” when they sign their rental agreement. If they opt to buy at the end of the lease term, that fee is applied to their down payment. If they choose not to buy, the owner keeps this deposit.

Overall, this is a good option if a potential buyer doesn’t have the credit or down payment to make a purchase now but, in the near future, will be better positioned to move forward.

Assumable Loans

Assumption mortgages or “assumable loans,” are similar to subject to deals. The difference is that with assumptions, you as the real estate investor take over the seller’s existing mortgage. You’re legally assuming the mortgage and ensuring it’s 100% in your name.

Depending on when the property owner secured the loan, assumption mortgages can be a great way to get a below-market rate.

For example, in November 2012, 30-year fixed mortgages were recorded at 3.31%. One year later, they were closer to 4.26% — nearly 1% higher. By taking on an assumption mortgage, an investor or retail buyer could have saved a full percent on their rate. On a $200K 30-year mortgage, that’s about $100 per month in savings, or nearly $35K over the remaining 29 years of this example loan.

Assumption Pros

- Potential to save versus today’s rates, depending on when the loan was secured and who secured it

- No down payment or closing costs

- Typically, assumption loans don’t have a “due on sale” clause—in other words, your new lender won’t call the loan due.

Assumption Cons

- Because you’re officially taking over the loan, you’ll likely need to go through a formal application process that includes a full credit check and financial history.

- Like any loan or credit, your new assumption mortgage will appear on your credit.

Lines of Credit

A line of credit functions almost exactly like a credit card. A bank or lender offers you an often-flexible credit amount and you can access those funds as needed. When you have credit outstanding, you’ll make monthly payments with interest. When your line of credit is paid in full, you won’t.

When you launch your real estate investing business, you’ll be a full-fledged business owner. With that, you’ll be able to leverage your business to take out a more substantial line of credit. That credit can be withdrawn as cash, or you can access it via a debit card- or check-style system.

While you’ll likely pay more than with a traditional real estate loan, the flexibility and versatility can’t be beat.

Line of Credit Pros

- Lines of credit are very flexible and can be accessed anytime, just like a checking or savings account.

- By withdrawing cash, you can close in cash or use that money to fund everything from closing costs to rehab work.

- While rates tend to be higher than mortgages and bank loans, they’re often lower than hard money or credit cards.

Line of Credit Cons

- Many lines of credit require an upfront fee or take money from the initial line as their servicing cost.

- Interest rates can be high.

- Unless you have a specific business structure in place, you’re likely personally liable to repay the line of credit.

- Depending on your credit history, it may be tough to secure a meaningful line of credit.

Retirement Accounts

The majority of Americans have retirement accounts. However, while many think their retirement accounts are meant to sit, often that’s not the case. Many IRAs and 401Ks have a “self-directed” option. With these accounts, you’re able to move the funds from your existing fund-based structure to something you want to invest in for the long-term (like real estate).

Self-directed IRAs and “solo” 401Ks can be used for virtually anything, from funding the purchase price of an investment property to rehabbing it. Depending on the structure and limitations of your accounts, you may also be able to invest in tax liens, gold, notes and other less traditional investments. If you don’t have a flexible account, contact your employer or account holder to find out about rolling your funds over to a self-directed option.

Retirement Account Pros

- The tax benefits are huge when it comes to real estate investing. You can also structure your investing so the profits generated from your real estate investments go into your retirement accounts on a tax-deferred basis. In other words, you won’t pay on those gains until you take qualified distributions in retirement.

- If you opt for buy and hold properties, your retirement income will not only fund a tangible asset but will also generate a passive, powerful income stream that funds your lifestyle well into retirement.

- Self-directed funds can be very flexible and can be used to secure the property and fund rehab work.

- Real estate is a safer investment than stocks, bonds, and funds, while offering greater upside than the paper investments that often make up the core of retirement plans.

- By integrating real estate into your retirement portfolio, you’re immediately diversifying, which is critical to long-term wealth growth and preservation.

Retirement Account Cons

- Per the IRS, you cannot use your self-directed funds to buy owner-occupied properties.

- The IRS restricts certain transactions. Consult an accountant, financial advisor or attorney to confirm you’re doing everything on the up-and-up.

- When you generate income from renting or selling one of these properties, you’ll need to put those assets into the IRA you used to pay for it.

Private Money

Private money can be any funds from anyone as long as they don’t come from a bank or traditional lender. As a real estate investor, you could easily tap a spouse, parent, auto or uncle, sibling, friend or neighbor to act as a private money lender and fund your next real estate investment deal.

Because private money lenders are using their own capital, they get to set the terms for the deal. Because these lenders are typically using cash in the bank, your deals can move as quickly as your funding source does. If they can write you a check right now, you can close immediately and move on to your next real estate investment deal. Compare that to the 30 to 60 days it takes to close a traditional bank-issued loan, and the benefits are immediately clear.

Private Money Pros

- There are no banks or lenders. As a result, there’s no serious underwriting or hoops to jump through with this real estate investment.

- Private money lenders may be more open to unique or customized terms when it comes to repayments, interest rates and other special considerations.

- Because you’re buying with cash, it’s often easier to get a good deal on a property. In many cases, sellers are more likely to negotiate because they know you aren’t waiting on a bank or lender for approval.

Private Money Cons

- Depending on who you’re working with, a private money lender could demand sky-high returns or short terms from a real estate investor

- You need to have an exit strategy to ensure you can effectively pitch your investment deal — and to ensure you can repay your lender, with interest.

Getting Started: Real Estate Investing For Beginners

If you’re ready to get started real estate investing and become a real estate investor, the next step is to TAKE ACTION.

With these real estate investing for beginner insights and intel under your belt, it’s time to really assess your lifestyle, your goals, your available capital — if any —and where you see yourself in the next 30 days . . . and 30 years.

From that broad vantage point, you as a real estate investor will be better able to hone in on a real estate investing strategy that makes sense for you right now, while identifying exit strategies that could be ideal in the not-too-distant future.

As you’re developing your initial real estate investing strategy, remember that nothing is cast in stone.

For example, it's easy to start as a wholesaler and assign contracts until you’ve built a solid cash buyer base and have cash in the bank to jumpstart your rehab career.

You might go the traditional real estate investing route and take out bank loans or hard money loans, then parlay your single-family investing into apartment buildings or commercial properties, all funded by your personal private money network.

You might find your fortune with one of these niche methods and keep on going.

In this business, the choice is yours because the real estate investing landscape is broad and lucrative.

There’s something for everyone here, whether you’re an experienced investor with endless cash reserves or have never even glanced at a listing.

That’s why real estate investing is an optimal path that drives you straight toward lasting success — and lasting financial freedom.