Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

When are you going to retire?

Have you thought about it?

Shouldn’t the answer be “ASAP?”

Before you throw all of your money into accounts you can’t touch for decades, consider another (faster) route to retirement . . . real estate.

Real estate investing can lead you straight to early retirement.

The clock is ticking.

No matter your age, it’s only a matter of time.

One day you’re going to reach the age where you’re too old to work, too hard to hire, or just plain don’t feel like working anymore.

When that time comes, you’re still going to need an income. So where is it supposed to come from, exactly? Here’s why real estate investing can put you on a direct path to early retirement.

Pensions are pretty much a phenomenon of the past for everyone but government employees, who make up only 10% of the population.

And social security, assuming it’s still around and able to meet its obligations when it’s time for you to retire, is not going to cover everything you need to get by, let alone live comfortably.

That leaves you with savings and investments.

The typical mantra of today’s financial planners is to invest in mutual funds and other low-yield investments. We’re told that in order to get higher returns you will have to take on more risk, so their alternative is 6% returns.

That means your money will double every 12 years, and for every $100,000 you save you’ll have a whopping $6,000 per year to live on.

I don’t know about you, but not everyone has that kind of cash or is willing to put up with that low of a yield.

Maybe your retirement timetable needs to be faster.

Or you want to invest in something tangible that churns out cash.

For this reason, I’m going to suggest using rental properties to fuel your retirement.

After all, nothing has created more wealth than real estate, including stocks, mutual funds, and even growing and selling a business.

And, I’m going to give you a step-by-step plan to follow in order to get there.

Focus on Income, not Net Worth

Before we get to the first step and begin with your retirement goals in mind, I strongly suggest that you do not set goals about your net worth.

Focus on passive income instead.

Why?

Because net worth is just a means to an end. You can’t eat your net worth. You can’t pay your bills with it.

If it’s in an account you can’t get to or tied up in a property, it doesn’t do you much good anyway.

What matters is your monthly incoming cash flow. After all, if you can achieve the retirement income you want with only half the net worth you thought you would need, wouldn’t that be better?

So focus on rental income first.

#1: How Much Do You Need to Retire Early?

How much income will you truly need when you retire?

The answer might surprise you.

Now, I’m not talking about buying a mansion, yacht, or a $200,000 recreational vehicle here.

I’m talking about retirement — being able to pay your bills with passive income.

It’s easy to pick big fat round numbers like $100,000 per year, but let’s take a realistic look at what it will take to live comfortably.

Here’s a surprise: It doesn’t have to be as much as you make right now, or at the peak of your earning potential.

Generally speaking, in order to retire at the typical retirement age, you’ll need to earn 70% of your current gross employment income.

You can adjust this figure up or down after considering each of the bullets below:

Children’s college expenses

You might require a higher income at present in order to cover college education for your kids, but you won’t need to later.

Discount retirement savings

You might need a higher income right now to save for your retirement, but you won’t need to do that later, either.

Less expensive neighborhood

You might choose to move to a less expensive area, in which case your housing payment among other bills would be significantly less.

Selling primary residence

You might choose to rent in your old age, so count on selling your primary residence and investing the profits into the rental property during the last few years of your timeline.

Lower taxes

The taxes paid on passive income from rental properties vs earned income from your job will be lower.

Other income streams

You may not need to depend solely on real estate for your retirement.

There may also be:

- social security

- pensions

- your 401k or other retirement plans, as well as your spouse’s

Working part-time

We often picture retirement as spending 100% of your time on the golf course or sitting on a beach, but many retirees have stayed healthy and active with some kind of rewarding part-time work where they earn an extra $10,000/year that is more enjoyable than a current full-time job.

#2: Choose a Time Frame To Retire

Every true goal has a time frame or else it’s just a dream. So when do you want to retire?

This depends on your current age as well as the age at which you want to leave the world of full-time employment behind.

You might have a burning desire to quit your current job and work in real estate full-time as soon as possible, but consider this . . . maybe you just need a better job!

Plenty of people have quietly built a real estate portfolio over time in just a few hours per week while still enjoying the peace of mind in the meantime from a consistent employment income.

So pick an age by which you want to retire with this in mind. Now, let’s move on . . .

#3: Set a Specific, Realistic, Measurable Retirement Goal

The next step is to get clear on your monthly income goal. I’m a strong believer in turning ambiguous and distant dreams into tangible, specific goals.

The more exact you get, the better you can plan, track your progress, and make changes as needed to either your plan or to the goal itself.

An example of this would be, “I will create a $10,000/month in passive income from real estate within 20 years.”

If you need more or less than that, don’t worry. It’s just an example. You can substitute your own numbers later and still finish this article with a solid plan.

And, if a few years go by and you realize this number is off, you can always adjust your goal later and the path to get you there. Remember, real estate is a long-term wealth-building strategy!

#4: Choose What Real Estate Investment Property to Buy

Now that you have a clear goal and time frame, let’s start breaking it down into actionable elements.

You’re probably wondering how many properties you’re going to have to buy.

Let me suggest a different way of looking at it.

We tend to be fixated on single-family houses, but multi-family offers even better returns because of economies of scale.

Buying and owning a 10-unit apartment building free and clear is probably more than enough to cover the average couple’s retirement.

The downside is, it requires a much higher investment today than you probably have.

So, I suggest you start with smaller multi-family properties like duplexes, triplexes, or fourplexes.

They cost less per unit than single-family but rent for about the same.

Plus, you’ll save a lot on maintenance by only having to replace one roof instead of four different ones, and so on.

Also, I would not settle for any property with a cash flow of less than $200 per door per month, after the mortgage and all expenses are paid.

Why?

Because the money is made when you buy, not when you sell.

You’re buying and holding, so set yourself up right from the beginning with a property that pays you more AND covers you better in the event of a surprise setback or problem tenant.

If you’re having trouble finding the right property, keep saving up and searching. It might not happen this year.

It might happen next year.

But do NOT be so impatient that you lower your standards just to buy a property.

This is one of a few key investments that will last a lifetime.

#5: Your Plan for Getting There

You could achieve your goal of $10,000/month with either of the two following strategies:

Strategy 1: The Leveraged Strategy (Buy and hold 6 properties)

Strategy 2: The Free & Clear Strategy (Sell a few properties and pay down the others)

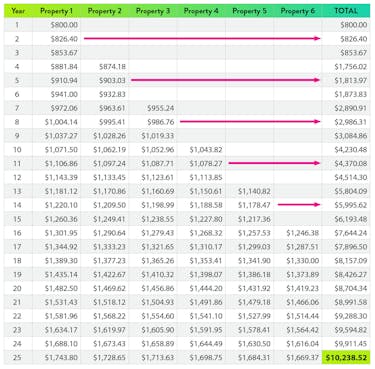

The chart below demonstrates how this would work. But first, let’s go over a few key assumptions:

Average cash flow of $200

It assumes you’re buying properties with an average cash flow of $200 per unit per month.

If you buy in an above-average area or find an above-average deal (which is not hard to do if you take a few years to pick and choose) then you would speed up this timeline.

Rent increases of 3.3%

It assumes rent increase of 3.3% per year, based on historical averages.

4-unit properties

It assumes you are buying four-unit properties because they are the biggest ones you can acquire with residential loans (much more favorable) instead of commercial loans.

New property every 3 years

It assumes you will buy one new property every three years.

You could buy more if you have more capital available.

Or, as your equity is paid down in Property #1, you could borrow a home equity line of credit against it for the down payment funds needed to buy another property.

One more thing . . . $200 per unit per month cash flow is just today’s numbers.

In three years, you should increase your standards as market rents increase.

So by the time you buy Property #2, it should generate a minimum of $218/month cash flow per unit, or $874.18 for a four-plex.

By following this strategy, you could create a $5,000 per month passive income in 12-13 years, or a $10,000 per month retirement in 25.

The Free & Clear Strategy

The previous strategy is based on cash flow alone. Can you guess what it didn’t include?

Appreciation.

The price of existing homes increased by 3.4% annually from 1987 to 2009, on average, according to the Standard & Poor's Case-Shiller Home Price Indices.

Obviously, an increase in price is an increase in your net worth, but how does that turn from equity on paper into passive income?

You would have to sell the property to get your cash out. And while that’s no fun, selling one house can provide you with the capital to buy several more, depending on how much of the loan principal has been paid down.

Remember, it’s not about the number of properties you own — it’s about doing what it takes to reach your passive income goal.

So, following this strategy, some investors buy a property every few years, and after at least 10 years of principal reduction and appreciation, they sell Property #1 and use it to pay down the mortgages of their remaining portfolios.

Now, if you’re thinking it’s going to take 30 years to pay down a 30-year mortgage, I’ve got some very exciting news for you.

You can pay off a 30-year mortgage in almost half the time if you reinvest the extra cash flow you realize from yearly rent increases into paying down the principal balance.

This means in around 17 years, each property will have no mortgage payment and the remaining cash flow would go straight to you (or to pay down other properties).

The Bottom Line: It's Time to Get Started with REI

The last thing to get clear on is how much cash you’ll need to get started.

Then, it’s just a matter of disciplined saving and searching for deals.

If your combined family income is $75,000 then you could conceivably save up a down payment in a few years’ time.

If you want to accelerate your timeline, you could:

- Reduce some key expenses for a few years (like housing, cars, luxury items, credit card interest, etc.)

- Use creative methods to reduce the size of the down payment required.

- Buy a home for only 3% down, live in it for at least a year, then keep it as a rental property and repeat the process.

However you go about it, make sure to follow this general process.

Figure out what you need to retire on, choose a time frame, make a specific plan to achieve it, and then work and revise your plan every year until it’s time to retire.

How can you ensure success?

The best way to increase your profitability while reducing your risk is to improve your financial education with resources like this.