Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

- What is the Relative Strength Index (RSI) in Stocks?

- What Is The Relative Strength Index (RSI) Formula?

- RSI Example

- Advantages of Using the Relative Strength Index in Stocks

- Disadvantages of Using the Relative Strength Index in Stocks

- Relative Strength Index in Stocks (RSI) vs (Moving Average Convergence Divergence): What’s the Difference?

- How to Use the Relative Strength Index (RSI) in Stocks to Your Advantage

- The Bottom Line: Using Relative Strength Index (RSI) in Stocks to Your Advantage

What is Relative Strength Index (RSI) in stocks, and how can it help you become a better investor?

Will your favorite stock’s next move be higher or lower?

Is now a good time to buy more shares or start looking for opportunities elsewhere?

How can you be sure?

Momentum.

Momentum is the speed of price changes over time in a stock. It shows the strength of a move, up or down.

Stocks can exhibit bullish momentum (the price is rising) or bearish momentum (the price is falling). Like Isaac Newton’s First Law, stocks trading in a trend tend to stay in that trend.

Determining whether you’re investing with the momentum or against the momentum of your stocks is critical for generating positive returns.

You can do that with something called the “relative strength index”, otherwise known as RSI in stocks.

What is the Relative Strength Index (RSI) in Stocks?

The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes.

J. Welles Wilder Jr., a prolific technical trader, developed the RSI and introduced it in his 1978 book, New Concepts in Technical Trading Systems.

The RSI is an oscillator — a line graph with two extremes — which can have a reading from 0 to 100 based on recent price activity.

The RSI measures momentum and is used to predict trend reversals:

- the end of an uptrend where prices will begin to head lower or

- the end of a downtrend where prices will bounce higher

Interpretations of the Relative Strength Index are that values below 30 indicate an oversold (or undervalued) condition and values over 70 indicate an overbought (or overvalued) condition.

In either case, when the RSI indicator reaches an extreme value, an investor can expect that the current trend is near its conclusion and a price reversal is coming.

This can be a tremendous advantage for stock investors looking to get out of a position near the top or enter a new position near its bottom.

What Is The Relative Strength Index (RSI) Formula?

The Relative Strength Index compares a security’s strength on days when the underlying stock’s price increases to its strength on days when the stock’s price decreases.

If the stock is increasing in price to a higher degree on positive days than it is decreasing in price on negative days, the RSI will trend higher.

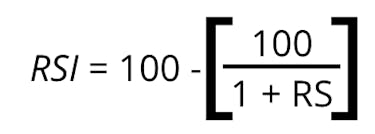

The RSI uses a two-part calculation. The first formula is:

- RS = Relative Strength = AvgU / AvgD

- AvgU = average of all up moves in the last N price bars

- AvgD = average of all down moves in the last N price bars

- N = the period of RSI (typically 14 days)

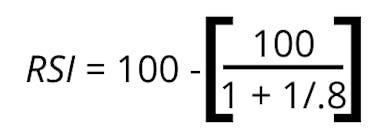

For example, imagine stock ABC closed higher 10 of the last 14 days with an average gain of 1% while the remaining 4 days ABC closed lower by an average of -0.8%.

The RSI calculation would look like:

The RSI for ABC would be 55.66.

After the RSI is calculated, it should be plotted beneath an asset’s price chart (see the example below).

The indicator should be used as a barometer over time to visualize trends, not as a standalone calculation.

Almost every charting program and stock trading website offers RSI as an indicator to overlay on your price charts, so don’t worry about memorizing the formula.

RSI Example

Let’s look at an example of RSI in real-time, using the chart below.

Starbucks’ 10-year chart shows:

- an uptrend from 2002-2007

- a downtrend from 2007-2009

- and another uptrend from there

The RSI flashed an overbought signal towards the end of 2005 and reversed its course shortly thereafter. In the beginning of 2009, the stock became oversold and quickly headed higher.

Advantages of Using the Relative Strength Index in Stocks

The Relative Strength Index is a simple way to “see” momentum.

Regardless of whether you’re a long-term investor or a short-term trader, knowing the momentum of the stock you’re considering buying or selling is critical.

There are 3 primary advantages of using the relative strength index in stocks indicator:

- It is easy to implement and understand

- It works well in non-trending, reversal levels where other momentum indicators may struggle

- It can be used to find the loss of momentum leading up to reversals

As seen in the SBUX chart above, the RSI is a leading indicator — it usually shows reversals before they happen.

If you’re an investor or trader who wants to stay a step ahead of your competition, that is a great characteristic in an indicator.

For these reasons, if you could only pick one indicator to use, the RSI would be a great option.

Disadvantages of Using the Relative Strength Index in Stocks

Like all indicators (and as seen in the example above), RSI in stocks isn’t perfect.

Overbought and oversold signals do not perfectly align with actual stock price movements and many reversal signals are false alarms.

As you can see in the SBUX chart above, since it’s simply a way to measure momentum, the RSI indicator can stay in the overbought or oversold region for extended periods of time.

Trading purely based on RSI can lead to losses or selling too early based on false signals — a disadvantage of using relative strength index in stocks.

Additionally, a severe limitation to using the RSI is the indicator does not take volume into consideration in its calculation.

Generally speaking, the greater the volume behind a stock’s move the greater the conviction.

If a stock moves 1% higher on the volume of 500,000 shares and the next day drops 0.8% on a volume of 5,000,000 shares, the RSI will show an uptrend while in reality there may be many any sellers ready to sell their shares.

Keep this in mind: like all technical indicators, it’s a tool to suggest what a stock may do next — it’s not prescient.

Relative Strength Index in Stocks (RSI) vs (Moving Average Convergence Divergence): What’s the Difference?

Another trend-following momentum oscillator, the Moving Average Convergence Divergence (MACD) measures the relationship between two Exponential Moving Averages (EMAs), while the RSI measures price change in relation to recent price highs and lows.

Either indicator may be used to signal an upcoming trend reversal.

The two indicators are often used in conjunction but, because they measure different factors, sometimes give contrary indications.

Keep in mind that stock investors can choose which indicator they prefer or simply decide to use them together.

How to Use the Relative Strength Index (RSI) in Stocks to Your Advantage

According to Wilder Jr., the RSI indicator is at its best when it shows divergence — when the movements of the RSI do not align with the movements in stock price.

Since the RSI indicator shows momentum, divergence means the current move is being supported by fewer and fewer investors, signaling an opportunity for traders to bet on the reversal.

Divergence can be bullish or bearish.

Let’s look at an example of each.

Relative Strength Index (RSI) Bullish Divergence

In this next graph, we can see bullish divergence. The stock made lower lows while the RSI made higher lows, signaling positive price action was imminent.

Relative Strength Index (RSI) Bearish Divergence

This next chart shows bearish divergence: the S&P made higher highs while the RSI made lower highs, indicating the next move would be lower. The stock fell shortly thereafter.

The Bottom Line: Using Relative Strength Index (RSI) in Stocks to Your Advantage

The bottom line is to utilize the relative strength index (RSI) indicator when trading.

Stocks trade in trends, known as momentum.

The best investors give themselves the greatest chance of success by investing, or not investing, in the direction of the current momentum.

Understanding how to read and using the RSI indicator as a gauge of momentum will bolster returns and help you avoid taking unnecessary losses.

The RSI indicator is not perfect, but it can provide you with expectations about future price movements and give you the edge you need to be successful on your stock investing journey.