There are many benefits to owning a rental property, including monthly cash flow and the value of the property increasing over time. There’s also a lesser-known perk with a significant financial upside that can save you money on taxes: it’s called rental property depreciation.

While you may be familiar with some of the basic ways in which rental properties provide value, you may not be as aware of the ways in which your residential rental property can positively impact your tax picture. What’s more, if you don’t use this tool, you LOSE it.

In this article, we will explain:

- what is rental property depreciation?

- common rental property depreciation questions

- the useful life expectancy of a rental property

- how to calculate rental property depreciation

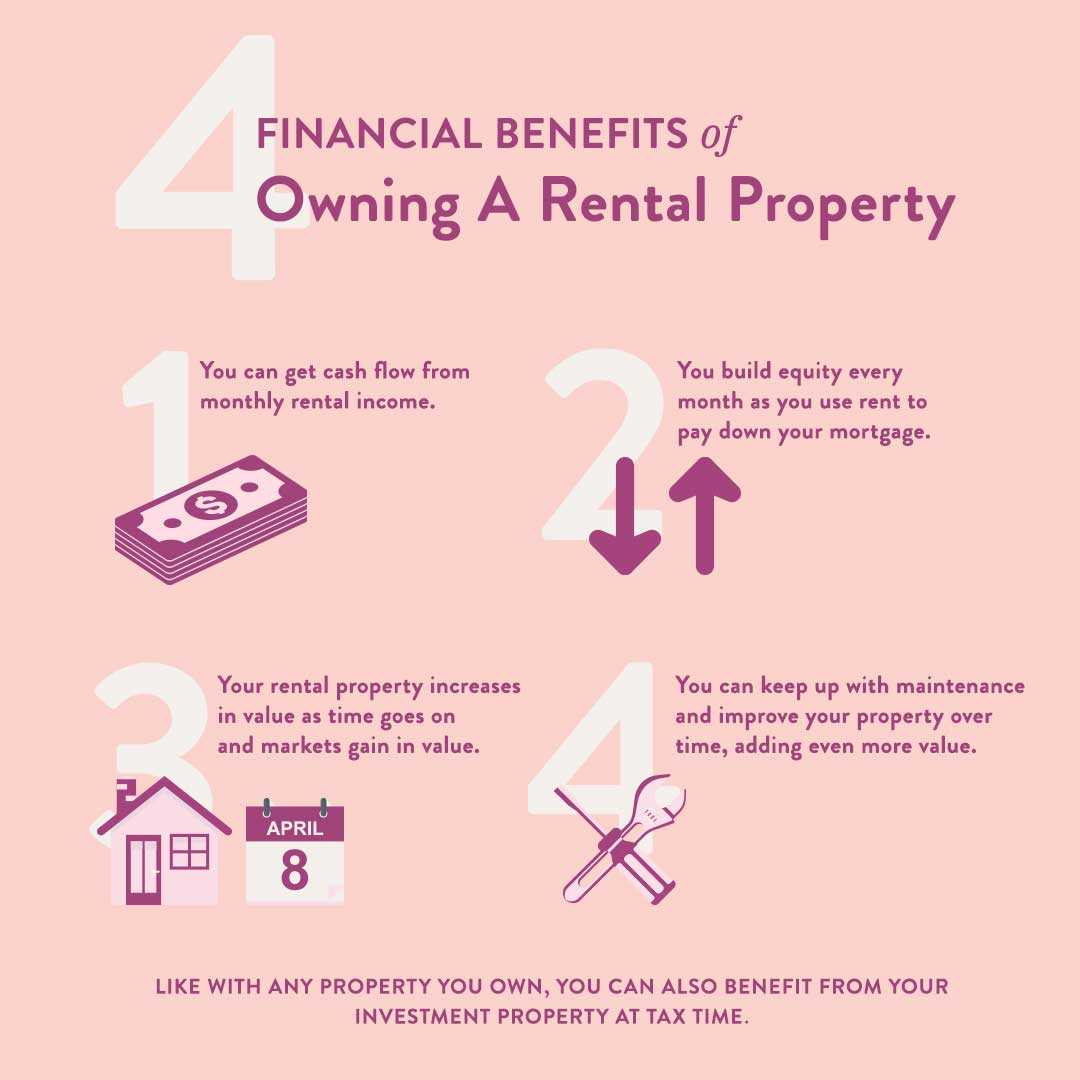

Financial Benefits Of Owning A Rental Property

Do you have a rental property? If so, are you already taking advantage of this rental property depreciation tax advantage?

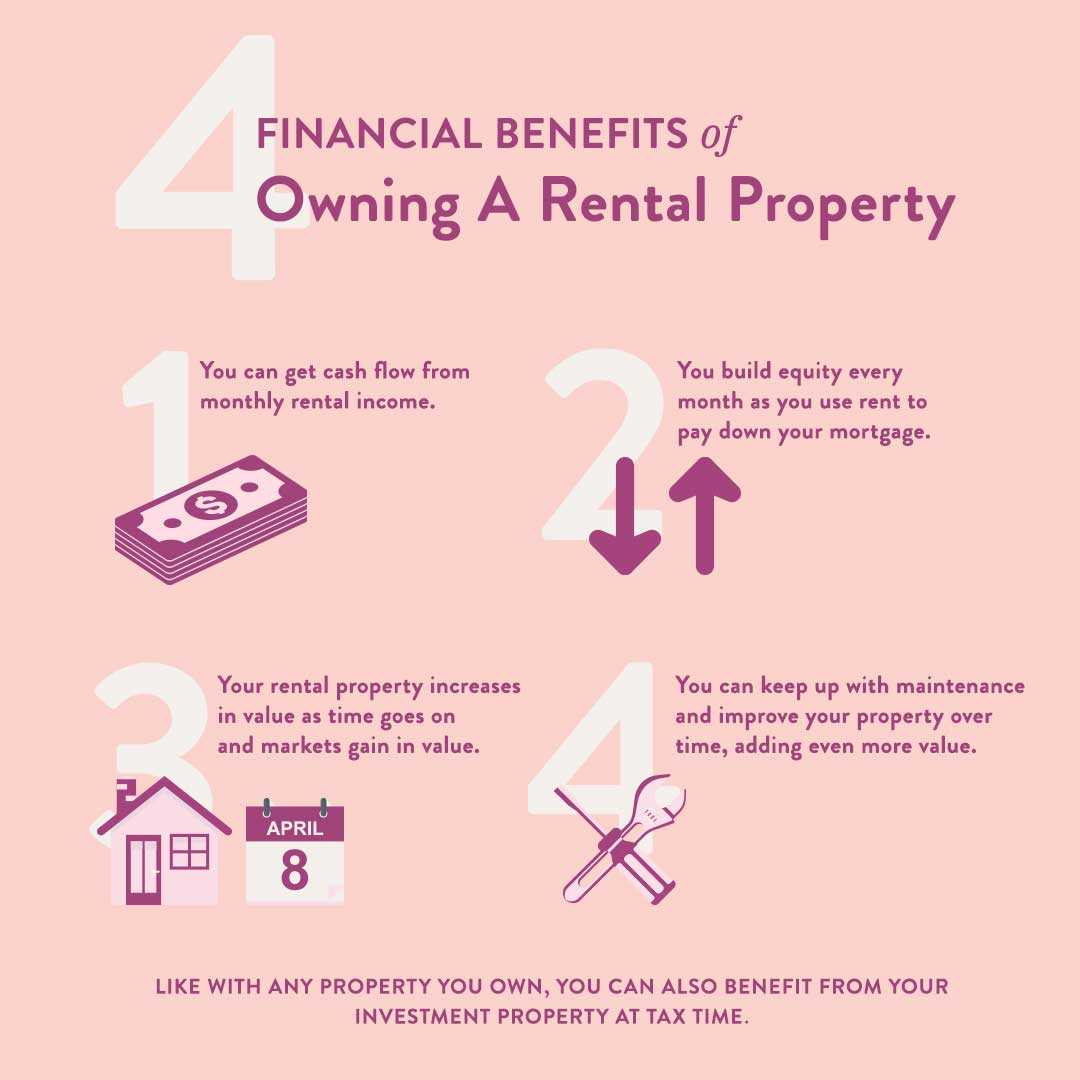

If you don’t own a property and you’re currently looking for investment opportunities, it’s important to know that one of the best things about owning a rental property is that it provides financial benefits in many different ways:

You can get cash flow from monthly rental income.

- You build equity every month as you use rent to pay down your mortgage.

- Your rental property increases in value as time goes on and markets gain in value.

- You can keep up with maintenance and improve your property over time, adding even more value.

Tax Benefits of Rental Property

Like with any property you own, you can also benefit from your investment property at tax time.

- You can deduct the cost of improvements and repairs from your rental income, which reduces your tax liability

- You can also deduct insurance, property taxes, professional services, and travel expenses associated with doing business as a real estate investor

In many cases, these deductions are taken in the year in which the money is spent on these items.

A different deduction — rental property depreciation — can be spread over time and help you save money on your taxes.

What Is Rental Property Depreciation?

By definition, depreciation is an asset — such as your rental property — losing value over time due to wear and tear. losing value over time due to wear and tear.

Rental property depreciation is just one of the many ways that you can experience long-term, annualized financial benefits from your rental property.

The rental property depreciation deduction allows you to spread the cost of buying and making major improvements to your property — and the resulting deduction — over many years.

A portion of these expenses can be deducted each year when you spread the costs over the “useful life of the property.”

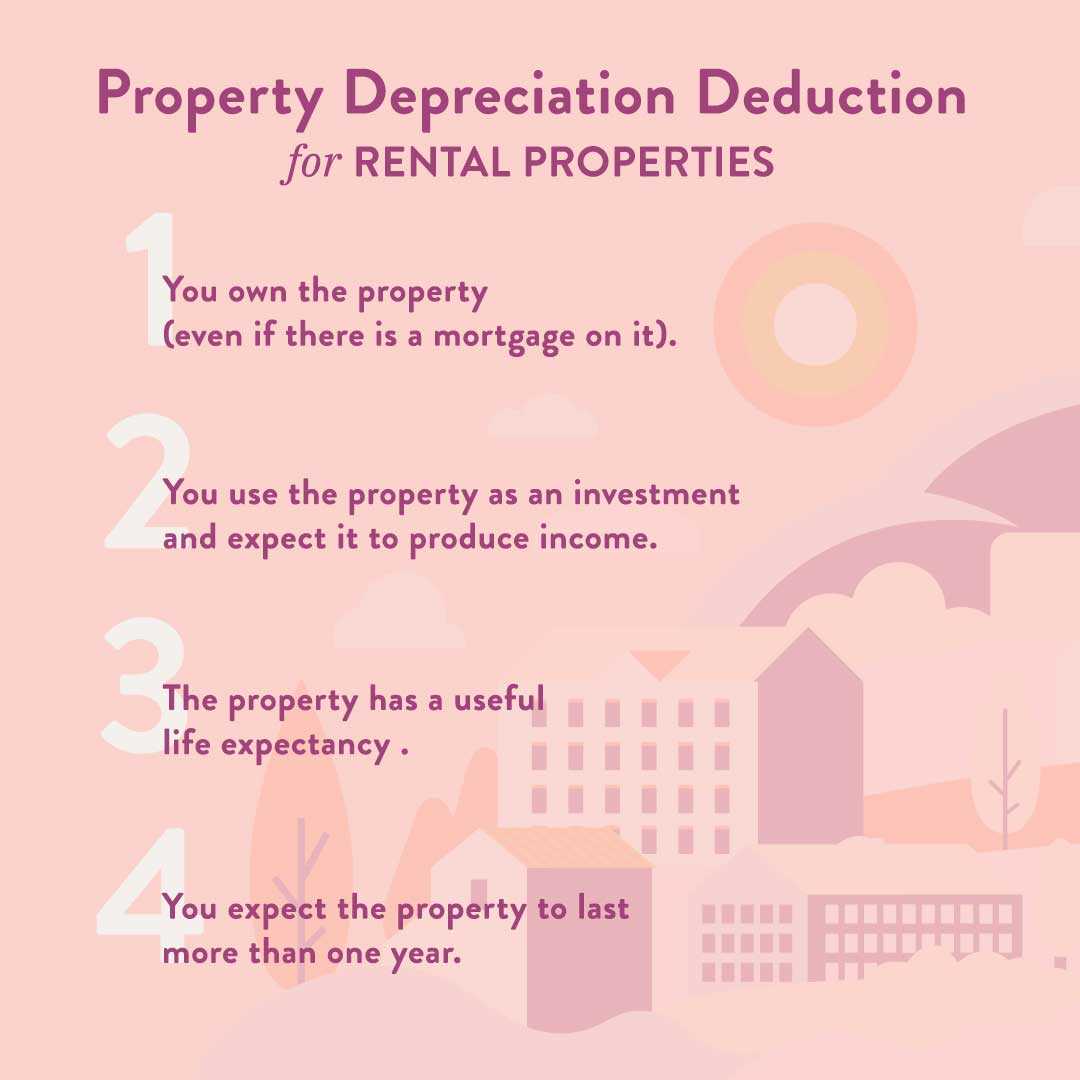

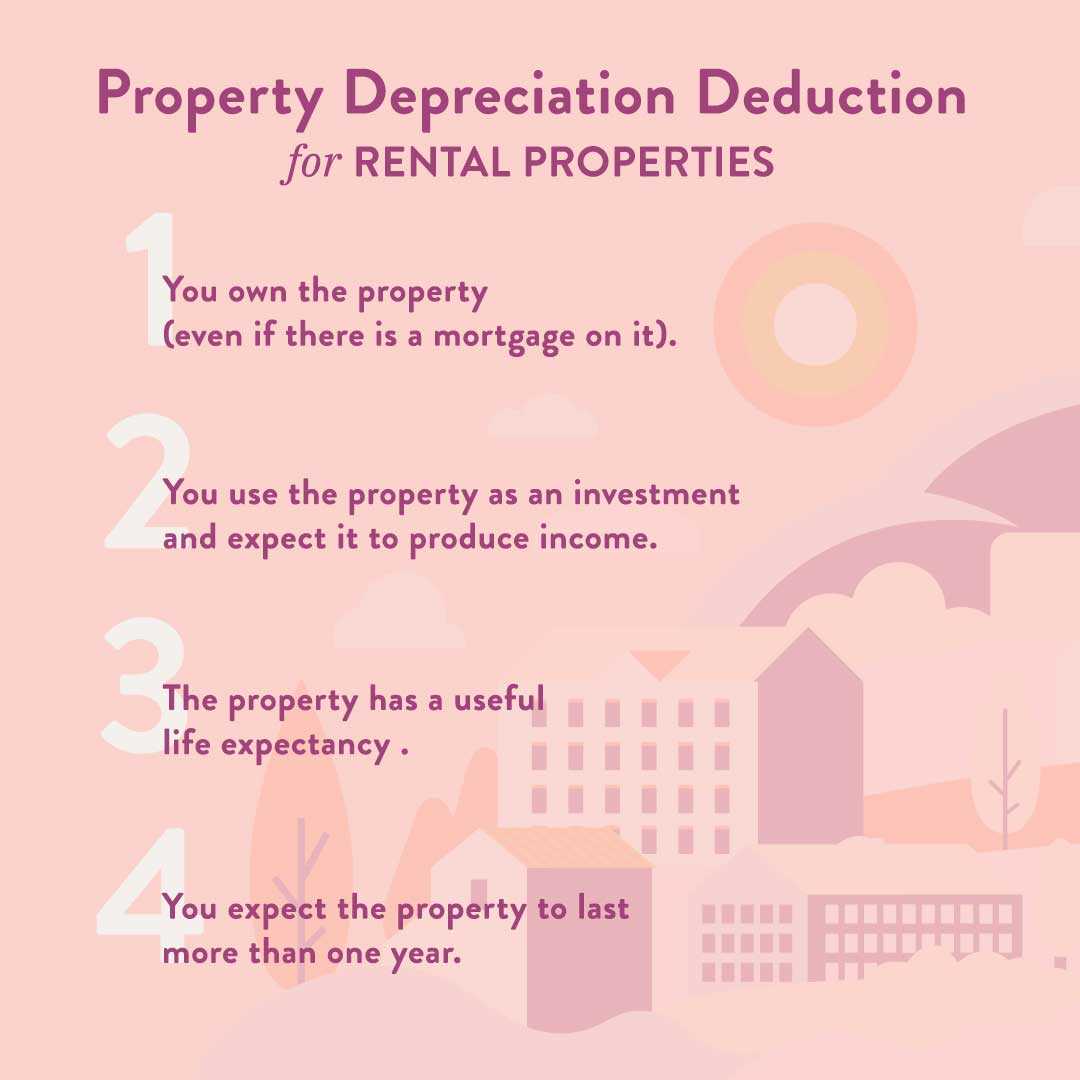

Rental property depreciation is available if your investment property meets the following criteria:

You own the property (even if there is a mortgage on it).

- You use the property as an investment and expect it to produce income.

- The property has a useful life expectancy (we’ll talk more about that in a minute.)

- You expect the property to last more than one year.

Keep in mind, you can’t deduct annual depreciation if you obtain and dispose of the property in the same year.

You also can’t deduct depreciation of the land or lot itself, nor, in most cases, improvements like landscaping, grading, or clearing.

For these purposes, land is considered permanent, even if its features change.

Depreciation deductions apply to the cost of the building or the capital improvements on the land — in this case, a rental home.

In order to determine how much of the property’s purchase price is for the residence and how much of the value is in the land, consult your county tax assessment which will include a breakdown of the assessed value of each.

You can also use an appraisal or your insurance agent’s estimate of value.

It may be worth checking each of these sources since assessments and appraisals can have very different values.

For instance, in highly desirable markets with rapid increases in home values, the appraised value can quickly outstrip the assessed value of a property.

In the case of a home with custom improvements and luxury finishes that make it more marketable, an assessment will not adequately represent the home’s value since it will have a far more limited scope.

What Is The Useful Life Expectancy Of A Rental Property?

IRS Publication 946 provides both a framework and guidelines to help you determine the useful life expectancy of your rental property so that you can calculate your rental property depreciation deduction.

Generally, residential rental property has a useful life expectancy of 27.5 years, according to the Modified Accelerated Cost Recovery System (MACRS) estimation system, which is commonly used.

As you’ll see, this closely corresponds to the 30-year mortgage term most homeowners use to finance their property.

It’s important to remember that if your rental property was put into service before 1987, you will need to use the Accelerated Cost Recovery System (ACRS) to calculate your depreciation.

This will result in a 30-year useful life expectancy for the property itself.

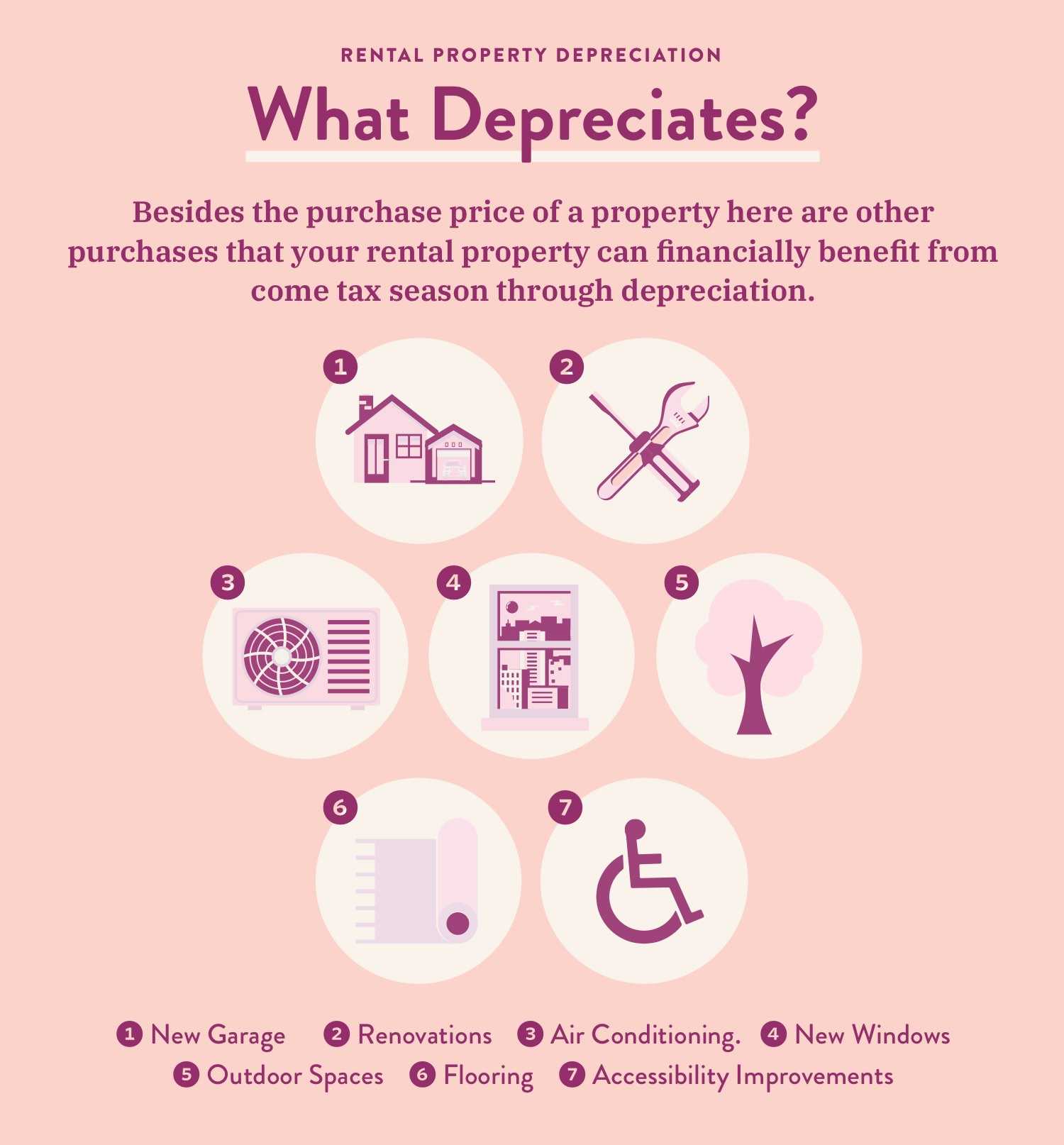

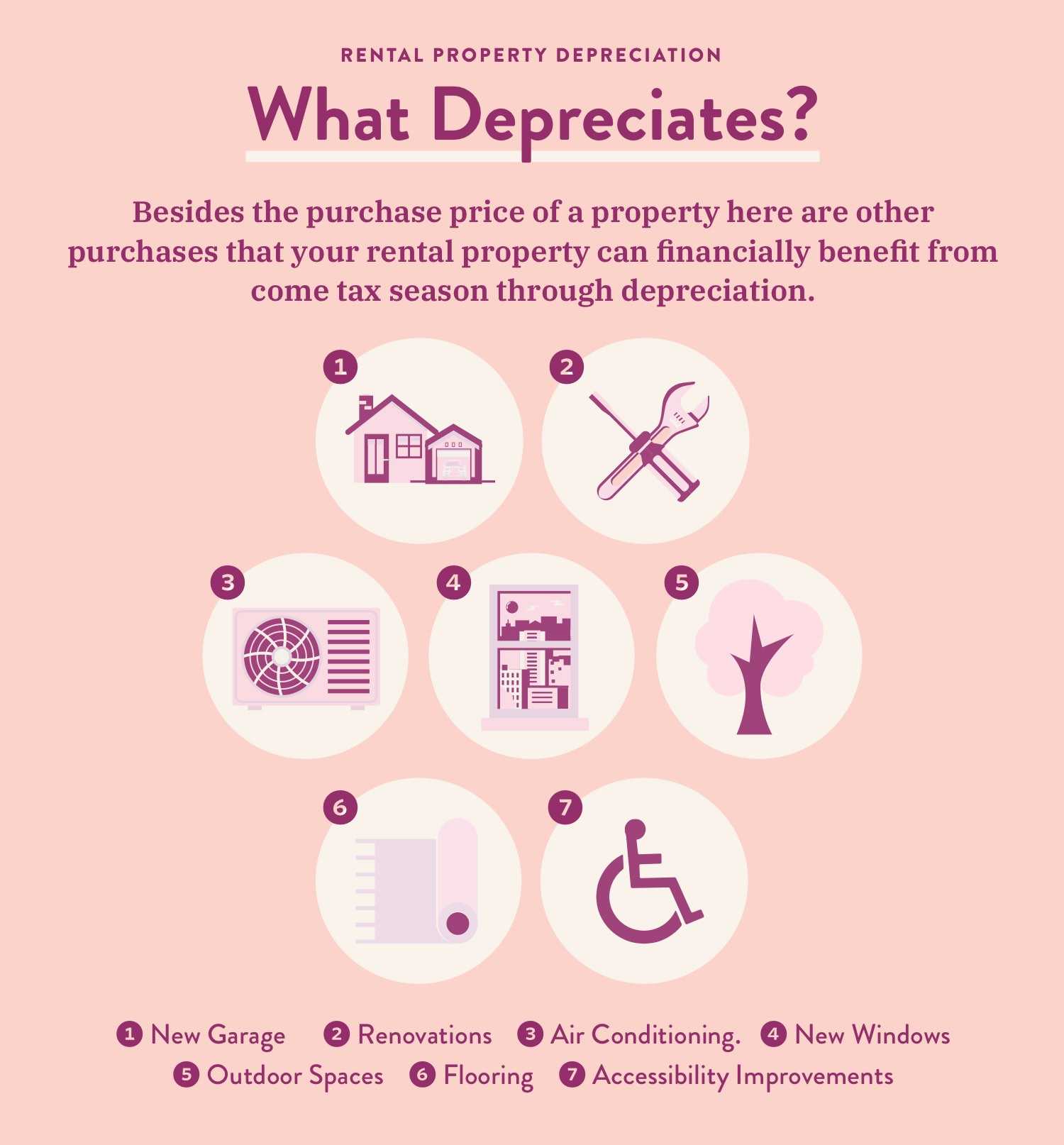

Rental Property Depreciation: What Exactly Depreciates?

Besides the purchase price of the property, you can also depreciate improvements, additions, or other features that are added in order to make the property:

- more desirable

- more functional

- more profitable

These could include:

Here are some examples of specific improvements as outlined by IRS Publication 527:

Repairs vs Improvements

Remember, there is a difference between repairs and improvements. A roof repair, like new tar or shingles to fix a leak, is deductible only in the year it occurs. A roof replacement is a major improvement and is eligible for depreciation.

Some improvements will have a useful life expectancy that differs from the 27.5 years of the home or unit itself. For example, while hardwood flooring is considered a long-term improvement and depreciates across the entire 27.5-year lifespan, new carpeting has a useful life of five years for deduction purposes.

Common Rental Property Depreciation Questions

Why Can You Write It Off Your Taxes?

The thinking behind the depreciation of rental property is similar to the way it is applied to income taxes for other small businesses.

Small business owners are able to deduct the costs of major purchases that are expected to last for many years, from vehicles to office equipment.

In addition, depreciation in a small business can apply to larger purchases, such as:

- store

- warehouse

- other commercial property

These are called capital expenditures and they are eligible for depreciation. This is different from smaller, short-term expenses like office supplies or other materials.

As a real estate investor, your business is based on your investment property portfolio. That means that the major expenses involved — acquiring the homes, improving the homes, and making major repairs — are eligible for the depreciation deduction.

How Much Can You Write Off?

There is no dollar limit on your potential deductible depreciation. The limit is based on the amount you have spent and careful record-keeping.

Be sure to check with your financial planner or tax advisor as changes to the tax code can create additional opportunities for deductible depreciation as well as additional eligibility.

Remember, since any eligible depreciation is going to be recaptured down the road, it is in your best interest to ensure that you deduct the full, eligible amount each year.

What’s The Maximum Savings Per Property Or Person?

You can continue to deduct rental property depreciation until one of the following criteria is met:

- You have deducted the entire cost of the property (also called the “basis in the property”), including the cost to purchase, fees and taxes paid at settlement, and any of the improvements you may have made to the property in order to get it generating income.

- You stop using the property to generate rental income. This may be because you decided to sell the individual property, cash out your entire portfolio, or because damage to the home or reversals in the market make the home itself no longer viable.

In addition, you may choose to use a rental property as an income-producing investment for a number of years, then as a primary residence upon relocation or retirement.

At the time that the status changes, the tax deduction for rental property depreciation will no longer be valid.

Is Depreciation Required For A Rental Property?

You are not required to deduct the value of depreciation for your rental property each year.

However, upon the sale of the property — whether it’s in a few years or many years away — you’ll be required to “recapture” the depreciation that was allowable on the property over the time that you owned it.

Recapturing rental property depreciation means that you pay tax on the depreciation you were allowed, even if you didn’t claim it.

That means that there is definitely an incentive to deduct the full amount of the allowable depreciation each year.definitely an incentive to deduct the full amount of the allowable depreciation each year.

How To Calculate Depreciation On A Rental Property

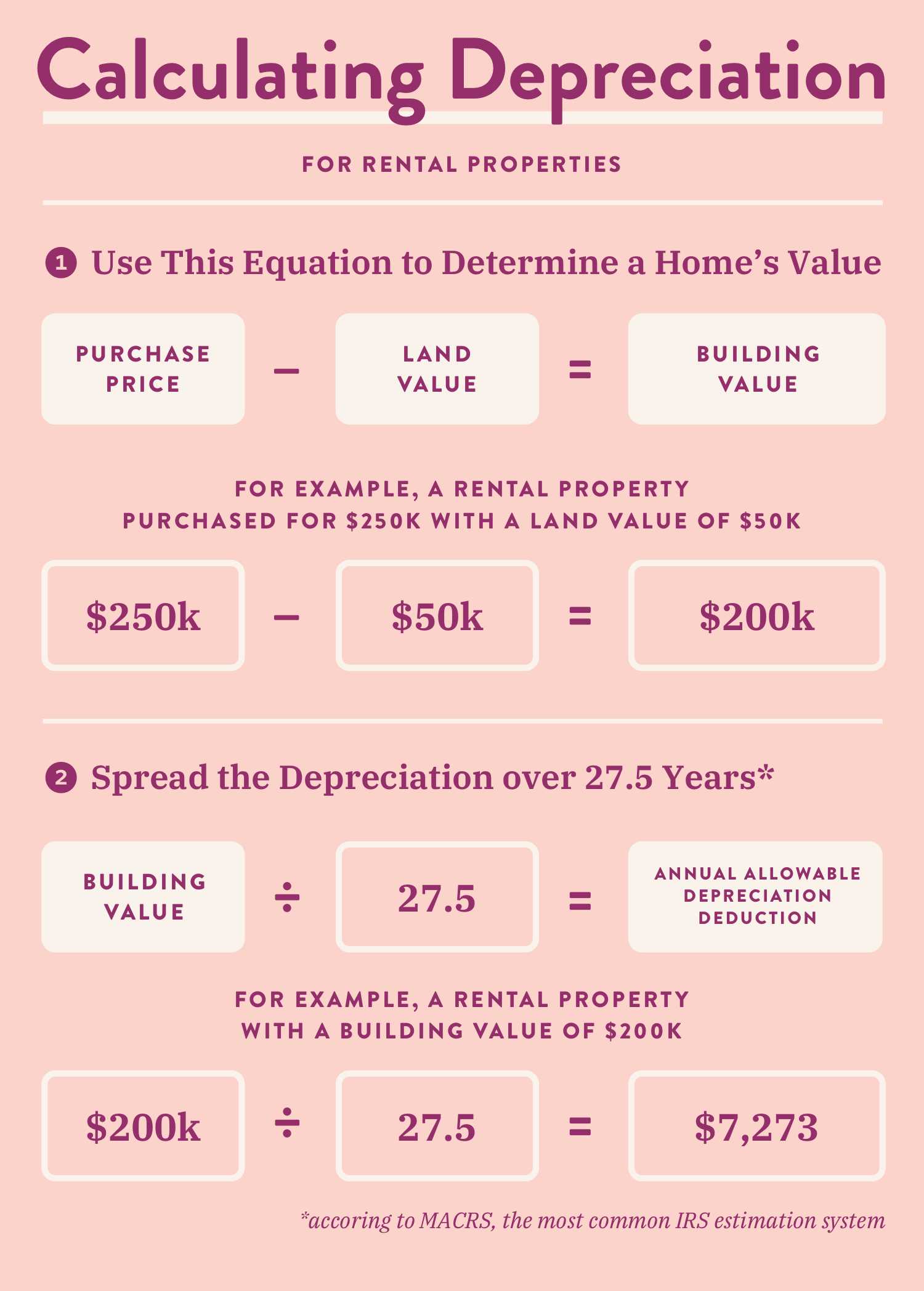

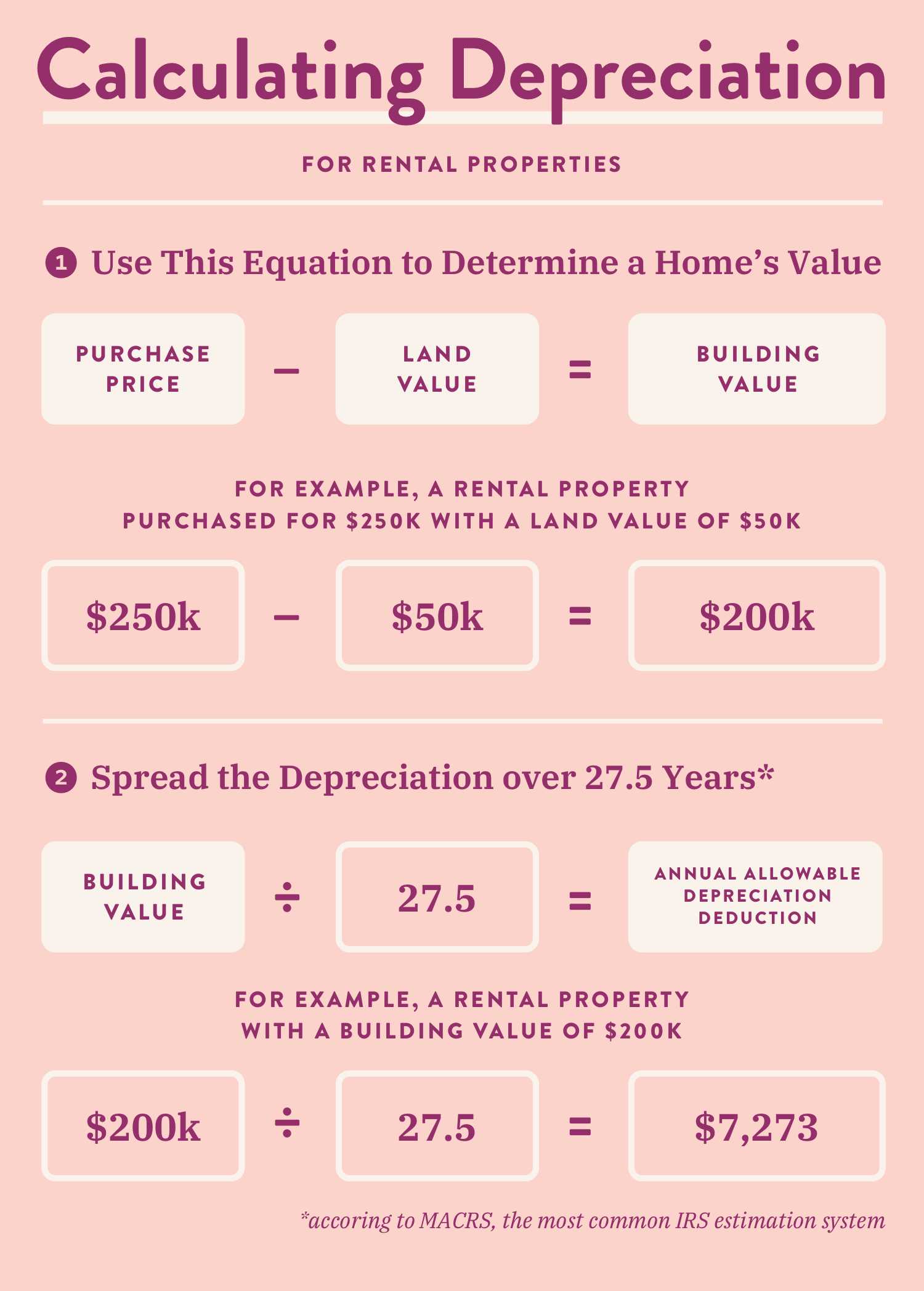

In order to determine how much you can write off for the purchase of the rental property, you’ll need to create two separate calculations.

Let’s imagine you purchased a duplex for $250,000.

For your first calculation, you’ll need to determine what the land value is according to the tax assessment or the appraisal. This will help you determine the value of the home itself.

The formula for this is to subtract the land value from the purchase price, which will provide the building value.

- Purchase Price – Land Value = Building Value

- $250,000 – $50,000 (according to the county assessment) = $200,000 building value

Now, according to the most common IRS estimation system, MACRS, you can spread the depreciation of your residential investment property over 27.5 years. Thus,

- Building Value / 27.5 = Annual Allowable Depreciation Deduction

- $200,000 / 27.5 = $7,273 per year for 27.5 years or until the property is no longer income producing.

Let’s visualize this:

Don’t forget, you’ll also have other expenses to include, such as:

- property taxes

- fees

- insurance

- improvements

You can see how depreciation can make a big difference in the amount of taxable income for which you are liable.

Whether you own one rental unit or an entire portfolio, you will want to ensure that you are maximizing the depreciation deduction for all of your properties and all eligible improvements.

In addition, the depreciation deduction offers you an incentive for keeping your properties in tip-top condition and making improvements to them over time.

This is good not just for your bottom line, but for your tenants and the communities where your properties are located.

If you already own rental properties, spend some time evaluating each one to ensure that you are getting all of the deductions you are eligible for.

Also, consider what cost-effective, value-added improvements you might make in order to enhance each of your properties and improve your deduction.

If you are buying your first property, make sure you keep careful records and consult with a tax professional to ensure that you are properly recording all of your eligible expenses.

Start now putting together a wish list of improvements that will help you continue to grow your property’s value over time.

Continued Learning

Now that you understand more about rental property depreciation, continue your real investing knowledge with these free resources:

Discover how to invest in real estate with bad credit or no money