Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

Everyone invests in the stock market for one reason—to create wealth. But in order to do that, not only do you need to understand how to make money in the stock market; you also need to understand how to lose money in the stock market.

An intelligent investor conducts a security risk analysis — assessing and researching all the stock market risks that can affect his or her investments before investing. Doing so can be the difference between creating lasting wealth and losing the entire investment.

What is risk?

The reality is that every security — a financial item that holds value, such as a stock, bond, CD, real estate, or gold — carries risk.

What is risk and why is it so important to understand?

Risk is the measurable possibility of losing the initial investment or that investment not gaining value. Risk is differentiated from uncertainty, which is not measurable.

This is critical: if you can assign probability estimates to various possible outcomes, then you’ve identified risks. If you do not know what the probabilities are, then you have uncertainty. This distinction is subtle, but important.

When an investor buys a security, typically he or she is most interested in the expected return. For a given investment, a high return is more desirable than a low one every time. But simply knowing the return of the investment is not enough information to make an educated decision.

Here’s why: let’s look at the average return of different securities per year:

- Stocks have returned 10%

- Corporate bonds have returned 6%

- Short-term US Government bonds have returned 3.5%

While investing in stocks seems like a no-brainer due to its percent return above, there are tradeoffs. Stocks have a greater chance of losing value compared to corporate bonds and corporate bonds have a greater chance of losing value compared to government bonds.

In a well-functioning financial market there is no free lunch — dynamite truck drivers make more money than milk truck drivers. If you want high returns in the stock market, you must bear the proportional amount of stock market risk.

As an investor, there are several key concepts that you should know regarding qualitative risk analysis and quantitative risk analysis associated with stock market risk. Understanding these can help prevent you from making a regrettable investment decision.

Systematic Versus Unsystematic Risk

A security risk analysis begins by understanding that stock risk can be divided into two main categories: systematic and unsystematic risk. Systematic and unsystematic risk are two separate entities that make up the total risk of an investment.

Systematic risk, also known as market risk, affects all securities in the same manner. It is a result of broader trends that alter the entire financial system. All securities are stuck with systematic risk — it can’t be eliminated through the strategy of diversifying a portfolio.

Types of Systematic Risk

There are various economic-wide risks that cannot be avoided with investments in the same industry, sector, or country. The risks include:

Political Risk

This is caused by changing government policies, laws, taxes, wars, and sanctions that could negatively impact the flow of goods and services. The United Kingdom’s decision to leave the European Union (known as Brexit) has created uncertainty regarding the UK's future legal and economic framework and how the UK will interact with other countries. Stocks of companies doing business in the UK could carry significant political risk.

Country or Default Risk

This refers to a country that can't honor it's financial commitments. When a country defaults and can't pay back its loans, this negatively affects security such as stocks, bonds, and mutual funds because less cash and therefore less business will flow through the economy. Starting in 2009, Greece nearly defaulted on its debt leading to plummeting stock prices, political instability, and one of the longest recessions of a European country to date.

Environmental Risk

The stock market can’t control fires in California, hurricanes in Florida, or droughts in Arkansas. Environmental risks can’t be avoided and because of this, their presence can decrease profitability and stock values across various sectors exposed to natural disasters.

In 2017, Hurricane Harvey flooded Houston, destroying $125 billion worth of property, according to estimates by Moody’s Analytics Inc. and drastically reduced economic output.

Market Value Risk

Investments will inevitably face fluctuations and decline in value due to overall economic conditions. Economies experience natural cycles of growth and recession. Recessions will affect almost all securities similarly.

The 2008 Recession provides an example of market value risk. Stemming from the collapse of the US real estate market, anyone with money in the market in 2008 saw the values of their investments decline dramatically due to this economic event.

Interest Rate Risk

Changes in market interest rates can increase fluctuations in security values. Ultimately, rising interest rates slow the entire economy as companies and investors alike are less encouraged to borrow and spend money. While interest rate risk may primarily affect the value of bonds, it also indirectly affects stock prices.

Since the 2008 Recession, interest rates have been one of the economy's strongest influences. Interest rates affect everything from individual investments to corporate profits, economic policies, and job creation.

Measuring Systematic Risk with Beta

In the world of stock market investing, security risk analysis commonly includes analyzing Beta, the statistical term synonymous with stock market risk.

The relevant risk of a stock is measured by its contribution to the riskiness of a well-diversified portfolio. A stock’s Beta measures the individual stock’s riskiness compared to the most diversified portfolio available: the S&P 500.

A stock’s return depends upon that stock's systematic risk relative to the overall market. The higher the Beta of the stock, the more volatile the price is, the higher the stock risk is, and the greater the chance that the price will sharply fluctuate up or down.

On the other hand, a stock with a lower Beta is less likely to drop in price, will have low stock risk but will most likely not generate as high of returns.

The market should reward investors for bearing systematic risk, realizing higher returns for securities with a higher Beta.

The S&P 500’s Beta of 1.0 represents the average volatility of all assets in the market. A Beta value greater than 1.0 means the security is more volatile than the market whereas a Beta value lower than 1.0 means the security is less volatile than the market.

You can find the Beta of stock from trusted financial reporting, such as Yahoo Finance.

Unsystematic Risk

Unlike systematic risk, unsystematic risk is specific to individual security or a smaller group of securities with similar characteristics.

For example, different stock market sectors all are exposed to risks unique to that sector, or industry.

For reference, these sectors are:

- Healthcare

- Utilities

- Consumer Staples

- Technology

- Financial

- Consumer Discretionary

- Basic Materials

- Real Estate

- Communications

- Industrials

- Energy

How can these risks be mitigated? By holding a diverse array of stocks within different sectors.

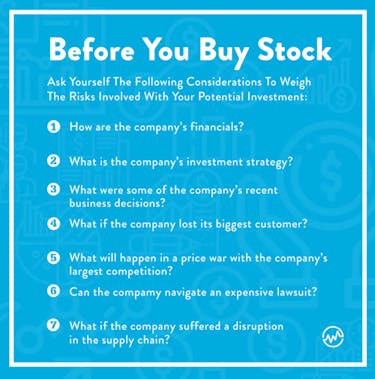

A company’s financials, investment strategy, and business decisions all create unique risks that should be taken into consideration before buying its stock.

What if a company loses its biggest customer? What if there are supply chain disruptions? What will happen in the event that a price war with a larger competitor? Can the company navigate an expensive lawsuit? Can it overcome the death of its innovative founder?

There are an infinite amount of firm-specific risks that are irregular, unpredictable, and could negatively impact an investment’s value.

Studying a company or industry can help an investor identify and anticipate its risks — but how can this be done?

Here’s the answer: public companies are required to disclose the risks that their business is exposed to in their annual reports. Public companies post their annual reports — or 10Ks — on their websites.

Before investing in a company, it’s wise to read the pages at the beginning of the report, which details risk factors.

Managing Investment Risk Through Diversification

Unfortunately, you can’t eliminate total investment risk, but you can mitigate it by holding a well-diversified portfolio of stocks. To understand how to maximize returns while minimizing risk, remember this formula:

Systematic Risk + Unsystematic Risk = Total Investment Risk

Diversification is a strategy that incorporates a variety of investments within a portfolio. As an investor, you want to own stocks across various sectors so that stock or industry-specific risk doesn’t hurt the entire portfolio. Instead of having three stocks of energy companies, it’s much safer for example to own one energy, one healthcare, and one technology stock.

The effects of portfolio diversification allow you to reduce risk but still maintain a higher return. Your overall portfolio risk decreases as the number of stocks increases.

The goal is to eventually have the total investment risk equal to the market-wide or systematic risk as you diversify out all firm-specific or unsystematic risk.

Action Plan

Identifying how you can lose money in the stock market shouldn’t deter you from investing. In fact, it should do the opposite — it should have you feeling confident that you can make the most well-informed decision possible.

The bottom line is that if you want to make money, you have to be willing to lose money. As the saying goes, you have to pay to play. That’s risk.

But understanding these risks— thanks to security risk analysis—will give you a better understanding of your stock market risk tolerance and improve your odds of being successful in stocks.