The Options-to-Income Guidebook

In This Article

Selling options for income is easier than you might think. It’s one of the few strategies where you can be wrong about the direction of the market and still win.

But at the same time, selling options can be complex.

So should you sell options for income?

In this article, we’ll break down selling options for income so that you can do so wisely and profitably.

Let's get started!

What Is An Option?

Just think of the word option. In our everyday lives, an “option” is a choice. It works similarly when you’re talking about investments.

An option is a security. When you’re investing, an option gives you the opportunity to buy or sell a stock at a certain price on or before a specific date.

Basically, you’re buying the option to buy or sell an underlying stock at a certain price.

There are two types of options:

- call options

- put options

Depending on which you choose, you’ll have the right to either buy or sell an underlying stock at the set strike price.

Call Options

A call is an option that offers the right but not the obligation to buy an underlying asset at a certain date for a predetermined price.

If you buy a call option, you are expecting that the underlying stock is going to increase in price. That way you can use your option to buy the stock at the lower “strike price” even though it’s worth more.

Put Options

A put is an option that offers the right but not the obligation to sell an underlying asset at a certain date for a predetermined price.

If you buy a put option, you’re expecting that the underlying stock is going to decrease in price. This way you can sell the stock at a higher “strike price” even though it is worthless.

Strike Price

There’s also a strike price. The strike price is the determined price that you can buy or sell the underlying stock for, regardless of how much the stocks appreciate or depreciate in value.

Expiration Date

But options don’t last forever. If they did, you could just wait for the market to turn in your favor.

The date your option runs out is called the expiration date, and it could be days or years after you purchase the option.

You need to exercise your option before or on this date, or else it will expire.

The Premium

When you buy an option, the price you pay for that option is called the premium. Options contracts give the buyer the right to buy or sell 100 shares of the underlying stock.

Therefore, when you calculate the cost for an option you need to multiply the premium price by 100.

Reading Option Contracts

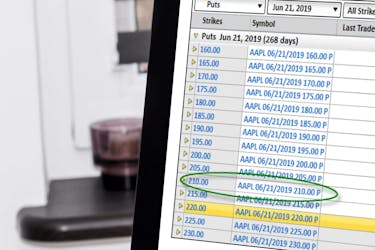

When you first look at an option contract, it might be straightforward or it might be a little confusing.

You might get lucky and see this:

AAPL (Apple) is the ticker, 06/21/2019 is the expiration date, 210 is the strike price, and P stands for “put”.

Or you might need to decipher a code, like this:

AAPL200619P0021000

If you see the latter, here’s how you read it: Ticker - Expiration date - Call or put - Strike price

This option lists the ticker — or underlying stock — as AAPL (Apple).

Expiration date is ordered as year-month-day.

For this option, the expiration date is 200619 (2020, June 19).

The next is Put or Call, and in this case it’s Put (P).

Finally, the strike price is 0021000 ($210).

This means the buyer can sell Apple shares at $210 on or before June 21, 2019.

Remember, each option contract allows you to purchase or sell 100 shares.

Your AAPL200619P0021000 might trade at $20 per share. Because the premium is $20 per share and there are 100 shares, the overall cost is $2,000 = ($20 x 100)

Why Sell An Option?

So, why sell an option?

When interest rates are low, selling put option and call option strategies are intelligent to use as an alternative to traditional fixed-income investments like CDs and treasuries.

Options premiums are paid up-front when an investor chooses to sell options.

In a low-interest-rate environment, the initial premium collected can be two or three times more than the interest earned on treasuries.

Investors who sell options benefit as time goes on, and the option's value declines — the greater the decline, the greater the profit.

The expectation is that the option will expire worthless. When that occurs, the entire premium can be kept as profits minus any brokerage transaction fees.

Because options contracts are derivatives, they can hedge against market risk.

They can be looked at as an insurance policy on stocks in a high-risk trading environment in many ways.

High volatility in the market is usually not desired by investors because the value of their investments will fluctuate more widely.

However, high volatility is preferable when selling put option or call option contracts because, most likely, high premiums are collected.

An investor can then sell options and capture these additional returns for their portfolio. This income offsets market risk and reduces overall investment risk.

Investors may sell options as a source of income and help protect stock portfolios. However, investors should distinguish between selling a naked put versus a covered put.

Before deciding to sell options, it is best to cultivate risk-averse option trading strategies to:

- Protect your portfolio

- maximize profits

- avoid the unlimited risk associated with undisciplined traders who sell options

Should You Sell Options?

Before anyone starts to sell options, it is essential to be aware of the potential risks and rewards.

Options traders who are consistently profitable understand how to take advantage of small but predictable profits while avoiding significant and catastrophic losses.

Selling put option and call option contracts should be taken very seriously.

Below are a few pros and cons of options trading that every new investor should know before officially starting to sell options.

Advantages of Selling Options

Easy to create consistent income

Collecting the premium from selling options is an excellent way to create regular income without being exposed to a high level of financial loss.

The profits from individual trades may be relatively small.

Still, the ability to sell options with a high probability of becoming profitable trades is almost impossible to recreate with other types of investments.

Provides more flexibility for stock investors

Typically, investors in stocks can only hold or sell their shares of stocks in order to minimize losses or protect income.

However, investors can sell options and offset losses or collect additional profits while maintaining their original stock positions.

Less upfront money is required for selling options compared to stocks

Remember: one option contract represents 100 shares of stock. This allows investors to take advantage of investment opportunities of an underlying stock for much less than the cost of purchasing 100 shares of the stock.

Disadvantages of Selling Options

Even with these advantages, there are disadvantages to keep in mind. These include:

Limited profits

Profits are limited to the amount of premium collected to open a trade.

There is no opportunity to take advantage of massive profits generated by large market swings.

Unlimited losses

Theoretically, losses are unlimited if the market moves in the wrong direction.

Depending on how far the move is and how much time is left before expiration, the losses could be substantial.

Not for beginners or casual investors

To sell options successfully requires more education and research than would be necessary for people who trade other investments.

It is almost impossible to sell options profitably overnight. This is why many options trading investors spend time utilizing options trading simulators to refine their investing strategy.

However, it is realistic to earn relatively passive income by utilizing conservative strategies and responsible money management practices.

Proper education helps protect against excess risk and is the beginning of the journey to sell options and create consistent income by collecting the premiums they provide.

What is an Option Premium?

An important term to know when discussing the topic of “how to sell options” is an option premium.

What is it, and how can it affect your options strategy?

The total amount paid for an option contract by an investor is the option premium.

Simply put, the options premium is calculated by adding the intrinsic value plus the time value.

The intrinsic value is calculated by using the difference between the underlying asset's current price and the option's strike price.

If a stock is currently trading at $50 and the stock option has a value of $40, then the intrinsic value is $10.

The stock option could be exercised at $40, and each share of the stock could then be sold for the current stock price of $50, which could create a profit of $10 per share.

The total amount of money an investor is willing to pay above the intrinsic value is the time value. Therefore, if an option's premium is $15 and the intrinsic value is $10, the time value is $5.

In general, the more time on a contract before expiration, the more money investors are willing to pay.

More time allows investors to wait for the underlying asset to make a profitable move for their position. Therefore, investors will pay a higher premium for that privilege.

For someone selling options, the higher the intrinsic value and the more time there is until expiration means more options premium (maximum potential profits) can be collected when the trade is first opened.

3 Strategies for Selling Options

Multiple strategies can be implemented to create consistent income selling options.

Next, we will explore three well-known strategies that deal exclusively with selling options and collecting premiums.

Selling Naked Options

This is the riskiest of all option selling strategies.

If the research reveals a high chance that the underlying asset will make a massive move up or down, selling a naked call or a naked put option will create an opportunity to generate limitless profits.

However, if wrong, the position is exposed to unlimited losses.

The Short Straddle

A short straddle is an options trading strategy that involves selling a call option and a put option with the same strike price and date of expiration.

If the research determines that the underlying asset will not make a substantial move before the expiry, a short staddle could be a winning strategy.

A short straddle has a lower probability of winning when compared to a short strangle.

However, the profit potential is higher.

The Short Strangle

A short strangle is a neutral options trading strategy involving the simultaneous selling of a slightly out-of-the-money put option and a slightly out-of-the-money call option of the same underlying asset and date of expiration.

A limited profit is earned if the underlying asset remains within the two strike prices at expiry.

While the win probability can be higher than a short straddle or naked call or put (especially when using out-of-the-money strike prices), the profit potential is lower.

Furthermore, the trade is still exposed to unlimited losses if there is a significant move in the market.

A short strangle may sometimes be referred to as a sell strangle. It is also known as a range-based strategy to sell options.

The Bottom Line: Sell Options

Selling puts allows you to win whether the market moves up, down, or sideways.

But keep in mind there are some risks associated with options trading. How can you mitigate those risks?

If you educate yourself and trade options using specific strategies, the form of investing can be even less risky than trading stocks.

According to the Chicago Board of Options Exchange, selling options is one of the few strategies that outperform a buy-and-hold strategy over time.

So what are you waiting for?