Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

- What is the Sharpe Ratio?

- What is the Sharpe Ratio’s Formula?

- How to Utilize A Good Sharpe Ratio

- Using the Sharpe Ratio When Adding a New Asset to an Existing Portfolio

- Advantages of The Sharpe Ratio

- Limitations of the Sharpe Ratio

- Sharpe Ratio of the S&P 500

- Sharpe Ratio vs Sortino Ratio

- Sharpe Ratio vs Treynor Ratio

- The Bottom Line: Calculating Sharpe Ratio

Is the only thing that determines the quality of an investment its return?

If your friend invests in stock ABC and it returns 15%, and you invest in stock XYZ and it returns 12%, can we say with confidence that your friend made the better selection?

Not necessarily.

Total return should not be the only factor we consider while evaluating investment decisions. Instead, risk and reward must be analyzed in tandem when considering multiple investment choices.

The Sharpe Ratio calculation is one of the best tools for measuring the balance between risk and reward. But knowing the sharpe formula is only half the equation — you have to know what a good sharpe ratio is.

In this article, we’ll break down how you can utilize the sharpe ratio to measure risk and reward in your next investment. In addition, we’ll answer the question “what is a good sharpe ratio?”.

Let’s get started!

What is the Sharpe Ratio?

Developed by Nobel laureate William Sharpe, the ratio is a financial metric that provides a numeric value of an investment’s risk/reward profile, allowing diverse investment options to be judged pragmatically.

More specifically, it describes how much excess return you receive for the extra volatility you endure while holding a riskier asset.

So, the ratio provides us with a measure of outperformance per unit of volatility (or risk) which can be used to compare multiple investment options based on their unique risk/reward profiles.

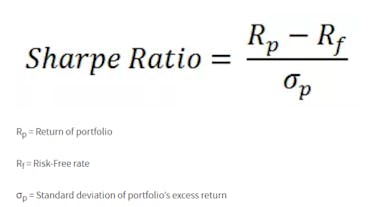

What is the Sharpe Ratio’s Formula?

The Sharpe Ratio’s formula is:

Let’s put it into practice: Investment Manager A generates a return of 20%, and Investment Manager B generates a return of 16%.

It appears that Manager A is the better performer, but if Manager A took larger risks than Manager B, Manager B may have had a better risk-adjusted return.

Let’s say that the risk-free rate is 5%, Manager A's portfolio has a standard deviation of 7.5%, and Manager B's portfolio has a standard deviation of 3%.

The Sharpe ratio for Manager A would be 2.00, while Manager B's ratio would be 3.00. Based on these calculations, Manager B has the better portfolio.

What is a Good Sharpe Ratio?

Now that we know what the Sharpe Ratio is, you may be wondering the question “What is a good Sharpe Ratio?”

Investments (or portfolios) with Sharpe Ratio calculations above 1.00 are considered “good”, because this suggests it produces excess returns relative to its risk.

If you find a mutual fund or other investment with a Sharpe Ratio higher than 1.00, it’s worth taking a further look.

If a good Sharpe Ratio is higher than 1.00, then a ratio of 1.50, 2.00, or higher is excellent.

That’s the best answer to the question “what is a good sharpe ratio?”

Remember, the Sharpe Ratio shows you the quality of returns. A good sharpe ratio — i.e a high sharpe ratio — means the returns were generated by good decision-making, not gambling on high-flying investments. A manager with a long track record of consistently good sharpe ratios has reliably proven their ability to create value for their investors.

What is a Poor Sharpe Ratio?

Now that you know what a good sharpe ratio is, let’s look at the alternative — a poor sharpe ratio.

Investments with Sharpe Ratio calculations below 1.00 (especially ratios significantly below 1.00) should be avoided.

If a portfolio is consistently showing a Sharpe Ratio of less than 1.00, its returns are paltry when compared to the risk it’s undertaking. For example, if you own a mutual fund which is returning 6% and has a 12% standard deviation (giving a Sharpe Ratio of 0.50), it’s time to look for a new fund.

How to Utilize A Good Sharpe Ratio

Outside of using it for forward-looking decisions, a Sharpe Ratio calculation can also be used to evaluate past performance relative to the level of risk undertaken (as in the example above).

The sharpe ratio can explain whether a portfolio's excess returns are due to wise investments or a result of taking on too much risk.

This is especially true in the case of mutual fund selection: Although one fund may enjoy higher returns than its peers, it is only a good investment if those higher returns do not come with an excess of additional risk.

On the other hand, a fund with lower returns than its peers but with much less volatility may be an excellent addition to stabilize your portfolio.

Using the Sharpe Ratio When Adding a New Asset to an Existing Portfolio

The Sharpe ratio calculation can also be used to compare the change in overall risk-return characteristics when a new asset is added to an existing portfolio.

For example, an investor is considering adding a hedge fund to her existing portfolio that is currently split between stocks and bonds and has returned 15% over the last year.

The current risk-free rate is 3.5% and the volatility of the portfolio’s returns was 12%, giving her a Sharpe Ratio 0.958.

The investor believes adding the hedge fund to her portfolio will lower the expected return to 11% but also expects the portfolio’s volatility to drop to 7%.

The investor finds her portfolio would have the expected Sharpe Ratio of 1.07 — a good sharpe ratio.

The performance, on a risk-adjusted basis, has improved. Thus, adding the hedge fund to the portfolio would be beneficial.

Advantages of The Sharpe Ratio

As we just demonstrated, the main advantage of the Sharpe Ratio is measuring whether a portfolio’s positive returns were the result of good management or taking on unnecessary risk.

In the example above, Manager A’s 20% return looked great at face value when compared to Manager B’s 16%. But, after considering the volatility needed to capture those returns, B looks like the better manager.

Limitations of the Sharpe Ratio

There are two drawbacks to using the Sharpe Ratio: Its usage of standard deviations and the ability for fund managers to tweak their inputs. We’ll look at both next.

Standard Deviations

The Sharpe Ratio calculation uses the standard deviation in the denominator as its proxy for risk, which assumes a normal distribution of risk (like a typical bell curve).

Financial markets, in reality, tend to be much messier.

Real returns are skewed away from the middle as large drops and unexpected spikes drive prices in both directions.

To put more succinctly, the Sharpe Ratio assumes a “typical” amount of risk — in practice, investors know there’s no such thing as “typical”.

Input Changes

Secondly, fund managers who report their Sharpe Ratios can tailor the formula to use inputs that give the most favorable results (instead of using a neutral look-back period).

This cherry-picking of the data leads to distorted views of past results and can mislead investors to expect higher future returns than will actually occur.

Sharpe Ratio of the S&P 500

What is the shape ratio of the S&P 500 — the benchmark of stock investing? Is it considered a good sharpe ratio, or a poor one?

Given the standard deviation and current risk-free rate, the S&P’s Sharpe Ratio is 1.06 — certainly in the category of a good sharpe ratio.

Sharpe Ratio vs Sortino Ratio

A variation of the Sharpe Ratio is the Sortino Ratio, which removes the effects of upward price movements on the standard deviation.

Both positive and negative volatility (sharp increases and decreases) count towards a stock’s total volatility.

Advocates of the Sortino Ratio disregard upside volatility as risk, since that type of movement is positive for an investment.

The ratio solves that by only measuring the downward price movements to determine volatility, which may give a more accurate view of risk — only adverse risk.

For example, consider a portfolio which has a return of 12%, the risk-free rate is 2%, the standard deviation is 5%, and the downside deviation is 4%. The portfolio has a Sharpe Ratio of 2.00 and a Sortino Ratio of 2.50.

Sharpe Ratio vs Treynor Ratio

A second variation is the Treynor Ratio.

The Treynor Ratio replaces standard deviation (which measures the risks of a single stock or portfolio) in the denominator with beta (which measures the risk of a market as a whole).

By doing so, the ratio attempts to determine whether an investor is being compensated for taking additional risk beyond the inherent risk of the market in general.

If a stock market index, which has a beta of 1.00, returned 8% and your portfolio returned 10% with a beta of 2.00, the Treynor Ratio shows you undertook twice the volatility of the general market for an extra 2%.

The Bottom Line: Calculating Sharpe Ratio

The risk and reward of any investment or portfolio must be evaluated together when making investment selections.

The Sharpe Ratio is a simple yet powerful tool you can use to calculate the investment choice which will provide the greatest level of returns relative to the risk of any asset.

Failing to account for risk is a common, critical mistake that savvy investors know how to avoid.