Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

Do you know what to look for when you start shopping for rental properties? How can you tell a good rental property from a bad one? What makes a rental property a good deal? How do you know you aren’t shooting yourself in the foot by buying a rental property that will never offer you a profit?

If you are new to investing, you’re probably in the dark when it comes to things to consider when buying a rental property.

It’s fair.

After all, you don’t know what you don’t know. How could you know when you were never taught?

To help you get started, here are 5 important considerations you should keep in mind as you begin rental property shopping:

Numbers matter in real estate investing. Period. Numbers are the whole point of investing in the first place. We invest in real estate to make money, and money is formatted in numbers.

Cash Flow

Let’s start with an easy one. Where is your profit coming from on a rental property? Profit comes from the difference in income and expenses. What are those numbers?

Every month, a rental property will cost you money. Most months, you will receive income from that same rental property.

What you need to determine is which is higher — the income or the expenses?

That’s your cash flow.

It will either be negative or positive each month.

Ideally, your rental property will produce positive cash flow each month. This means you’re earning more than you’re spending.

However, there are some good reasons to buy a negative cash flow property. But regardless of whether you’re shooting for positive cash flow or you’re okay with some negative cash flow, you need to know what the projected cash flow is.

Remember: you’ll need to calculate your cash flow based on concrete numbers.

There’s no room for your “best guess” here.

Return on Investment

Once you know your cash flow, you can start to calculate what kind of return on your investment you’ll be looking at. The big question is:

How much income will you receive compared to how much you invested?

You’ll often hear this described as your return on investment, otherwise known as your ROI.

There are multiple ways you can make money on your rental property: monthly cash flow, appreciation, tax benefits, equity build-up via mortgage paydown, and indirect profit via hedging against inflation.

A perfect rental property will produce income from all five of these profit centers, but not all five apply to all properties. All five aren’t even necessarily required in order to see a profit.

What you do need to know before buying a rental property (or any investment property) is which profit centers you can reasonably expect to see income from. If you don’t have a confident answer for this, you aren’t ready to buy the property.

Your overall ROI will include your gross income from all of the applicable profit centers. But there’s a catch — ROI can be tough to calculate accurately. Not all of the numbers you’ll need for your calculations are readily available.

Appreciation, for example, is speculative and not guaranteed.

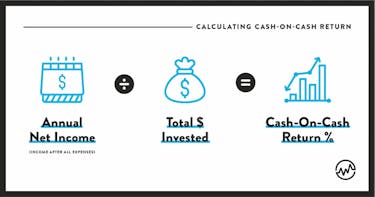

Tax benefit returns are also very hard to calculate. Due to these unknowns, the “cash-on-cash return” is typically calculated on a month-by-month basis.

The cash-on-cash return can be calculated by dividing the annual net income (income after all expenses) by how much money you put into the deal. This will show you the percentage return you are getting on your investment. This number can be positive or negative. If it’s negative, you may need to look for another property.

At the end of the day, the price of the property will be the primary contributor to the numbers because this, combined with the condition of the property, will determine your expenses on the property.

The question you have to ask with every property you see while you shop is: What are the numbers?

The next question you’ll need to ask yourself after you run the numbers is whether or not those projected numbers will ever see the light of day.

What does this mean?

When you run numbers on a property, those numbers are projected numbers and they remain projected numbers until they are proven — but they can’t be proven until you’ve already bought the property.

This may seem unfortunate. It is. But there are some factors that can help you predict the odds that your projected numbers will become proven numbers.

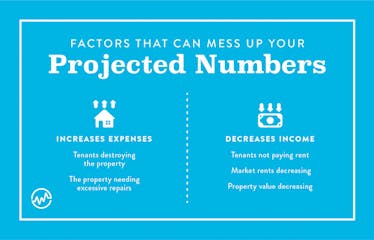

First, take a look at what factors can mess up your numbers.

Some of these things may include:

- Tenants not paying rent (decreases income)

- Tenants destroying the property (increases expenses)

- The property needing excessive repairs (increases expenses)

- Market rents decreasing (decreases income)

- Property value decreasing (decreases income)

See any trends there? How about tenants, property quality, and market? Those 3 things will be the biggest threats to your cash flow. So then what should you think about in order to minimize those threats?

Tenant quality

It’s not enough to just have tenants. You need good tenants.

You don’t want tenants who don’t pay rent. You don’t want tenants who damage your property. You don’t want transient tenants.

These sorts of tenants will severely impact your income by saddling you with repair costs, vacancy costs, turnover costs, eviction costs, and a loss of whatever value you want to assign to your sanity (cost of therapy, maybe?).

Property quality

If you buy a fixer-upper, you can bank on having to eat the repair expenses.

If you budget excessive repair expenses into your numbers and the numbers still work out, that’s great. But if you buy a nightmare mess of a property and tell yourself that you won’t be consistently paying to fix it, you’re deluding yourself.

Location, location, location

The location of your rental property will strongly impact its fate.

If a market declines, so will the value of your property. The rent will decrease. The quality of your tenant pool is likely to suffer.

If a market continues to grow, on the other hand, so will demand. Demand increases property values, rents, and tenant quality.

Location is one of the biggest determinants for property demand. Two aspects of location should be considered: the larger market that you invest in (the bigger city the property is closest to) and the neighborhood in which the property is located.

The things that keep your numbers up are also the things you should think about when considering risk.

This means you should think about buying properties that don’t pose excessive repair risks and buying in decent locations.

You’re either going to be fixing things constantly or you’re not.

It’s okay if you are — but you need to be aware of what you’re signing yourself up for. How much time and money will you need to put into this? Be realistic. You need to know before you buy your property. If you don’t plan for this, your profits will be eaten up by repair expenses.

You also need to think about how much effort you’re willing to put into a fixer-upper. If you aren’t willing to take on what’s essentially a second job, then it might be in your best interest to reconsider. If you buy a fixer-upper, it’s going to require a significant amount of your time and attention.

There’s a big difference between rent-ready properties and fixer-uppers in terms of your financial, time, and sanity investments. A newer, nicer home in mint condition will require a lot less maintenance than an older, cheaper property. While rent-ready properties require minimal work, they are typically more costly upfront.

There is no wrong condition of property to invest in. You just need to make sure the quality of your property aligns with the amount of responsibility you’re willing to take on. Make sure the property you invest in is one that you want, one your can handle, and one that your budget can accommodate.

The source of the property doesn’t really matter as long as the property itself checks out. But new investors might not know exactly to look for when judging a rental property. This makes it easy for a shady deal to end up on your plate without you even knowing it.

So who is selling you this property? Why are they selling it?

If you buy an investment property from a wholesaler, how credible is that wholesaler? Do they know what makes a good deal? If they are an amateur wholesaler with minimal experience, they could easily be presenting you a trash deal. If they know what they’re doing and they have a keen eye for killer investment properties, you’re probably in good hands.

Where did you find this property? Did you find it on the MLS? In an investor’s market, properties from the MLS are often deemed automatic bad deals because most properties don’t even make it to the MLS.

But that doesn’t mean it is a bad deal. You just need to dig in.

If your property is on the MLS and it’s a normal market, how long has it been listed? If it’s been listed for a long time, you can probably assume there are some red flags there.

You should know where your property comes from and why it’s being sold. Knowing these two things can eliminate a bunch of red flags and risks.

While the source might not matter for a seasoned investor, beginners should gain some insight to these questions. The answers can give you more valuable information than you might realize.

While the other 4 considerations may seem commonplace, very few people think about the rentability of their property.

Let’s say you buy the nicest property on the block in one of the nicest neighborhoods in town. It’s scheduled to cash flow and you’re pumped. You think you’ve just found the most rockin’ rental property investment out there. The property inspection comes back clean, the house is great, and you feel like you just landed the deal of a lifetime.

What could go wrong?

You buy the house. You list it for rent.

No responses — or maybe one or two, but nothing serious.

No prospects.

What’s going on?

You lower the rent some, thinking maybe you overpriced it.

Still minimal response.

You got the best property in the neighborhood.

What gives?

Turns out you bought too nice of a rental property. In the nicest neighborhood in town, most people aren’t renting. They’re buying. There’s no rental pool in your area.

And there it is: rentability. How rentable is your property?

There are a million little factors that could make a property less rentable than you might’ve expected. Rentability should be in your mind any time you are shopping for rental properties.

Unfortunately, this isn’t something you can conduct a quick search for online. The best way to find out how rentable a prospective rental property is would be asking either a real estate agent or a local property manager.

How likely is your property to find a good tenant?

Is there a solid tenant pool?

How are the vacancy rates in that area — is it easy to fill properties?

2 Things to Ignore While Rental Property Shopping

In addition to these 5 things to look for while shopping for rental properties, there are 2 key things that you should not consider while you shop:

1. Estimated numbers.

It’s so common to see people analyze prospective rental properties using only estimated numbers. There is absolutely no reason to only use estimates in your calculations. The amount of risk in that is absurd.

The only expenses that should be estimated are repairs and vacancy expenses. And even with repairs, costs should be based off ongoing maintenance rather than off-the-bat rehab.

Property taxes can be found on the tax assessor website for the county in which your property is located. You can get an actual insurance quote.

Property management fees, condo, or homeowner fees, and any miscellaneous fees like those can be determined ahead of time.

If there are no tenants in the property currently, you can offer a real estate agent or property manager some money to run a Comparative Market Analysis (CMA) to come up with a realistic rent amount for that property.

You really want the rent as un-estimated as possible because the rental income is a key factor in your overall investment.

2. Percent rules

If you’ve looked into real estate investing, you’ve heard of these . . . the “50% rule”, the “2% rule”, the “1% rule”. They can be helpful, but they’re not a valid replacement for really crunching the numbers.

50% Rule

The 50% rule tells us that 50% of rental income will go towards expenses. That would mean that the remaining 50% is free for you to pocket. This is the most dangerous percent rule of them all.

The 50% rule might pan out in some cases, but there are plenty of locations where property prices are so expensive that the 50% rule is downright foolish. Banking on this rule could land you in a nasty spot when you see your actual cash-flow.

2% and 1% Rule

The 2% and 1% rules can also be risky.

They tell us that a deal is good if the rental income is equivalent to or higher than 2% or 1% of the purchase price of the property. In some cases, this can be true. The 2% rule is often suggestive of good cash flow, but nowhere in either of these percent rules is there any mention of numbers sustainability.

In a seller’s market, any property that meets the 2% rule is likely riddled with risk. Maybe it’s in a dangerous area, or the property is falling apart, or it’s in a trashed city . . . who knows. In those markets, buying a property based on the 2% rule could be highly disadvantageous.

These percent rules can be used for very surface-level shopping, just to quickly analyze which properties you’d like to pursue further.

But once you have some properties you’d like to look at more seriously, the percent rules should be thrown out the window.

There you have it: your first guide to rental property shopping.

By no means will the right answers to each of these checklist items guarantee success, but you’ll be a lot further along the road to success if you take the time to look at each of these things.

At the end of the day, there’s no better teacher than experience. But hopefully, these checklist items allow your “experience” learnings to be less treacherous and more supportive of you reaching your rental property goals.