Subject-To Real Estate Investing

The Mortgage Takeover Method for Investing in Cashflow Properties

In This Article

- What Is A Subject To Real Estate Deal?

- Advantages of Subject to Real Estate Deal

- Disadvantages of a Subject to Real Estate Deal

- Types of Subject To

- When To Offer Subject To Real Estate Deal

- When NOT To Do A Subject to Real Estate Deal

- How to Present Subject To Real Estate Deal

- Creating The Contract

- Making Payments

- Subject To Real Estate Examples

- How to Use a “Subject To” Real Estate Deal to Invest in Real Estate

- Continued Learning: Real Estate Investing

What is a subject to real estate?

Although being a real estate investor requires a conventional approach to investing, there are some scenarios where these conventional options — such as using private money lenders or traditional mortgages — may not work.

Using creative, outside the box methods of financing can secure a profitable deal at times when a conventional method can’t get the job done.

One of these creative methods is known as a subject to real estate.

This subject to real estate strategy can be an effective method if you are just starting in real estate investing. Or, if you are already an experienced investor, subject to real estate is another investment strategy that you can add to your toolbox.

In this article, we’ll explain tips about how to effectively use this unique method of real estate investing, including:

- What is a subject to real estate deal, along with its unique history

- The advantages associated with a subject to real estate, and its legal ramifications

- When to offer a subject to real estate deal, and how to present it

- Additional real estate resources

Let’s get started!

What Is A Subject To Real Estate Deal?

So what is a subject to deal in real estate?

Let’s first define what a subject to real estate deal is. It is purchasing a property subject to the existing mortgage that is already in place.

With a subject to, you are not formally assuming the loan; instead you are taking on the responsibility of making sure the mortgage is paid on time until you renovate and resell the property.

In this scenario, the terms of the note that were initially created with the lender stay the same — this includes the name in which the loan was purchased.

History Of The Subject To Real Estate Deal

Maybe this is the first time you’ve heard of a subject to. But it isn’t a new form of real estate financing. In fact, people have been asking “what is a subject to deal in real estate” for some time.

In the 1950s and 1960s, it was a common practice: homeowners would sell their property to a buyer with insufficient credit subject to the existing mortgage to purchase on their own.

Over time, banks evolved and made it easier to buy houses with personal credit. Because of this, the subject to became less popular.

But it can still be used today on listed and distressed properties because there is nothing illegal or unethical about buying a property subject to.

Advantages of Subject to Real Estate Deal

Here are a few advantages for everyone involved in the subject to the process, along with the legal ramifications.

Advantages For The Investor

- You don’t have to qualify for a loan

- You have the advantage of the owner’s lower interest rate

- You have instant ownership in the home

Advantages For The Homeowner

- Provides an instant solution to their urgent problem

- It can improve the homeowner’s credit rating (because you are making their payments)

- Quick process

- There are no closing costs, no fees, and no repairs

Advantages For The Lender

- The loan is made current and payments are made on time

- A possible foreclosure is avoided

Disadvantages of a Subject to Real Estate Deal

Subject to real estate is an easy option for investors and sellers, but there are some disadvantages to using subject to for your real estate transaction.

Disadvantages For The Investor

- The lender for the subject to real estate can exercise their right to call the loan in, requiring that the loan get paid in full

- The seller of the subject to real estate could file for bankruptcy, making the investor lose the money spent on mortgage payments on the subject to

- The subject to seller’s situation may change, and now they want their property back. This could lead to a legal battle between the investor and the subject to seller

Disadvantages For The Homeowner

- The subject to homeowner’s credit rating is in jeopardy if the investor doesn’t make the mortgage payments

- The loan is still in the subject to homeowner’s name, which may prevent him from being able to carry other loans until this one is paid in full

- The owner of the subject to real estate doesn’t have any control over how fast the loan is paid

Disadvantages For The Lender

Lenders are typically happy no matter who pays the loan, so their disadvantages aren’t as significant as those of the investor and homeowner.

The impact on the lender is minimal:

- The lender is usually out of the loop on a subject to real estate transaction and unaware of the sale

- If the lender is unaware of the subject to sale, they missed the chance to charge the investor a loan assumption fee

Legal Ramifications Of A Subject To Real Estate Deal

First and foremost, use a trusted real estate attorney throughout the process of the deal to protect you and the homeowner.

Also, ensure that all prospects of the subject to is in writing.

- Contracts are state-specific, so ensure that you are using a contract for your state.

- Almost all mortgages have a due-on-sale clause, giving the lender the chance to call the loan in case of a sale or transfer. In this scenario, the bank may require that the loan is paid in full in 30 days. Lenders rarely enforce this clause because they want regular payments and not foreclosures. However, it is still important to have a backup plan. Again, while the loan being called due is highly unlikely, it is possible.

- There is safety in using a third party to hold funds and make mortgage payments. You can also let the homeowner have limited access to account to see that mortgage payments are being made on time.

- A possible foreclosure is avoided

- You will need to open a new insurance policy, naming you or your company as the insured. This limits liability

- Some state realtors can be fined for performing subject to sale. Make sure your realtor is educated in the process and this type of contract

Types of Subject To

Within a subject to real estate deal, there are 3 types of creative financing that you can utilize.

A Straight Subject To Cash-To-Loan

This occurs when a buyer pays the difference between the purchase price and the existing loan balance.

Because of its straight forward nature, this is the most common type of subject to real estate deal. And when someone is talking about a subject to, this is typically what he or she is referring to.

A Straight Subject To With Seller Carryback Wrap-Around Subject To

In order to understand this type, you first have to understand that a seller carryback is simply seller-provided financing.

Thus, a subject to real estate deal with a seller carryback takes the form of a second mortgage.

Wrap-Around Subject To

This is the third option. Because the seller is making money from the existing mortgage balance, the wrap-around subject gives the seller an override of interest.

Depending upon which type is best for you depends upon your financial situation — along with the situation of the seller.

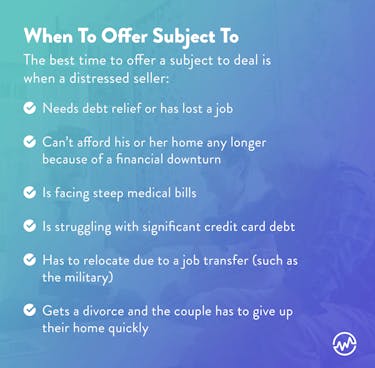

When To Offer Subject To Real Estate Deal

The best time to offer a subject to deal is when a distressed seller:

- Needs debt relief or has lost a job

- Can’t afford his or her home any longer because of a financial downturn

- Is facing steep medical bills

- Is struggling with significant credit card debt

- Has to relocate due to a job transfer (such as the military)

- Gets a divorce and the couple has to give up their home quickly

You can also offer use subject to if you are considering investing in the following properties:

- Homes with existing equity

- Homes with minimal equity, but make sure you are happy with the ROI

- Multifamily homes with cashflow are also ideal for this type of deal

- Rehab properties where existing homeowners cannot afford to make the repairs

When NOT To Do A Subject to Real Estate Deal

Some homes may not be good subject to investments because of circumstances with ownership or the existing loan.

A property co-owned by a group of individuals may be one to avoid.

Subject to real estate requires complete transparency and buy-in between sellers and buyers. With more owners involved, there are additional opportunities for one to change their mind about the sale.

In addition, a bankruptcy by one could lead to the investor losing his money.

Homes with higher interest rates, or variable ones, may not be good subject to investments, because one of the biggest advantages to subject to investing is acquiring properties with lower interest rates.

Sometimes it’s not the property that’s not a fit for subject to investing — it’s the investor.

Investors should have access to quick cash when buying subject to properties.

This is not only for making any back payments due to the lender, but as insurance against the lender exercising the due-on-sale clause.

Without the funds and credit worthiness to assume the mortgage should the lender call in the loan, investors risk losing the money they’ve invested so far in mortgage payments.

With these kinds of properties, you may want to profit as a wholesaler rather than a subject to investor.

How to Present Subject To Real Estate Deal

Now that you know when to offer a subject to, let’s examine how to present a subject to.

When presenting a subject to real estate deal, keep in mind that the motivation of every home seller may be unique, so you have to be understanding of their needs.

You have to determine if the subject to real estate deal is the best choice for a seller.

If you are presenting “subject to” to a seller, present it as one of the options.

You should explain to the seller that, in some situations, selling through traditional or conventional channels can actually be detrimental to their best interest.

Their home may stay on the market for a long time or the buyer may need considerable time to arrange to finance.

This also means paying commissions and holding costs.

Also, since the buyer will be responsible for making the mortgage current as well as making the payments on time, this can improve the seller’s credit score.

Your conversation can be along these lines:

“Our company has an amazing program for sellers like you. We will pay off your mortgage, and you don’t have to worry about defaulting on your loan. Also, with this program, you can improve your credit score, which will help you in the long run.”

Then you can inform the seller about the legal ramifications of the transaction.

It is important to be open, transparent, and honest and answer all their questions and concerns truthfully.

Due Diligence Checklist for a Subject To

When offering subject to, due diligence is vital.

Here is a brief, 3-point checklist to ensure that you are protected in the deal.

Research State Laws

This is because the laws of different states tend to vary with regard to how they deal with subject to real estate transactions.

Research The Loan Terms And Look For Items or Clauses, Such as Prepay Penalties

Consider whether the loan is fixed-rate or adjustable and whether or not the loan has been modified. You should also determine if insurance and taxes are included in the monthly payment.

Determine If You Have To Pay Past Balances

If there are significant past balances in items such as utilities, this can factor into how much cash you will need.

Creating The Contract

A subject to real estate contract should be created with an attorney present as well as a live notary who can authenticate the documents.

Subject to contracts are legally binding and enforceable in a court of law. Record the contract in a district court where the relevant property is located.

You will also have to make sure that your seller signs a limited power of attorney as well as an authorization to release information form.

This form will allow you to call the lender and inquire about the loan directly.

Making Payments

You may need significant cash for your “subject to” deal if you need to make back payments before going subject to in the event of a foreclosure, or if you have to make considerable repairs before putting the property on the market.

When you begin making payments, ensure that you:

- Have a trusted title company on your team

- Set up an escrow account or a separate bank account and have your title company make the payments from that account

- Set up insurance and hazard insurance policies in your name as the new owner. This is because old policies are voided when the title deed changes hands

Subject To Real Estate Examples

We’ve discussed the three types of subject to transactions.

Now let’s compare how they work using a home listed for $175,000 with a mortgage balance of $125,000.

Example #1 – Using Straight Subject To Cash-To-Loan

The cash-to-loan subject to the transaction is the most straightforward.

In this example, the buyer pays the seller the difference between the sales price and the loan balance: $50,000.

Example #2 – Using Straight Subject To With Seller Carryback

Now, let’s suppose the buyer doesn’t have $50,000 to pay the seller, but he has $25,000 available. In this case, the seller accepts the $25,000 and agrees to carry the balance at an interest rate and term they negotiated.

The buyer makes a monthly mortgage payment to the lender and a monthly payment to the seller.

Example #3 – Using Wrap-Around Subject To

Wrap-around subject to is a new loan that includes the existing mortgage and is seller-financed.

We’ve mentioned that the seller earns money on the existing mortgage using a wrap-around subject to.

Here’s how:

Above, we’ve established the sales price as $175,000 and the mortgage balance as $125,000.

Let’s assume the interest rate on the existing mortgage is 3%.

As with example #2, the buyer paid $25,000 of the $50,000 and asked the seller to finance the remaining $25,000.

In this example, the seller is carrying $150,000 ($175,000 sales price - $25,000 down payment).

By charging the buyer 4% interest, he’s making 1% on the existing $125,000 mortgage balance and 4% on the $25,000 balance.

How to Use a “Subject To” Real Estate Deal to Invest in Real Estate

A subject to is another creative method of financing that savvy real estate investors have in their toolbox.

There is nothing illegal or unethical about buying a property subject to. Before you enter into a subject to real estate deal, it’s critical to understand and weigh each advantage and legal ramifications and speak with a real estate attorney.

Now that you know the answer to “what is a subject to deal in real estate”, you can share the answer with others when they ask the question.

Continued Learning: Real Estate Investing

A subject to real estate deal isn’t the only way to invest in real estate.

There are several other financing options, explained in these free WealthFit resources:

- Boost your real estate investing IQ with these resources

- Discover other forms of real estate investing, such as investing in real estate notes, mobile homes, or commercial real estate

- Learn 5 ways to invest in real estate even if you have bad credit

- Find out how to find the best real estate investment deals in your local area

- Learn how to fix and flip a property

- Find out how rental income is taxed — and how to save money on taxes