Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

Can tax strategies really help save you money? While everyone wants to save money on their taxes, most taxpayers claim the obvious tax deductions, pay their tax bill and move on. But what if there are other deductions you may have missed that can lower how much you owe? The BEST way to minimize your taxes is by maximizing your knowledge and learning these powerful tax strategies.

While everyone wants to save money on their taxes, most taxpayers claim the obvious tax deductions, pay their tax bill and move on. But what if there are other deductions you may have missed that can lower how much you owe? The BEST way to minimize your taxes is by maximizing your knowledge.

The truth is that every person has the option of choosing tax strategies so that his or her taxes are as low as possible. All you need to do is find them and figure out which ones work for you.

Judge Billings Learned Hand, a renowned judge once said, “Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one's taxes."

The majority of tax strategies involve reducing your taxable income, which lowers your effective tax rate and thereby the total amount of taxes you pay.

How To Reduce Taxable Income with Tax Strategies

Reducing taxable income is at the core of many effective tax strategies. Taking advantage of the available tax deductions and credits as well as maximizing tax-advantaged retirement savings are good options to reduce taxable income.

Individual Tax Deductions Vs Credits

Your gross income is the total amount of money you make in a year, wherever it comes from, whether a salary, self-employment income, or investment returns.

In the United States, we have a graduated tax system. The percentage of income the federal government takes in taxes increases as your income increases.

A tax deduction is money you subtract from your gross income for federal tax purposes. Deductions are taken before you arrive at your adjusted gross income. Your adjusted gross income determines your tax bracket, which is the percentage of money that the government takes in taxes.

Deductions can:

- lower the amount of money being taxed

- lower the actual rate of tax on your money

If you claim enough deductions, you can move to a lower tax bracket.

On the other hand, a tax credit is a dollar-for-dollar refund. Credits are given after your tax bracket is determined. Taxes are then taken out of your adjusted gross income.

So while they work differently, tax deductions and credits each reduce your taxable income.

Aim to maximize both for the greatest reduction in your taxable income. Hundreds are available to individuals and small business owners. Many tax preparation software programs will prompt you about popular ones. With just a little research, you might find there are also niche deductions and credits available to fit your situation.

- If you’re a student or still have loans, you can deduct education expenses and student loan interest paid in the calendar year.

- Do you have children? If so, there’s a child tax credit and a deduction for qualified childcare expenses.

- Other well-known deductions are for mortgage interest and state and local taxes. These can be hefty, but the limits also sharply decreased with the 2017 Tax Cuts and Jobs Act, so it’s important to look elsewhere for maximum effect.

Business Tax Deductions and Credits

If you own your own business, you can take advantage of tax strategies specific to entrepreneurs.

You may have heard of the common deductions, like deducting all “ordinary and necessary” business expenses. This means an expense has to be directly related to your business and essential to running it.

There are separate deductions for items like business supplies, business-related car and home office expenses (or regular office expenses).

Even taxes are deductible. Sole proprietors and anyone who owns a pass-through business can deduct self-employment taxes. And as of late 2017, you can deduct up to 20% of business income on your personal tax return.

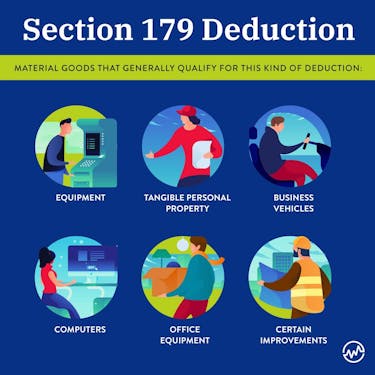

Section 179 Deductions

Many big-ticket items are considered “capital expenditures” and the deduction for these purchases is usually split into percentages that you put on your tax return for several years.

Section 179 allows small businesses to take a depreciation deduction for some of these capital expenditures in one year rather than over a longer time period.

There are two requirements for Section 179.

Property Must Be Acquired For Business Use

When a property is acquired for business use, it’s known as “qualified”. Common items like cars (for business transportation), buildings (for office space), and any contents of that building (computers, couches, desks, water coolers) are qualified.

Similar to the general vehicle and property business deductions, if the item is used both for your business and personal use, you can take a Section 179 deduction for the business percentage only.

Property Must Be Bought And Used The Same Year the Deduction Is Claimed

This means that if it’s a car, you have to start driving it. If it’s a building, you have to open up a shop.

Taking the deduction in one year can significantly reduce your taxable income. It makes sense if the asset is most valuable in the first year and depreciates over time, which means the value of the asset decreases over time. Assets like cars and computers almost always depreciate as technology ages and wear and tear occurs.

The annual limits on Section 179 deductions are highly relative to the purchases of most small business owners. In 2018, the limit was $1 million in deductions for computer software and related items and $2.5 million on overall deductions for this section.

Keep in mind that you’re allowed to deduct part of the cost of qualified property and depreciate the rest if that will be the best way to reduce your taxable income this year and in the years to follow.

If you’re updating your computer system this year and investing in a new delivery vehicle next year, you could take a Section 179 deduction each year.

If this year’s purchase is significantly more costly, then taking a partial Section 179 deduction and saving the rest of the deduction for next year might be a better choice.

Retirement Savings

Retirement savings are an essential component of any tax strategies intended to reduce taxable income — 401ks and IRAs are the most popular vehicles.

Any earnings you contribute to a regular 401k or IRA will reduce your taxable income by the contribution amount. This makes sense if you expect your tax bracket in retirement to be lower than it is now.

If you don’t have that expectation, Roth IRAs are a great alternative. Even if your income exceeds the limit for contributing to a Roth IRA, you can contribute to a 401k or regular IRA and roll the funds into a Roth.

In 2019, the maximum IRA or Roth IRA contribution for individuals under age 50 is $6,000. The maximum 401k contribution is $19,000.

Remember, you can contribute to both an IRA and a 401k in the same year.

If you can maximize both, that’s $25,000 in deductions and a $25,000 reduction of your taxable income.

The process is simple. If you have a 401k, you first roll the funds into a regular IRA. Most major providers (like Vanguard, Fidelity, and Schwab) will do this for free.

Once you’ve rolled the 401k funds over, or if you already had a regular IRA, you contribute the entire amount to a Roth IRA. This triggers a taxable event.

The result is that you pay taxes on the money now, at your current tax rate, rather than when you withdraw the funds in retirement.

Many people don’t know about the rollover option, but if you expect your tax bracket to increase in the future, it could save you a significant amount in lifetime taxes paid.

How to Avoid Paying High Taxes with Tax Strategies

Individual and business deductions and credits are the bread and butter of reducing your taxable income.

For further reduction, look to considering the whole family on your tax return, including the appropriate structuring of any separate maintenance and making gifts.

Consider Your Family

Families come in all shapes and sizes. Unless you’re extraordinarily lucky, yours will face healthcare expenses from time to time.

Health Savings Accounts (HSAs) serve as yet another one of the many tax strategies to utilize, and they are a great way to reduce taxable income. Contributions are tax-deductible. Withdrawals are tax-free as long as the money is used for qualified medical expenses.

If you’re married with children, you may earn income while your spouse stays home to care for the children. You can contribute to a separate spousal IRA or Roth IRA on your spouse’s behalf.

If you already had $25,000 in deductions from your own IRA and 401k, this adds another $6,000. If you are separated or divorced, it’s important to look carefully at the different child and dependent tax credits to ensure you’re minimizing the family’s overall tax liability.

You might have two households, but it’s better to keep the money for your kids rather than hand it over to the IRS. The 2017 tax law made this a little trickier because it eliminated the tax deduction for paying alimony. But there are still ways your family can benefit.

One parent will have the option of filing Head of Household rather than as Single or Married Filing Separately.

If possible, discuss with your former spouse to see whether this will lower one or both of your tax brackets.

In addition, make sure your decree of separate maintenance deals with various child-related deductions and credits including the dependency exemption, the child tax credit, the child and dependent care credit, and the medical expenses deduction.

The custodial parent doesn’t always have to take these. They can sign Form 8832 to release the deduction or credit to the other parent.

The key is to make sure that whoever takes the deduction or credit is the one whose taxes will be reduced the most. Remember that your kids are the ones who benefit.

Does Gifting Reduce Taxable Income?

Unfortunately, you can’t reduce your taxable income by gifting. What constitutes as a “gift”? According to the IRS, it’s “any transfer to an individual, either directly or indirectly, where full consideration (measured in money or money's worth) is not received in return.”

While gifts are not tax-deductible—you cannot deduct the value of gifts you make—you can take advantage of the annual gift exclusion, which is the amount you can gift before you (the donor) have to pay a gift tax on it. As of 2018, that amount is $15,000.

Charitable Contributions

Unlike gifts, charitable donations are deductible to the donor and tax-free to the recipient. And unlike gifts, the sky is (almost) the limit.

According to the IRS, you can deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent of limitations apply in some cases — yet another one of the many tax strategies to take advantage of.

If you decide to give to a private foundation or other special organizations, like fraternal orders or cemeteries, the limit is 30% of your adjusted gross income.

Check the IRS directory of tax-exempt organizations if you’re not sure how to categorize your preferred recipient.

This tax strategy allows you to choose the beneficiary of your money, rather than paying it to the government in taxes and allowing it to make the decision for you.

Whatever organization is the target of your affections, you’ll be giving back and reducing your tax burden at the same time.

With Tax Strategies, Knowledge Truly Is Power

It’s your duty as an American citizen to pay taxes, but that doesn’t mean paying more than you should. That's where tax strategies come into play.

Make sure you take advantage of all the available deductions and credits, save for retirement, and make charitable contributions that benefit you and your family.

If you utilize these tax strategies, you’re making the most of your money.