Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

What comes to mind when you hear the word trust fund? If you’re like a lot of people, you probably think of “trust fund babies” — privileged rich kids with zero responsibilities who have never worked a day in their lives. But trusts funds aren’t just for the ultra-wealthy. This flexible and powerful tool can help many people achieve their estate planning goals.

Even if you aren’t wealthy, you probably want to protect your money and make sure your property is handled the way you want after you die. Trust funds are one way to achieve this.

But they’re usually not the only option.

Understanding whether to set up a trust fund and how to set up a trust fund can be confusing. You’ll need the help of an estate planning attorney to make the right choices.

Once you get clear on what trust funds are, how they work, and their potential benefits, you’ll be in a better position to decide if you want to explore this option further.

What Is A Trust Fund?

First, the basics: a “trust fund” is a special type of legal entity that holds valuable assets (like cash, stock, and real estate) for the benefit of a person or entity. It’s created through a legal document called a trust document.

People generally create trusts for one or more of the following reasons:

Reducing Taxes

Depending on the type of trust, it can help save money on estate and income taxes.

Avoiding Probate

“Probate” is the legal process that takes place after you die to authenticate your will and make sure your assets go to the right people.

Probate, which is court-supervised, can be lengthy and expensive — 3–7% of the total estate value, or even more. It’s also a public process, which means it’s harder to maintain privacy.

Flexibility

Trust funds are very flexible. Your trust document can include very specific instructions on how and when your assets are distributed. This means you can plan accordingly if a beneficiary has poor money management skills, receives government benefits, suffers from addiction, or has other special circumstances.

Types of Trust

There are a lot of types of trusts, each structured to meet certain goals. To understand how to set up a trust fund, you should at least know the basic types. Generally, trust funds fall into two main groups: living trusts and testamentary trusts.

Living Trusts

A living trust, or “inter vivos” trust, is formed during the lifetime of the grantor. It’s created as soon as the grantor signs a valid trust document.

When you form an irrevocable living trust, you can’t make any changes to the trust once it’s created. The assets in the trust are no longer yours — the trustee will manage them until it’s time to distribute them to the beneficiaries.

When you form a revocable living trust, you keep control over the assets. You can make changes to the trust over time, or even terminate it. When you die, a revocable trust becomes irrevocable, and no one else can make changes.

One benefit of living trusts is that they keep assets out of your estate when you die. This means those assets won’t be subject to probate.

Testamentary Trusts

A testamentary trust, or “will trust,” is created by language in your will. This means it’s only established upon your death.

The will acts as the trust document, so it also includes all the trust instructions. You’re free to change these terms at any time by amending your will.

Unlike living trusts, testamentary trusts don’t avoid probate. The testamentary trust is only created after the probate process is complete.

While testamentary trusts tend to have lower upfront costs than living trusts, your estate may still end up paying more during the probate process.

Finding An Attorney

Trust funds can get complicated, so it’s best to get the help of an experienced attorney who knows how to set up a trust fund the right way.

In particular, an attorney can:

- help you understand all of your estate planning options — not just trust funds

- determine the best structure for your trust fund

- draft the trust document

- make sure all of the assets are properly transferred into the trust

Of course, hiring an attorney costs money. It’s possible to find DIY tools that will show you how to set up a trust fund, but if you make mistakes, your trust can end up being invalid. In this scenario, your assets will go through probate and may not be distributed the way you intended.

When choosing an attorney, be sure to pick an attorney in the state where you want your trust to be established. Trusts are governed by state law, so your attorney should know how to set up a trust fund properly in that state.

5 Questions To Ask When Setting Up A Trust Fund

Setting up a trust fund requires a lot of preparation. Below are some questions you’ll have to consider. You don’t have to have all the answers before meeting with a lawyer, but you should at least begin thinking about them.

What Is The Purpose Of My Trust?

Why you want to set up a trust is the most basic question. The answer will help you figure out how to set up a trust fund the right way.

Maybe you want your loved ones to avoid the stress of probate. Maybe you want to reduce your taxes. Or maybe you want the trust to fulfill a specific purpose, like:

- putting away money to ensure a child with special needs will be taken care of

- preventing heirs from inheriting a lot of money all at once

- making gifts to charities

Who Are The Beneficiaries?

You can choose whoever you want as beneficiaries:

- family members

- friends

- even entities, like charities

If you don’t name a clear beneficiary, the trust will usually be invalid and the assets will go through probate. But sometimes you can create a valid trust without naming a beneficiary if you specify a clear purpose (like caring for pets, or maintaining your grave).

Who Will Be The Trustee?

The trustee can be a lawyer, accountant, bank, trust company, or another person or entity of your choosing.

Depending on the purpose of the trust, it can even be you, which is usually the case for revocable living trusts.

Ideally, the trustee should have experience handling the type of assets in the trust.

And of course, before naming a trustee, you should discuss the responsibilities with them and confirm that they’re willing and able to take them on.

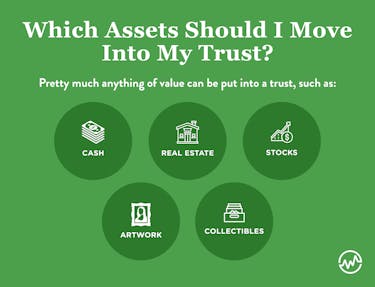

Which Assets Should I Move Into My Trust?

Pretty much anything of value can be put into a trust, such as:

You can put all the assets into the trust at the same time, or you can add assets to the trust over time.

Keep in mind that if you’re forming an irrevocable trust, you’ll no longer have control over the assets once they’re put in the trust.

When Will The Assets Be Distributed?

It’s your property, so you have a lot of freedom to decide when and how to distribute the trust assets.

For example, you may give part of the assets to a beneficiary each year, or upon reaching certain milestones. Or you may give a lump sum at some point in the future.

You can also put conditions on the distributions. For example, you may require that the assets only be used for education costs, to start a business, or to buy a home.

How to Structure the Trust

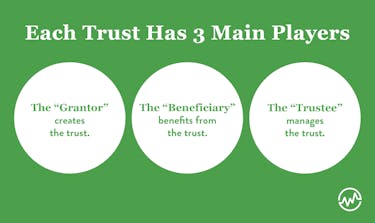

Once you’ve answered the questions above, you’ll need to lay out the structure of the trust in your trust document. Generally, you need to think about three things when deciding how to set up a trust fund:

- your reasons for forming the trust

- your tax planning goals

- how comfortable you are giving up control of your assets

Again, working with an attorney is the best way to make sure the trust document is drafted in a way that meets your needs.

Once the trust document is complete, you’ll need to sign it. Then you’ll have to take the crucial step of funding the trust with all the assets.

Properly transferring assets into a trust can involve a lot of paperwork. If you fail to transfer assets properly, they’ll end up in probate. An attorney will help you get it right.

Trust Fees

The biggest expense in setting up a trust fund is attorneys fees. Those fees vary based on the attorney and the complexity of the trust.

Setting up a simple trust for an individual can cost over a thousand dollars. For spouses or more complex situations, it can cost much more.

The trustee is also entitled to a fee for managing the trust. Corporate trustees usually get paid a percentage of the trust assets each year. Private trustees like family or friends generally get paid an hourly rate (unless they decline payment).

Although setting up a trust can cost a lot more than a will, often the costs of a trust will be justified by savings on taxes or probate fees. You may also decide the cost is worth it because the trust serves an important purpose for you and your family.

Tax Implications

Many people are interested in learning how to set up a trust fund because they want to save on taxes. But not all trusts have tax advantages.

If reducing taxes is your main concern, you should consider an irrevocable living trust.

Once you put assets into an irrevocable living trust, they’re no longer yours. This means if any money is made from the assets, you don’t have to pay income tax on those earnings. Instead, the trust itself will be responsible for those taxes.

Putting income-generating assets into an irrevocable living trust can also help move you into a lower tax bracket. When you die, the assets also won’t be part of your taxable estate.

If you have a revocable living trust or a testamentary trust, the assets are still considered part of your estate. This means these trusts won’t help you avoid income taxes or estate taxes.

Alternatives To A Trust

Not sold on the idea of a trust fund? Depending on your situation and goals, you may have alternatives. Here are a few alternative estate-planning options.

Wills

Wills are the most common estate planning tool. They’re cheaper to prepare than a trust, but there are downsides:

- They won’t reduce taxes.

- They don’t give you as much control over how your property is used and when.

- They’re subject to probate.

Even if you have a trust, you should at least have a “pour-over” will. This type of will ensures that any of your assets that are outside of your trust when you die will be transferred into your trust.

Joint Tenancy with Right of Survivorship

If your only concern is making sure your property passes directly to someone when you die (like your spouse receiving your shared home), you might consider a type of co-ownership called joint tenancy with right of survivorship.

If you have a joint tenancy with right of survivorship, when you die, the surviving owner or owners will automatically receive your interest in the property.

The property won’t be part of your estate, so it won’t go through probate and won’t be subject to estate tax.

But since you’re co-owners, you won’t have full control over the property while you’re alive. You also have to make sure that the property title is worded carefully to make the joint tenancy clear. Otherwise, your interest in the property will end up in probate.

Transfer on Death and Payable on Death Designations

Transfer on Death and Payable on Death designations are used to name beneficiaries who will receive assets in an investment or bank account when the owner of the account dies.

The designations are free and simple to do. If you have these designations, the assets won’t go through probate. This means the beneficiary can receive the account assets upon your death fairly quickly.

But there are no tax advantages to these designations, and the assets will still be subject to creditors’ claims. You also have to remember to keep your designations updated over time.

Other Options

Depending on your goals, there may be other options available to you.

For example, if you just want to safely put away money for a minor until adulthood, you can consider a UGMA or UTMA Custodial Account. Or if you want to save money for education, a 529 savings plan might be a good option.

Keep in mind there are advantages and disadvantages for every option, so it’s best to discuss them with a professional.

Do You Need a Trust?

Whether you need a trust is a very personal decision. Trusts have several advantages:

But unless you’re confident you know how to set up a trust fund without a lawyer, they do cost money to prepare. Depending on the type of trust, you may also have to give up control of your assets.

Trusts are often worth it if you have a complex estate, young children, or beneficiaries with special circumstances. But sometimes it may make more sense to use one of the less expensive options described above.

The best way to decide if you need a trust is to get a full picture of your assets, your goals, and your priorities. Then meet with an estate planning lawyer to review all of your options.

Estate Planning Is For Everyone

By now you should have a better idea of how to set up a trust fund. But even if a trust fund doesn’t seem right for you, remember that nearly everyone can benefit from having some sort of plan in place.

Estate planning isn’t just for the wealthy, or the elderly. Dealing with the death of a loved one is already a difficult situation.

By taking the time now to get your affairs in order, you can help ensure there’s little confusion about your wishes — and minimize the stress of those left behind.