Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

Headlines like this make the budding entrepreneur salivate:

February 2018: “Amazon acquires Ring for over $1 billion”

May 2018: “Recruit Holdings acquires Glassdoor for $1.2 billion”

August 2018: “Walmart purchases a 77% stake in Flipkart for $16 billion”

We all know not every startup attracts the attention of a Fortune 500 buyer, just as not every high school star football player ends up in the NFL. Frankly, most small business owners just want to control his or her own destiny, not try to make a billion dollars.

There are really only three possible outcomes for the business you’ve built:

- Pass it down to your heirs

- Shut it down when you’re ready to retire

- Sell it

(You can argue there are four possible outcomes, but failure is not an option, right?)

Perhaps you aspire to create a ground-breaking business and then sell it to a larger company for a handsome payoff; perhaps your entrepreneurship goals are less lofty but far more achievable.

Either way, the most critical component of selling a business is knowing what your company is worth, so let’s explore how to value a small business.

The Importance of Valuing Your Small Business

The first, foremost, and most obvious reason you need to know how to value a small business is to determine its sale value.

Having this information can help you plan the timing of a sale (business owners often have “the number” in mind — the amount they want to walk away with when they sell) or strategize what’s needed to get your company to a particular value.

Knowing the likely proceeds from a sale will assist you in retirement planning, or — if you’re not ready to retire — tell you what will be available to invest in your next new business.

Don’t assume, however, that if you have no immediate plans to sell you have no need to know your company’s worth.

There are several other reasons to keep track of its value at all times — some good, some not so good, but all-important.

The Good

Hopefully, your business is growing — by expansion, by acquisition, or both. But that growth requires money, and cash flow only supports so much, especially in the earlier stages of the business. That means money from lenders or investors is a necessity. They will want to know what your business is worth.

You might also have an opportunity to bring in one or more partners who will provide additional capital. How large or small of a share they purchase will be based on the overall value of the company.

Bringing in others also means an appropriate agreement (partnership agreement for a partnership, operating agreement for an LLC, etc.) which will need to explicitly state the value of the business at that point in time.

Sometimes an opportunity to sell or merge your business comes along unexpectedly. Given the fast pace of business these days, sometimes those opportunities don’t last long.

Already knowing the value of your business will enable you to negotiate intelligently and secure the best possible deal, whereas having to delay for a valuation could mean the interested parties move on to someone else.

Finally, if you are using an employee stock option plan (ESOP) to reward key players in your company, both the IRS and the Employee Retirement Income Security Act (ERISA) impose legal requirements to annually value the business in order to determine the fair share price.

The Bad

You probably plan to spend many years on this earth (and hey, here’s hoping), but sometimes bad things happen. If an accident or sudden illness takes you out of the picture (as in death or long-term incapacitation), it may be necessary to sell or dissolve the business, and you won’t be there to guide your family, who probably don’t know how to value a small business and could potentially be the victims of predatory advice.

Knowing the value of your business ahead of time will be an immense help to them at an already difficult time.

Since we do all eventually pass away, business valuation is a fundamental step in estate planning if you intend to pass down your company. Determining the likely estate tax burden allows you to fund that liability beforehand so that your heirs aren’t stuck with a huge tax bill.

A disaster that strikes — whether that’s a fire, a storm, civil unrest or any other possibilities that keep you awake at night — can create the need to know before and after business valuations.

This is especially true in major disasters with widespread impact (think Hurricane Katrina here) when the government may step in with assistance.

Knowing the dollar value of your losses can improve your chances of recovery. For example, this exact situation occurred in the wake of the Deepwater Horizon rig explosion in 2010; BP later reimbursed many businesses based on their business valuation in the region for losses caused by the oil spill.

The Ugly

It’s no secret that divorce is often financially disastrous for both sides. Having a business involved only exacerbates the problem because keeping the business intact generally means your spouse must be bought out (unless you look forward to having your ex as your business partner . . .).

If divorce is on the horizon — and let’s be honest, these things usually aren’t a surprise — getting yourself into a financial position to deal with a buyout means knowing the value of the shares of the business you’ll have to purchase.

Sometimes the “divorce” is from your business partner rather than your spouse. While that may or may not be less emotionally traumatic, the result is the same: having to come up with funds to buy someone out.

Knowing and preparing for the cost will put you in a better position when it’s time to have that difficult conversation.

Finally, if you become involved in litigation in which the value of the business is an issue, having a current valuation will aid you and your legal counsel in negotiation, litigation strategy, and evaluation of possible pretrial settlements.

How to Put a Value on Your Small Business

Hopefully, you’re now convinced of the need for regular periodic business valuation. The next question is the truly important one: how to value a small business. The answer (and please, don’t be annoyed) is “it depends.”

Here’s what I mean: There is no one method that applies to every small business across every industry. The good news is that the result is a more precise valuation.

For example, valuing every business based on its physical assets would be great for a manufacturer (a factory with lots of machinery) or a farmer (lots of arable land) but less so for a restaurant (the building is probably leased, and the equipment has a residual value of about 10 cents on the dollar).

In short, how to value a small business depends primarily on its business model.

The original method of valuing a business is based on its assets. If your company makes widgets, it presumably owns a widget factory filled with widget-making equipment and has a stock of widget raw materials. It is easy to appraise the factory and the land it sits on, and the cost of widget-making equipment is easily determined in the marketplace, as is the cost of raw materials.

Of course, there is more to the value of a business than the total cost of its physical assets. If there were, why would anyone ever buy an asset-based business when they could just assemble the necessary assets and go for it?

There are intangible aspects to such a business, including its brand name, its established customers, and its experienced workforce, which all have real value.

Putting a dollar value on those intangibles is often as much an art as a science, and it is the space where negotiation over the final selling price of a company takes place.

The next question is how to value a small business that does not rely heavily on physical assets, such as a restaurant or a service business.

In this type of business, the value of the assets the company has is the cash they can generate, and income is the basis for valuation.

What is EBITDA?

More specifically, the common yardstick is EBITDA, which is an acronym that stands for “earnings before interest, taxes, depreciation, and amortization”. EBITDA is a rough approximation of cash flow that eliminates key differences among different potential owners. It takes net income and adds back the items listed above. Let’s break it down, in reverse:

Amortization

Amortization is an accounting and tax mechanism for spreading the cost of an intangible asset (copyrights, trademarks, etc) over its useful life.

For example, if you pay a $30,000 franchise fee to open a nationally branded fast-food restaurant, and the term of the franchise agreement is 20 years, the franchise fee would be expensed in equal amounts annually ($1,500 in this case) over 20 years.

Because you’re not actually spending that money each year — you paid the $30,000 upfront — amortization is a non-cash expense, so it gets added back to net income.

Depreciation

Depreciation is just like amortization — spreading the cost of an asset over its useful life — except for fixed assets, which are long term items (such as buildings or equipment).

You may be accustomed to thinking of depreciation as an asset losing value as it ages and wears out, but the accounting concept is a bit different.

Taxes

These can vary significantly depending on the circumstances of a given owner. They can also change as tax laws change (the Tax Reform Act of 2017, for example, had some very significant impacts on business taxes).

For that reason, in order to achieve an apples-to-apples comparison of a business’s value to two different owners, taxes are added back to net income.

Interest

Interest expense is an actual cash outflow (unlike depreciation and amortization), so why is it added back to net income?

A business has interest expense only if it has debt, and a potential new owner could have less debt or more debt (and possibly a significantly different interest rate) than the current one, or no debt at all.

As with taxes, to arrive at an apples-to-apples comparison, interest expense is added back to net income.

This talk about interest may have you wondering about principal payments on debt (the amount borrowed) — and a gold star for you if you were wondering!

The principal portion of debt maintenance doesn’t affect net income, for accounting reasons that are beyond the scope of this discussion, which also affects EBITDA’s accuracy as an approximation of cash flow. However, it is ignored for the same reasons that interest is excluded.

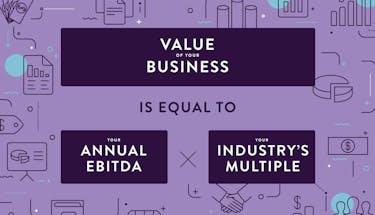

Valuations Using EBITDA

Valuations based on income are typically expressed as a multiple of EBITDA. If your company generates $2 million in EBITDA each year (the annual amount is always used) and a buyer is willing to pay a 4 multiple, the selling price would be $8 million.

Exactly what the multiple depends on the industry and in some cases even more specific factors.

For example, in the restaurant industry, EBITDA multiples are driven by two factors: brand and deal size. Someone selling 200 restaurants will command a higher multiple than someone selling five restaurants, with a premium typically around 0.5. A brand is king, though: those that are favored in the marketplace will sell at multiples of 5.5 to 8.0, while mainstream concepts range from 4.0 to 5.5 and struggling or unproven brands will sell around 3.0 to 4.0.

The median EBITDA multiple across all industries was 3.0 in 2018. On the high end were mining, quarrying, and oil and gas (8.6) and information technology (11.1); on the low end were accommodation and food services (2.5) and other services (3.0).

You will occasionally see valuations based on a multiple of revenue (albeit much smaller multiples than EBITDA, and typically well under 1.0), but this is not a popular method.

EBITDA, after all, indicates how much cash the business is generating. A poorly managed business can have plenty of revenue but low (or negative) net income.

It is important to understand that a buyer who truly knows how to value a small business will not simply accept the EBITDA number from your financials and then start negotiating with you over the multiple.

Any savvy buyer will evaluate your financial statements for unusual items and adjust accordingly. You should do the same when conducting an internal valuation.

For example, if you pay your wife and your two children salaries for “management,” the car notes and insurance for all of your vehicles, and the family’s health insurance all out of the company, those are extra expenses that a potential buyer won’t have. Removing them increases EBITDA and therefore the value of the company.

Conversely, say your spouse fills a key management role but draws no salary. A buyer would have to hire someone to fill that position, so an appropriate amount should be deducted from EBITDA.

More significantly, if your business is facing headwinds such as declining sales or increasing input costs (raw materials, labor, etc.), it is reasonable to expect that future EBITDA will decline.

At the very least, a buyer will value your company based on that assumption, so you must account for it.

Reevaluating the Value of Your Business

Now that you understand how to value a small business, don’t rest on your laurels. Valuing your business is not a once-and-done affair.

It’s important to reassess value periodically; annually is a good practice, normally once your books are closed for the year.

Obviously, if there are significant changes, you should assess the value in light of that change. These changes may include:

- acquisition

- divestiture

- adding or closing a location

- expanding into a new market

- adding a new product or service line

- the emergence of a significant new competitor

We have already established the many reasons why business valuation is important. It’s not hard to see that in every one of those cases, outdated information would be at best useless and at worst harmful.

Periodic valuation (especially when performed consistently around the same time every year) provides a valuable benchmark to see the progress of your business and to see whether you’re on track to meet any goals you may have (such as for the business to be worth X by year Y).

It’s not necessarily the job of the owner to know how to value a small business. There is no shame in having your internal finance team or even an external professional handle the task.

What is important is that you understand the process and know what factors to consider.

Above all, remember this: The true value of your business is what someone is willing to pay for it (and practically speaking, what a lender is willing to finance) and not a penny more.

Take your ego, the number of years you spent building the company, what you think it “should” be worth what you think it “could” do in the future, and all the rest out of the equation.

That’s the challenge of the sale process — finding a buyer who will pay more than anyone else for what you’re selling.

If you know how to value a small business — an accurate, objective, justifiable value — you’re already several steps down the right path.