Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

Starting a business is your chariot ride to financial independence. But first you must brave the coliseum. Win your freedom in battle against scores of entrepreneurial gladiators.

Avoid The Traditional Business Plan

Contrary to popular belief, traditional business plans are useless. A business plan is a document where you propose the strategy for your upcoming business. A typical business plan describes the product, market, distribution, costs, and revenue projections. A hopeful entrepreneur typically fills these sections in with vague estimations for the course of the business. Then they set sail on making the plan a reality.

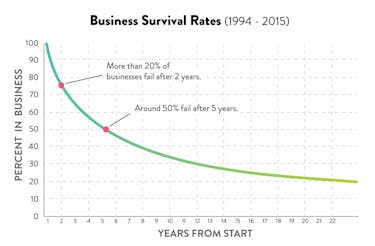

Starting a business is a huge risk, and starting out with a vague, untested plan only barely reduces that risk. If having a business plan was all it took to start a business, most businesses would succeed. According to the US Bureau of Labor Statistics, 50% of businesses fail within the first five years. If business plans were effective, these numbers wouldn’t be so high.

So if generic business plans are essentially useless, what you should do instead? Follow the WealthFit Startup Strategy.

The WealthFit Startup Strategy

The WealthFit Startup Strategy is a tested method for starting a successful business. The strategy was developed by serial entrepreneurs at WealthFit with decades of experience. The WealthFit Startup Strategy is designed to get companies from square one to their first round of revenue without external funding. A WealthFit Startup is one that has:

- Inspiring Vision

- Proven Teammates

- Proven Demand

- Proven Product

- Unique Sales Channels

If your business follows the WealthFit Startup Strategy, it’s got a serious advantage on the competition and is poised to beat the odds.

Form A Vision That Inspires Collaboration

Begin by forming a vision that inspires collaboration.

You need a vision to unite your team. A strong and inspiring vision is the cornerstone of any company. A good vision incites team members to work hard and fosters loyalty to your mission.

A vision inspires collaboration. You’re going to need help. In order to recruit others to your team, you need a vision worth seeing through. Your vision should ignite a fire in everyone who hears it.

A vision will also guide your company through obstacles. A vision is your company's core. The vision will survive when parts of your business model are modified or destroyed. For more on visions, read our article on leadership.

Recruit Proven Teammates

Take your inspiring vision and use it to recruit teammates.

A company is simply a group of people.

Only a fool starts a company alone. A team of two is greater than the sum of its parts. Co-founders give a company greater balance. Each founder has an opportunity make up for the shortcomings of the other. In this arrangement, strengths should compliment weaknesses.

Good co-founders push one another to challenge themselves and to succeed in new ways. They hold each other accountable. It can be hard to stay motivated when no one is depending on you. When you tell a co-founder about your objectives and milestones, you feel more obligated to meet them. Co-founders provide the motivation for traction.

This is why you shouldn’t select co-founders carelessly. Start with respected acquaintances (not friends, not family, not strangers). Past success is the best predictor of future success. Choose co-founders that are executors, with records of accomplishment behind them. You want co-founders with grit.

If you’re considering a person as a co-founder, consider these three things:

- Is this business worth ruining my relationship with this person forever?

- Am I choosing this person because I respect them professionally, or is it something else?

- Would I loan this person one month’s salary?

Ask yourself these questions or your business might fail and you might permanently destroy a personal relationship at the same time. Choosing a co-founder will be the single most important decision you make at the start of a business. Choosing the wrong one can single-handedly tank your business.

But your co-founders aren’t your only teammates. Teammates can be anyone who supports your vision. Potential teammates include:

- Business advisors to serve on your board

- Industry experts who support your vision

- Academics with complementary research

- Companies with complementary products

- Entrepreneur and small business support organizations

Even within your business, don’t stop at a co-founder. Recruiting teammates is an ongoing process. At every turn, you should be seeking out opportunities to grow your team. The stronger your team, the faster you’ll be able to climb. Your company’s traction will be proportional to the quality and size of your team.

Demonstrate Proven Demand

After you recruit a team, you need to demonstrate demand. You must be sure people want what you’re offering. Why build a product you’re not sure people want?

You can verify demand even without a tangible product. Digitally, you can build landing pages to test demand. Landing pages can provide excellent insights into consumer demand even if you don’t have a supply. You can ask for the e-mail addresses of interested customers and estimate your market size from there.

In the physical world you can conduct customer interviews. Customer interviews are a go-to strategy for most startups without capital. Customer interviews allow startups to measure demand for their product and gain invaluable insight into the mind of the consumer.

Test demand before you build the product so you don’t waste time building a product nobody wants. You don’t need to sell your product before you build it, but you do need evidence that people actually want to buy it.

Build a Proven MVP

If you can prove demand, it’s time to build the first version of your product: the minimum viable product (MVP).

An MVP is a complete first draft of your product. Why is it important to have an MVP? Because there’s no point in putting years of effort into a product you can’t sell. An MVP is the first version of your product that solves your customer’s problem.

Do not confuse an MVP with an excuse for half-hearted effort. Your MVP should be a complete product, not an incomplete attempt. The point of establishing an MVP is to prevent your company from diving into feature overload. You’ll want to focus all development efforts on an initial product and build from there.

Prove Unique Sales Channels

The crucial final step for a WealthFit Startup is verifying unique sales channels.

Sales channels are the ways you’ll market and distribute your product. If your marketing strategy is just “sell through social media,” I can promise you that you’re going nowhere and you’re going there fast. It’s okay to sell through social media, but you need to be more specific. Defining your sales channel with something as broad as social media isn’t actionable or testable. This is one of the biggest mistakes of small business owners. Don’t make it.

Imagine somebody asked you how you planned on selling your product and your response was: “We’re gonna do marketing.” Of course you’re going to do marketing. Of course you’re going to have some sort of social media involvement. But you’re not looking for broad strategies. You need proven channels.

You need to create specific and unique sales channels. Start by listing potential target customers. Then create a list of channels for reaching those specific customers. Finally, create the advertisements you’ll use to reach those target customers.

Create multiple potential channels to test. When you’re ready to test, you can just turn your channels on and pump money into them until you either make a sale, or burn through your profit margin. If a test burns through your profit margin, consider that channel a failure and look for a new one.

If you can’t sell your product below your profit margin, don’t sell it.

Choosing an Entity for Your Business

When you’re ready to start a business, you need to choose an entity that fosters growth and matches your business goals.

An entity is a legally recognized organization. For example, imagine you started a club with a friend and called it the “He-Man Woman Haters Club”. If you went to a bank and tried to open an account for your club, they probably wouldn’t let you do it. The bank wouldn’t know who was in the club, which members to trust, or what the rules of the club were.

But imagine you register your club as a corporation with the state instead. Now you call yourselves the “He-Man Woman Haters CORPORATION”. When you go to the bank this time, they understand your organization. They know to only give power to your officers (President, Secretary, Treasurer), and they know your club must follow the state’s rules for corporations.

Opening a bank account isn’t the only reason to form an entity. Entities are popular because of the many benefits they provide. However, the two most important benefits are limited liability and funding potential.

Why Form An Entity?

Limited Liability

Why do you want to start a corporation or an LLC? The main reason: limited liability. Liability, in this case, is simply the responsibility for money owed to people. And limited liability means that the owners of a business aren’t liable for the business.

Imagine you mow your neighbor’s grass. While you’re mowing, you hit a rock and it flies through the window of a nearby home. That homeowner is probably going to sue you. If you’re not a corporation or an LLC, any money the homeowner gets is coming out of your personal savings. And if your savings don’t cut it, you might lose your car or your home.

But if you are mowing grass as a corporation or an LLC, the homeowner’s lawsuit can only take money from the bank account of your mowing company. The entity is a liability shield.

Companies are often criticized for having limited liability. But those criticisms don’t consider the positives of limited liability. Here are some reasons to love limited liability:

- Limited liability doesn’t protect owners who break the law or defraud people. If you break the law, intentionally defraud, or act recklessly and injure people, you won’t be protected.

- Limited liability spurs innovation. Technology advances because entrepreneurs are willing to take calculated risks. If they didn’t have limited liability, the risks would be too great. Innovation would be stifled.

- Limited liability protects investors who have no control over the business but provide funding. Technology advances so quickly because businesses are able to accept funding to scale their ideas. But investors wouldn’t fund businesses if it made them personally liable for a company they have no hand in managing.

Limited liability is great, but there’s another reason to form an entity: the funding potential.

Funding Potential

No one's going to fund you if you don’t have an entity. The law for LLCs and corporations is designed to protect their investors. If you raise funding for your company, that funding is put in your entity and the investor becomes a partial owner. Done right, this makes the investor feel safe knowing you won’t run off with their money. Even more tantalizing, an investment in the company can grow in value with the company.

This won’t happen without an entity.

Types of Business Entities

Another important decision you have to make for your company is what type entity it is going to be. Types of entities may vary by state, but there are four main types of entities in the United States: Sole Proprietor, Partnership, Corporation, and Limited Liability Company (LLC). The entity you choose will depend on your state laws and your business goals. You should speak with a licensed attorney before choosing an entity type.

Sole Proprietor

If you go mow your neighbors lawn for $20 right now, you are a sole proprietor. Technically, you don’t even need to register to be a sole proprietor. A sole proprietor is the default entity of any single person working (not as an employee) for money. Money made as a sole proprietor is taxed as the personal income of the individual.

Partnership

A partnership is similar to a sole proprietor, but it involves more than one person. As with a sole proprietor entity, each partner is taxed as an individual.

Here’s the thing— as a sole proprietor and in a partnership, there’s no limited liability. If someone sues you as a sole proprietor or partner, they can take the money they win right out of your personal bank account.

If you want to limit your liability (prevent people from taking money from your personal life), you need a corporation or an LLC.

Corporation

Corporation are our typical business entities. You’ve probably heard a lot of complaining about corporations in the past decade. This is because corporations have limited liability, meaning that the debts of the corporation can’t be taken out of the shareholders’ personal accounts. The “American corporation” is an old business entity. It is modeled after British corporate law, which has been around since the 1600s. Corporations are typically complex organizations with lots of rules.

Another thing to keep in mind is that a corporation’s profits are taxed twice. Corporations are taxed once when they make money, and then again when they divy their profits with the owners.

LLC

An LLC is more modern entity than a corporation. Wyoming was the first state to allow LLCs in 1977, but they were so useful that all 50 states soon adopted them. LLCs have less rules than corporations, and the owners of an LLC have more freedom to structure their company the way they’d like.

LLCs combine the limited liability of corporations with the tax benefits of a partnership. The owners of LLCs only pay taxes once, when the company gives them profits. The LLC doesn’t pay taxes itself. If you are planning to start a micro-business, an LLC is a good option.

Choosing between an LLC and a corporation is a tough decision. Ideally, it should be made with an attorney. The biggest factor in choosing between an LLC and a corporation is the company’s vision for the future.

How to Form an Entity

There are three mainstream ways to form an entity:

- Hire a Lawyer ($$$$)

- Use an Online Service ($$$)

- Do It Yourself ($$)

Hire a Lawyer

If you hire a lawyer, make sure you find a lawyer that specializes in startup business law. A lawyer will help you map your business goals onto a type of entity. The insights a lawyer can provide are especially valuable. That’s probably what makes this the most expensive option.

Use an Online Service

Every year there are new and improved online services for filing legal documents. Some popular options include Rocket Lawyer, LegalZoom, and NOLO.

Online services can great. The downside is that they don’t give you much flexibility in how you organize your company. For flexibility, you’ll need to hire an actual lawyer.

Do It Yourself

There are lots of people who create entities themselves. Most states have online portals that allow you to file the paperwork from anywhere. Further, it’s easy to find standard management documents for free online.

This is least safe method of forming an entity. No online template is going to be a perfect match for your company. Legally, it won’t matter whether or not you understood the document you signed. These documents set the rules for your company and they’re pretty ironclad, so opting to do them yourself is very risky business.

Name and Register Your Business

Now you know what entity you want, but what do you name it? I know. It’s a tough decision. Here’s some advice for vetting a name.

Picking a Name

Picking a name for your business is difficult. Sometimes it’s best to start with a management company. That’s right— the name of your company doesn’t need to be the same name you use for products or marketing. A name you use for products or marketing is called a “trade name”.

Imagine you just created the nicest diamond necklace on the market, but now you’re struggling with what to name your company. Instead of worrying about the name now, you can start with something like “Diamond Necklaces Corp.” and pick a catchier trade name later on.

When a management company uses a trade name for marketing, the trade name is listed under “Doing Business As” or “DBA.” It’s typical to see companies listed as “Diamond Necklaces Corp.” (the company name), DBA “Ice Jewelers” (the trade name).

Before choosing a name, check the availability of related domain names. Domain names are more scarce than business names because they’re cheaper and easier to acquire. Regardless of your market, it’s very likely that an online presence will be the key to your success. If you decide on a business name and find an available related domain, you should purchase it immediately. Worst case scenario, you lose $12. The current most popular service for researching and buying domains is GoDaddy.

Next, you need to search the U.S. Patent and Trademark Office (USPTO) search trademark database to make sure your business name isn’t already trademarked. If your name is trademarked, you’ll need to hire a lawyer to help you decided whether or not you should go forward with your business name.

Once you’ve secured a domain name and searched the USPTO, search your state’s entity database for businesses using your desired name. The registration of a business with a state is completely different and independent from the USPTO’s trademark registration.

Registering with the Federal Government

If you know your entity type and the name of your business, you’re all set to register with the federal government and the state.

For the most part, the federal government only cares about one part of your business: taxes. Unless you’re in an industry with specific regulations, all you have to do is apply for a federal Employer Identification Number (EIN) to register your company with the federal government .

You can apply for an EIN online. You’ll receive your EIN immediately after completing the application. Guard it carefully. Your EIN is basically the social security number of your company. You’ll use your EIN to register your company with your state and your bank.

Registering with the State

After you get an EIN, you’re ready to register your entity with the state.

In the United States, each state has its own set of rules regarding the organization and management of companies, and every company is registered on a state-by-state basis. There is usually a designated department responsible for registering companies. You will submit an application to start your company and soon after the state will accept or deny your application.

If the state accepts your application, it will publish your company in a directory that lets everyone in the state know that your business name is reserved. Once your company is published, nobody in your state should be able to use your business’s name in your industry or a similar industry. Don’t forget this is limited to the state in which you register. To make your registration national, you need to file a trademark application with the USPTO.

Time to Start

The first steps of a WealthFit Startup are forming a vision and recruiting teammates. These steps can be performed with little time and money. If you know you want to be an entrepreneur, don’t delay any longer. Start crafting your vision and inspire others to get on board.