Developing a Rich Mindset

How To Overcome the Lies That are Making the Poor & Middle Class Poorer

In This Article

When’s the last time you took a moment to zoom out and think about the trajectory of your professional life? It’s easy to allow your career to go on autopilot and even easier to lose sight of your goals. The best way to evaluate is by using what's called the cashflow quadrant.

This is why it’s helpful to have the resources to evaluate your development and track the progress of your vocation.

The cashflow quadrant, developed by Robert Kiyosaki, is one particularly useful resource you can use to analyze your professional life.

You’ve probably heard of Robert Kiyosaki before: he is one of the most influential business authors today and is best known for his Rich Dad book series, including his 1997 bestseller Rich Dad Poor Dad.

It’s the second book in that series, Rich Dad’s CASHFLOW Quadrant, that we’ll be using as a reference today, exploring Kiyosaki’s “titular cashflow quadrant”.

It’s a surprisingly simple concept that has an enormous amount of utility for your career.

If you’re ready to learn about the cashflow quadrant and how it can help you make pivotal professional changes, let’s get started.

What Is The Cashflow Quadrant?

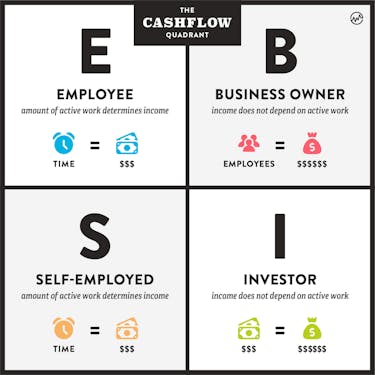

First, let’s take a look at the quadrant itself:

There are two important things you need to understand about the cashflow quadrant.

First, the letters each represent a type of worker:

- E stands for employee.

- S stands for self-employed.

- B stands for business owner.

- I stands for investor.

We’ll talk more about these four categories in more depth later on.

Second, the cashflow quadrant is split vertically into two halves. In other words, E and S are paired together, and so are B and I.

This will become important later on when we take a look at the four categories.

Benefits of Using the Cashflow Quadrant

First, the cashflow quadrant will help you understand and change the specific quadrant you’re in.

As Kiyosaki mentions in his book, the quadrant will specifically benefit employees and self-employed individuals who want to become business owners or investors.

Kiyosaki calls this the path to financial freedom, which you gain when you stop working for money and start having money work for you.

Second, the quadrant is also great for anyone who wants to evaluate (or reevaluate) their career.

That’s because it forces you to take a step back and look at your entire professional life.

No matter what your goals are, the cashflow quadrant will help you put them into perspective and think about the big picture.

Finally, it’s beneficial to simply use the quadrant as an exercise. It makes you think about how you earn your money and what your work life is like.

By extension, it makes you think about how satisfied you are with your current quadrant.

Let’s take a closer look at each quadrant.

E – Employee

The E quadrant is where most workers reside — an employee who works for a business or organization that provides them with a paycheck and benefits. In return, employees provide their skills to their employer and trade their time for money.

Employees prioritize long-term job security, which is decided by their employer. Employees with a high degree of job security have problems to face. If employees don’t work, they don’t get paid. And along with self employed individuals, employees pay the most in taxes.

S – Self-Employed

A self-employed person is their own boss. While an employee works under a management structure, the self-employed person owns their job because they work for themselves.

Although being self-employed seems like a huge improvement over being an employee, the two quadrants actually have many similarities.

They both pay high taxes and trade their time for money. Just like an employee, when self-employed people stop working, they stop earning an income.

B – Business Owner

Business owners don’t just own their job; they own a system. Business owners are leaders who outsource work to experts and prefer to delegate work instead of taking it on themselves.

As a result, the business owner doesn’t have to work nearly as hard as employees or self-employed people.

As Kiyosaki notes, business owners “can leave their business for a year or more and return to find their business more profitable and running better than when they left it.”

Like investors, business owners pay much less in taxes than the employed/self-employed and have much more freedom.

Business owners can take vacations and still make money, and they don’t have to actively work to earn an income.

I – Investor

Whereas the self-employed own their jobs and business owners own systems, investors own assets that make money for them.

The investor is the person who has earned money in one or more of the other quadrants and has put that money to work for them. Investors often purchase assets like company shares and real estate.

According to Kiyosaki, the B and I quadrants are where true financial freedom is.

Although financial freedom can be found in all four quadrants, Kiyosaki recommends the B and I quadrants for their unique benefits.

People in these quadrants pay far less in taxes and don’t have to work to make money.

Now that you’re familiarized with the quadrant, there are a few questions you need to ask yourself:

- Which quadrant(s) am I in right now? (Remember: it’s possible to be in more than one quadrant –– for example, dentists can own practices and still work for themselves.)

- Now that you know which quadrant you’re in, which quadrant do you want to be in?

- What do I need to do to move to the quadrant I want to be in?

These questions might reveal more to you about your career than you think.

If it’s been a while since you last thought about how you earn your money –– and whether you’re satisfied with it –– then this exercise will be a real eye-opener.

How Do You Change Quadrants?

Changing quadrants is one of the most common questions about the cashflow quadrant, and it’s easy to see why.

Maybe you’re a self-employed freelancer who’s suffering from burnout, or maybe you’re a business owner who wants to expand and seek other income sources.

How do you go from one quadrant to another?

There are many ways to move quadrants, but Kiyosaki recommends that most who aren’t business owners jump to the B quadrant before going into investing.

That doesn’t mean you can’t start an investing career — it just means that developing good business skills will help you learn how to invest more wisely.

The good news is that starting a business is a lot easier than you might think. There are countless resources available to you that will allow you to build a business with little more than your laptop, some capital, and a generous dose of perseverance.

But knowing how to actually get a business up and running isn’t everything you need to move quadrants.

It all depends on which quadrant you’re in right now and which one(s) you want to move to.

If You’re An Employee…

If you’re in the E quadrant, then the B quadrant is an ideal next step. Why?

Because you don’t have to deal with the uncertainties of starting a self-employed career, and you can keep your day job while you work on a business in your spare time.

The biggest problem with starting a business is risk.

Thankfully, the risk of starting a business is lower than ever before thanks to all those abundant resources available to budding entrepreneurs.

If you’re thinking about creating your first business, you have a lot of options. One approach is a side hustle or a micro business.

This is a small, simple business that may require a small upfront investment and can be grown into a passive income generator.

Starting a micro business requires a fraction of the time and money required to start a small business, so it’s a great option for employees who are pressed for time and money.

You can continue working your 9-5 and scale your micro business without burning out. This means that you can very easily transition from the E quadrant to the B quadrant.

Furthermore, many micro business owners find that they can quickly scale their businesses and even sell them.

Don’t let the term “micro” fool you –– these businesses can be seriously profitable.

They can give you the capital needed to start a small business (or even multiple small businesses).

If You’re Self-Employed…

If you work for yourself, then you’ve already developed some business skills you’ll need to move into the B quadrant.

You know how to network, how to find the right people for the right jobs, and maybe even how to manage others if you’ve worked in teams.

When you’re first starting out, you might try building a business that you can sustain yourself (since you’re already accustomed to working for yourself).

There are many micro businesses that meet this criteria, such as:

However, to fully make the move to the B quadrant, you’ll need to put your existing skills to work and pick up some new ones, such as leadership skills.

Kiyosaki emphasizes that a great business owner is a great leader, so the sooner you feel confident in your leadership abilities, the better.

Cashflow Quadrant: Becoming An Investor

Kiyosaki says that the best time to get serious about investing is after you’ve developed your business acumen by building successful companies.

One benefit of this approach is that you’ll have an increased cash flow once you’ve built businesses.

The more successful your businesses are, the more money you’ll be able to put into investing.

Of course, you don’t need a ton of money to start investing. You can begin with even $1,000 or less. But investing really pays off once you can put some serious money into it.

The I quadrant, according to Kiyosaki, is where money becomes wealth. This is when you stop working for your money and make it work for you.

When you become an investor, you use money to make money.

Remember: many people reside in more than one quadrant. There are certainly some people who are just investors, but it’s more common to see, for example, a business owner who’s also an investor.

Employee, Investor...Where Do You Want To Be?

Regardless of your goals, the cashflow quadrant poses a vital question: Are you happy with how you’re making your money?

Take a second to think that over.

Ultimately, how you earn your income matters.

The quadrant you’re in will inform your financial freedom, or lack thereof. As Kiyosaki argues, it’s much easier to achieve financial freedom in the B and I quadrants.

You don’t have to rush out and start buying stocks, but you should take some time to think about where you want your professional life to take you.

You are the ultimate master of your fate AND your finances — and using the cashflow quadrant can help you get to where you want to be.