Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

- What is Forex?

- Currencies Traded in the Forex Market

- Forex For Beginners: The Forex Market

- Forex For Beginners: How Forex Pairs are Traded

- What’s a Pip Worth in Real Money?

- Trading with Leverage

- Placing a Forex Trade

- The Spread

- Forex Trading: Advantages and Disadvantages

- How to Create a Forex Trading Strategy

- Action Step: How to Begin Investing in Forex

- Forex for Beginners

When you venture to a different country for work or pleasure, one of your first things to do — after getting your passport stamped — is exchanging dollars for another currency at a Foreign Currency Exchange.

After all, you don't want to be turned away at a bustling cafe in the busy streets of Rome because you don’t have any Euros.

But there’s more to the Foreign Exchange Market, which is called “forex” for short, than just trading one currency for another so that travelers can make purchases during trips.

Did you know that it’s a unique investment and trading opportunity?

Forex traders are simply investors in currencies. Investors aim to profit by buying a currency they believe will increase in value (relative to another currency), or by selling a currency that they believe will fall in value.

What’s more, one advantage of forex is that it offers more leverage than any other financial market, meaning that investors can make sizeable returns on investment with just a small amount of trading capital. Later on in the article, we break down an example of a forex trade to further explain this advantage.

Plus, only a small amount of capital is needed to get started. This is different from other investment options such as cryptocurrency, gold, and others.

But there are downsides, including managing that leverage and other associated risks.

So how does this form of investing work? And is it right for you?

Keep reading to learn everything you need to know about forex for beginners.

What is Forex?

If you’re wanting to know forex for beginners, let's start with this: the forex market is unique. According to DailyFX, the foreign exchange market, with an average daily turnover of $5 trillion, is the largest financial market in the world. For comparison, the US stock markets trade less than $1 trillion daily.

The Forex market opens Monday morning in Australia and closes Friday afternoon in New York. From Monday through Friday, the market is open 24 hours a day.

Like stated before: forex traders are simply investors in currencies.

For example, if you believe the British pound will increase in value relative to the US dollar, then you would look to buy the currency pair Gbp/Usd (Great British pound vs US dollar).

Forex can be both a short term and long term investment — short term strategies focus on buying and selling currencies in response to short term fluctuations while long term strategies focus on buying and holding.

Currencies Traded in the Forex Market

The instruments traded in the forex market are currency pairs. Whenever you make an investment in the forex market, you are essentially buying or selling one currency against another. Currency pairs trade the world’s major, or most widely used, currencies:

All the major pairs include the US dollar as one of the two components. Currency pairs that don’t contain the US dollar are referred to as cross-currency pairs, or just “crosses”.

Among the most widely traded cross pairs are:

- Eur/Gbp (Euro vs Great British Pound)

- Gbp/Jpy (Great British Pound vs Japanese yen)

- Cad/Jpy (Canadian dollar vs Japanese yen)

The “exotic” pairs typically pair a major currency with the currency of a relatively small or undeveloped country. For example, the exotic pair Sgd/Jpy trades the Singapore dollar relative to the Japanese yen.

Forex For Beginners: The Forex Market

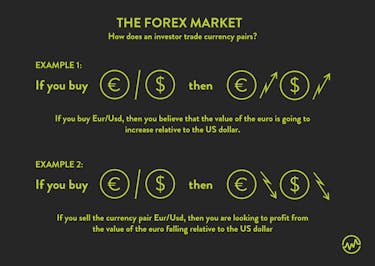

Okay, so how does an investor trade currency pairs?

Keep in mind the basic fact that, in forex trading, you are always trading the value of one currency relative to the value of another currency. For example, if you trade the pair Eur/Usd, then:

1 – If you buy Eur/Usd, then you believe that the value of the euro is going to increase relative to the US dollar.

2 – If you sell the currency pair Eur/Usd, then you are looking to profit from the value of the euro falling relative to the US dollar

The price of forex pairs expresses the current exchange rate between the two currencies.

The first currency in a pair is the “base” currency.

The second currency is the “quote” currency.

For example, at the time of this writing, the price of Eur/Usd is quoted as 1.1071. That means that $1.10 (and 71/100th) in US dollars currently equals one euro.

The value of a country’s currency reflects the market’s opinion of the strength of that country’s economy.

Stronger economies typically have stronger currencies. Relatively weaker economies typically have relatively weaker currencies.

Forex For Beginners: How Forex Pairs are Traded

Let’s get into the specifics of trading the forex market and how you make money. Currency pair price quotes are generally quoted to either the fourth or fifth decimal place — for example, 1.1078 or 1.10783, for the pair Eur/Usd in the above example.

The fourth decimal place — the number “8” in this example — represents the smallest generally recognized value amount in the price quote.

This value amount is known as a “pip” — an important term to note for those looking for information on forex for beginners. (The fifth decimal place represents a tenth of a pip.)

The difference between the exchange rate of 1.1078 and 1.1079 is one pip. The difference between 1.1079 and 1.1091 is 12 pips. Make sense?

What’s a Pip Worth in Real Money?

Trading one standard lot (100,000 units of the base currency), one pip equals 10 “dollars” worth of the quote currency (the second currency in a currency pair). For example, if you’re trading one standard lot of Gbp/Usd, then one pip = $10 US.

Trading one mini lot (10,000 units of the base currency), one pip equals one “dollar” of the quote currency.

Trading one micro lot (1,000 units of the base currency), one pip equals 1/10th of a dollar of the quote currency (for example, if the quote currency is Usd, then a pip equals 10 cents).

Trading with Leverage

Forex trading offers unique leverage — you don’t have to put up the full value of the chosen lot size.

Most forex brokers offer at least 20:1 leverage, and many offer up to 50:1 leverage.

What does that mean? Well, 50:1 leverage means that you only have to put up 2% of the trading lot value.

For example, you can trade a position of five micro-lots of Aud/Usd by putting up just a little over $100 US in the margin.

This means that it’s possible to start trading the forex market with as little as a few hundred dollars.

Placing a Forex Trade

Placing a trade in the forex market is very simple. You have two options:

- you can either buy long (when you’re expecting the value to increase)

- you sell short (when you’re expecting the value to decrease)

One unique note is that there are no restrictions in forex trading on short selling like there are in stock trading.

Once you’ve decided whether you want to buy or sell a given currency pair, you then choose your trading lot size.

Make sure that you have enough money in your trading account to cover the necessary margin, plus allow for the market to move moderately against your position at least temporarily.

If, for example, you want to trade five micro lots of Gbp/Usd, with 20:1 leverage, that will require $250 US in margin money to place the trade.

However, if the market moves 20 pips against your position, then you must have at least $10 more in your trading account to cover that open loss. If you don’t have enough money in your account to hold your position, along with any open trading loss you may have, your broker will usually close out your trade.

At the time you place your trade, you can go ahead and enter a “take profit” order that will automatically close out your trade if and when it reaches your specified target price.

You can also place a stop-loss order to minimize potential losses. Large price moves can occur suddenly in the forex market. It is, therefore, recommended that you always trade using protective stop-loss orders. Minimizing risk is critical to successful forex trading.

You must have enough money in your account for the margin required for the trade and to cover any open trading loss that may exist while you’re holding the position.

Example of a Forex Trade

For all your forex for beginners — here’s an example of a forex trade.

While there are many types of orders, for this example we will focus on a Take Profit Order and Stop-Loss Order.

Entry Order

A forex trade beings with an investor placing an entry order. Let’s say an investor decides to buy five mini lots (which equates to 50,000 units of the base currency) of Gpb/Usd at the price of 1.2485.

The margin requirement at a 20:1 leverage is $2,500 — this is the amount of cash needed for the trade.

Option 1: Take Profit Order

In this instance — a Take Profit order — the investor has specified the exact price to close out his or her position. This exact price is 1.2550.

So if the price of Gbp/Usd rises to 1.2550 or higher, then the position will be automatically closed out.

The profit in this scenario is 65 pips, which equals $325. Recall that the pip value per mini lot is $1, and you’re trading five mini lots, so you make $5 per pip.

Thus, the ROI — return on your $2,500 investment — is 13%.

Here’s a tip: Let’s assume that after the order is filled, Gbp/Usd advances to 1.2520, providing an open profit in the trade of 35 pips equals $175.

At that point, it’s important to reassess the market’s price action to determine if the profit target of 1.2550 is reasonable.

If the investor no longer thinks so (for example if there are signs of possible weakness in the market) then he or she may decide to close out the trade with the existing profit.

Option 2: Stop-Loss Order

In this instance — a stop loss order — the investor has specified that if the value falls to a specific price, then he or she wants to close out the position. A stop loss order is designed to limit loss.

The investor originally purchased Gbp/Usd at 1.2485. Let’s say he or she places a stop-loss order to sell the five mini lots Gbp/Usd at 1.2466.

If the exchange rate/price of Gbp/Usd declines to 1.2466, then the position will automatically be closed out, with a 19 pip loss, which equates to a $95 loss.

The Spread

In trading forex pairs, there is always a bid and ask spread. What does that mean?

The bid is the highest price currently offered to buy the pair, and the ask is the lowest price currently offered to sell the pair.

For example, if you’re looking to buy Aud/Usd, and the bid-ask spread quoted by your broker is 0.68395/0.68415, then the spread is two pips.

Buying Aud/Usd, you would pay the “ask” price of 0.68415; selling Aud/Usd, you would sell short at the bid price, 0.68395.

You must always subtract the spread from your gross profit in a trade (or add it to your gross loss) to determine your net profit/loss for the trade.

Forex Trading: Advantages and Disadvantages

As with trading any investment market, there are both advantages and disadvantages of forex trading.

Advantages of Forex Trading

Here’s a rundown of the main advantages offered by forex trading:

- It requires only a small amount of capital to get started. The forex market is very appealing to small investors because you can begin trading with as little as a few hundred dollars.

- It offers a high degree of leverage. Because of the leverage forex trading offers, one can make sizeable returns on investment with just a small amount of trading capital.

- Selling short is just as easy as buying long. This means that you can just as easily make money in a currency pair that is trending down as in one that is trending up.

- Low transaction costs. The transaction costs for forex trading are relatively low compared to trading other assets. With most brokers, the transaction costs are simply factored into the bid/ask spread.

Forex Trading Disadvantages

Here are some of the potential disadvantages of forex trading:

- Managing trading with high leverage. Trading with a high degree of leverage amplifies both profits and losses. Traders who fail to realize the importance of careful risk management when using leveraged investments often end up losing money.

- The difficulty of finding a good broker. There are hundreds of forex brokerages to choose from — that alone can make finding a good broker a daunting task. This task is made more challenging by virtue of the unfortunate fact that many forex brokers are simply not reputable firms.

- Risks associated with volatility. Like trading with high leverage, volatility is a double-edged sword. The bid/ask price of a currency pair can move up or down 50, or even 100, pips in the space of just a few moments. Unexpected price surges or collapses can happen at any moment.

How to Create a Forex Trading Strategy

Most forex traders rely heavily on technical analysis to guide them in initiating and exiting trades.

Time Frame

One of the first choices a forex trader must make is what time frame(s) he or she wants to trade. Because of the constant “action” in the forex markets, day trading is very popular among forex traders.

Long-term or intermediate-term traders most frequently chart price action on the daily or weekly time frame, although they may also look at market action through the lens of the four-hour, or evenly the hourly, chart.

Day traders may plot their trading moves on time frames ranging from one minute all the way up to the daily charts.

Which Pairs to Trade

Which currency pair(s) do you plan to trade? You’ll find that each of the major pairs has its own particular patterns of price movement, average daily trading range, and an average level of volatility.

Some traders focus their efforts and only trade one currency pair. Other traders may trade multiple pairs but concentrate on mastering one currency — for example, focusing on Gbp, they may trade Gbp/Usd, Eur/Gbp, Gbp/Aud, and Gbp/Jpy.

Selecting a Trading Strategy

Having selected currency pairs and time frames to concentrate on, it’s time to craft a trading strategy to use. If you’re familiar with technical analysis and have used it successfully in other financial markets, there’s no reason that you can’t apply the same technical tools you’ve used in stock market or commodity trading to forex trading.

Forex brokers provide their clients with a wealth of technical indicators to choose from and apply to charts.

Technical indicators range from simple moving averages and candlestick charts to indicators such as pivot points and Fibonacci retracement tools, all the way to rather complex trading “systems” that include multiple indicators, such as the Ichimoku Cloud.

A simple technical strategy might employ two moving averages, one faster (such as a 10-period average) and one slower (such as a 20-period average).

The trade entry signal with such a strategy is the faster moving average crossing over the slower moving average.

For example, when the 10-period moving average line crosses from below to above the 20-period moving average line, that generates a “buy” signal.

Managing Risk

Once you’ve settled on a strategy, before taking a position, you need to decide how much you’re willing to risk.

Part of figuring out your risk equation is deciding on what size position you are going to trade: five micro lots? One mini lot? One standard lot? Your position size will, of course, depend a lot on how much trading capital you have to work with.

Always consider the risk/reward ratio of a trade. It doesn’t make good trading sense to risk losing 50 pips if the most you hope to make is only 20 pips.

Exit Strategy

Finally, you want to have an exit strategy for closing your trade out and taking a profit. This is the case not just with Forex, but with any investment.

Potential profit targets can be derived from technical indicator price levels, such as a daily pivot point or Fibonacci retracement level.

Action Step: How to Begin Investing in Forex

Here are the logical steps to move you from the mindset of forex for beginners to an investor.

Step 1 – Continue your forex trading education

Fxstreet.com and DailyFX.com are two major forex trading information websites.

They offer up-to-the-minute currency trading news, opinions from forex market analysts, and daily calendars of economic news releases likely to impact the market.

Step 2 – Open a brokerage account

BabyPips.com also has an excellent forum with reviews of forex brokers.

Other forex broker review sites include Forex Peace Army.

Key considerations when choosing a broker are:

- spreads

- transaction costs

- methods of funding your account

Step 3 – Fund your trading account

Fund your account with enough money to enable you to trade at the level you want to in terms of trade size, hold two or three trading positions simultaneously, and of course allow for a few losing trades – no forex trader is perfect and hits a winner every time.

Step 4 – Familiarize yourself with your broker’s trading platform

You don’t want to be stumbling around, trying to figure out how to place an order, in the middle of a fast-moving market. Get comfortable with your trading platform so that you can use it easily, quickly, and confidently.

Step 5 – Test out trading strategies in a demo account

Nearly all brokers offer a demo account where you can test out various trading strategies and practice using the trading platform.

Forex for Beginners

The first step to becoming a successful (i.e., profitable) forex trader is learning what it fundamentally is. The next step is to dive deeper into examining Forex trends and familiarizing yourself with the marketplace, as well as market trends.

If you decide that forex is a strategy perfect for you, remember what introduced you to it — a motivation for growing your financial education.

It’s that motivation that will help you succeed in forex and other investment strategies throughout your lifetime.