Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

- Why Should You Invest in Gold?

- Gold Versus Other Assets

- What Type Of Track Record Does Gold Have?

- What Advantages Does Gold Have Over Other Investments?

- How Correlated Is The Investment With Other Investments?

- What Is The Future Of Gold?

- How To Buy Gold

- Research Before Investing

- Choosing a Company/Brokerage/Platform

- How Long Should You Keep Your Investment?

- Become A Seasoned Investor

When most people think about investing in gold, they imagine pioneers in the 1850s furiously panning in California rivers, hoping for the slightest golden glint that will make them instantly rich. But investing in gold isn't relegated to the Gold Rush of centuries past—it continues to be a widely used investment instrument today. Not only can it help diversify your portfolio—did you know the precious metal’s value actually increases when paper currency devalues?

This guide to investing in gold explores the case for investing in gold and how to buy gold if you decide that doing so is right for your financial needs.

Why Should You Invest in Gold?

The Short Answer

The short answer to the question is that precious metals—such as gold—have the ability to hold their value over the long-term, offering investors a way to protect their money from inflation.

The Long Answer

To give a longer answer, it’s important to focus on why gold is able to protect your money.

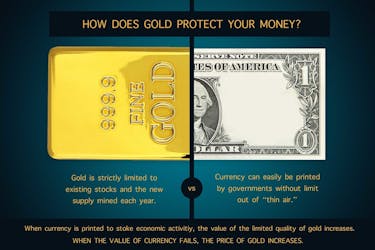

The primary reason for this is that the amount of gold available at any given time is strictly limited to existing stocks above ground and the new supply mined each year.

Fiat currencies—currency created by a government that is backed only by faith in that government, such as the U.S. dollar or the euro issued by the European Union—can be printed or electronically created by governments at will and without limit out of “thin air.”

During periods of economic or political turmoil, governments around the world have exhibited a tendency to resort to “easy money” policies to deal with crises—printing more money to stoke the flame of economic activity, which lowers the value of currency (otherwise known as currency debasement).

This, in turn, causes gold’s price in that currency to rise because the supply of gold does not increase as the currency does.

Thus, currency and the price of gold have an inverse relationship: when the value of a currency falls, this increases the demand for commodities, and the price of gold increases.

Gold Versus Other Assets

When evaluating any investment, gold included, there are a variety of questions investors typically ask to help them determine whether the asset in question is worthy of a place in their portfolio.

These questions often include:

- What type of track record does the investment have?

- What advantages does the investment offer over other investments?

- How correlated is the investment with other investments?

- What are the investment’s prospects when you take into account projected future economic and political conditions?

Read further and we’ll consider these questions one by one for gold.

What Type Of Track Record Does Gold Have?

Over thousands of years of human history, gold has been seen as a store of value and an object to be treasured.

Because of this, it has been used as a form of currency for much of recorded history, whether directly, via a link to bank notes or currency printed by a nation.

In recent times, there is no link between national currencies and the precious metals. Because of this, even though inflation has decreased the purchasing power of fiat currencies (such as the dollar), gold has retained its value.

Here is an example of how gold’s value has stood the test of time: It has been said that throughout history, an ounce of gold can buy a good man’s suit. At its current price—just above $1,400 per ounce—that certainly seems to hold true today.

What Advantages Does Gold Have Over Other Investments?

Given gold’s extensive history as a store of value, it seems obvious that the yellow metal has a value that few other objects have. There are several reasons for this, including:

Fungibility

This is a fancy way of saying that a unit of gold has value wherever you go around the world.

Non-Corrosive

Gold distinguishes itself from most other metals in that it doesn’t corrode, or become damaged, over time, enabling it to hold its value.

No Counterparty Risk

Unlike a fiat currency, bank note, share of stock, or other marker of value, gold’s worth does not depend on the ability—perceived or actual—of a counterparty to honor their promises or competently manage a business.

How Correlated Is The Investment With Other Investments?

Gold can help provide portfolio diversification by reducing correlation risk, which refers to the risk that different assets will move together given similar market conditions. Here’s what that means: if your portfolio’s holdings all tend to move in the same direction at the same time, it reduces the benefit of being diversified.

Gold lowers correlation risk because its performance is not directly linked with that of assets such as stocks and bonds. Make sense?

In addition to decreasing correlation risk, gold has the ability to reduce systemic risk—losing value in the event that an entire industry collapses.

While assets such as real estate, bonds and stocks can offer protection from correlation risk by offering different performance characteristics, these assets are at risk of performing similarly in the event of systemic breakdown.

We saw this during the market crash that accompanied the Great Recession in 2008. During that time, some believed the financial system was in danger of failing, and markets around the world all fell at the same time.

Even though the chances of catastrophic events that can cause systemic collapse such as war, financial panic, or natural disasters are rare, there is peace of mind in holding an easily transportable form of wealth like gold.

This is because the precious metal can be transferred to a new location in a way that may not be possible with stocks, bonds or real estate if these assets are located in the area where the catastrophe occurs.

What Is The Future Of Gold?

Given current and projected future economic conditions, gold can be attractive on both a long and short-term basis—if you do your research and decide this is the right investment for you.

After the yellow metal’s price plummeted from 2011 through 2018, 2019 has seen a resurrection in the price of the commodity.

While there is no guarantee that this trend will continue, there are specific signs to look for that indicate the health of gold and should play a part in your decision making.

What are these signs? They include:

Slowing Economic Activity Worldwide

IF central banks around the world ramp up easy monetary policy—printing more money to combat economic downturns—this bodes well for gold.

Domestic Political Turmoil

When disagreement exists between political groups within a country it can lead to unpredictable policy changes. Chaotic situations such as this can benefit gold as investors turn to the yellow metal as a safer investment.

Geopolitical Turmoil

Conflict between countries can also send investors running to gold as a safe haven.

How To Buy Gold

If you decide to purchase gold, the next question to ask is how to buy gold. The answer will depend on which of the various kinds of gold you want to buy. There are four main ways to own gold, whether directly or indirectly:

- Gold bars

- Gold coins

- Gold stocks, ETFs and mutual funds

- Gold futures and options

The form of gold you choose to buy will depend on your personal preferences and investment objectives.

Gold Bars

Purchasing gold bars is the purest way to own the commodity. However, this is an expensive proposition, given that a good delivery gold bar as traded by most central banks and bullion dealers is 400 troy ounces.

With gold hovering around $1,400 per ounce currently, a single gold bar at that price would be worth $560,000. Given the high value of gold bars, many owners of these bars choose to have them held at a third-party depository.

If you go this route, it’s important to understand the difference between allocated and unallocated storage arrangements.

Allocated Gold

If your gold bars are allocated, that means that you own specific physical bars that you can inspect and withdraw in accordance with your agreement with the gold depository. This storage option is typically more expensive than holding unallocated gold.

Unallocated Gold

If you hold unallocated gold, your gold bars are not specifically designated. Instead your ownership of them is a liability of the depository institution. In this case, you must rely upon the depository to hold enough supply to be able to deliver your gold bars upon request.

This form of ownership could be considered riskier than the first if the gold depository were to get into financial or legal trouble. In such a case, your unallocated gold bars could potentially be tied up in litigation.

Gold Coins

When you ask how to buy gold, another answer is gold coins. Because of the high cost of gold bars, some experts recommend gold coins, or collectibles, as a more affordable way to purchase the yellow metal.

For instance, an American Gold Eagle coin produced by the United States Mint contains one ounce of gold, meaning that its intrinsic value with gold trading at $1,400 per ounce would be $1,400.

When buying coins, make sure to differentiate between the gold value and collectible value of a coin. For instance, a gold coin might contain gold worth $2,500 while the coin itself sells for $2,650.

The $150 premium represents the “collectible” value of the coin. This premium can decline if the coin is seen as less desirable (or rise if seen as more desirable) than it was previously for any reason.

As a result, you should make sure that you are comfortable—and aware—with the premium you pay for any coin you purchase.

While gold bars and coins typically feature higher transaction fees and storage costs than securities linked to the price of gold (such as gold stocks and mutual funds), they offer a higher level of catastrophe insurance in the case of systemic breakdown.

As mentioned earlier, as a fungible store of value, physical gold can be transported to and used in almost any part of the world in the event of the collapse of the economic and social systems where a person is based.

Thus, if you anticipate high levels of socioeconomic conflict where you live, paying extra to own some physical gold may be worthwhile.

Gold Stocks, ETFs, And Mutual Funds

These offer an easy way to own gold in indirect form. Because these securities are traded on public markets, their value can change rapidly in response to market fluctuations and news related to individual securities.

Buying gold-based securities is generally considered a riskier strategy than simply buying gold due to the volatility (or unpredictability) of these investment instruments.

However, because there is no need to physically take possession of or store gold when buying such securities, some investors prefer this approach when they are examining how to buy gold.

Gold Stocks

Individual gold securities can be highly volatile, and also feature company, or idiosyncratic, risk. This means that even if gold itself performs well, if a public company that mines for gold is poorly run, or can’t profitably develop its resources, an investor could actually lose money investing in its stock.

As a result, while gold stocks can offer leverage to the price of gold by increasing at a substantially greater rate than gold when the yellow metal makes increases in price, they are also a riskier way to play movement in the price of gold.

ETFs And Mutual Funds

ETFs (exchange-traded funds) and mutual funds offer an approach to buying gold-based securities that are generally less volatile than individual gold stocks.

Because these investment vehicles diversify their investments across a variety of stocks or hold gold itself, they avoid the company risk associated with buying a single or small number of gold stocks.

Gold-backed ETFs that actually hold gold in trust for shareholders offer returns that are more directly linked to the price of gold than mutual funds and ETFs which hold gold-related stocks.

Gold Futures And Options

These are the riskiest way to invest in the precious metal. Because of the short-term nature of these instruments, you can be right about the long-term direction of the price of gold and still end up losing big if the price goes against you in the short run.

These investment instruments should only be used by seasoned investors who either are willing to take on the significant risk of such investments or understand how to hedge their risk using high level strategies.

Research Before Investing

Once you’ve decided what form or forms of gold or gold-related investment securities you want to purchase, the next step in determining how to buy gold is to research your options.

- If you plan to buy gold bars, where should you buy them and how should you hold them?

- If you want to buy gold coins, which ones are most likely to maintain or increase their premiums and what vendors offer the best deals?

- If you plan to buy gold-related securities, are you better off buying individual gold stocks, mutual funds, or ETFs?

If you need assistance on how to buy gold, you can also discuss the process with a financial advisor.

While the approach you take should affect your personal investment strategy and financial situation, seeking out assistance from external sources, whether online or in-person, can provide you with information essential to making an informed decision.

Choosing a Company/Brokerage/Platform

After you’ve decided how to buy gold, the next step is to determine where to buy gold.

Depending on the kind of gold you are buying, you will typically need to select a company, brokerage or platform to make your purchase.

If you plan to buy gold bars or coins, there are a number of reputable vendors you can use. Make sure that you perform due diligence on both the seller of the gold and the depository where you plan to store it if you don’t want to hold the precious metal yourself.

You can also run into unscrupulous dealers, so it pays to check the background of any dealer you use to find one you feel comfortable working with.

Be sure to pay attention to the fees charged by the dealer and storage depository if you go that route. Fees can vary widely from vendor to vendor, so it’s important to have a good idea of the prevailing fee structure for the form of gold you are buying before making a purchase.

You can also buy gold online, whether in the form of gold bars or coins. Because you won’t get a chance to physically inspect the merchandise before making a purchase this way, performing due diligence on the seller is even more important when transacting online.

If you are buying gold stocks, ETFs or mutual funds, you can typically make these purchases through your existing broker/dealer or advisor.

Again, be sure to look into the fees or commissions you are being charged for making these transactions to make sure you aren’t paying fees that are excessive for the services you are receiving.

How Long Should You Keep Your Investment?

Your investment time horizon for holding gold or gold-linked securities will depend upon factors such as your investment objectives and your personal investment approach.

While every investor has their own unique financial situation, there are nonetheless some general guidelines which can be cited with regard to investment holding period.

All of the gold and gold-related investments discussed so far, with the exception of gold futures and options, are generally best thought of us as long-term investments.

While gold stocks, mutual funds, and ETFs can certainly be traded easily, to truly benefit from a big move in price will usually take months, if not years. This isn’t to say that you can’t trade these securities for short-term gains, just that when gold begins an upward trend such a move has historically tended to last for a fair amount of time.

As a result, if you are trading these securities on a short-term basis you risk missing out on such a run.

Another reason to hold such investments for the long term is to avoid excessive transaction costs. These can be particularly costly for physical gold such as gold bars and coins.

Again, this doesn’t mean you can’t sell your gold investments in the short term if you want to take some profits or you need the money, just that the combination of transaction costs and persistent trends make physical gold best-suited for longer-term holding periods.

Become A Seasoned Investor

While buying gold in its many forms can look different for every investor, there is one requirement: do your research on every facet of the investment process.

By doing this, not only can you understand how to buy gold; you can also understand the market and invest wisely, further increasing your financial literacy on your way to becoming a seasoned investor.