Smart Budgeting

How To Create a Cashflow-Positive Budget ... and Stick To It!

In This Article

You sleep better at night knowing money is stashed away in an accessible and safe savings account for emergencies—but if you knew that inflation is eating away at it year after year, would you still rest easy?

The truth is that inflation destroys large sums of cash that sits in traditional bank accounts over time.

Though the idea of investing an emergency fund—which acts as a mighty protector against inflation—might seem too risky even to consider, don’t dismiss the idea. Learn more about it and you may find that it’s the ideal fit for your financial situation.

While it’s a highly personal decision, and one you shouldn’t take lightly, making a move to invest your emergency fund—or even a portion of it—could not only preserve the buying power of the money you worked so hard to save. It could even help it grow over time.

What is an Emergency Fund?

You’ve likely heard the saying hope for the best, but plan for the worst. Maybe you spend more time hoping than you do planning.

While there’s nothing wrong with being optimistic, you can’t ignore Murphy’s Law, which states that anything that can go wrong will go wrong. This often comes with significant financial costs.

Have you found yourself in one or many of the following situations—while low on cash?

- You lose your job

- A routine trip to the dentist results in a root canal

- You are involved in a car accident

- A bigger than predicted tax bill shows up

- Your baby arrives weeks early

- Your pet becomes significantly sick

- You have to fly your family across the country for the funeral of a loved one

If you fail to plan for events like these, you’ll realize why you’re planning to fail.

Setting up an emergency fund is proactive planning for sudden or serious situations showing up in life—these are expenses outside of your regular budget.

An emergency fund prevents you from taking on high-interest debt during a stressful time when you have bills you cannot pay or a significant expense you weren’t expecting. It’s also your first step on the path to financial independence.

Think about an emergency fund as a safety net—a non-negotiable one that adds stability to your life.

Why Would You Invest an Emergency Fund?

Whether you finally saved $1,000 to cover small emergencies or you’ve amassed the recommended three to six months (or more) of living expenses in the bank—congratulations!

You’re already ahead of most Americans who can’t produce a few hundred dollars in an emergency.

But should it be in your bank of choice, or some other place?

Many people believe the safety and liquidity provided by banks address the goals of your emergency fund—security over returns, period.

But while it’s certainly easier to access money from a traditional brick-and-mortar bank, the interest paid on a savings account is almost non-existent.

That’s why people invest their emergency funds. Here’s the kicker, though: investing limits immediate access to your money.

You may even incur penalties to withdraw invested funds. You’ll also face the risk that you will need money for an emergency at a time when your investments have decreased in value.

And should you sell investments for an emergency when their value is down, you’ll miss the gains when investments recover.

There’s a chance you may even lose money, which negates the reason for investing in the first place.

When your money isn’t making more money for your future, inflation takes over. This “silent killer of wealth” negates cash sitting in bank accounts year after year.

Just like you want to protect your retirement funds from inflation, your emergency fund might need protection too.

But it needs repeating: investing emergency funds is risky, and it’s definitely not for everyone.

Reasons to Keep an Emergency Fund in the Bank

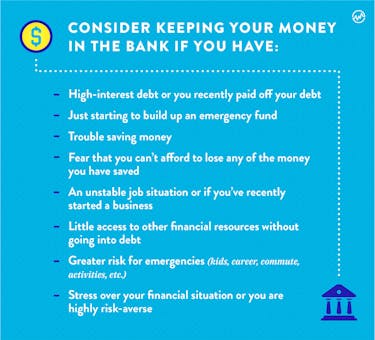

There are plenty of good reasons to keep your emergency fund in a savings account even though inflation may be slowly eating away at your purchasing power down the road.

While your goal is to leave your emergency fund alone until an unexpected or sudden expense strikes, if your budget is squeaky tight, you might need access to savings at times.

You can battle some inflation in your emergency fund by using high-yield online savings accounts over those at traditional banks.

With many online banks paying 2% interest (or more) on savings accounts, it will help your money keep pace with inflation.

Even though you can’t walk into a branch to make a withdrawal when trouble strikes, you can typically access money via an ATM or transfer money easily on an app from savings to write a check from your online account.

When to Consider Investing an Emergency Fund

While there is plenty of disagreement about investing money you’ve saved for an emergency, when you factor in the effect of inflation on savings, it’s easy to see why people go that route.

Even though a lack of liquidity and risk presents issues with investments, there are good reasons to consider investing to save your emergency fund from inflation.

Investing can be a good decision if you’re capable and confident in your ability to choose investments meeting your financial goals while still having access to money if you need it.

But investing all your emergency funds is very risky.

Instead, consider splitting it up. Put one month (or some part) of your expenses in a high-yield online savings account.

This covers short-term needs allowing you to invest what’s left. You can then use the cash savings before accessing investments if something happens.

While mitigating risk is important, for some it can make sense to fight inflation on emergency funds by investing at least some portion of them.

If it’s a possibility, you can also reduce risk by increasing the amount of your emergency fund to help offset any market corrections.

What are Emergency Fund Investment Options?

If you decide to move your emergency funds into accounts outside a traditional savings account, you have several options to consider.

The first two products are more saving than investment vehicles but are worth noting here due to their generally higher interest offerings with little downside.

Carefully weigh the risk versus potential returns and align your saving and investment decisions to your financial goals.

It’s important to mention you must also pay attention to fees when comparing savings and investment options.

While earning a higher return on your money is great, having to do so by incurring high or unnecessary fees can actually harm you in your battle against inflation if you’re not careful.

Here are your emergency fund investment options:

Certificates of Deposit (CD)

These might be the safest investment you can make, but likely offer a return just slightly higher than an online savings account. Look for No-Penalty CDs to avoid a loss of money for withdrawing funds before certificate maturity. Here’s a tip: CD laddering can help spread out the risk of tying up funds for lengthy periods.

Money Market Accounts

Like CDs, these are a safe product, offering slightly higher returns than online savings accounts but include FDIC protection, debit cards, and check-writing privileges. Fees, minimum balance requirements, and limited monthly withdrawals are potential drawbacks on these accounts.

Money Market Mutual Funds

With some similarities, but key differences from bank money market accounts, these are investment vehicles obtained through brokerage companies and mutual fund companies. Essentially, cash reserves within an investment portfolio can earn interest by buying shares in a money market fund while it awaits being withdrawn or invested in another investment product. Money market mutual funds invest in relatively safe vehicles like CDs, and short-term debt of governments and major corporations. Money in these funds can be accessed anytime, and some may come with check-writing privileges. But these accounts are not FDIC insured and may have expense fees.

Roth IRA

If you are eligible to contribute to a Roth IRA in 2019, you can invest up to $6,000 ($7,000 if you’re over 50) of after-tax money. Your contributions can be withdrawn at any time without a penalty.

Brokerage (Taxable Investment) Accounts

You have the potential for higher returns investing in stocks, but you accept more volatility as well. Bonds offer more stability, but you may also sacrifice returns. Consider index or exchange traded funds over individual stocks or bonds. You can sell assets and withdraw funds from brokerage accounts without penalty, but you may face transaction fees and taxes on earnings.

Health Savings Account (HSA)

If you’re enrolled in a High Deductible Health Insurance Plan (HDHP), you might choose to invest some of your emergency funds in an HSA. Many HSA’s are like a 401k in that you can decide how money is invested. The options to invest depend on which HSA company your employer (or financial institution) uses.

A 401k, 403b, or 457

You normally don’t want to touch funds in a retirement account before age 59 ½ because you risk both growth and penalties. But you may be able to take a loan or make a hardship withdrawal in some situations.

Investing an Emergency Fund

An emergency fund is a staple of financial stability—establishing one should be considered an absolute necessity. Without one, you risk going into severe debt when the unforeseen happens.

Deciding to keep funds in a savings account or invest emergency funds instead is both a personal and a financial decision. It doesn’t matter where you get the money from when it comes to paying for an emergency — it matters that you have money.

Don’t blindly follow the advice of a relative, friend, or something you read online. While inflation is a significant concern, investing an emergency fund may not be the right decision for you, no matter what anyone else says.

If you decide to invest, strike a balance. Benefit from higher returns and compounding over the long-term, while maintaining the ability to address immediate needs with money in a high-yield savings account.

Then you will not only be prepared for the unexpected; your emergency fund will also grow over time.