Get Access to Live, Online Real Estate Investing Classes Each Week

Create a Free AccountIn This Article

Bad credit score? It’s just a number. It doesn’t define you. Don’t let your credit score prevent you from investing in real estate. Don’t wait until your credit score is better to start.

Too often, we hear the common objection “I would love to buy an investment property, but my credit is so B-A-D.”

If this sounds familiar to you . . . take the first step: breathe deeply and know that you aren’t alone.

Close to 1 in 3 Americans have poor credit. So if you’re one of them, don’t worry. There are specific things you can do to improve your credit — and master your personal finances.

If you have poor credit, you aren’t dead in your tracks when it comes to investing in real estate.

Anyone who’s ever bought a house knows the importance of credit scores.

It’s almost impossible to get a traditional home loan if your credit score is bad — plain and simple.

Most lenders won’t consider an applicant with a score below 620.

Depending on the lender, you may need scores above 700, 720, or even 740 to be eligible for a mortgage.

But What About Real Estate Investors?

The good news is: there is much more flexibility when it comes to real estate investing.

Is it easier to get a traditional loan when your credit score is off the charts? Absolutely.

But even if your score is on the low side, you still have a host of other options for investing in real estate.

If you are serious about real estate investing, the first thing to learn is that there are unlimited ways to fund any deal.

So have no fear.

Here are 10 ways to invest in real estate with no money and bad credit.

#1. Get a Hard Money Loan

Getting a loan from a hard money lender is a great option for real estate investors with less than stellar credit. Despite its name, “hard” money isn’t hard to come by — it’s everywhere.

Hard money lenders are private individuals or groups who offer short-term loans that are backed by real estate. These lenders are only interested in investment deals — they aren’t funding someone who wants to buy a house to live in.

The best part is that hard money loans can give you funds very quickly — often, within days.

That’s why so many real estate investors use this source.

They’re quick, painless, and easy to turn around.

Hard money lenders don’t consider credit scores as the “be all, end all.” They can determine who they lend to and what those loans look like. If your credit score is good, GREAT!

But if not, your application is still more than welcome. The majority of the time, hard money lenders only care about one thing: if the deal is a good deal.

Their main concern is the value of the home. If the numbers work, they’ll more than likely fund the deal, whether you walk in with a 780 credit score or not.

A hard money lender will use the property as collateral. If you don’t pay them back, they take ownership of the property. That’s why they care about the numbers.

If you bottom out, they’ll still make money.

So, if you have a solid deal on your hands with good profit potential, a hard money lender will likely fund it — even if your credit score is just . . . eh.

Drawbacks of Poor Credit

A poor credit score won’t keep you from loan approval, but the interest rates are higher than traditional bank loans. Most interest rates range from 10% to 15%, depending on the lender. Hard money borrowers also have to pay “points,” which are a percentage of the loan. Points can range from 2% to 4% of the total loan amount.

So, you’ll pay heftier fees in exchange for convenience, but that’s okay given the potential profit you’ll walk away with.

Another obstacle is that they may not cover the full cost of buying the property. These lenders usually lend 65%-75% of the current value of the property. Some will lend based on the value of the property after it’s been improved, also known as the "after repair value" (ARV).

That leaves you to fund the difference or find another source of funding to bridge the gap.

How To Find Hard Money Lenders

Do a quick Google search for hard money lenders in your area and see what pops up.

Also, go to local Real Estate Investors Association (REIA) meetings and network. Ask for recommendations from the members there.

Once you’ve found a hard money lender, don’t forget to make sure that lender is reputable. We recommend you do this by asking the lender for references and then following up on them.

You should also see if any complaints have been filed with the Better Business Bureau against your potential lender.

At least one person associated with the hard money lender must have their Real Estate Broker license.

You should confirm that their license is valid and check to see whether or not any complaints have been filed against it.

#2. Look For Private Money Lenders

Another funding source to consider is private money lenders.

Private money can come from anyone looking for a return on their investment. This can be anyone from a structured lender to a friend, relative, business partner or acquaintance.

Even if your credit score isn’t great, private money lenders can still lend to you, often with competitive terms. The quality and value of your deal are much more important to a private money lender than your credit score.

Private money lenders don’t abide by a certain set of rules. So repayment terms, interest, and everything else is up for negotiation.

And because it’s that person’s own cash, they decide whether or not they run your credit.

If you can show your deal has value and that you can close quickly — and make a profit quickly — private money lenders can overlook dings on your credit report.

#3. Get a Partner

There are many people interested in real estate investing and would happily use their credit to fund deals, provided they don’t have to tackle the other heavy lifting (your work).

So why not strike up a partnership with someone like that? Someone who has A+ credit? In exchange, you’ll be able to lock down more funding for your deals.

It’s the ultimate win/win.

Your partner could be anyone — a friend, relative, colleague, neighbor or someone you met from a local networking event or Facebook group.

Just remember, you want to partner with someone who has the skills and resources you lack, and vice versa.

In this case, you lack the credit, so partner with someone who has excellent credit and can secure the funding for your deals. And maybe you have something that they don’t have.

You might consider the best way to consolidate credit card debt and start rebuilding your credit history for long-term financial success.

So what can you bring to the table? Perhaps it's your time, your deal-making skills or another resource. You can work out a 50/50 partnership so once the deal closes, you split the profits.

Should you decide to go this route, you’ll want to formalize your agreement by choosing a business structure and then registering your business.

This will protect your personal assets should your partnership run into problems down the line.

Consult a business lawyer to establish your company.

#4. Make The Seller The Bank (Seller Financing)

Seller financing is a strategy best utilized for properties that are fully owned and paid off. If a seller doesn’t need “quick cash” from the sale of their home and cash flow isn’t the issue, then this strategy could be a great option.

When the seller finances a deal, they basically become the bank.

In other words, you essentially have a mortgage with the seller.

With these agreements, the seller allows you to make monthly payments until you pay off the property or the term of the loan ends.

Benefits Of Seller Financing

- Little or no qualifying

- Negotiable terms

- Credit not a factor

- Flexibility to meet needs

- Very low closing costs

Seller financing deals can be a win-win for everyone. The seller dictates the terms, and many won’t ask to see your credit score or dig into your finances too deeply.

Meanwhile, the seller gets a monthly income stream.

For example, a retiree may love the idea of getting a set monthly payment for their home. Likewise, a landlord may want to unload a property without getting out of the market completely.

In both cases, a seller financing agreement could satisfy all sides, helping you build capital and credit along the way.

So, how do you find a property owner willing to do this? You have a few different options:

- Vacant Homes - Vacant homes present a great opportunity. Drive around your neighborhood and look for them. Then, contact the owners to see if they’d be interested in this type of arrangement.

- Absentee Landlords - An absentee landlord is someone who owns an investment property but doesn’t live in it. You can locate absentee landlords by buying lists from RealQuest.com or ListSource.com. Once you’ve identified prospects, contact them to see if they’re interested in your proposition.

- Real Estate Industry Gatherings - Attend real estate meetings and industry gatherings in your area. Events like these are great places to network and meet people who may be looking to get rid of an investment property.

#5. Consider Wholesaling

Wholesaling is a common first step for new real estate investors. This approach doesn’t require you to fund anything, so your credit score often makes zero difference.

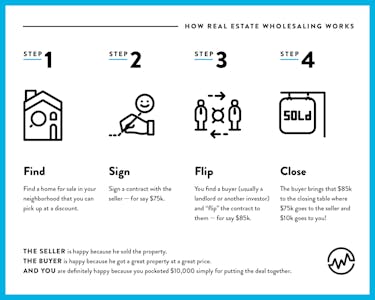

How Does Real Estate Wholesaling Work?

- Use the DealMachine app to find a seller who wants to sell their home. You then negotiate the price and terms with the seller and put together an agreement to buy the home.

- Instead of buying the home yourself, you find another buyer to take your place. This could be another investor who wants to fix up the home or a landlord who wants a rental.

- That buyer will assume all the terms you’ve outlined in your purchase agreement and they’ll close the deal.

- They take ownership of the home, the seller gets the amount you both agreed to, and you get an “assignment” fee for facilitating the deal.

Many real estate investors start wholesaling just to build capital. A good wholesale deal could drive $5,000, $10,000, $20,000 or even more.

A few of those deals could help you rebuild your credit and generate serious capital in the process.

#6: Option To Buy/Lease Option

A rent to own lease is a great opportunity if you’re trying to figure out how to invest in real estate with no money. It is also a viable option for property owners who are thinking about selling but are not in a rush to do so.

In this strategy, the landlord is interested in selling, but not at the moment. The tenant agrees to pay their rent as well as an extra amount every month which is allocated towards a down payment. At the end of the lease, the landlord has a guaranteed sale.

The tenant can get ownership of the property — and therefore real estate — without the need for a huge sum of money.

For more information on the rent to own strategy, click here.

#7: House Hacking

Another way to invest in real estate with no money and bad credit: house hacking.

House hacking is the practice of using a primary residence to generate income to offset the cost of that residence’s monthly mortgage.

This could be renting out one of the following options:

- An extra bedroom

- A studio

- ADU housing

Even if you have no money and bad credit, you can purchase a house, and use the income you receive from house hacking to pay off its mortgage. In some cases, you can live rent-free.

Some investors even strategically buy small multifamily properties (four units or under) that qualify for advantageous financing including government-backed loans and live in one unit while renting the others.

For more info on house hacking, click here.

#8: REITs

For those interested in buying an investment property without a huge cash investment, and for those who don’t want to be a landlord, REITs offer the perfect solution.

A REIT — real estate investment trust — is an investment in which at least 100 shareholders co-own a group of properties or other real estate-related assets.

Think of it in the same way as a mutual fund, but for real estate.

REITs require a low time commitment and allow you to diversify your portfolio — and minimize the risk — with a minimal entry barrier.

For more info on REITs, click here.

#9: BRRRR

The BRRRR strategy follows 5 specific steps:

- Buy

- Rehab

- Rent

- Refinance

- Repeat

Using the BRRRR strategy, you can use hard money loans or private money loans to secure your first property; the key point is that you can refinance the property and use that money to secure a second property, and so forth. It’s another way to invest in real estate with bad credit and no money.

For more on the BRRRR strategy, click here.

#10: Government Loans

Many loans, including the FHA Loan, USDA Loan, or the VA Loan sometimes offer low credit credit score requirements, low down payments, and the property can then be used as investment property.

While most people use these loans to purchase a single-family home, they can also be used to finance 2-to-4 units multifamily properties.

However, keep in mind that you will need to use the property as your primary residence for a time and deal with living next door to your tenants.

The Bottom Line: You Can Invest in Real Estate with Bad Credit Or No Money

One of the best things about real estate investing is that it’s open to everyone. You don’t have to have millions in the bank or a good credit score.

You need passion, perseverance, and desire. If you can package that, there’s no ceiling to your success.

Get creative, make connections, and focus on finding the funding to close deals without good credit.