Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

As a teenager, you might feel like investing money is the last thing you should be thinking about. After all, you’re already busy with exams, sports, college applications, and social life. So can you become a teen investor? And if so, how can you start investing? In this article, we’re going to break down everything you need to know about investing for teens.

If you start learning about investing, which JP Servideo teaches in this online course “Investing For Teens: The Beginner’s Guide To Smart, Successful Investing”, you can accelerate your financial growth track — and provide incredible opportunities for yourself and your loved ones that would otherwise be out of reach.

After all, who doesn’t love a head start, especially when the goal is to achieve “wealth”?

Read further to learn a few of JP’s teaching lessons, including:

- Provide a definition of what wealth that you’ve never heard before

- Explain how to begin investing as a teenager, including stock investing for teens

- Show you the 4 bucket system so that you can grow your money

- Give an explanation as to why some debt is “bad” while other debt is “good”

- Show you how you can become a bank

Ready? Let’s get started!

What Is Wealth?

In order to learn investing for teens, let’s first look at what wealth is.

While many people define it differently, here’s how we at WealthFit look at it this term: it’s the abundance of time, money and influence.

- An abundance of time is being able to do what you want to do, when you want to

- An abundance of money isn’t about having a lot of money in your bank account; instead, it’s having financial security, which means having enough money for your needs to be met, even in the event of an emergency.

- An abundance of influence is having the ability to financially help or bless those who matter to you, including your friends, family or people in need.

Here’s the thing: getting true “wealth” is hard. It takes time and knowledge, too.

That’s why it’s never too early to start learning about investing — or actually investing.

In fact, try this: ask anyone older than you when the best time to learn and begin investing is.

Did you ask someone?

Chances are, they’ll agree that your teen years are a perfect time to get educated about what investing is and how to do it.

Before we dive any deeper into the topic of investing for teenagers, it’s important to understand that there are laws you must abide by.

You must be 18 years of age to invest.

If you aren’t 18, you can still do so with joint or custodial accounts with your guardian.

So even though you may not be old enough to invest, you can learn investing fundamentals.

Got it?

Now that we have that understanding, this investing for teens article is designed to explain why and how to invest, but it’s up to you to ultimately decide what and where to invest in.

If you’re ready to learn how to start investing as a teenager, let’s begin!

How To Start Investing As A Teenager

The first step to investing for teens and growing your wealth is developing a mindset that is compatible with your money goals.

To do this, you have to think about money the same way that wealthy people do.

Though you may have grown up putting your birthday money in one piggy bank, wealthy people don’t put their money all in one place.

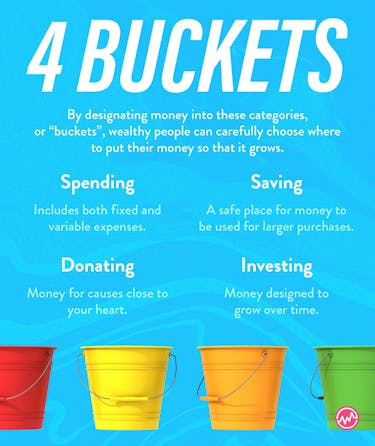

Instead, they spread it out among four categories:

- money to spend

- money to save

- donations

- investments

By designating money into different categories, or “buckets”, wealthy people can carefully choose where to put their money so that it grows.

Let’s look at each one in-depth next.

Spending

The first bucket is spending. Spending includes both fixed and variable expenses. What do these fancy terms mean?

- Fixed expenses are expected costs that you can anticipate to be the same on a regular basis, like paying rent each month.

- Variable expenses are costs that change in cost but that you can expect to incur frequently, like buying groceries or clothing.

Saving

The second category, saving, is a dedicated place to stockpile money for larger purchases, like a car.

Savings are intended to be a safe place for money to sit for a while but not grow.

Donate

The third bucket is optional but recommended. It’s a category to put money in that you would like to donate or use to give back.

Many people, wealthy or not, have designated funds to give to charity or spend on a cause that is close to their hearts.

Donating money not only helps people, organizations and causes in need — it can also help you when it comes to paying taxes.

Investing

Bucket number four is what we’re discussing in this article: investing.

Money dedicated to this purpose is designed to grow over time.

While there is risk involved in investing, it is an opportunity to make your money work for you.

Wealthy people put their money in the investing category first. They know that, over the long term, investments will help them to reach wealth.

A good rule of thumb is to put at least 10% of the money you make into your investment bucket. As a teenager, this can include:

- birthday money

- money from side jobs

- money given to you from your parents

Remember, you have four buckets to work with: spend, save, donate, and invest. Let’s say each of these buckets is filled with water, representing the money you have.

The first three buckets are sitting in the sun and will lose water over time as it evaporates.

Even the money in the savings category will go down in value over time, due to something called inflation, a term meaning that the value of things you can buy — from clothes to cars and even food — goes up over time.

Bucket number four, investing, is sitting under a rain gutter. Frequent rains trickle into the bucket, filling it to an overflow.

When done right, these positive investments actually add in enough water to refill the other three buckets.

Remember: prioritize filling your investment bucket with at least 10% of your income and it will help you out by filling the other buckets.

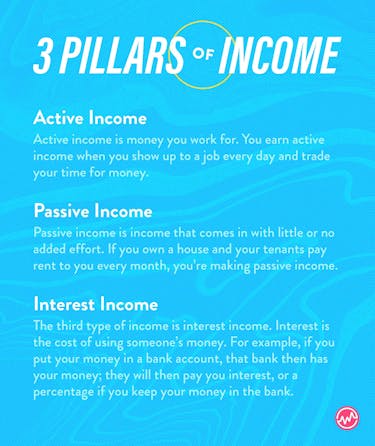

Three Pillars of Income

Income comes in three flavors: active, passive and interest. Let’s look at each of these.

By utilizing these pillars of income, you can have money flowing to you from different sources and, in time, achieve true wealth.

Assets and Liabilities

Along with these pillars, it’s important to understand something called assets and liabilities.

The trick on your wealth-building process is to increase your assets and decrease your liabilities.

What Is Risk?

Another item to keep in mind when thinking about investing for teens: risk.

There is risk involved with investing. Financial risk is the real possibility that you could lose money instead of making it. Perhaps you make an unwise investment and a company you bought into goes out of business, or you buy a house and it turns out to cost simply too much to rehab.

How you minimize risk? Financial knowledge — the goal of this article — proper research, consultations with industry professionals (and your guardians if you’re under 18) can lower the amount of risk you take on as you invest.

3 Ways To Start Investing As A Teenager

Are there investments for teens? Yes!

Let’s explore 3 ways to invest for teens:

- Stocks and Index Funds

- Retirement Accounts

- Real Estate

We’ll look at each in depth next.

Stocks and Index Funds

Yes, there is stock investing for teens (keeping in mind that you must be 18 years of age to invest. If you aren’t 18, you can still do so with joint or custodial accounts with your parents or guardian).

You might not be Mark Zuckerberg, but invest in Facebook with stocks and you can technically call yourself a part-owner.

A stock is a share in the ownership of a public company. Companies like Facebook, Uber and Bank of America sell shares of the company to the general public.

This is different from an index — another important element to remember when thinking about stock investing for teens.

An index is a group of stocks that include multiple companies and can represent an industry, like water or technology.

There are a number of ways to make money by investing in the stock market.

How To Make Money Investing in the Stock Market As A Teenager

Sell Stocks

“Buy low, sell high” is a common investment strategy focused on growth. Here’s a simple example: if you buy ten stocks at $10 and their value goes up to $20, you can now sell them for $200 and make $100 in profit. Make sense?

Dividends

You can also make money from dividends. Some companies pay out a percentage of their profits back to investors, based on the amount that they own.

Importance of Research

Doing research into industries and what’s called “market trends” — or what the market is likely to do based on past history — as well as consulting investment professionals can help you optimize the odds that your stocks will do well.

Starting this research in your teens will give you a good foundation for investments going forward.

Retirement Accounts

Even though we’re talking about how to invest for teens, it’s never too early to begin a retirement account.

A retirement account is designed to grow over a lifetime and support you once you stop working.

A popular type of retirement account is a Roth IRA. The benefit of this type of account is that you pay taxes once you put the money in and then it can grow freely without being taxed down the road.

A 401k is another type of retirement account. This one is set up between a person and their employer and allows the person to redirect money from their paychecks into the account. Unlike the Roth IRA, it is taxed when you pull the money out of the account.

Depending on your 401k plan, employers can actually match funds that you put into this account, further increasing your investment with free money.

With both types of retirement accounts, the goal is to add to them over time and let them grow so that you can retire on your own terms.

Real Estate Investing

There are four main ways to earn a profit by owning property and they can all be combined to both save and make you money — something to think about when discussing the topic of investing for teens and investments for teens.

Of course, this may not be something you can do on your own immediately, but you can do it alongside a parent or guardian and learn the process. Plus, by being aware of it, you’re already ahead of the curve.

- Renting Out A Property

One method is renting out a property that you own. Buying a house and renting it to other people for a monthly fee will eventually pay off the price of the house.

Since most people take out a mortgage (or a loan) from the bank on a house, renting contributes to your debt reduction.

The money you make from renters can go directly to the bank to pay off your loan.

- Real Estate Appreciation

Depending on the location of the property, it can also appreciate in value over time.

For example, If you bought a house in Palo Alto before Silicon Valley became a tech hub, it likely is worth much more today than it was 30 years ago.

Appreciation is not guaranteed, however, and it’s possible to lose money if the value of your house decreases over time.

- Flipping Houses

You may have heard of people “flipping” houses for profit. Flipping is the process of buying something — houses other items of value — and upgrading it to sell at a higher price.

People who flip houses sometimes buy them from others in a distressed situation — a situation where someone needs to get rid of a house quickly — to save money on the initial purchase. This is called “rehabbing”.

If you buy a house and don’t want to fix it up yourself, you can resell it “wholesale” for a profit to someone who does.

Flipping is a useful choice for people who have the time, energy, and money to spend fixing up and remodeling a house.

If you have the time and energy but not the cash, a person can lend you the money with interest to buy and fix up the house. When it sells, they will get a percentage back and you keep the rest.

- Tax Benefits Owning Real Estate

It’s also possible to receive tax benefits from owning real estate.

Taxes on your property can be deducted (“written off”) from your income tax, which reduces the amount you have to pay.

Many of these principles can be applied to commercial real estate, such as offices and stories, as well.

Research the value of properties in your local area to get a sense of the real estate market around you.

If you want to learn about more ways to invest, click right here.

Now that we’ve discussed ways to invest, there are a few more principles that you need to know to increase your financial education.

Debt: Is It Good Or Bad?

Bad Debt

Bad debt is buying something that you cannot immediately afford that will decrease in value over time.

If you buy a $300 pair of Gucci sunglasses on a credit card and take a year to pay it off, you’ll end up spending much more than $300 on those glasses with interest added in.

You probably won’t ever be able to sell them for more than you paid for, and you’ll lose money in the long run.

Good Debt

In contrast, good debt allows you to make a profit off of the things you went into debt for. If you buy materials for a business with credit and you make a lot of money, you’ll be able to pay off your debt and walk away with more cash in hand then when you started.

Using credit like this allows you to keep your own dollars in your pocket or use them for other purposes, like investing or saving.

Using debt as leverage to boost your money-making and investing abilities truly is a wealth-building strategy.

Most people who own businesses or property have used the bank’s money to their advantage.

Lending: Become The Bank

Did you know that if you make enough money, you can actually become an investor and lend it to others for profit. When you lend someone money, you can charge interest on that money until it is paid back to you and/or receive a percentage of the profits made with your money.

Yes, there is risk involved in lending money. Yes, it is possible or even easy to lose lots of money by investing in others.

But smart business people are careful about their investments and do the research to back up their financial choices.

Wealthy people use strategic debt as an accelerator to success.

A little risk can, and sometimes will, come with great rewards.

Investing For Teens: How To Start Investing As A Teenager

Why is money important? Although money isn’t everything, it does buy financial freedom.

Investing is an open field to plant your money seeds and grow your way to the top — and the sooner you start, as JP discusses in this online course, the better you and your loved ones are down the road.

That’s why it’s critical to learn more about investing for teens.

After you take his course and learn more about investing, don’t stop there!

You can master your personal finances by learning more about:

- What “Financial-Adulting” looks like

- How to graduate college DEBT-FREE

- Creating your own personalized “wealth plan”

- Find out how to create a budget — and more importantly, how to stick to it

You can learn all of this — and much more — right here.