Start Your Own Gold & Silver Business

How To Flip Gold, Silver, Platinum & Diamonds For Profit

In This Article

Gold has been in high demand for thousands of years, the desired investment choice over other options, including currency. But you knew this, right? Here’s what you may not have known: there is another way people are capitalizing on gold’s value besides using it as an investment: selling gold and starting a precious metals business. If you sell gold, along with silver, platinum, and even diamonds, you can increase your income. The best part? Unlike other businesses, it takes little upfront capital. So how can you sell gold? We’ll break it down in this article.

Starting a precious metals business and selling gold is the subject of a course by Matt Wallace, the President and founder of AURIC Enterprises, where he buys and sells over $150,000 of gold each month.

In Start Your Own Precious Metals Business, he provides a step by step template you can use to get into the business of buying and selling gold, precious metals and diamonds.

In this article, we will: outline the main principles and concepts he covers so that you can learn how to start your own precious metals business and sell gold.

Why Should You Learn to Buy Gold, Silver & Diamonds?

Buying (and selling) gold, silver and diamonds is a strategy for those looking to increase their income without needing a huge chunk of upfront capital.

Another plus is that acquiring the basic knowledge to buy and sell gold, silver, and diamonds doesn’t take as much time as other businesses.

Add some specialized equipment that doesn’t cost a fortune to the equation and you can start earning extra money quickly — you can use this strategy to make $500 to $1,000 this very weekend if you sell gold, according to Wallace.

A big part of what you need to make money using this strategy is:

- hustle

- grit

- drive

When you combine this with the knowledge necessary to profitably pursue such a business, you can consistently make extra money doing this every weekend or during the week.

For those looking for passive investments — receiving returns without having to do much work — you could use the profits from your precious metals business, if high enough, to purchase income-generating real estate property.

Wallace does this himself, taking a portion of the profits from his precious metals business and investing it in real estate.

By comparison, while trading stocks as a day trader can be profitable, for every such trader who hits it big, there are likely many hundreds, or even thousands, who don’t do as well.

If you buy and sell gold and other precious metals, on the other hand, it’s not as difficult to understand.

There is much less risk involved.

If you buy gold and have it in your possession, you can be confident because gold’s value has never fallen to zero — and it likely won’t.

You could take a loss on your holdings now and then, but you don’t have the same risk of losing it all that you might have with a speculative stock or other investments that may weigh on the risky side.

The great thing about learning to buy and sell gold and silver is that the practice is likely to be essentially the same 10, 20 or 30 years from now.

For instance, a large gold buyer Wallace knows used the “acid method” for testing gold all 60 years he was in business.

It’s rare to find a business where you can use the exact same methods or procedures for the entire time you work in the field.

Testing Gold, Silver and Diamonds

There are two major things you need to know to purchase and sell gold and silver:

- You need to be able to accurately test it.

- You have to be able to calculate its value.

Typically, when people try to get started in the business of buying and selling gold, they run into two major problems.

First, they don’t feel confident in their ability to test the gold, which leads to the second issue: they don’t take any action.

Wallace identifies several methods to test gold and silver to determine their purity and ensure the items are genuine.

Gaining knowledge of these testing methods can boost your confidence in your ability to identify deals that will enable you to sell gold at a profit after you acquire it.

Next, let’s explore ways to test gold and silver.

3 Ways to Test Gold and Silver

Acid Testing

One major method used in testing gold and silver is acid testing.

Acid testing is one of the most accurate methods for testing gold because it enables you to do a “destructive” test to drill into the layers of a piece to ensure it is solid gold throughout.

The acid test has not changed significantly in many years and serves as a very affordable method (kits range from $5-$100) of testing gold and silver.

Electronic Testing

Another method of testing precious metals uses electronic methods. The electronic testing approach can appeal to people who don’t want to deal with acids in the testing process.

However, one thing to be cautious about with these testers is that they are susceptible at times to being fooled by gold-layered pieces, classifying them as solid gold when they are not.

In these cases, a destructive test conducted with acid can be more definitive.

XRF

The most advanced portable electronic gold tester is an XRF.

These battery-operated testers contain an x-ray tube and shoot a small x-ray beam at the piece being tested.

The beam interacts with the elements in the piece and the machine reads the results.

These very powerful testers — at a cost of around $17,000 — are most suitable for those who sell gold in high volumes.

Calculating the Value

Besides testing the items you are looking to acquire, the other major thing you need to do when running your own precious metals business is calculating the value of the scrap gold.

After all, if you hope to sell gold at a profit, you need to purchase it at a discount.

ScrapgoldPro

Mobile apps can help with this. For example, scrapgoldpro can be downloaded on an iPhone.

The app lets you enter any weight of gold/carat and then calculates the value of that gold. If you enter a percentage, it will tell you what to pay your customers.

It’s also important to understand the manual ways to calculate the gold value of your items so that you can do so with a piece of paper and a pencil or pen.

Here are some important numbers to remember:

- 24 carat is pure gold

- 18 carat is 75% pure gold

- 14 carat is 58% gold

- 10 carat is 41.6% gold

A higher carat means the item has more value by weight.

To calculate the value, you need to know the spot price, purity, or carats, of gold, and finally either what you will receive from the refinery or what you will pay the customer.

You will also need the weight of the item you are buying or selling.

To calculate the value, you need to know the spot price, the purity, or carat, of the gold, and finally either what you will receive from the refinery or what you will pay the customer.

Finally, you will need the weight of the item you are buying or selling.

Once you know these variables, you can use the following formula to find the price per gram (PPG) of gold:

Spot price x purity x (what you are paying or what you are receiving from refiner)/31.1 = price per gram

The PPG times the weight is what you will pay for gold if you are buying or receive for it if you are selling.

Where to Find Them

Before you can sell gold, you need to find it. Where do you go to find gold (and silver and platinum) jewelry in your area?

There are a variety of places to look.

Wallace notes that not all of the strategies mentioned below will work for everyone, so it’s up to you to experiment and find out what’s best for you and your business.

Estate Sales

One of the best places to buy these types of items are estate sales.

One great thing about these sales is they generally will disclose if they have jewelry for sale.

In a true estate sale someone has passed away and their heirs or whoever controls the estate must dispose of all their possessions.

Thus, in an estate sale scenario the following can happen:

- The family may pick out the most sentimental items but leave behind the better, high-quality items.

- The sale may be run by the trust and the family can’t afford to keep the high-end items.

If you visit garage sales, you will find that often people are just using them to try and get rid of junk.

At estate sales, however, you can find truly valuable items that must be sold — sometimes at prices that are very attractive for the buyer.

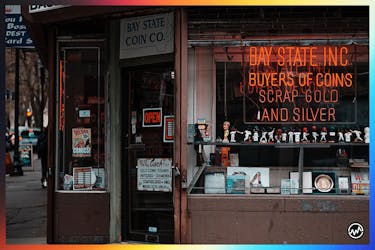

Pawn Shops

Pawn Shops can be another good source of scrap gold. While the larger establishments often have their own gold buyers, the smaller owner/operator shops may be willing to sell you their scrap gold items.

At a medium size pawn shop, you might be able to work a deal where you buy their scrap at 100% of the value and pick up a few diamonds here and there for free.

At larger shops, you will basically only have a chance to buy their mistakes when they mispriced items they have for sale.

Auction Houses

Local auction houses are another good potential source of supply. You will need to do some investigation to find if there are any in your area that you can visit to pick up scrap jewelry or sell jewelry.

Auction houses have different customer demographics, which affect the type of items they sell. Some also offer an online bidding platform, which can make it harder, though not impossible, to find good deals.

The ability to look at the items prior to an auction is a great feature of auctions, as it gives you a chance to see beforehand the quality of the merchandise being sold.

Safety Deposit Box Auctions

Safety deposit box auctions offer yet another way to buy jewelry. These auctions occur when a bank turns the contents of a box over to the state if the owner fails to pay the fee for renting the box.

If the state can’t find the owner or the owners’ heirs, the contents eventually go up for auction. While these used to occur in person, now almost all also have an online component, with some done entirely online.

They are typically listed under the department of state lands as “unpaid property auctions”, or sometimes “safety deposit box auctions”.

A good feature of these auctions is that a significant number of items are auctioned off in a short amount of time, providing you with the chance to make substantial purchases and find a number of good deals.

Craigslist

Wallace teaches that while it’s no longer as easy to source deals from Craigslist, it still is an option to utilize in order to buy and later sell gold.

Here’s an example of a tactic: place an ad saying that you are a gold buyer looking to work with people who visit estate sales to buy scrap gold.

This can provide you with a chance to work with people who go to these sales for other reasons but pick up jewelry with scrap gold value from time to time.

Where to Sell Them

Once you’ve acquired it, where do you go to sell gold?

There are two main options:

- Look for a larger gold or silver buyer or someone who will pay you a higher percentage

- Go to a refinery

A larger gold buyer, such as Wallace’s AURIC Enterprises, will often pay 90% to most of their dealers.

That means that if you pay someone 70% of value for an item you can flip it for a profit margin of 20%.

None of the larger gold dealers pay 100% of value for gold unless a piece is being sold as jewelry.

The majority of the items you acquire will be melted for the scrap gold or silver value.

Many of these larger gold buyers can assay (which means testing the item to see its ingredients and quality) your gold inhouse and melt down the gold from your items without being a refinery themselves.

There are only 5 or 6 true refineries in the country, and these have systems in place to make sure their customers are paid a fair amount for their gold.

You can get fair prices from the melt and assay shops, but some put themselves out as refiners when they are not and don’t pay fair prices.

So, do some research before choosing a buyer for your gold and silver.

A large gold buyer can serve as a valuable teacher to you, so even if the payout is a bit less than a refinery and you miss out on an extra 2% to 3% payout, there can be value there.

This is especially true if they are local to your area and willing to work with you.

Intro to Diamonds

To truly become good at buying and selling diamonds, advanced training is required.

However, in the course, Wallace explains the basics of the process to help people avoid major mistakes when it comes to buying, valuing and selling diamonds as a part of your precious metals business.

His strategy is to acquire small diamonds for little or nothing and stockpile them. These diamonds are removed from gold jewelry prior to melting it down.

Wallace stockpiles his diamonds until he has enough to buy an investment property, likening them to a savings account of a sort.

Because diamonds can be a volatile market, be careful how much you pay for them.

There are two main types of diamond testers. The primary difference between the inexpensive one and the one costing a few hundred bucks is that the more expensive tester can distinguish between moissanite and diamond.

While it may at first seem unlikely that the tiny little diamonds you acquire in the course of running your precious metals business can ultimately buy you a whole investment property, with a little training and hustle, Wallace teaches, acquiring and selling diamonds can actually turn into the most profitable portion of your business.

Sell Gold & Create Your Own Precious Metals Business

If you sell gold and start your own precious metals business, the benefits can be easily stated.

Quite simply, as revealed in Matt Wallace’s course Start Your Own Precious Metals Business, it is a straightforward way to increase your income.

While it is not a passive income strategy and will require plenty of effort on your part, keep in mind that the barriers to entry are not high.

With a small amount of capital and some minimal equipment, you can buy and sell gold and other precious metals to start generating extra funds.

The cash you earn from owning your own precious metals business can help get you closer to realizing your major financial goals.