Ignite Your Genius

How To Activate Your Subconscious Mind, Eliminate Mental Blocks, and Achieve More

In This Article

Some people turn whatever they touch into gold. Others can’t seem to catch a break. Thousands of things factor into the amount of wealth a person creates—but one underappreciated explanation is their thinking.

If you want to grow rich, you need to think differently. You need to gain an unshakeable state of mind.

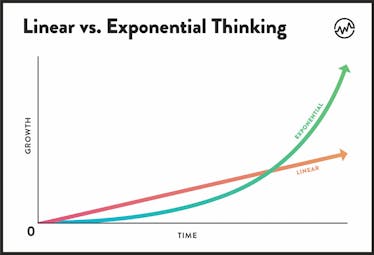

Highly successful people practice exponential thinking, while the less successful remain stuck in a linear mindset. This can be the difference between experiencing grand and mediocre growth.

Two Forms Of Growth

Before we explore the linear and exponential mindsets, it's important to understand the fundamentals of linear and exponential growth.

Growth results when the number or size of something increases.

Put $1 a day in a savings jar for 30 days, and you’ll accumulate $30. Eat 3,500 more calories in a week than your body needs, and you’ll gain one pound. Continue to eat 3500 extra calories a week for six additional weeks, you’ll gain six more pounds, and your waistline grows.

This type of growth is considered linear. It’s logical, incremental, the results are steady and can be easily predicted and seen. The increase will continue as long as you keep adding to it, but it’s limited by the amount being added.

In other words, the savings in your jar cannot grow any faster than $1 a day unless you increase the rate of or amount of your deposits into it. Similarly, if you continue to consume 3,500 extra calories in a week, you’ll continue to gain one pound per week. The only way to gain (or lose) weight faster is to add (or reduce) more than 3,500 calories to your weekly food plan.

Exponential growth is different. It occurs when the increase in quantity or size, is at a constant growth rate. The results accelerate over time and are often unfathomable at first glance.

For example, if you put $1 in your savings jar on day one and doubled the amount the next day you’d now have $3 in the pot. Continue doubling the deposit amount each day over the next 28 days, and at the end of 30 days, you’d have multiple jars filled with cash totaling a whopping $536,870,912.00.

Your savings on linear growth is 1x; your savings on exponential growth is 10x.

When you combine people who think with an exponential growth mindset with today’s technology, you create businesses like Facebook, Google, Airbnb, and Slack.

What Is Linear Thinking?

Linear thinking is only believing what you can see. When you think linearly, you’re blinded from the future.

Linear thinking is organized, rule-based, logical, and easy to replicate. It draws a straight line from here to there. Society teaches us to think linearly.

But when you think linearly, you underestimate what's actually possible with time.

It’s easy to see how linear thinking can be efficient. We get dressed after we shower and we earn our paychecks before paying our bills. We sort physical objects by size, color, or price tag, and we organize information alphabetically, numerically, categorically, or by date.

Getting to point B is contingent on first completing point A, and sometimes that’s exactly what we need. But not always.

Linear thinking leads to mediocre growth. It may cause us to avoid taking risks to increase earnings potential, i.e., failing to negotiate a higher salary increase because corporate-speak says everyone receives 3%. Or we stay stuck churning out low-quality products instead of focusing our attention on quality to increase customer satisfaction and sales.

Without an exponential mindset, we won't realize massive growth or wealth. Not by a long shot.

What Is Exponential Thinking?

If linear thinking is taking one step at a time, exponential thinking is taking huge leaps and bounds.

An exponential mindset can be best explained through this visualization exercise created by Ray Kurzweil and Peter Diamandis, co-founders of Singularity University. It goes like this:

Picture yourself taking 30 steps in a straight line.

Logically, you’ll end up 30 paces away from where you started. You could probably even see where you’d end up from your first step.

Now, what if somebody asked you to take 30 exponential steps? In this case, there would be a doubling of each step: 1, 2, 4, 8 . . . After 30 steps, you’d be one billion paces away. It’s almost impossible to fathom.

Someone with an exponential mindset might look at the past and see that it took five years to get where they are today. Then, they would set a goal to get to where they want to be in only two years. They believe they can use their past momentum and successes to accelerate their progress.

Understanding that it’s possible to take 30 exponential steps is what's propelling people to achieve exponential growth in their financial lives.

Exponents In Everyday Life

Exponential growth occurs in our everyday lives as well, albeit on a smaller scale.

Taking full advantage of an exponential mindset requires that you keep your eye on the prize. Focus on large-scale future growth over smaller incremental gains.

We do this without even thinking. We brush our teeth and floss every day. We slather on sunscreen before we go to the beach. We eat healthy and go to the gym. We don’t see the benefits of doing these things right away, but we know that they’ll pay off over time.

Exponential Growth & Finance

We can apply that same principle to our money.

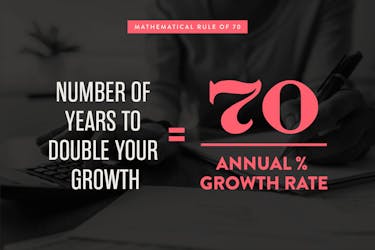

When it comes to growing your wealth, a linear mindset might keep you holding $20,000 in a savings account with a 2% annual percentage rate (APR) growth. Your money would grow, but not by a lot. It would take 35 years to double your savings to $40,000. You can calculate this using the mathematical rule of 70:

But what if you could earn 7% APR instead of 2% APR? By applying even a small amount of exponential thinking, you could double your savings in 10 years. In 35 years, your $20,000 would grow to over $213,000.

The key is to stay the course. The most substantial increases occur in the final years. Consistent growth builds up over time. In the first 5 years of earning 7% APR on your $20,000, you accumulate just over $8,000 in interest. In your 34th year alone, you make almost $14,000 in interest.

Another good example of exponential growth in finance is in home mortgages. You’re paying most of the interest on your home loan in the early years of your mortgage, so the equity you have in your home grows slowly.

It takes about 20 years to pay down a 30-year $200K mortgage at 4.5% interest to a balance of $100K. After those 20 years, you’ll still owe almost 50% of your mortgage!

But if you take out a 15-year mortgage instead of a 30-year, you'll hit that $100K balance in less than nine years. This way you’re increasing the equity in your home, decreasing your debt, and growing your net worth much faster. One extra step you can take to get even a better deal is to negotiate your mortgage rate.

Exponential Growth & Technology

Exponential technologies shape every aspect of our lives. These technologies include artificial intelligence (AI), virtual reality (VR), data science, digital biology, digital fabrication, robotics, and autonomous vehicles.

A technology is considered exponential if the "power and/or speed of it doubles each year, and/or the cost drops by half."

Humans don't work like that. We tend to operate within the constraints of a linear mindset. If it took you five years to get here, it’ll take you another five years to get there. We look to the past to predict future possibilities.

But two concepts can help you understand exponential growth: Ray Kurzweil's Law of Accelerating Returns and Moore’s Law.

1. Ray Kurzweil’s Law of Accelerating Returns

The law of accelerating returns dictates that the rate of change in learning systems, including technologies, tends to increase exponentially.

"An analysis of the history of technology shows that technological change is exponential, contrary to the common-sense ‘intuitive linear’ view. So we won’t experience 100 years of progress in the 21st century—it will be more like 20,000 years of progress (at today’s rate)." Ray Kurzweil

2. Moore's Law

After observing that the number of transistors in a square inch on integrated circuits doubles approximately every two years, Gordon Moore released a prediction in 1965:

Computing would dramatically increase in power and decrease in relative cost at an exponential pace far into the foreseeable future.

This became known as Moore’s Law.

What is an Exponential Business Model?

Exponential business models are similar to other business models in that they each evaluate and define key business assumptions and relationships-mission, values, processes, customers, unique proposition, revenue streams, partners, resources, etc.

But while a linear thinking entrepreneur may project 10% growth on future profits, an exponential thinking business owner is planning ten times that growth or 10x.

Exponential business models aren’t designed to create a better company or product. They’re used to create a vastly different company or product. Think Amazon and Uber.

A linear business model may target an audience within one state or one country. An exponential business model aims at the world. Linear models seek customers. Exponential models build a community of raving fans, and they connect and collaborate with them in a multitude of ways on several platforms.

Linear businesses create and follow systems and set controls through management practices. Exponential models automate and scale systems and procedures.

While linear business models create partnerships with suppliers, logistical, and marketing companies, exponential models create uncommon partnerships with businesses in different industries to realize a new vision, such as Facebook’s Libra cryptocurrency.

Exponential leaders combine smart business thinking, creative and innovative ideas, and today’s technology within their business model to achieve rapid 10x business growth in the digital era.

Exponential Growth Is Changing the World

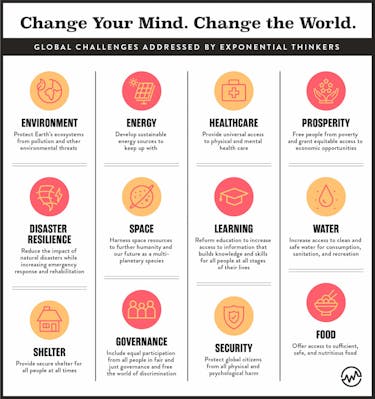

The shift from linear to exponential thinking doesn’t only benefit us. It benefits the world. The shift from linear to exponential thinking is what's led Singularity University (SU), the Bill & Melinda Gates Foundation, and others like them to embrace initiatives that will solve some of our global challenges. According to SU, these initiatives will address these 12 grand global challenges:

Where these global hurdles once seemed impossible to overcome, the exponential growth in the minds of innovators makes them more feasible every day.

How Can You Think Exponentially?

Knowledge is half the battle. The human mind isn’t made to account for exponential growth. But now that you know that, the next time you’re tasked with calculating what’s really possible, be sure to do the math.

Exponential thinkers don't just set goals—they stretch goals. Need $1000 in 30 days? Make your goal to have $1000 in 15 days instead.

Doing research is one thing. Getting out there and trying, failing, and trying again is how you’ll really learn and grow.

Remember: what got you here will not get you there.

Change how you think, change what you do, change your life, maybe even change the world.