Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

- How Good Is a 700 Credit Score?

- What Makes Up My 700 Credit Score?

- Is a 700 Credit Score Good Enough For a Credit Card?

- Is a 700 Credit Score Good Enough for a Car Loan?

- How Much Can You Borrow with a 700 Credit Score?

- Is a 700 Credit Score Good Enough for a Mortgage?

- How Long Does it Take to Get a 700 Credit Score?

- How to Improve Your 700 Credit Score

- 5 Credit Pitfalls to Avoid

- The Bottom Line: Don’t Stop at a 700 Credit Score

Is a 700 credit score good, bad, or average?

Building or rebuilding credit isn’t always easy. While sometimes you may be able to boost your credit scores quickly, most of the time the process requires a lot of hard work and a little patience thrown in for good measure.

If you’re like the majority of people, you’re working to improve your credit scores, even if you just received your first credit card.

So, should you aim for a 700 credit score? Furthermore, what can you do with a 700 credit score?

The answer is. . .you can do a lot.

The truth is that a 700 credit score isn’t perfect, but most lenders consider it to be good.

Keep reading to learn some good credit score habits that could help you earn a 700 credit score — and why a 700 credit score is worth the effort.

How Good Is a 700 Credit Score?

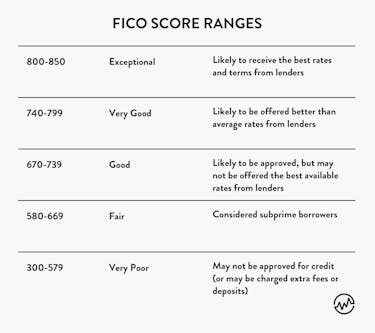

According to Experian, a credit score of 700 falls within the “good” score category under both FICO and VantageScore credit scoring models. Here’s a look at how a 700 credit score measures up.

As you can see, with a 700 credit score you have a great chance of being approved when you apply for financing. (This is based on the credit piece of an application. Other factors, like employment and income, will be evaluated too.)

But a 700 score doesn’t guarantee you the lowest interest rate or the best terms available.

What Makes Up My 700 Credit Score?

Payment History

Your ability to pay your credit card bill on time Is the biggest factor affecting your credit score accounting for 35%.

Having late payments and how late they are matters. For example, a 30-day late payment will not affect your credit score as harshly as a 90-day late payment for example.

Having multiple late payments is going to affect your credit score negatively for the foreseeable future.

Amounts Owed

Your credit utilization ratio — how much of your credit limit you are typically using per cycle — is attributed to the next 30% of your credit score.

Whenever possible, it is best to pay down your credit card even before it’s due to maintaining a low balance in comparison to your limit.

In addition to the credit utilization ratio, things like the total amount of debt on your credit report, the number of accounts that currently have balances, and the distribution of debt that you hold are each item that contributes to your score.

Length of Credit History

Another 15% of your credit score comes from how long you have had credit. The longer your history, the more information is available for the system to point to and determine you are a reliable borrower.

This is why it is important to begin establishing credit early on. A report with several established accounts will look much better than one with recently opened accounts because even if the history is flawless, there isn’t much of it.

One way to expedite this process is to be added as an authorized user of someone’s else’s existing credit card. As long as the account is in good standing, it could help earn you some points toward your overall credit score by extending the age of your credit.

Credit Inquires

You may know simply checking your credit can cause it to take a hit. This is where the next 10% comes in. It is important to note, however, that this is only the case when there is a hard inquiry (compared to a soft query, which doesn’t impact your credit score).

These are typically done when applying for a new line of credit. The inquiry will be noted on your credit for 25 months and potentially hurt it for the first 12.

Credit Mix

The final 10% focuses on your credit diversity. Including a good mix of loans, such as a credit card, mortgage, and auto loan — is ideal. This helps show that you are capable of managing multiple kinds of credit.

Is a 700 Credit Score Good Enough For a Credit Card?

Once reaching a 700 credit score, you begin to unlock some decent credit card options with solid perks, such as travel and cashback.

Is a 700 Credit Score Good Enough for a Car Loan?

A 700 credit score also puts you in solid position for a car loan at competitive interest rate.

It classifies you as being in the “prime” credit range so the rates offered will be better than others, though still not quite the best available.

How Much Can You Borrow with a 700 Credit Score?

Your credit score can have a big influence over your ability to qualify for a loan. It can also impact how much you’ll pay for financing (aka your interest rate) once you’re approved.

But your credit score isn’t the first thing lenders look at when they want to figure out how much money they’re comfortable loaning you.

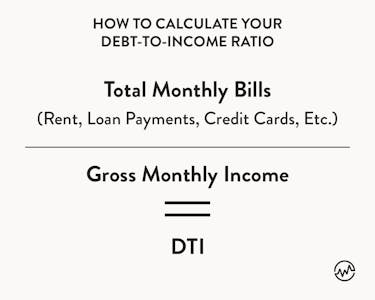

How much you can borrow often has more to do with your debt to income ratio — how much money you earn versus the debt you already owe.

Here’s the formula to calculate your debt-to-income ratio (DTI).

Each lender sets its own requirements when it comes to DTI. The lower your DTI, the lower your risk. With a lower DTI, a lender may be more comfortable issuing you a higher loan amount.

In general, a DTI of 20% or less is considered excellent. However, if you’re buying a home, Fannie Mae sets the maximum DTI ratio at a high 50%.

(You’ll have to meet credit score requirements to qualify.)

Keep in mind, just because a lender let’s borrow up to a certain maximum, doesn’t mean it’s the right financial decision.

You should take an honest look at your budget and do your own calculations.

Figure out how much money you can comfortably afford to pay on a new loan each month before you commit.

Is a 700 Credit Score Good Enough for a Mortgage?

The short answer is yes. A 700 credit score is high enough to satisfy most mortgage lenders.

In fact, a 700 credit score could help you land a pretty decent interest rate on a home loan.

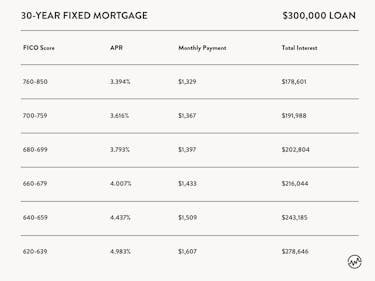

Here’s what FICO has to say about how a 700 credit score stacks up when you want to take out a mortgage, based on available interest rates at the time this article was written.

According to FICO, a 700 score could help you qualify for the next-to-lowest available rate on a mortgage.

On a large mortgage loan, that lower interest rate could add up to a significant savings over the years, especially if you worked hard to bring your scores up from the 600s.

How Long Does it Take to Get a 700 Credit Score?

If starting from nothing, it can take between 3-6 months for your history to become substantial enough that a score can be determined.

Referencing the categories that make up your credit score above and capitalizing on each will be the quickest route to getting to a 700 credit score — and beyond.

How to Improve Your 700 Credit Score

Credit scores come in many different shapes and sizes. In fact, there are hundreds of credit scores that are commercially available. It’s up to each lender to decide which credit score brand and which version it wants to use to evaluate the credit reports of new applicants.

Most credit scoring models used by lenders feature a credit score range of 300 to 850. The higher your score climbs on that scale, the better off you’ll be.

You can’t control which scoring model a lender will use to evaluate your credit reports. But you do have a lot of control over the information that shows up on your credit reports in the first place. This is where you should focus your attention if you want to boost your credit scores.

Step one to earning a 700 credit score is to figure out which information from your reports influences your credit scores in the first place. From there, you can design some credit-smart habits that may help you earn a higher number of points.

These 5 good credit score habits can help.

#1: Keep an eye on your credit reports

You’ll want to check all three reports from Equifax, TransUnion, and Experian. If you find mistakes — they do happen — you can dispute them with the credit bureaus.

#2: Always pay on time

This one isn’t negotiable. 35% of your FICO Scores and a significant portion of your VantageScore credit scores are based on your payment history. It’s the most important category that influences your scores.

#3: Only use a small portion of your credit card limits

Your credit card has a limit. Whether it’s $500, $5,000, or $25,000, just because you can charge that much doesn’t mean you should. Credit scoring models pay attention to your credit utilization (i.e. the percentage of credit card limits used, per your credit reports). The higher your credit utilization climbs, the lower your credit scores may fall.

#4: Ask a loved one for help

You might consider asking a loved one to add you onto an existing, positive credit card account as an authorized user. This strategy is far better than co-signing because it could potentially help you build credit without putting your loved one at risk.

#5: Mix it up

Credit scoring models are designed to reward credit reports that show a healthy mixture of account types. So, if you only have credit cards on your reports, you might consider adding an installment account (like a credit builder loan) and vice versa.

#6: Write a Goodwill Letter

Writing a goodwill letter involves asking a creditor to remove negative marks from your credit. There is no obligation for them to take action but explaining that certain circumstances put you in a tough position and caused a late payment is worth a shot and has proven to be successful.

Pointing to proof of a solid history otherwise or with other creditors would be good to include in a goodwill letter.

You can learn more about using a goodwill letter with this guide.

#7: Write a 609 Credit Repair Letter

Another powerful tool you can use is called a 609 credit repair letter. A 609 credit repair letter challenges any unverifiable bad marks on your credit.

Once submitted, these marks will be reviewed and if deemed to be inaccurate, they will be removed from your report, instantly increasing your credit score.

The opposite can be true as well — the mark could be verified as accurate and actually end up lowering your credit score further.

You can learn more about a 609 credit repair letter with this guide.

5 Credit Pitfalls to Avoid

Once you’ve done the work to earn a 700 credit score, you’ll need to keep up with the good habits that helped you get there in the first place. Yet sometimes knowing what not to do is just as important when it comes to maintaining good credit.

Here are 5 credit pitfalls to avoid so that you can be on your way to a 700 credit score.

Don’t close old credit cards

You might not know it but closing an unused credit card could hurt your credit scores. Closing an account won’t lower your average age of credit (that’s a myth), but it might increase your overall credit utilization rate — a big credit score no-no.

Avoid applying for too much new credit

When a lender pulls your credit as part of a loan or credit card application, there’s a chance it could hurt your credit score. If any damage happens (and that’s not a given), it’s usually only a little and will only last for up to 12 months. Still, it’s wise to make a habit of applying for new credit only when you need it and probably not because you’re trying to get 20% off your purchase at the mall.

Don’t wait until the due date to pay

Did you know that most credit card issuers only update account information (including your balance) with the credit bureaus once a month?

If you wait until your due date to pay, your credit report could show a high balance and utilization on your credit card until the next monthly update. (Remember, high utilization can be bad for credit scores.)

Pay before the statement closing date on your account, however, and you should bypass this potential issue.

Missing a Payment

Remember: the FICO scoring model uses your payment history to determine 35% of your total score.

Set up a monthly reminder in your phone so you make those payments by their due dates, each and every time.

Using A Debt Settlement Company

Having an account back in good standing is obviously a good thing for your credit — but how you get there matters.

The idea of settling your debt for less than the full amount is enticing, but when dealing with a debt settlement company, you are likely to incur fees for their services.

Most importantly though, your credit score will suffer. It is a much safer bet to contact your creditors directly and aim to find a solution instead.

The Bottom Line: Don’t Stop at a 700 Credit Score

If you’re trying to improve your credit, a 700 credit score is a great initial goal to set. But don’t stop there. Ideally, you should aim a little higher than a 700 credit score if you want lenders to roll out the red-carpet credit treatment for you.