The Complete DIY Credit Repair Kit

In This Article

Do you have too many credit cards? Are tired of paying an annual fee for a card you don’t use? You might think the solution is straightforward: cancel a credit card. But it’s not that simple. Canceling a card can be detrimental to your credit score. So how can you cancel a credit card without hurting your credit score?

In this article, we’ll explain:

- Reasons to cancel a credit card

- Why canceling a card can hurt your credit score

- The 8-step process of how to cancel a credit card without hurting your score

- Alternative options to canceling a credit card

- Frequently asked questions associated with how to cancel a credit card

- Healthy credit habits that you can begin practicing today

Let’s get started!

Reasons To Cancel A Credit Card

Here are a few reasons why you may want to cancel a credit card, whether it’s now or in the foreseeable future:

Too Many Cards

How many credit cards do you have? One? Two? Five? If you open multiple accounts for rewards or for a balance transfer, you might find that you have too many and you’d like to cancel one.

Inactivity

If you haven’t used a card in a significant amount of time, you may see a need to learn how to cancel a card and close the account.

Temptation

Maybe you racked up a large credit card bill, the temptation to use it is just too much and you’d like to close the account.

If this is the case, keep reading because we will explore ways later in this article how to find a long term and sustainable solution to your spending habits.

Sharing a Joint Account

If you share a joint account with someone and you no longer wish to do so, such in the event of a divorce, you may see the need to cancel your credit card.

High Fees

When you first sign up for a credit card, there’s excitement and anticipation, especially if there are rewards associated with the card. It’s easy to overlook the fine print stating it’s APR, or annual fees. Plus, either of these may be waived for some time when you first open an account.

But after some time, you may not want to be on the hook paying these fees, and you may want to know how to cancel a credit card.

How Canceling A Credit Card Hurts Your Credit

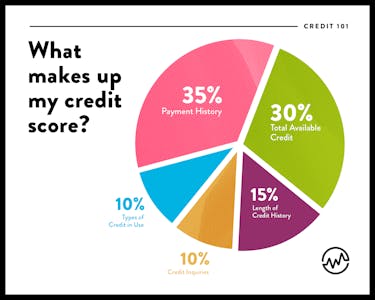

It’s not just a myth: canceling a credit card can lower your score. In order to understand how, it’s important to know what makes up a credit score.

Your Length of Payment History Is Reduced

15% of your credit score is tied to the length of your credit history.

If the length of payment history is tied to one account — such as a credit card you’ve had for years — and you close that account, your credit score will likely drop.

Your Credit Utilization Increases

If you close an account, your credit utilization ratio — how much available credit you have versus how much you are using — will increase.

If you don’t know your credit utilization ratio, it’s found by dividing your total credit card balances by your credit limit (or available credit).

For example, let’s say you have a credit card with a $30,000 credit line, and you have a balance of $15,000. That’s a 50% credit utilization ratio.

A general rule is that lenders like ratios of less than 30%, and those who have low credit utilization ratios, signifying they are low risk by not carrying a high balance, typically have high credit scores.

Your Variety of Credit Decreases

Because 10% of your credit score is dependent upon the types of credit in use, it’s good to have different forms of credit, such as a car loan or a mortgage and not just a credit card.

If you only have one credit card, and you close that account, you will reduce your variety of credit, which can then lower your credit score.

How To Cancel A Credit Card in 8 Steps

Now that we’ve explained why you may want to cancel a credit card along with why it can lower your credit score, let’s break down how to cancel a credit card.

Step 1: Evaluate The Impact

The first step for how to cancel a credit card is to examine what impact closing an account will have on your credit report.

Are you planning on applying for a loan in the next year or so? If the answer is yes, we advise waiting to close an account, because closing an account could lower your score enough to not get the loan you’re looking for.

Keep in mind that if you have a short credit history, such as only a few years, closing the account could lower your credit score significantly because of your lack of payment history.

On the other hand, if you have a long credit history, such as someone in their 40s or 50s who has been practicing healthy credit habits for decades, closing an account won’t do nearly as much damage.

Plus, if you are maintaining other types of credit and have a low credit utilization ratio, you may not see much of a decrease.

Step 2: Pay The Balance

If you decide that you’d like to close the account, the next step is to pay off any balances that remain on the card.

Step 3: Redeem All Rewards

Are there rewards that you haven’t used on the card?

If you decide to close the account, you won’t have access to them. This can include:

- Cashback

- Flyer miles

Step 4: Call The Creditor Or Bank

Contact customer service and ask to close the account. Keep in mind that the representative will likely try and persuade you to keep the card or provide some of the company’s other offers.

Ensure that the company provides notice — either in mail or email — of the account closing.

Step 5: Update Your Payment Process & Notify Authorized Users

If you have set up automatic payments to the account, update the information since this will no longer be necessary.

Also, if you have an authorized user on the credit account, notify him or her that the account has been closed.

Step 6: Check Your Credit Report

Even if you have received confirmation of the account closing, it’s important to check your credit report 30 to 45 days afterwards to see that it’s being reflected as well.

Step 7: Dispute any incorrect information

If you find any incorrect information in your credit report, ensure that you dispute it with the credit bureaus.

Step 8: Destroy the Card

The final step is to ensure that the card is never used again. Instead of throwing it away intact, it’s wise to cut it into pieces.

Alternatives to Canceling A Credit Card

Now that you’re aware that canceling a credit card can have a negative impact on your credit score, you may opt for an alternative to canceling a credit card. Here are a few of your options.

Downgrade The Card

If your credit card has an annual fee, you may be able to downgrade to a card within the same company that doesn't have an annual fee. To do this, contact customer service and ask if there are cards without such fees.

Keep in mind that you may lose the rewards in the process.

Ask For Fees To Be Waived

With credit card companies, you do have negotiating power. After all, it’s in the companies vested interest to keep you as a customer. In some cases, you may be able to negotiate fees with them.

If you have a high APR or annual fee, ask the company to reduce the APR or get rid of the annual fee. If the representative is hesitant at first, explain that if not, you will close the account and take your business elsewhere.

Examine Your Spending Habits

If you are overspending with the card, and it’s too much of a temptation, you can close the account and cut the card to pieces. But this is a short term solution that isn’t sustainable.

Instead, examine your spending habits. Why are you overspending? Are you not aware of how much you’re spending, or are you spending more than you have?

If You’re Not Aware of How Much You’re Spending…

Create a budget so that you don’t overspend.

But do budgets even work?

They do if the plan is catered to your personal finance needs. Plus, they can offer financial peace of mind. Here are a few free resources:

- Learn how to create a simple budget based on your money personality

- If you’re a restaurant server, learn how to budget when you work for tips

- Discover how to budget even if you’re bad at numbers

- Find out how to track and manage your monthly cash flow with this free template

If You’re Spending More Than You Have...

There’s nothing wrong with wanting items that you can’t afford. So instead of closing an account because you are too tempted to use it, we encourage you to make more money so that you can afford the things you desire.

There’s truly no ceiling to how much you can make.

How can you do that?

Here are a few free resources:

- Choose from our 101 Side Hustles to begin earning money quickly

- Read this guide to starting your own startup business to make money and become your own boss

- Discover how to make money by creating and selling your own online course

- Here are 12 ways a website can make you money

Frequently Asked Questions: How To Cancel A Credit Card

Next, let’s look at a few questions that arise on the topic of how to cancel a credit card.

Can I Cancel My Credit Card Online?

The majority of companies require you to contact their customer service to close an account.

This gives companies an opportunity to persuade you to keep the card instead of closing the account.

Can I Cancel A Credit Card I Just Opened?

In the event that you want to close a recently opened credit card — such as if you didn’t realize the fees associated with it or you opened it for rewards and then used the rewards — be aware that it’s a bad idea to close the account before the one year mark.

Some companies have a record of taking back rewards or even closing your account if they believe you are opening an account simply for the reward and plan on closing it immediately thereafter.

For example, if you try to open an account with Chase, you can’t have opened five or more personal credit cards in the last 24 months. This is widely known as the 5/24 rule.

Will Closing An Account Remove My Late Payments?

Closing an account will not remove your late payments from your credit score, because even after you close the account, your payment history will remain on your credit report.

If you are struggling with late payments, here are a few free resources:

- Use this template to write a goodwill letter and have negative items removed from your credit report

- Find out how to permanently remove derogatory marks from your credit report

Can You Cancel A Credit Card Without Paying It Off?

While you can cancel a credit card without paying it off, you will still be on the hook for paying for the full balance, which includes the interest your account has accrued.

Can A Credit Card Company Close My Account Due To Inactivity?

A credit card company can close your account if it hasn’t been used for a year or more.

4 Healthy Credit Habits

Regardless of whether or not you are going to cancel a credit card, it’s important to maintain healthy credit habits so that you can have a near perfect credit score — and reap the incredible benefits that come along with it.

Here are 4 ways to do that.

Pay On Time

It may seem like missing a payment or two isn’t a big deal — but missing even a single payment can place a derogatory mark on your credit report and drop your score.

Plus, you may be fined a late fee for missing the payment.

Take the proactive approach of paying on time by setting up reminders on your phone or marking it on a calendar so that you never miss a payment.

Monitor Your Credit Report

Do you know what your credit score is? If not, it’s important to be monitoring it not only to see if you can qualify for a loan in the near future, but also to ensure that there are no mistakes on your report.

After all, one in five people have an error on at least one credit report.

If you do find a mistake, you can dispute it and have it removed.

The three credit reporting agencies — TransUnion, Equifax, and Experian — provide one free credit report per year that you can examine.

Keep Your Credit Utilization Low

Along with monitoring your credit report, monitor your credit utilization. What’s the best ratio? The good rule of thumb is to keep it below 30%.

If you’re aiming for a perfect credit score, try to achieve a 2-3% revolving credit ratio.

Use Multiple Forms of Credit

Because 10% of your credit score is based upon the types of credit in use, it’s important to not just have a credit card, but other forms of credit.

Consider other types of loans that are affordable to help diversify your credit and keep it healthy.

How To Cancel A Credit Card

Although it may seem simple, learning how to cancel a credit card requires careful thought and planning.

The next time you apply for a credit card, ensure that it (and the fees associated with it) fits your spending habits.

And if you want to cancel a credit card, weigh the pros and cons. Also, consider the alternative options mentioned in this article.

Plus, continue to practice healthy credit habits so that you can have a peace of mind and reap the financial benefits you deserve.