Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

If you currently feel like you can’t get ahead when it comes to your credit cards, you’ve probably daydreamed more than once that the debt would simply go away.

There are few experiences in life that are more frustrating — or more expensive — than sitting underneath a soul-crushing pile of credit card debt.

Can’t you imagine how that would feel?

You might be surprised to learn that, at least sometimes, credit card debt can disappear.

Of course, the process isn’t as simple as you probably wish. Credit card debt forgiveness sounds amazing on the surface, but the reality of how it works might not match up with your dreamy expectations.

In truth, even if you’re lucky enough to be approved for some degree of debt forgiveness, there may be an unexpected price to pay.

Read further to learn about credit card debt forgiveness and if it can help your financial situation.

What Is Credit Card Debt Forgiveness?

Let’s start with a basic definition of credit card debt forgiveness.

Credit card debt forgiveness is what happens when a card issuer forgives your debt — either partially or in full.

In the credit card world, full debt forgiveness is rare. However, partial debt forgiveness isn’t uncommon.

While credit card debt forgiveness isn’t a magic wand, it may offer you some immediate financial relief. There is, however, a catch.

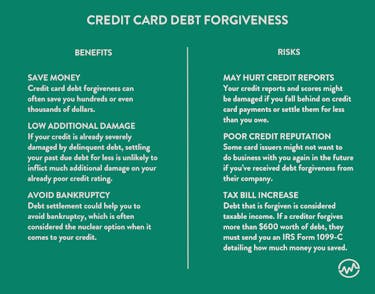

The consequences of credit card forgiveness may be harsh when it comes to your credit reports and scores.

Debt forgiveness may also result in a bigger tax bill at the end of the year.

How Does Credit Card Debt Forgiveness Work?

Credit card debt forgiveness can be broken down into a five-step process. The first three steps occur before or during the debt forgiveness process and the last two take place afterwards.

The Right Time to Make an Offer

When you fall far enough behind on your credit card payments — more specifically, after 180 days of not making the minimum payment on your credit card balance — your credit card issuer may decide to “charge off” your outstanding balance.

Before you get too excited, know that the term “charge off” doesn’t equal debt forgiveness. You still owe the same amount of money to your credit card company.

Once a credit card account reaches charge off status, it’s often sold or turned over to a collection agency. At this point, a collection account may be added to your credit reports in addition to the original account.

Because your credit card debt is severely past due, the collection agency who now owns the debt (or is collecting on behalf of the card issuer) may be willing to entertain settlement offers. You can also make an offer right before your account gets to this point.

Here’s a tip: You don’t have to wait for your credit card debt to get out of control to take action.

These get-out-of-debt strategies can help you deal with your credit card debt and hopefully protect your credit scores at the same time.

You can also utilize a balance transfer to save money on interest, use a credit union to consolidate credit card debt or find a consumer credit counselor.

Negotiations

When you’re behind on a credit card bill, you or a debt settlement company acting on your behalf can reach out to a card issuer or collection agency to try to negotiate the debt for less than you owe.

If you’re lucky, you might be able to settle an account in a lump sum for as low as 50% of the outstanding balance, though results vary widely.

Remember, you’ll most likely need to be past due on your payments for this strategy to work.

Unfortunately, many credit card companies aren’t willing to settle for less unless you’ve already fallen behind on your payments. That’s not great news in the credit score department.

Some debt settlement companies recommend that you deliberately fall behind on payments in the hopes of scoring better settlement offers. However, because of the damage this can inflict on your credit, you should think long and hard about the risks involved before you follow this advice.

Forgiveness

If a card issuer or collection agency accepts your settlement offer, your next step should be to get the agreement in writing.

A reputable debt settlement company should handle this on your behalf if you’ve hired one to represent you. But be sure to ask just in case.

Any settlement agreement should clearly state, in writing, that your remaining account balance will be forgiven. Verbal promises aren’t enough to protect you if there’s a misunderstanding or something goes wrong.

What Happens When a Debt Is Forgiven?

Updating Credit Reports

Once you’ve settled your credit card debt in full, your work isn’t done. You still need to follow up to make sure the account shows a zero balance on all three of your credit reports with Equifax, TransUnion, and Experian.

Taxes

Debt forgiveness has the potential to increase your tax bill to the IRS. If a creditor forgives more than $600 worth of debt, it’s supposed to send you an IRS Form 1099-C detailing how much money you saved.

Let’s say you settle a $15,000 credit card debt for $7,500. The forgiven amount ($7,500) should be listed on a 1099-C and mailed to you and the IRS.

Once you receive your copy, you’ll need to include the amount as “other income” on your upcoming tax return.

At this point, you might need to work with an experienced tax advisor or attorney to see if reducing your tax liability is possible.

Certain exclusions may protect you from having to count the full amount of forgiven debt as taxable income. However, most taxpayers need a professional to help them sift through potential tax exclusions.

Credit Card Debt Forgiveness Benefits vs. Risks

The appeal of freeing yourself from a ton of credit card debt is understandable.

There’s no question that credit card debt forgiveness has its benefits. However, the process isn’t without its drawbacks either.

Here’s a side-by-side look at some of the benefits vs. risks of credit card debt forgiveness.

How To Get Credit Card Debt Forgiveness

Getting approved for debt forgiveness isn’t a given. However, there are a number of ways you can approach a credit card company or collection agency to see if they’re willing to cut you a break financially.

Below are four of the most popular ways to get some level of credit card debt forgiveness.

Settle It Yourself

You always have the right to try the DIY approach when it comes to credit card debt forgiveness. There’s nothing to stop you from picking up the phone and calling a creditor or collection agency with an offer to settle your debt for less.

Settling your own debt might help you save money when you compare the cost of professional debt settlement fees. Yet professional debt settlement companies will be quick to point out the possibility that their experience might be able to net you bigger savings and that could outweigh the cost of their services.

If you do opt for the DIY approach to debt forgiveness, it’s typically best to settle your debts in one lump sum.

Setting up a payment plan might reset the collection clock on time-barred debts, opening the door for creditors to potentially sue you over old accounts again.

Hire A Debt Relief Company to Settle It For You

If you prefer to hire a professional debt settlement company to help you, know that there are dishonest people in the industry. This doesn’t mean every debt settlement company is out to get you. It’s simply a sign you should take your time and thoroughly vet anyone you consider hiring.

The Federal Trade Commission recommends checking out debt settlement companies with your state Attorney General and local consumer protection agency. You can also search for online customer reviews to help guide your choice.

Also, debt settlement isn’t free and, often, it isn’t cheap. You should compare costs and take a truthful look at your budget to decide if it’s something you can afford in advance.

Join a Debt Management Plan

A debt management plan (DMP) is another way to get a certain level of debt forgiveness. If you consider this option, you should make sure the plan is administered through a trustworthy consumer credit counseling program.

You can find a list of certified credit counselors in your area at the National Foundation for Credit Counseling website, or NFCC.org.

A DMP doesn’t exactly result in credit card debt forgiveness, but it can save you money. A credit counseling company can negotiate with credit card companies to reduce (or even stop) the interest on your accounts. These companies generally charge fees as well.

Your actual credit card balances, however, remain the same. So, while this option might save you some money, it’s not technically the same as debt forgiveness.

Filing For Bankruptcy

You shouldn’t declare bankruptcy lightly because it can both damage your credit and make it difficult to borrow from lenders again in the future.

But if you’re debt is out of control and far beyond what your income can support, bankruptcy is an option that may offer you some immediate financial relief.

If you qualify for a Chapter 7 bankruptcy (based on your income), your credit card debt might be wiped out entirely. Chapter 13 bankruptcy, on the other hand, could allow you to keep some of your property (like a house or vehicle) while reducing your debt payments to a manageable level.

How to Decide What Is Right for You

Out-of-control credit card debt can be a serious problem.

When you revolve high balances on your credit cards it’s usually bad for your credit scores, not to mention bad for your budget.

The truth is, none of the debt forgiveness options above will offer you a quick fix.

However, any of them can offer you a chance to start down a new financial path.

Whether you choose bankruptcy, DIY debt settlement, hire a debt settlement company, or do something else entirely, it will take time to solve your debt problems.

You might need to work to rebuild your credit after the fact as well.

Still, any choice is better than ignoring the problem.

The quicker you decide how to deal with your credit card debt problem, the sooner you’ll be able to enjoy the freedom that eliminating your credit card debt can bring.