The Complete DIY Credit Repair Kit

In This Article

Everyone loves a surprise — unless it's a derogatory mark on your credit score.

If you thought you had good credit and applied for a loan, whether it was for a car or mortgage, and you were either denied or given a high-interest rate because your score had recently dropped, you know the unsettling feeling of this surprise.

When you check your score to find out why it dropped, you may find a derogatory mark.

What is a derogatory mark? Why did it make your credit score drop? More importantly, how do you get rid of a derogatory mark?

In this article, we’ll break down:

- what a derogatory mark is

- how to avoid one, and

- how to get it taken off your credit report

- how to boost your credit so that you can enjoy a lifetime of good credit — and the benefits that come with it

Let's begin by exploring why a good credit score is so important.

Why Is a Good Credit Score Important?

First, let’s do a quick refresh on why credit is important — and why a good credit score can save you money.

At some point, you are going to want to borrow money for a car loan or mortgage.

Because a credit score is an indicator of trust, the better your credit score, the better interest rates you can qualify for, which means you’ll be paying less in interest. And overall, saving you money.

Derogatory marks, which lower your score, can hinder this.

[ DOWNLOAD: Get our Complete DIY Credit Repair Kit and learn how to get your credit back on track in less than 30 days! ]

What Are Derogatory Marks?

Derogatory marks are long-lasting negative items on your credit report that lower your score.

While they can range from a missed payment to foreclosure or more, they all have one similarity: it stems from not paying your bills.

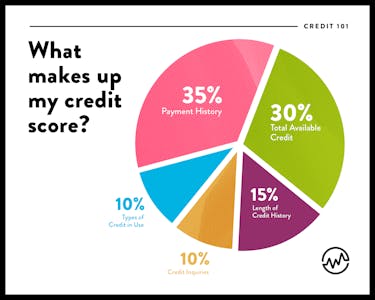

And because payment history accounts for 35% of your credit report, a late or non-payment can make a huge impact.

Here’s a look at what makes up your credit score:

We’ll look at what can cause a derogatory mark next.

What Causes a Derogatory Mark?

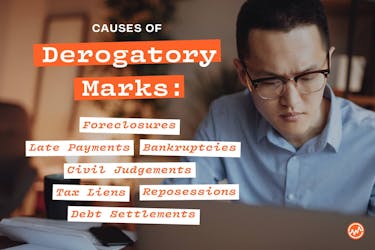

There are many things that can cause a derogatory mark which you need to steer clear of.

Late Payment

If you are 30 to 60 days late on making a payment, such as for a credit card or car loan, you’ll receive a minor derogatory mark; if you’re over 90 days late, you’ll receive a major derogatory mark.

Late payments can stay on your credit report for 7 years.

Bankruptcy

If you can’t repay your debts and you file for bankruptcy, you’ll receive a derogatory mark.

Chapter 13 bankruptcy can stay on your credit report for 7 years and Chapter 7 can remain on your report for 10 years.

Civil Judgement

If you don’t pay a debt, creditors have the ability to sue you in court. A civil judgment is a court order to repay damages.

If left unpaid, civil judgments can last 7 years on your credit report.

Debt Settlement

While a debt settlement — when you and your creditor come to an agreement on paying less than the full amount you owe — can help you financially, it will place a derogatory mark on your credit score that can last up to 7 years.

Foreclosure

If you don’t pay your mortgage, you will forfeit the property and have a derogatory mark that can last 7 years on your credit report.

Tax Lien

While paying taxes isn’t the most exciting task, there are steep penalties if you don’t pay by the deadline (if you need a tax extension, learn how to get one here or learn how to file your taxes here).

The government can place a tax lien against your property, which means they’ll be first in line ahead of other creditors for the right of your property.

A paid tax lien can last 7 years on your report, while an unpaid tax lien can stay on your report permanently.

Repossession

Not only will your assets be seized with repossession — it will last 7 years on your credit report.

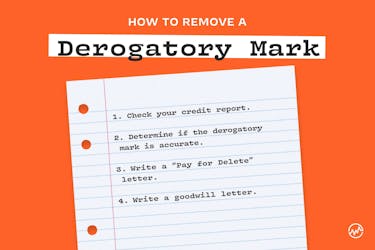

How To Remove A Derogatory Mark

Do you have a derogatory mark on your credit report? If so, there are ways to address it.

1) Check your Credit Report

The sooner you are aware of it, the sooner you can work towards getting it removed.

2) Determine If The Derogatory Mark Is Accurate

According to the Federal Trade Commission, one in five people have an error on at least one credit report.

Again, this is why it’s so critical to check your credit report routinely.

If there is an error, you can file a dispute with the creditor by either mail or online. Here’s how.

Experian

- Online

- Via mail, P.O. Box 4500, Allen, TX 75013, include the Experian dispute form

Equifax

- Online

- Via mail: P.O. Box 740256, Atlanta, GA 30374-0256

TransUnion

- Online

- Via mail: P.O. Box 2000, Chester, PA 19016

3) Write A Pay for Delete Letter

A pay for delete letter is asking the creditor to remove the negative mark in exchange for paying the balance you owe.

Keep in mind that removing an accurately reported item may be in violation of a creditor’s agreement with credit bureaus, which can be seen as unethical. Because of this, a pay for delete letter may not work.

But if you can get a negative item removed using this method — ensure that you get the agreement in writing before paying — your score will improve.

4) Write A Goodwill Letter

If you did miss a payment but later made the transaction, you can ask your creditor to remove that derogatory mark using a goodwill letter.

Also known as a forgiveness removal letter, it’s a letter you write where you ask for the creditor to remove a negative mark from your credit reports.

Goodwill letters still work today.

You can find out how to write a goodwill letter with templates included right here.

How Many Points Will Your Credit Score Go Up When A Derogatory Mark is Removed?

Although it’s a case by case basis, if the mark lowered your score by a certain amount of points, once it’s removed, it should increase that same amount.

For example, if your score lowered 75 points, it should increase 75 points when removed.

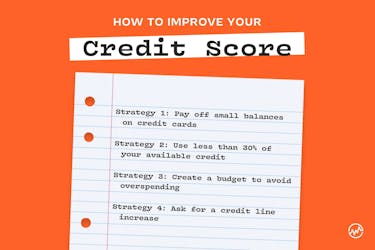

How To Improve Your Credit Score

Aside from removing derogatory marks, there are other ways to increase your credit score so that you can obtain the best loans from credit agencies and save yourself money.

Here are 4 strategies to do just that.

Strategy 1: Pay Off Small Balances on Credit Cards

Did you know that a credit card that has a balance can negatively impact your credit score? It's true.

That’s why if you have small balances on the card, pay them off instead of letting the balances sit there. Also, if you forget about a balance, it could accrue interest that you'll be on the hook for. This strategy will help prevent that as well.

Strategy 2: Use Less Than 30% of Your Available Credit

Whenever you use more than 30% of your credit limit, your credit score takes a hit.

Rather than doing that, keep a close eye on your balances, so you don’t go over 30%. If you anticipate going over that percentage in a given month, pay your balance before it's due.

Strategy 3: Create A Budget To Avoid Overspending

Do you have a budget? If so, are you sticking to it?

By making a budget and tracking your money, not only will you make better decisions about where your money goes; you’ll lower your credit utilization and avoid getting in high-interest bad debt by overspending.

If you are currently in bad debt — and paying high interest — create a plan TODAY to get out of it.

Strategy 4: Ask For a Credit Line Increase

Every 6-12 months, call your credit card company and request a credit line increase, using your record with the company as a justification. Have you been paying on time? Have you been a loyal customer? Do you have a "good" credit score? If so, use these details in your argument.

If you receive a credit line increase, say from $10,000 to $16,000, your credit utilization may decrease, which can boost your credit score.

Avoid Derogatory Marks

Half the battle of a derogatory mark is knowing that it exists. Ensure that you are checking your score, and then enacting healthy credit habits mentioned in this article.

It’s easy to believe that an occasional late payment doesn’t matter. But it does: there are stiff, credit-impacting penalties. Set up a monthly reminder, whether it’s a notification on your computer or smartphone or writing it on a calendar to ensure that you make payments by their due dates. By doing so, you can avoid derogatory marks and their negative impacts.