The DIY Debt Elimination Worksheet

In This Article

Are you feeling the weight of financial stress? A 2017 report by the American Psychological Association (APA) found that 62 percent of Americans are stressed about money, whether it’s worrying about making ends meet or feeling bogged down by debt.

With statistics such as nearly one in four Americans have no emergency fund, and as many as 73 percent of Americans will die in debt, it’s no wonder financial stress has been on the minds of so many Americans.

If you have financial stress, it isn’t something to take lightly.

It affects:

- everyday life

- long term financial plans

- long term health

Living paycheck to paycheck can make you extremely stressed about making payments on time, and too much debt makes it difficult for you to get a mortgage or a loan.

Financial problems can have a snowball effect — like quicksand, the deeper you get in debt, the harder it becomes to get out. In extreme cases, these circumstances can lead to bankruptcy and foreclosures.

The amount of financial stress varies from person to person. Here’s a rundown of how financial stress affects you.

The Bad News: The Effects of Financial Stress on Your Life

Financial stress affects all ages and demographics.

Millennials are dealing with exorbitant student loans.

Baby Boomers are finding out they didn’t save nearly enough for retirement.

A lack of money or the burden of debt influences long-term decision-making. For example, younger generations are choosing to delay marriage or homeownership, and older generations are delaying retirement.

More immediately, financial stress can also affect your health, leading to:

- anxiety

- emotional exhaustion

- burnout

- depression

- depressed immune system, leading to illness

Anxiety has a mental component, such as an impending sense of doom, and it can also manifest as physical symptoms like panic attacks.

Similarly, depression can lead to feelings of hopelessness, as well as sleep deprivation, poor eating habits, and worse.

Even in the absence of mental and emotional disorders, financial stress can cause a variety of bodily diseases due to the constant state of “fight or flight” mode.

Long periods of increased heart rate and adrenaline pumping through your veins can lead to:

- heart disease

- high blood pressure

- insomnia

- gastrointestinal problems

Other destructive behaviors that can result from financial stress include eating disorders, substance abuse, or gambling addiction.

The Good News

Ready to hear some good news?

If you experience any of these physical manifestations of financial stress, there is a solution.

First, if you are experiencing health issues, work with a medical professional to reduce symptoms and treat any illnesses.

Second, it’s time to reduce financial stress from your life. Here are a few ways to do that.

How to Manage Financial Stress

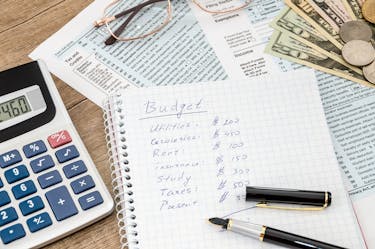

1) Create a Budget — and Stick To It

Budgets are not just about curtailing spending.

A budget is a holistic view of how much money you earn and how much you allocate to specific expenses.

It’s important to not view a budget as something restricting and hard. Instead, view it as a safety net: it’s keeping you from spending more than you should, which will lead to true, long-lasting financial freedom — which also means freedom from financial stress.

Keep in mind that your budget doesn’t necessarily have to be rigid; it can also adapt from month to month.

For example, your utilities bill in January may be much higher than in July, which means you can allocate those additional summer funds into other expenses or paying off debt.

When creating a budget, a good rule of thumb is to prioritize your needs, and then your wants. Keeping up with the Joneses is not the way to get your financial situation under control.

Instead, ask yourself: what can you absolutely not live without? Some of these items include:

- housing

- utilities

- food

- healthcare

Any minimum payment on student loans, credit card debt, or other debts also fall within this category of “needs.” Whatever is left over can be spent on wants and on savings.

Reduce These 2 Expenses Today

Here are a few expenses that you can reduce immediately:

- eliminate subscriptions you don’t use, such as a gym membership. Create your own workout plan instead.

- eliminate those streaming services that cost as much as $40 per month. Instead, share the expense with friends or family, or limit yourself to one of the cheaper options like Netflix or Hulu.

Using coupons, cash back apps, and store brand products rather than brand name are other tried-and-true ways to save money with minimal effort.

When possible — and when it makes sense — allocate some money each month for an expense for treating yourself so that you don’t feel like your budget is too restrictive. You will also be less tempted to spend money you have allocated for other things, like groceries, on a spur-of-the-moment purchase.

If you’re looking for more resources on budgeting, here are a few:

- Learn how to create a simple budget

- Discover how you can budget effectively if you are a restaurant server living off tips

- Here are ways to create a budget even if you are bad with numbers

- By packing your lunch every day, you can save $1,222 per year

2) Make a Plan for Paying Off Debt

The average U.S. household has $137,063 worth of debt — a staggering amount considering the U.S. median household income is $57,617.

The most common forms of debt are:

- mortgages

- student loans

- credit card debt

- auto loans

If your debt situation is overwhelming, don’t give up. The way out is one foot in front of the other, step by step.

Don’t forget, not all debt is bad!

If debt is an investment in an asset, like real estate or education, and can generate positive cash flow then it’s good debt.

On the other hand, bad debt doesn’t generate any return on investment or enrich your life in a sustaining way. Here a few examples of bad debt:

- maxing out your credit card to pay for designer clothes

- a vacation you can’t afford

- taking Ubers everywhere

Know the difference between the good and bad, and make borrowing decisions wisely.

3) Save for Retirement and Your Emergency Fund

Invest in a 401k, IRA, or Roth IRA depending on how much you can put away each month, what retirement accounts your employer offers, and what tax benefits you want to take advantage of.

If your company offers 401k matching, max out your contribution to take advantage of this “free money.”

Roth IRAs and IRAs are post-tax, but might be a better option if you want to max out your yearly contribution ($5,500 for both types of IRAs, compared to $18,500 for a 401k).

Another benefit of a 401k is that the money comes out of your paycheck pre-tax, so you won’t see it reflected in your take-home pay (and thus be tempted to spend it).

If you want to learn more about retirement, check out these resources:

- Learn how to retire using this blueprint

- Here are 4 ways to kickstart your retirement in your 20s

- Find out if you truly have the best 401k plan… or if there are better options

Likewise, determine a specific amount of money each month to put into your emergency fund and automate your savings so that the amount instantly transfers from your checking account to the savings account.

If you can’t trust yourself not to touch your emergency fund, open an online account or an account with another bank — one where you won’t get an ATM card and therefore cannot access the money right away.

Ideally, you should have at least 3 months of savings stored in your emergency account.

4) Start a Side Hustle & Boost Your Income

Another way to combat financial stress is to make more money in your free time: what’s called a side hustle. This is where jobs such as driving for Uber or offering fitness lessons come into play.

There’s truly no limit to how much you can make doing a side hustle. This, combined with your regular income, can help you get out of debt and/or boost your savings.

Here are 10 options:

1) Driving: Interested in earning money while driving? With businesses like Uber or Lyft, you can do just that, and earn as much money as you want. To get started, download the Uber or the Lyft app and check out the driver's requirements.

2) Join a Delivery Service: You can earn money on your own schedule by using services like UberEATS or DoorDash to deliver take-out orders in your local area, or you can start your own delivery service.

3) Rent Your Home with Airbnb: Do you have an extra room in your house? Are you planning on leaving for an extended vacation? If the answer to either of these questions is yes, you can earn money by renting your house on Airbnb. You could cover your entire rent or mortgage with this side hustle. Get started by setting up a listing at airbnb.com.

4) Become a Notary: After obtaining a notary certification from your state (which typically costs less than $100), you can charge your own fees to notarize documents, such as mortgage signings. Submit an application to your state to get started!

5) Rent Your Car: If you have an extra car, or you don’t plan on using your car for an extended period of time, you can rent it out to make an extra income on Turo (the company takes care of insurance!). List your car by creating an account on Turo.com.

6) Child Care: Do you enjoy spending time with children? If so, companies like SitterCity, Care, and UrbanSitter connect sitters with families. Visit one of these websites to learn how to build your own list of consistent clients.

7) Teach Courses Online: Through websites like Udemy, you can create your own course on a topic that you’re passionate about. Whenever someone purchases your class, you earn money! Sign up at Udemy.com to get started.

8) Complete chores: You can earn money by helping others with miscellaneous tasks such as shopping, yard work, interior painting and more on Task Rabbit. To sign up and begin earning money through this errand running service, visit TaskRabbit.com.

9) Coach Sports: Are you passionate about sports? School and league teams in your area may be looking for a coach to help lead them to victory. Contact local universities, schools, and leagues to see if there are any opportunities out there.

10) Be a Caregiver: If you enjoy spending time with grandma and her elderly posse, you can make money by caregiving through Care.com. Sign up and begin building your client base today.

To see our full list of 101 side hustles, click here.

Financial Stress

Don’t let financial stress take over your life. Instead, follow this plan:

- Create a Budget — and Stick To It

- Make a Plan for Paying Off Debt

- Save for Retirement and Your Emergency Fund

- Start a Side Hustle & Boost Your Income

No matter your age or financial situation, you are in control of your financial destiny and can make the changes you want to see in your bank account — and in your life.