Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

Let’s be honest: filing taxes can be confusing and complex. If you aren’t sure how to do your taxes, you’re certainly not alone. With recent changes, 77% of workers surveyed are confused by new tax legislation.

There is a benefit to learning the intricacies of filing taxes and the tax code (hint: it’s green!).

By learning how to file your own taxes, you can learn ways to save money now — and into the future.

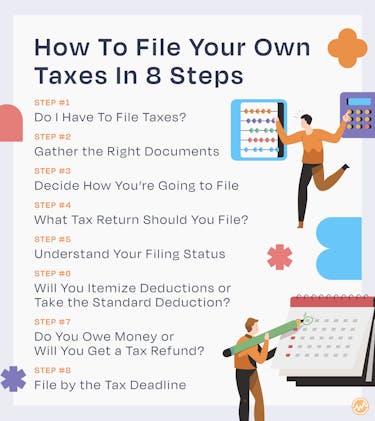

How to File Your Own Taxes in 2022: 8 Steps

Step 1: Do I Have To File Taxes?

With the tax deadline approaching, you may wonder if you really need to file or if you can skip filing taxes this year.

Not everyone has to file taxes. But even if you don’t have to file, you still may want to.

Here’s why.

Whether you have to file will depend on three factors:

- your filing status

- income

- age

The 1040 instructions published by the IRS for 2019 include the following information to help you decide whether you need to file.

When reading this chart, understand that “gross income” is money that you may have received during the year that isn’t tax-exempt.

If someone else can claim you as a dependent on their tax return (such as your parents), different thresholds apply, which you can find on page 10 of the IRS 1040 instructions for 2022.

If you don’t have to file taxes...

Based on this information, even if the IRS doesn’t require you to file, there are reasons you may want to do so.

If you worked for an employer that withheld federal income taxes for you, you may be owed a refund. You have to file taxes to get that refund.

There are also tax credits offered that are refundable, meaning that even if you don’t owe money in taxes, you can still get a refund. These tax credits include:

Earned Income Tax Credit (EITC)

If you didn’t earn a lot of money, you may be eligible for the EITC. Since this is a refundable credit, you could get money back without paying taxes.

Child Tax Credit

Up to $1,400 of this tax credit is refundable for each qualifying child you have under the age of 17.

American Opportunity Tax Credit

This education tax credit for students is partially refundable.

If you do have to file taxes — like the majority of Americans — let’s walk through the process step by step.

Recovery Rebate Credit

If you should have gotten the third stimulus check in 2021 but didn’t, then you’ll want to apply for this tax credit.

Student Loan Interest Deduction

Did you pay interest on your student loans throughout 2021? If so, then you can claim this credit to get some of that money back.

Residential Energy Credit

If you upgraded your home’s energy efficiency, then you could be eligible for a residential energy credit, which could help you recover some costs associated with:

- insulation

- solar power equipment

- water heaters

- energy-efficient heating

- AC systems

- Doors

- windows

- roofs

Step 2: Gather the Right Documents

Before you jump into your taxes, it’s important to spend time getting prepared. It takes the average taxpayer (who doesn’t own a business) seven hours to file their taxes.

This includes three hours of tax planning and record-keeping.

Start by gathering all documents you might need to help you file your taxes. This includes:

- Your prior year's tax return, if applicable

- A photo ID

- Social security numbers and birth dates for you and anyone included on your tax return (a spouse or dependents)

- W-2 Forms from all employers

- Any 1099 forms, including 1099-Misc, 1099-K, 1099-DIV, and 1099-INT

- Your bank account and routing number

- If you plan to itemize deductions (covered below), any supporting documents that are needed

- Total amount paid to a daycare provider and their tax ID number

- 1098-T for any tuition paid

- 1098 Mortgage Interest Statement for mortgage interest paid on your primary residence

This isn’t a full list — depending on your situation not all of these will apply to you and there may be other documents that you need.

But this should help get you started finding documents and getting organized.

When you’re learning how to file your own taxes, keeping these documents organized can be a major stumbling block.

So, how can you stay organized for future returns?

We recommend that you create a spreadsheet where you can outline all your information. Save this document and return to it regularly when you need to update information.

If you get a W-2, 1099, or other type of tax form in the mail, immediately scan it and save it alongside your spreadsheet.

It can be difficult to remember to keep this document up to date, but it will be much easier if you tackle each situation as it comes up.

Remember to update your document, and it should be completely ready to go — and stress free — when it’s time to file your taxes.

Step 3: Decide How You’re Going to File

The big question when learning how to file your own taxes: do you DIY your taxes or file a tax pro? There are plenty of options, but how do you decide what is right for you? Let’s explore both.

Complexity

Figuring out how to file your own taxes is a challenge for many Americans, especially those that have complicated tax situations or work for themselves.

Do you have a fairly basic situation or are things a little more complex?

If you are taking the standard deduction, are a W-2 employee, and haven’t had any large transactions during the year (like selling a home), your tax return is probably going to be straightforward.

Filing yourself — or with the help of an online filing software — probably won’t be too challenging.

When things start getting more complex, it might be a better idea to bring in the pros. If you own a business, an investment property, or want to itemize deductions, a tax professional can help you walk through the details.

For example, if you need a professional’s help to calculate how much income you made after being self-employed all year, they’ll likely charge you more than if you have all your paystubs together and organized already.

The cost of professional tax help varies depending on how complex your situation is and how much help you’ll need.

On average, expect to pay anywhere from $150 to $450 to file your taxes with an expert’s help.

Tax software is often less expensive, but you’ll have to do much of the work on your own.

Bottom line: if you’re confused about how to do your taxes, getting professional help is a good idea.

Cost

If you don’t know how to file your own taxes, hiring someone will cost you more than doing it on your own.

According to the National Society of Accountants, it costs an average of $176 to hire someone to prepare and submit a federal and state tax return with no itemized deductions.

If you decide to use an online tax filing program, you might be able to have your federal tax return submitted for free.

If you make under $69,000 you can use free filing products that are available on the IRS website.

If you make over $73,000, you’ll have to pay for online filing but filing fees for submitting both state and federal returns generally don’t cost too much.

Advice

One of the benefits of working with a good tax professional is they can offer you advice.

The tax code is complicated and it only gets more complex as your income increases.

A good tax preparer can help you be strategic and make smart tax moves that can save you money in the years to come.

If you need additional help figuring out how to do your taxes, you may want to look into free programs offered.

The Volunteer Income Tax Assistance (VITA) program offers free help to people who make less than $56,000 per year, have a disability, or have limited English speaking abilities. Volunteers will assist with free income tax preparation and electronic filing.

There’s also a program aimed at people over 60 — Tax Counseling for the Elderly (TCE). You’ll receive free advice about pension and retirement issues.

The IRS website has a location finder tool to help you locate a VITA or TCE site.

Step 4: What Tax Return Should You File?

The IRS used to offer simplified forms for people with no dependents and who earned under a certain income level.

Those shorter forms were eliminated, so taxpayers are left with two filing options: 1040 or 1040 SR.

If you are over 65, you may be able to use the newly created (and shorter) form 1040 SR. Everyone else needs to file the full 1040.

Step 5: Understand Your Filing Status

Another important item to understand when learning how to file your own taxes: your filing status.

Why?

How much you pay in taxes depends on your filing status.

Your filing status options are:

- Single: if you weren’t married or were divorced by December 31 of the tax year.

- Married filing jointly: if you were married at the end of the year. If your spouse passed away during the year and you didn’t remarry or your spouse passed away before you filed taxes, you can still file jointly.

- Married filing separately: you are married but you and your spouse choose to file your tax returns separately.

- Head of household: if you are unmarried and provide a home for a certain other person. You must pass one of two tests outlined in the IRS instructions.

- Qualifying widower: if your spouse died during the prior two tax years and you didn’t remarry, you have a child or stepchild who is a dependent and lived in your home, and you pay for over half of the cost of maintaining your home.

Choosing the right filing status can be confusing. If you use tax preparation software, it will walk you through questions to help determine the right filing status for you.

Step 6: Will You Itemize Deductions or Take the Standard Deduction?

When filling out your own taxes, you’ll be asked if you want to take a standard deduction or an itemized deduction. These deductions are income that you don’t need to pay tax on.

The standard deduction is a fixed deduction amount, set by the IRS. For the tax year of 2021, the standard deduction based on your filing status is:

- Single or married and filing separately: $12,550

- Married filing jointly or qualified widower: $25,100

- Head of household: $18,800

So if you are single and choose to take the standard deduction, you’ll be able to exclude $12,550 of your income from being taxed.

Itemized deductions are made up of a list of deductions that you can take, set by the IRS. If you add up all of your itemized deductions and it’s greater than the standard deduction, you’d choose to itemize your deductions and have more of your income excluded from being taxed.

Some of the things that can be included as itemized deductions are:

- Mortgage interest paid on up to $750,000 of a mortgage

- State and local taxes paid (up to $10,000)

- Donations to charity

- Medical expenses above a certain threshold

Most people are going to go with the standard deduction — it’s estimated that only 13% of filers choose to itemize deductions.

Step 7: Do You Owe Money or Will You Get a Tax Refund?

The main question in your mind when you’re learning how to file your own taxes will be: “am I owing or getting a refund?”

The US Tax System is a pay-as-you-go system meaning that you pay taxes throughout the year.

If you work for an employer, they automatically withhold taxes from your paycheck.

If you’re self-employed, you make quarterly estimated tax payments.

The goal is to pay the government the correct amount in taxes during the year so that when you file taxes you don’t owe them anything and they don’t owe you anything.

But, that’s very difficult to do.

If the IRS owes you a refund, you should expect to get one soon. The IRS reports that 90% of their refunds are issued in less than 21 days. If you elect to get your refund by direct deposit, rather than a paper check, it will speed up how quickly you can get your refund.

In 2020, the IRS issued over 125 million refunds. The average tax refund amount was $2,546.

Step 8: What’s the Deadline For Filing Taxes in 2022?

In 2022, the deadline to file is April 18th.

Your personal tax return is due each year on April 15th. But in any year that April 15th falls on a weekend or a holiday, your tax return is due on the next business day. And this year, April 15th is Emancipation Day, so the deadline falls on the following Monday.

If you live in Maine or Massachusetts, you have until April 19th to file because that Monday is Patriot's Day.

If you’re just learning how to file your own taxes, it might take you a little longer. So if you’re not ready to file by the due date, you can request an automatic six-month extension using Form 4868. You’ll have an additional six months to file your taxes, but you won’t get an additional six months to pay them.

This will give you until October 17th, 2022 to file your returns.

The deadline to file for an extension is April 18th, 2022.

How To File Your Own Taxes

Yes, the process of learning how to file your own taxes can be confusing. But don’t get overwhelmed — the value in understanding the process is that knowledge can help save you money during tax season each year.

Regardless of how many times you may have filed taxes, use the tools and information in this article as a guide that way you can pay the taxes you owe while utilizing tax write-offs to lower your overall bill.