Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

- Protecting Your Savings Against Inflation

- Smart Reasons To Save Money

- You Should Save for Emergencies

- You Should Save for Retirement

- You Should Save For Investments

- Where to Put Your Emergency Fund

- The Most Popular Savings Ratios

- The Bottom Line: When You Should Focus on Making More Money Instead of Saving

How much should you save each month? It’s not a straightforward answer! Everyone has a different opinion, and situations vary so much. But if you can’t save at least 20% of your income each month—you NEED to focus all of your attention on making more money.

Saving money is a critical part of improving your personal finances.

Before we talk about the 20% minimum, let’s go over why we save in the first place . . .

Protecting Your Savings Against Inflation

First, saving just to save won’t get you very far. While it’s nice to have money in the bank, it actually usually loses value over time thanks to something called inflation.

Inflation is the price increase of goods (like food, gas, and housing) over time.

While today’s inflation rate isn’t as high as it has been in the past (it’s currently about 2%), it can still eat away at your savings. Here’s why: the interest rate of many savings accounts is actually less than the inflation rate.

Before we break down how much should you save each month, it’s important to understand that you need to save with a purpose.

Smart Reasons To Save Money

So now that you’re aware the pitfalls of saving without a purpose, it’s time to tackle another personal finance question: why do you need to save?

First, you need to save to protect yourself from financial emergencies. Second you need to save for retirement. And third, you also need to save for investments which can include:

- Starting a Business

- Real Estate Investing (or just buying your first home!)

- Stock Investing

You Should Save for Emergencies

Financial emergencies don’t always give us time to prepare for them. Unexpected injuries can result in hefty medical bills and lost income if you can’t work.

Your car could break down at the worst time. You might even lose your job in a competitive economy.

If you don’t have an emergency fund, something going wrong can be a disaster. Without savings, you’ll have to turn to debt to get access to the money you need.

Then you have to pay interest on the debt you borrow—and it may take months or years to pay that debt off.

You Should Save for Retirement

While Social Security may provide some income during retirement, it won’t allow most people to continue living their normal lifestyle after they retire. This is why it’s so important to be aware of budgeting tips and money saving tips so that at the end of the day you’re saving money.

Pensions have been disappearing over the last few decades and have been replaced with 401ks. This means you’re responsible for saving the enormous amount needed to fund a comfortable retirement.

Saving enough money to live for decades is no small task. You’ll need to consistently put away a substantial amount of money in investment vehicles to make it happen.

You Should Save For Investments

Emergencies and retirement aren’t the only things to save for. It’s hard to retire early on an employee salary. You need to start making your money work for you. Investing is the only way to accelerate your wealth building.

Where to Put Your Emergency Fund

How much should you save each month toward each of these goals? Your first savings goal should always be an emergency fund. An emergency fund is fundamental to launching your wealth building career.

Keep your emergency savings in a very safe investment. For most, this is a high yield savings account. While you could be more aggressive with this money, many people don’t want to take the risk of not having it when it’s needed.

After you have three to six months of income in your emergency fund, you can then focus on accelerating your savings toward retirement and investments.

The Most Popular Savings Ratios

Before we explain how much you should be saving, let’s take a look at some popular recommendations and budgeting tips that seek to answer how much should you save each month.

Save 10% of Your Income

The popular EveryDollar budgeting tool suggests budgeting 10% of your income for savings.

Save 15% of Your Income

After you pay off your debt, financial guru Dave Ramsey suggests putting 15% of your gross income into tax-favored investment plans. These include 401(k)s, IRAs and other tax-advantaged investments.

Save 20% of Your Income

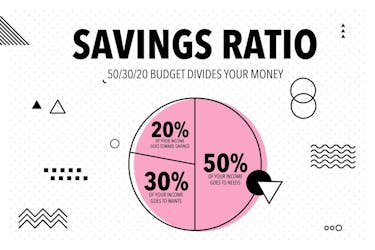

The 50/30/20 budget divides your money into three buckets:

- 50 percent of your income goes to needs

- 30 percent of your income goes to wants

- The remaining 20 percent of your income goes toward savings

Others share this advice, as well. For example, the insurance company TIAA suggests saving at least 20% of your income.

Save 50% of Your Income

Mr. Money Mustache, a popular figure in the financial independence movement, is on the more extreme end of the saving spectrum. He suggests saving 50% of your take-home pay.

Saving such a large amount of money could result in reaching financial independence in about 17 years. Of course, this assumes you invest the money and get consistent investment returns.

The Bottom Line: When You Should Focus on Making More Money Instead of Saving

Here’s the bottom line. What’s the minimum amount of income you should have left after you pay all of your expenses each month? If you want to get ahead financially, the minimum percentage of your income you should save is 20%.

If you have ambitious financial goals or want to retire early, that percentage of how much should you save each month needs to be even higher. It’s not unheard of to save 50% or even 70% of your income.

But if you can’t save 20% of your income—you’re wasting your time with saving strategies. You should put all of your effort into making more money.

If you’re saving less than 20% of your income, you will either stay stuck in place, or go into debt.

So how do you make more money? We have a million ways to get after it. You could:

- Ask for a Raise

- Get a Side Hustle

- Start a Business

- Invest in Real Estate

Take action today. Check your budget, and answer this question: am I making enough money to save 20% of my income? If the answer is yes, start saving. If the answer is no, figure out the fastest way to make more money.

If you master your savings, turn your attention to mastering other aspects fo your personal finance, including debt, budgeting, credit, and more.