Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

You make dozens of decisions daily—you even make a few before you get out of bed in the morning. Some of those decisions are made out of habit, some are carefully considered, and others are made in the spur of the moment.

Whether you spend 10 seconds or 10 days weighing a decision, each one comes with strings attached.

With each option you choose, you’re saying “no” to a different option. The value of what you do not select is called your opportunity cost.

You can think of it as the value of what could have been.

Understanding opportunity cost is a crucial part of getting an investor education.

How To Calculate Opportunity Cost

Opportunity cost plays a major role in your personal finances.

How you spend your resources corresponds directly with how successful you’ll be in your wealth-building activities.

Spending money on a new sports car means you can’t invest that money in real estate or a stock portfolio.

The same $500 can’t be invested in your child’s college savings account and your IRA at the same time.

Choices need to be made.

Making these choices means being aware of the opportunity cost of them. That’s where the opportunity cost formula comes in.

What an opportunity costs you is the difference in the amount you gave up by choosing one option over another.

Opportunity Cost = Return on Best Option Not Chosen – Return on Option Chosen

Opportunity cost is the value of what you don’t choose minus the value of what you do choose.

Let’s say you are making a choice between buying a new bike and saving that money in an interest-bearing account. If you choose to buy the bike instead of saving, you are giving up the interest you would have earned. The opportunity cost of choosing the new bike is the potential earned interest.

Opportunity Cost Example: Savings for College or Saving for Retirement?

For example, if you choose to invest $500 into a savings account for your newborn baby, it has approximately 18 years to grow with compounding interest for their first year of college.

That same $500 invested in your retirement savings account would have maybe 25 years to build for your retirement.

So, the opportunity cost of investing $500 for college is the potential growth of the $500 if invested in your IRA.

Opportunity Cost Example: Buying a House

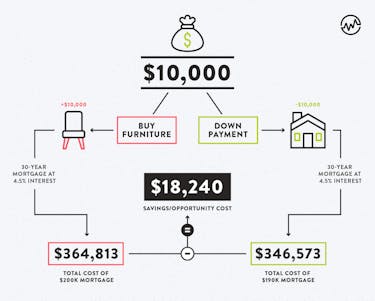

Similarly, choosing to spend $10,000 on furniture and appliances for your new home goes beyond just spending $10,000 of your cash—you’re giving up the ability to apply it to your home’s down payment, which would save you thousands of dollars on interest costs over the term of your mortgage.

The total cost difference between a $200k and $190k 30-year mortgage at 4.5% interest is $18,240. So, the opportunity cost of buying new furnishings instead of buying a lower mortgage is $18,240 over the life of the loan.

But let’s not stop there.

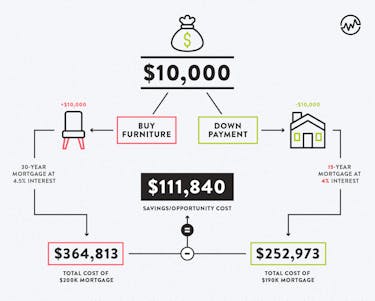

What if instead of a 30-year mortgage you chose a 15-year mortgage at 4%?

The difference in interest between a $200K and $190K loan is only $13,315.

But what about the opportunity cost?

The opportunity cost of choosing $10,000 in new furnishings and the 190K mortgage over the 30-year $200K is $111,840.

That’s huge.

Opportunity Cost: Buying a New Car

Or let’s say you were torn between making a car down payment of $10,000 or investing that same $10,000 into an index fund.

Well, that down payment on a car would leave you down $10,000 (but up one car!)

Meanwhile, if you were to invest that $10,000 into an index fund with an annualized growth rate of 9.8%, it would become a whopping $25,470 in years.

If you buy the car, your opportunity cost is all the money you could’ve made investing — nearly $15,000! That’s over twice your initial investment in spendable or investable passive income. If you decide to invest, your opportunity cost is a set of wheels.

Which would you choose?

Opportunity Cost (The Not-So-Obvious Costs)

It’s important to consider more than just the financial implications of a decision.

Perhaps you really do need a new stove, refrigerator, and sofa. It’s essential that you consider the psychological and unseen values of your choices.

Will dealing with a broken stove or faulty refrigerator cost you more in time and money later?

Will your dirty, broken-down couch impact your health and relationships?

Other Examples of How To Calculate Opportunity Cost

Have you ever been out shopping for one thing and ended up coming home not only with that thing and another item you saw on sale?

The next time you face a similar ‘sale’ situation, consider the opportunity cost first—before you purchase the big sale item.

While it may not stop you from blowing $20 on a quesadilla maker or hundreds of dollars on a flat screen TV, it will help you to understand what you are giving up (e.g. a $20 book to improve your knowledge, a $300 course to learn a skill you can capitalize on or savings for your next vacation).

Wait . . . Free Isn’t Free?

Even free items have opportunity costs. They can take up space, cause clutter, distract you from a bigger goal, affect your health, or cost you more money in maintenance down the line.

Take the ever-so-popular “free to a good home” scenario used by animal shelters. That little puppy or kitten doesn’t require an exchange of cash, but it sure does come with many costs. What opportunities would you be giving up paying for the lifelong expenses of a “free” pet?

If having a pet in your life is important, then the benefits of a dog or cat will probably outweigh the expense and time requirement. Just be sure you consider all the costs before committing.

The opportunity cost of a “free” puppy could be thousands of dollars—but that’s more than worth it if you decide that “having a puppy is priceless.”

Limitations of Opportunity Cost

The opportunity cost formula can help you make decisions and even save money. But there are limitations when calculating opportunity cost.

It takes time to analyze your options.

While you can make better decisions by calculating opportunity costs, sometimes you simply don’t have the time.

You may have a deadline for buying, or an opportunity that requires a quick decision.

Sometimes you have to make the best choice you can and figure it out later.

It’s hard to predict the future.

One of the main limitations of using the opportunity cost formula is that it is difficult to estimate what might happen in the future.

If we had a crystal ball that could tell us how different investments will perform, then calculating opportunity cost would be easy.

But since we don’t, the next best thing is to analyze historical data to help with your decision.

Comparing the two options may not be possible.

Some comparisons are more straightforward; for example, choosing between two investments with different rates of return.

However, some decisions involve factors that are difficult to quantify, such as satisfaction, peace of mind, or how to spend your free time.

Putting a number to your happiness can be difficult.

Sunk Cost vs Opportunity Cost: What's the Difference?

What’s the difference between opportunity cost and sunk cost?

Opportunity cost.

The potential earnings not realized because of choosing one opportunity over another.

Sunk cost.

This is a past cost — money that has already been spent that you can’t recover. In business, it can include equipment, marketing, or salaries.

In your personal life, it’s money you spend — whether or not you get any benefit from it.

For example, you may buy the latest kitchen gadget, only to realize two years later it’s still sitting in its box.

The money spent is a sunk cost.

When analyzing future cost decisions and calculating opportunity cost, beware of the sunk cost fallacy. Sunk costs have no place in deciding for the future.

The sunk-cost fallacy is the tendency to not want to give up on something because you’ve spent money, time, or effort on it. Even when continuing is clearly the worse decision, people — and even companies and the government — will stay the course because of sunk costs.

For example, the fancy kitchen gadget you bought that is just sitting in your cabinet... The tendency is to hang onto it because you spent money on it.

You don’t consider that you feel guilty every time you look at it, or the shelf space it takes up that you could use for other things, or even the fact that you are never likely to use it.

You falsely believe it has value, simply because it cost you money.

In reality, the gadget is a sunk cost.

You spent the money and cannot recover it.

Don’t make the decision of whether to keep it by using sunk costs.

Use opportunity cost instead.

The opportunity cost of keeping the gadget means you’ll be giving up peace of mind and shelf space. It’s your decision which is more valuable to you — a gadget you’ll never use or a clutter-free home.

The Bottom Line: How to Calculate Opportunity Cost

It can be easy to determine the financial opportunity cost of a situation with a calculator in hand.

However, it’s important to remember the additional non-monetary costs of a decision as well.

When choosing one option over another, any lost time, energy, health, or pleasure is just as much a part of your opportunity cost as money.

Opportunity cost isn’t cut and dry. It varies from person to person. We all value things differently, even time and money. The opportunity cost of a decision you make will likely be different than it would be for your friends and family.

At the end of the day, you are in charge of how you spend and invest your money and your moments.

Use the concept of opportunity cost to achieve what brings you and your family the most wealth, productivity, and happiness possible.