Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

It’s true. A 401(k) is a noble way to save for retirement. But do you know how much your fees are? They’re probably killing your nest egg. Let’s find out how much you could be saving with a different 401(k) plan . . .

Are you interested in creating the biggest nest egg you can, to set yourself up nicely for retirement?

Would you like to maximize the return on your 401(k)?

Of course you would and while these are admirable goals, there’s one big problem—401(k) fees.

Unfortunately, many people don’t experience great 401(k) returns, because they’re paying ridiculously high 401(k) fees.

Types of 401(k) Fees

There are actually a number of different types of fees you may be charged when you’re participating in a 401(k). For example, Investopedia describes four different fee types:

- Investment Management Fee. This is a monthly or quarterly fee used to pay mutual funds’ portfolio managers.

- Administration Fee. This fee goes to the custodian of your plan for maintaining records, holding funds, and providing other services. Typically, it’s charged on a quarterly, biannual or annual basis.

- Sales Charge. A lot of the mutual funds you’ll find in a 401(k) plan charge a fee either when they’re purchased or when they’re redeemed.

- Mortality & Expense Charges. While this fee isn’t assessed on every 401(k), you will pay it if your 401(k) plan is invested in a variable annuity contract.

As you can see, there are plenty of different fees that can “creep in,” impacting your return on investment. And while you may be thinking that these fees have marginal impact, that actually isn’t the case.

The fees on a 401(k) plan add up quick!

How 401(k) Fees Impact Your ROI

So, we’ve mentioned all the various types of fees you can be charged, and by now, you’re probably wondering what all these different fees add up to. It actually depends on your 401(k) plan.

For instance, the smaller your plan, the higher the fees are that you’ll probably pay. On average, NPR reports that plans with 100 participants and $5 million in assets pay a fee of 1.25%. For larger retirement plans (those defined as 1,000 participants with $50 million in assets), your plan fees will run about .96%.

While these fees might not seem like such a big deal, they really start to add up over the years, having a big impact on the size of your retirement nest egg.

This can be best illustrated with an example.

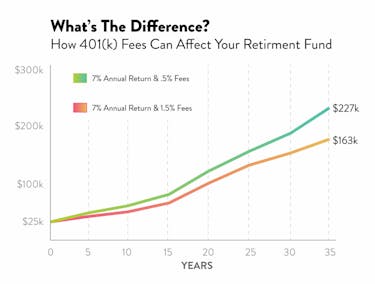

Say you had $25,000 in your 401(k) and you earned an average 7% rate of return.

Over the course of 35 years, your money would grow to $227,000 if you paid fees of.5%.

But if instead your fees were 1.5%, you would only have $163,000.

With just a 1% difference in fees, the value of your nest egg would be 28% less.

That’s huge.

And while the amount you’ll lose to fees depends on your unique circumstances, Demos, the public policy think tank, reports that a worker making approximately $30K annually and saving 5% will lose about $155K to 401(k) fees. A worker making $90K a year would lose more than $277K in fees.

But That’s Not All. . .

Unfortunately, the value of your 401(k) isn’t just impacted by fees. According to Investor Junkie, it’s also impacted by the performance of the fund itself and by poor investment choices.

For instance, the site reports that a whopping 86% of active large-cap fund managers failed to beat their benchmarks in the last year, according to an S&P Dow Jones Indices scorecard.

Additionally, you also run the risk that the funds in your 401(k) weren’t selected because of their performance. Instead, they might have been chosen because they pay big fees and commissions to your plan provider.

An Alternative to Beat the System

The good news is that you have a couple different things you can do to minimize the fees you’re paying on your 401(k). One popular choice is to use a unique plan like America’s Best 401(k) (ABK).

For instance, with ABK, employees are charged a fee of .65% or less of their balance. But that’s just one way this is a different kind of 401(k) plan.

Another thing that makes America’s Best 401(k) different is that fees are completely transparent—ABK offers a “line item” pricing proposal, explicitly stating the fees associated with each fund they offer.

And ABK doesn’t receive fees from any of its funds, so it’s motivated to select the best-performing, lowest-cost funds available. On average, these core funds only have an expense ratio of .12%, meaning that the companies managing these funds charge just .12% for their management services.

Your Steps to Beat the System

So, America's Best 401(k) might sound great, but your company already has a 401(k) plan. How do you get it to switch?

Your first step is to find out what the fees are in your plan. You can do this by visiting ABK at this link. With a little information from you, the company will be able to tell you what your current 401(k) fees are.

Once you’re armed with that information, you’ll have leverage to use with the executives in your office. If you’re losing money to exorbitant fees, the executives and owners of your company are too, and they’re losing a lot more than you are.

But if you can’t sell them on the benefits of switching, you’re not out of options. There are still other things you can do to maximize the amount of money you save for retirement:

- Compare Fund Costs. Different funds in your plan have different costs associated with them. Check out the fees you’re paying—if they’re high, consider switching funds.

- Get the Full Match. Even if your 401(k) has high fees, you still want to contribute enough to get the maximum match from your employer. That will always be to your financial benefit, even if your 401(k) fees run on the high side.

- Save in an IRA. Once you’ve earned the maximum match with your 401(k), you might want to invest any money beyond that in an IRA. As with a 401(k), the amount you contribute to an IRA is tax-deductible, although there are limits.

Your Greatest 401(k) “Weapon” Of All

You’ve probably heard the phrase before, “knowledge is power,” and nothing could be more accurate here. The absolute best way you can grow your retirement nest egg is by being financially aware.

So, pay attention to how much you’re contributing to your 401(k), which funds you’ve allocated money to, how those funds are performing, and what fees you’re paying. Then, use that information to make good financial decisions—like switching to a mutual fund with lower fees or saving in an IRA, for example.

Follow that advice and when it comes time to “cash out,” you’ll have earned the maximum 401(k) return possible!