Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

- The Difference Between Good Debt and Bad Debt

- How To Pay Your Mortgage With A Credit Card

- Finding the Best Credit Card to Pay Your Mortgage

- When Does It Make Sense to Pay Your Mortgage with a Credit Card?

- The Benefits and Risks of Paying Your Mortgage With A Credit Card

- Should You Pay Your Mortgage With A Credit Card?

- Continued Learning

Paying off your mortgage with a credit card might sound crazy. But there are benefits that may interest you.

Having a mortgage is a blessing, but it can also be a curse. Mortgages provide you with the ability to buy a home, along with some incredible tax advantages, but they also strip you of some of your financial freedom.

One option that you may not have considered is to pay your mortgage with a credit card. It’s a strategy that’s becoming popular among those who want to find ways to improve their credit and earn rewards in the process.

But is it a good strategy?

Can you pay off your mortgage with a credit card?

Or are you better off making regular mortgage payments via check or recurring payments?

We’ve been conditioned to think of all credit card debt as “bad debt.”

In fact, you may have avoided obtaining a credit card in fear of getting in debt.

But that conditioning is wrong.

What’s more — having a credit card is important to building your credit so that you can obtain low-interest rates when you apply for a mortgage or car loan.

You may have never heard this before, but not all debt is bad debt. Some can even be good. It’s true!

The Difference Between Good Debt and Bad Debt

If you use your credit card to buy a jet ski, or an object that won’t return more money than you’re spending, you’re creating bad debt.

That jet ski is going to decrease in value immediately. You’re not making any income off of it (unless you’re a competitive jet skier). It doesn’t translate to income or up your net worth. That’s bad debt.

On the other hand, good debt is money you’ve borrowed to make an investment in a cash-producing asset. You’re using it to make more money than the debt costs you.

So what does paying your mortgage with a credit card fall under?

You guessed it: good debt.

Having a mortgage builds good debt. When you make mortgage payments, you create equity in your home. Over time, this increases your net worth.

Next, we’ll look at how to pay your mortgage with a credit card.

How To Pay Your Mortgage With A Credit Card

There are very few people who can buy a house with cash — and you’re probably not one of them. That’s okay. This is why mortgages were invented.

It’s also why getting approved for a mortgage is the first step in the process of buying a home.

There's a catch with mortgage payments, and it’s this: your first payments are mostly interest.

That means you’re typically only paying down $50 or less on the principal balance of your loan. So, the equity you have in your home is . . . next to nothing.

Using a credit card to pay can help you make something as you pay off your mortgage. How is this possible?

Credit card rewards can earn you immediate benefits on your mortgage payments, such as:

- cash back

- frequent flier miles

However, you’ll need to check with 3 sources first:

- your card network

- your card issuer

- your mortgage lender

Keep in mind that some lenders don’t accept credit cards. If they do, they’ll pay a fee to the credit card issuers.

Because of this, you may need to use a third-party service to pay your mortgage with a credit card.

Going through a third-party service means taking on the payment yourself. One service to consider is Plastiq, which takes your credit card payment and cuts a check to your lender.

This is a common answer when discussing how to pay your mortgage with a credit card.

Finding the Best Credit Card to Pay Your Mortgage

The key to paying the mortgage with a credit card is finding a card that offers rewards that make your investment worthwhile. Many credit card companies offer a range of reward cards.

Cashback Rewards Card

A card with cashback rewards can offer you easy-to-quantify rewards for paying off your mortgage.

If you earn back a percentage of your spending, the amount can offset any fees you’d pay and put more cash in your pocket.

Points Card

Points cards can also be worth using as well. Many credit cards allow cardholders to earn points that they can later redeem for money or merchandise.

A points card can increase your purchasing power while helping you to make your mortgage payments on time.

Airline Mileage Card

The final kind of card to consider is an airline mileage card. If you’re looking for a way to reduce the costs of your family vacations then using a mileage card to pay your mortgage can help you earn free flights.

The key is to make sure that you earn rewards that are worth at least as much as the fees you pay to use a credit card for your mortgage.

Evaluate any credit card offers thoroughly and crunch the numbers before you sign on.

When Does It Make Sense to Pay Your Mortgage with a Credit Card?

It doesn’t always make sense to use a credit card to make mortgage payments — but let’s talk about when it does.

The biggest incentive to use a credit card for mortgage payments is when your credit card has a sign-up bonus with a minimum spending requirement.

Maybe you need to spend thousands of dollars in the first few months of having your card to qualify for the bonus.

It can be difficult to meet those minimums with non-mortgage spending — and you certainly don’t want to overspend just to receive the bonus.

Putting the payment on a card can help you get there.

Sometimes people put their mortgage payments on a credit card and then use the cash for something else — but beware of this strategy.

If you can’t pay off your balance in full, you will pay interest on both your mortgage and your credit card balance.

Using a credit card to pay your mortgage makes sense when it earns you rewards or cash back.

It doesn’t make sense if you’re only building up more debt and using the money you’d spend on your mortgage for additional spending.

The Benefits and Risks of Paying Your Mortgage With A Credit Card

Making mortgage payments with a credit card has its benefits and risks. The benefits include:

- Meeting your credit card’s minimum spending requirement to earn a sign-up bonus

- Earning cash back that you can invest or save

- Earning points or airline miles

The risks of using a credit card to make mortgage payments are:

- Needing to pay a third-party vendor to process the payments

- Being on the hook for fees that erase any benefits you earn from the card issuer

- Carrying a credit card balance at a higher interest rate than your mortgage

If you do your research, choose the right card, and pay your credit card’s balance every month, the benefits should outweigh the risks.

The Importance of Credit Utilization

Another item that you should be aware of: paying your mortgage with a credit card can hurt your score if you don’t monitor your credit utilization.

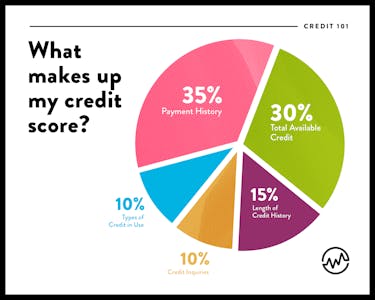

Credit utilization is the amount of credit you have available. Credit utilization makes up the second largest portion of your credit score at 30%.

The rule of thumb is that creditors like to see a credit utilization of 30% or less. Those who have very low credit utilization ratios typically have high credit scores.

So, if you do pay your mortgage with a credit card but don’t pay the balance every month, your credit utilization could increase dramatically, thus lowering your credit score.

Let’s look at an example. Say you have a $20,000 limit on a credit card, and you already owe $5,000. Your credit utilization is 25%. Your mortgage payment is $2,000 per month. With that balance on your card, you now owe $7,000. Now, your credit utilization ratio is 35%, and because it’s more than the recommended 30%, that can hurt your credit score.

Should You Pay Your Mortgage With A Credit Card?

Now that you know how to pay your mortgage with a credit card, should you?

The truth is that using a credit card to pay your mortgage isn’t a hack. But in some cases, it can provide added benefits.

There's nothing wrong with paying your mortgage the old fashioned way — but if you can qualify for a rewards card that offers significant benefits, you can leverage your mortgage payments and earn added benefits.

If you like the idea but don’t have a credit card with the right rewards yet, make that your first order of business.

Consider which method makes sense for you and get started paying off your mortgage.

Continued Learning

Since you know how to pay your mortgage with a credit card, consider these free credit resources:

- Learn what credit card APR is — and how to avoid high interest rates

- Find out how to graduate college debt free

- Facing mounting debt? Try a balance transfer for a 0% interest rate

- Use these strategies to improve your credit score in 30 days

- You can achieve a perfect credit score. Here’s how