Estate Planning

How To Protect Your Family, Your Assets, & Your Legacy With a Revocable Living Trust

In This Article

It’s a powerful question that every person has asked at some point: what happens after we die? While we may not have an answer for that, we do know what happens to your estate after you pass away. And that’s why it’s vital to make plans before you leave the earth. If not, it could be subject to heavy taxes.

If you ever worry that your kids will be stuck paying off estate taxes when you’re gone or fear that the government is going to confiscate even more of your hard-earned money from beyond the grave, you’re not alone.

There are many questions surrounding the inheritance tax, how much the inheritance tax is and how to pass money to heirs tax-free.

Most people have misconceptions about the federal estate or death tax.

Some think that if you inherit money, you need to pay taxes on your inheritance. Others believe that they need to hurry up and give their money away before they die or else it will disappear to taxes.

These aren’t paranoid thoughts. There really are some ridiculous taxes out there.

But what’s the death tax really about? It’s about time you knew.

In this article, we’re going to explore the nuances of the inheritance tax to answer all the questions you have about the topic. Plus, we’ll explore additional ways for you to master your personal finances so that you can have your money in order.

How To Determine Your Taxable Estate

What makes up your taxable estate? Let’s take a look.

These are the same assets that make up your net worth. Every now and then, it’s a good idea to put a pen to paper and figure out exactly what that is.

When you die, your executor will need to file a form 706 reflecting how much money you had within your estate when you passed.

The 201 Tax and Job Act Law: What Does It Mean for You?

It’s not only important to know what your taxable estate is; You need to know the laws that apply to it.

Estate tax laws have changed many times over the years. Lately, they’ve become more favorable towards taxpayers — dead or alive.

The 2017 Tax and Jobs Act Law dictates that the first $11.18 million dollars you leave to your heirs may be transferred without owing any estate tax.

This means that if your last surviving parent dies (knock on wood), the first $11.18 million they leave to their heirs (meaning you) would not be federally taxed.

What is “Exemption Equivalent”?

This $11.18 million is known as the “exemption equivalent.” That’s the amount of money that can be passed on to heirs without being subject to federal estate tax.

That’s a huge improvement from what it once was. Prior to the 2017 tax law, that exempt equivalent amount was $5.49 million. That’s a $5.69 million difference.

This means very few people will need to deal with paying the federal estate tax.

What If There’s More Than $11.18 Million Left In My Estate?

If this is the case, here’s exactly what will happen. The federal tax return form 706 will be filed and the estate tax owed by the estate will be calculated.

Any amount over $11,180,000 is subject to a 40% federal estate tax.

It is important to remember that it is the estate that is taxed, NOT the person inheriting the money.

If you know how to do the math yourself, you can run the numbers on how much the estate will owe in taxes.

To make it easier, here are the equations you’ll need to use.

The estate’s executor is responsible for paying the estate tax using the assets within the estate. The tax collector only accepts cash.

This means assets often have to be sold to raise the cash to pay the tax. These assets include:

Imagine a large family farm that’s been in the same family for a century.

Say it’s valued at $20,000,000. The estate tax calculation is ($20,000,000-$11,180,000=$8,820,000)x 40% = $3,528,000 estate tax due.

In this case, the family may have to sell the farm to pay the $3.5 million tax bill.

Nobody wants to be confronted with that sad scenario, especially if there are many family memories attached to that farm.

It’s a good thing there are ways around it.

How Are Smaller Annual Gifts Taxed?

The current law allows you to gift up to $15,000 every year to a recipient, without having to pay any gift taxes.

That means a husband and wife could each give their children $15,000 (or a combined 30k) per year without any gift tax issues.

But what if you give more than $15,000 to one person as a gift?

Interestingly, the gift and estate tax work together as one. If you give more than the annual gift tax exemption or $15,000 per person, per year, the excess will be counted against your estate tax exemption amount.

Let’s look at how this works with some real-life examples:

Scenario 1

Your widowed mother gives you $14,000. The amount falls under the $15,000 annual tax exclusion. There is no gift tax to worry about.

Scenario 2

Your widowed mother gifts you $25,000. That creates a gift tax issue for the $10,000 in excess of the $15,000 annual exclusion. The good news? No gift tax is owed by either you or your parent.

The $10,000 excess is simply counted against the lifetime gift/estate tax equivalent amount of $11,180,000.

This means your mother would have to file form 709 and make note of the gift using that against her lifetime exemption equivalent amount with no tax due. In this case, your mother will have used up $10,000 of her $1,180,000 gift/estate tax limit, leaving her with an exemption equivalent of $1,170,000 instead.

Scenario 3

If both parents are making gifts, they can give $30,000 (2x$15,000) to anybody they want.

In summary, you can gift or pass at death $11,180,000 without any federal estate or gift tax.

Does Your State Have an Estate or Inheritance Tax?

While most people have estates smaller than $11,180,000 and won’t need to deal with the federal estate tax, some states have an estate income tax.

So, does your state have an estate or inheritance tax?

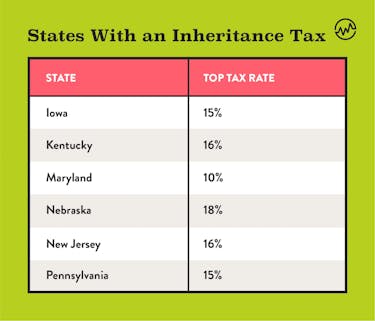

Twelve states have an estate tax and 6 states have an inheritance tax.

One unlucky state poses both (we’re looking at you, Maryland).

States With An Estate Tax

States With An Inheritance Tax

Meanwhile, these six states have an inheritance tax:

How To Avoid The Federal Tax Rate

If your estate is larger than $11.18 million, is there something you can do to avoid the 40% estate tax?

First: don’t stress out. Instead, focus your energy on solutions.

There are actually several strategies you can use to minimize or even eliminate estate tax if you have an estate that exceeds the exemption equivalent:

Gift Assets

Gift assets that are appreciating quickly to your heirs to keep those assets out of your asset count upon your death.

As mentioned above, you can gift $15,000 per person per year to reduce your estate size — and let your heirs reap the benefits of the growth of those gifted assets.

Create A “His and Her” Marital Bypass Trust

If you are married, this can be a great way to avoid the 40% estate tax. This advanced legal planning strategy involves dividing a couple’s living estate between two retractable trusts. Each trust can pass up to the $11.18 million dollars to heirs tax-free.

Done correctly, this effectively doubles the amount a couple can pass on to their heirs without the hitch of the federal estate tax.

This strategy was very popular when the estate tax exemption equivalent was much lower and the estate tax impacted more people.

Tax Refugee: Move To A State That Doesn’t Have An Estate Tax

There are currently 33 states that don’t impose an estate or an inheritance tax. Becoming a tax refugee won’t help you avoid the federal tax, but it could save you some money on state-imposed taxes.

Spend Your Money Until You Are Under The Exemption Amount

If you spend enough money that your estate falls below $11.18 million dollars, you won’t need to pay the estate tax. It’s a simple solution. For example, donate to charity and reap some benefits on your tax returns. It doesn’t matter as long as your taxable estate falls below $11.18 million dollars at the end of the day.

Inheritance Tax

Here’s the good news: very few estates will owe federal estate tax. There is no federal inheritance tax, but there are currently six states that can and will tax inheritors above a specified estate level.

Use the strategies you’ve learned wisely and you’ll be able to set your heirs up with a comfortable inheritance without having to pay a sum to the government.

Continued Learning: Tax Strategy

Taxes can be complicated and stressful. But with an education, paying taxes can become easier. Now that you know the nuances of the inheritance tax, here are a few other free tax resources to help you file taxes and help you pay less tax:

- Find out how to avoid an IRS audit

- Entrepreneurs pay less tax than the average person — here’s why

- Here are 10 ways to use your tax refund to make more money

- Here are 4 proven ways to pay less tax

- Find out how tax write-offs work here

- These are the most effective tax strategies to reduce taxable income